Update 279: Much Ado About the Fed

From Systemic Risks To Interest Rates

The Federal Reserve made news this week in the usual way, with another interest rate hike, and also in less visible but important ways.

Today, the Financial Stability Oversight Council (FSOC) — of which the Fed is a key member — met in executive session. Prudential Financial’s status as a non-bank Systemically Important Financial Institution (SIFI) is again on the agenda of the Council, created by Dodd-Frank to monitor systemic risk. Worth watching.

Good weekends all…

Best,

Dana

____________________________

SIFI Delisting in the Offing?

Prudential is the one remaining non-bank institution with SIFI-designation status. After deferring on a decision on Prudential’s SIFI status at a meeting in February, the FSOC could hand down a decision on the company’s status today. Previously de-designated non-bank SIFI’s include:

- AIG (de-designated by Trump’s FSOC)

- General Electric,(ditto)

- Metlife, (de-designated via the courts)

Prudential is the last shadow bank to still face enhanced regulatory standards under the Dodd-Frank Act. Prudential’s de-listing would end oversight over all firms in this sector — particularly troubling given that the shadow banking sector makes up the fastest growing portion of the American financial system, another signal from the administration that safety and soundness take a backseat to systemic deregulation.

Monetary Policy

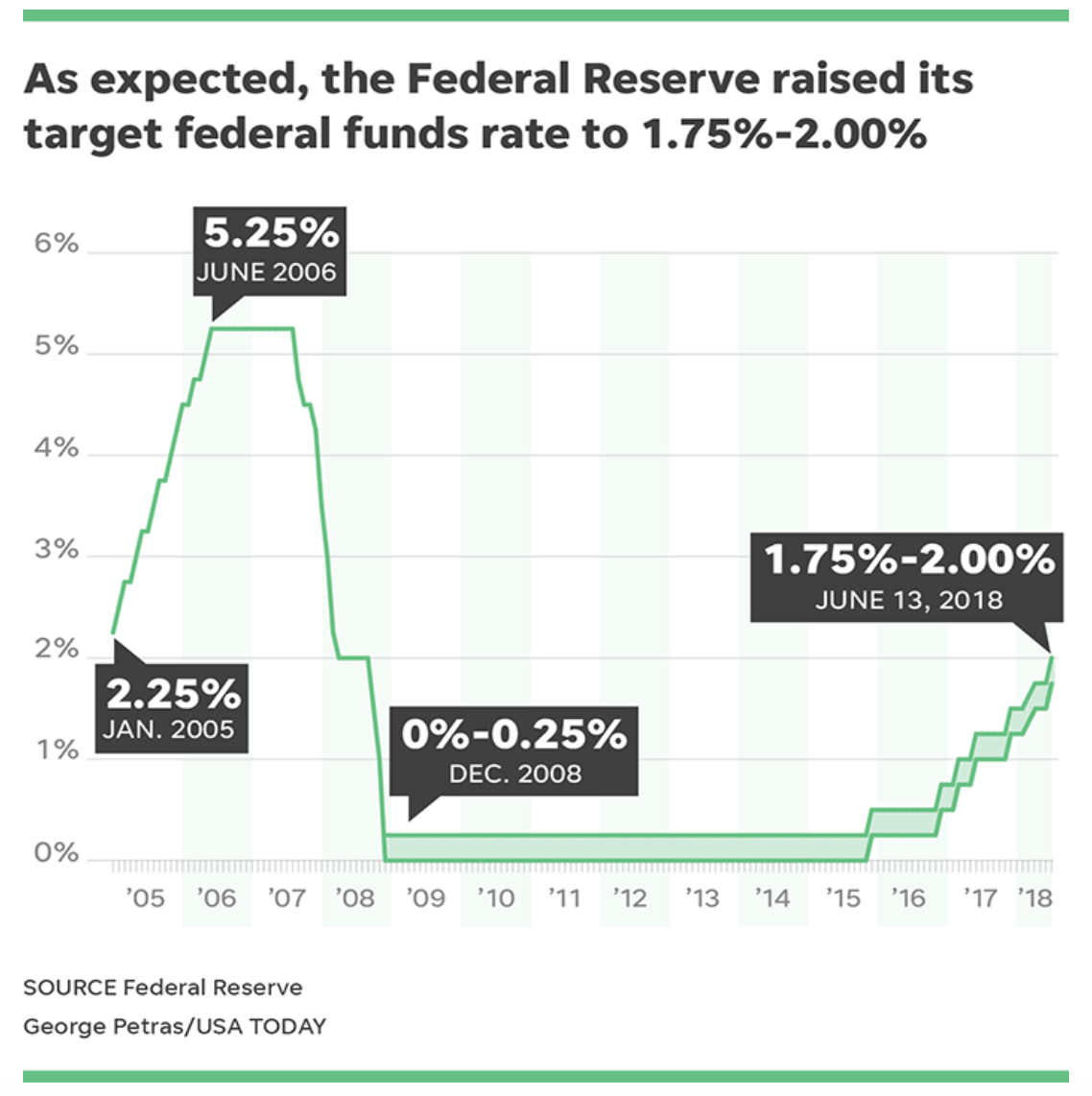

As expected, the Fed raised interest rates 25 basis points from 1.75 percent to 2 percent during its eight times a year Federal Open Market Committee (FOMC) meeting on Wednesday. Due to upward revisions in GDP growth projections, the Fed signaled it will raise interest rates two more times this year, increasing the total number of anticipated hikes to four.

