Week of Data Drops Shows: Economy Yielding at Last to Fed Rate Hikes

From today’s benign August jobs report to a downward GDP growth revision, to dips in inventory investment, mortgage rates, and Treasury yields, this week’s data drops show an economy cooling, perhaps enough to encourage the Fed to pause its long campaign of interest rate hikes to subdue inflation. Complicating the calculus was a consumer spending surge and an uptick to 3.3% year-on-year from 3.0% last month of the Fed’s preferred inflation measure, personal consumption expenditures.

Gains in prices for goods slipped for the third straight month while rising for services, a concern for the Fed. But taken together, against a backdrop of slowing wage growth, the week’s data suggests that the economy may finally be yielding to Fed monetary policy — at a rate that points not to imminent recession, a risk that the Fed’s rapid rate hikes runs, but to a soft landing. Data and details below…

We are searching for a Chief of Staff and Economic Analysts. If you or someone you know might be a good fit, let us know!

Good Labor Day weekends all,

Dana

This week saw the release of major economic data that could bear substantially on the Federal Reserve’s decisions on the fate of interest rates for the remainder of 2023, with “live” meetings, i.e., with policy moves possible. This morning, the jobs report for August was released, showing job growth continuing to moderate during the month. Yesterday, the latest personal consumption expenditures (PCE) data was released, showing a modest increase — mixed signaling on inflation. And on Wednesday, the Bureau of Economic Analysis released its second estimate of GDP growth in the second quarter of this year, a downward revision from 2.4 to 2.1 percent growth.

Mixed Signals on Inflation

Yesterday, the Bureau of Labor Statistics released data on personal consumption expenditures, which is the source of the Fed’s favored inflation measure. Month over month, the PCE price index increased 0.2 percent, and the core PCE index increased 0.2 percent. Year over year, these changes were 3.3 percent and 4.2 percent respectively. Interestingly, on an annual and monthly basis, good prices decreased and service prices increased.

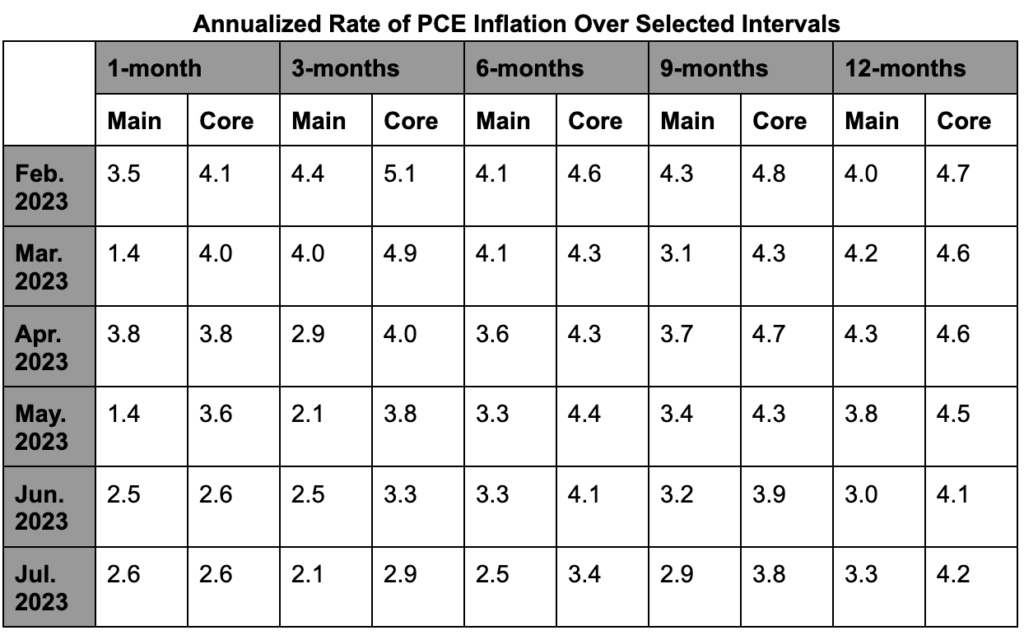

These numbers appear to show a slight uptick in inflation in the month of July, but the situation is more complicated. Prices can be measured from any starting point, and it is only by convention that they are measured in one month and one year intervals. Looking at every monthly interval from one month to 12 months shows a decidedly more mixed picture than these topline statistics show. For the PCE as a whole, the inflation rate increased across six of those 12 timeframes, while the core index only increased across three of the 12.

The table above shows two important pieces of information: inflation is still too high, and understanding the direction it is headed is exceptionally difficult. Furthermore, the inflation data is not consistent across categories. This week’s report makes clear that driving prices up are housing, food, and insurance costs. For the Fed, unfortunately, these categories are uniquely resistant to cooling via increases in short-term interest rates. We discussed housing a few weeks ago, and while food and insurance are worthy of their own updates, a significant portion of their price increases seem to be driven by structural causes such as the continued war in Ukraine and the expensive climate-enhanced natural disasters such as the named storms Hilary and Idalia.