In his post-meeting statement, Fed Chair Jay Powell emphasized the gradual nature of any further rate increases and intimated that the Fed remains committed to the wind-down of its balance sheet. He indicated he expects the Tax Cuts and Jobs Act will provide a fiscal policy boost to the economy in the short term, predicting a positive demand side impact over the next three years. He also expects the tax cuts to have noticeable supply side effects, i.e., increased business investment.

With official unemployment at 3.8 percent, its lowest point in two decades, and 191,000 new jobs on average over the past 12 months, the economy is regarded as at or near full employment. Somewhat paradoxically, a Bureau of Labor Statistics report released earlier this week found that hourly wages actually fell between May 2017 and May 2018. Powell stated that the Fed is “puzzled” by the lack of wage growth, but responded to questions by asserting that the low unemployment rate should see wages tick up in the near future.

Fed Rules and Regulatory Policy

Within the next few weeks, Federal Reserve will finalize proposals to change two pillars of Dodd-Frank systemic risk policy: the enhanced supplementary leverage ratio (ESLR) and stress testing. A third change addresses interfirm credit exposure risk. The changes alter the framework that is in place to ensure systemically important banks maintain sufficient loss-absorbing capital buffers to withstand crisis conditions.

- ESLR – This capital requirement currently applies to the eight most systemically important banks in the country. The new proposal cuts back minimum leverage rules for each of these banks, replacing the fixed 2 percent capital buffer with a buffer equal to one half the firm’s Globally Systemically Important Bank (GSIB) surcharge. The public comment period closes June 25 but it will likely be months before it is finalized.

- Stress Testing – Under the proposal, severely adverse stress test results would impact a bank’s required stress capital buffer. This change would work to integrate stress testing with the regulatory capital regime, but the proposal also waters down some stress testing assumptions. Based on the latest data, the proposal would cut aggregate capital at banks subject to stress testing by $30 billion. As with the ESLR rule, the comment period closes June 25th but it will likely be months before it is ultimately finalized.

- Credit Exposure – On Thursday, the Fed approved a rule to prevent concentrations of risk between the nation’s largest banks. Under the rule, banks considered Globally Systemically Important Banks (GSIBs) are given an exposure limit of 15 percent of Tier 1 capital when lending to any other GSIB. Banks holding $250 billion or more in total consolidated capital are limited to a 25 percent Tier 1 capital limit to any counterparty, a threshold that was increased from $50 billion in assets following the passage of S. 2155.

Pending Nominations

On Tuesday, the Senate Banking Committee advanced the latest Trump picks for top roles at the Fed. The committee voted 20-5 to recommend Richard Clarida for Vice Chairman, and 18-7 in favor of Michelle Bowman to be a Fed governor as a community banker on the Board.

During a Senate Banking Committee hearing on May 15, Clarida hued close to the Powell line as he described his views on normalizing monetary policy. He also agreed with Powell on the Fed’s regulatory mandate, arguing that “there are opportunities to tailor regulations appropriately.”

Michelle Bowman also criticized regulation broadly in her May 15 testimony at the same hearing. Her comments on the “burdensome” post-crisis regulatory framework fits nicely into the narrative of Dodd-Frank rollback and adds another deregulation supporter to the Fed board.

Senate Banking Committee ranking member Sherrod Brown urged caution, noting similarities between the statements of nominees and those of Fed staffers. Despite this, as with Dodd-Frank bill S.2155, some moderate Democrats supported their nominations, a decision that risks more front-page excoriation and embarrassment.

Powell’s P

Powell painted a rosy picture of the US economy during his Wednesday press conference, but there are storm clouds on the horizon. Despite labor shortages, the Fed remains confounded by the lack of wage growth in the economy. As the job market continues to heat up without much sign of wage growth, it is becoming increasingly evident the broken (or flattened) Phillips Curve will be around for at least a little longer.

As the Fed inches toward a natural rate of interest and the post-crisis stimulus continues to wind down, Fed policymakers need to be transparent in their decision-making and swift to react as the economic situation changes. They will also continue to confront a lagging or stagnant wage market that vexes and befuddles labor economists across the country.

Magnificent goods from you, man. I’ve understand your stuff previous to and you are just extremely great.

I actually like what you’ve acquired here, really like what you’re stating and

the way in which you say it. You make it enjoyable and you still take care of to keep it wise.

I cant wait to read much more from you. This is really a tremendous website.