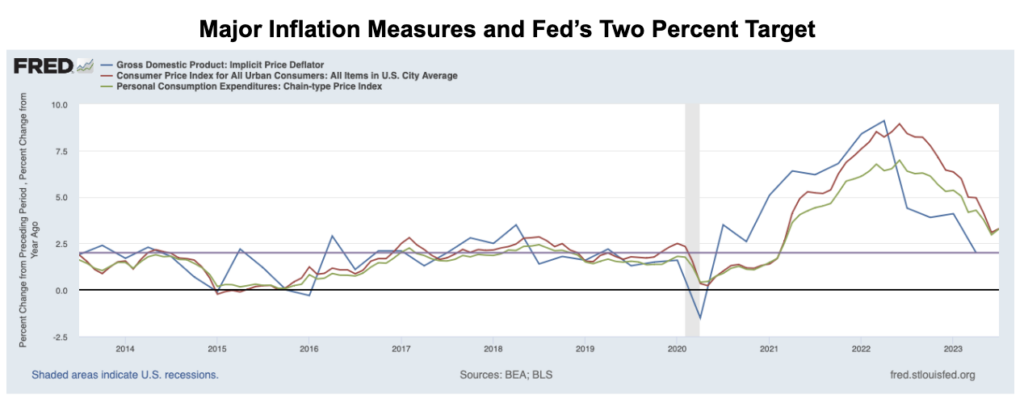

On Wednesday, the revised estimate of the GDP for the second quarter was released. Included in the report was another crucial measure of inflation: the GDP deflator. It registered an annual growth rate of 2.0 percent for the second quarter of this year. Notably, this is the first of the three major inflation measures to reach the Fed’s target rate. Unlike the other two measures, the GDP deflator does not measure consumer prices, rather it measures the changes in prices of goods and services produced in the United States. Therefore, almost by definition, it excludes the price increases for imports. American inflation has been lower than in most of the developed world, so it stands to reason that import prices would have accelerated faster than prices for domestic goods. While it is a singular data point, it does tend to validate the administration’s focus on increasing domestic productive capacity.

Jobs Growth Continues to Moderate in August

This morning’s jobs report showed that total nonfarm payroll employment increased by 187,000 in August, exceeding expectations of a 170,000 increase over the month. In its release, the Bureau of Labor Statistics revised jobs added to the economy in June and July downward by a combined 110,000.

Gains in employment were seen in health care, leisure and hospitality, social assistance, and construction. Employment in transportation and warehousing fell following the closure of trucking company Yellow. August marks the first month during which the impact of the actors’ strike has been reflected in jobs data, subtracting about 16,000 jobs.

The unemployment rate rose to 3.8 percent from 3.5 percent in July, reflecting an increase in labor force participation. Wage growth continued to moderate in August, rising by 0.2 on a monthly basis and 4.3 percent on a year-on-year basis, the latter down slightly from 4.4 percent in July, significantly down from highs seen last year.

The report marks the last release of a jobs report before the Federal Open Market Committee’s next meeting on September 19-20. Data indicating a cooling labor market may lean the Fed towards another pause. Consumer price index data showing inflation over August, which will be released on September 13, will also be pivotal in the Fed’s decision.

Revised Q2 GDP

On Wednesday, the Bureau of Economic Analysis released their second estimate of GDP growth in the second quarter of this year. The growth rate of real GDP was revised down from an annualized rate of 2.4 percent to 2.1 percent. Despite an upward revision to household spending, a downward revision to business spending was enough to bring down the overall average.

Meanwhile, another estimate of national income, Gross Domestic Income, which had been the source of massive debate over the direction of the American economy, reversed two quarters of decline to show an increase of 0.5 percent. The average of the two measures showed the most growth in almost a year.

Powell Navigating by Stars amid Clouds at Jackson Hole

Last Friday, Federal Reserve Chair Jerome Powell delivered his address entitled Inflation: Progress and the Path Ahead at Jackson Hole. Powell outlined the Fed’s progress in bringing inflation down from its peak last year and the challenges that remain ahead as it seeks to return inflation to the Fed’s target rate of two percent.

In his speech at Jackson Hole last year, Powell identified the Fed’s primary concern as inflation. While the monetary policy debate of the past year has centered on how high and how quickly the Fed would raise rates, the Fed’s fight against inflation has entered a markedly different phase. After raising the interest rate from near zero in early 2022 to a range of 5.25 to 5.5 percent, the question now is how high will the Fed keep or push rates and how long rates will remain elevated.

Powell maintained his position that decisions on additional hikes would be made on a data-dependent basis, but emphasized that “restrictive monetary policy will likely play an increasingly important role.” After this week’s data, the Fed sees below-trend economic growth and softened labor market conditions along the path ahead.

Powell’s speech centered on the Fed challenge of “navigating by the stars under cloudy skies.” The full effects of rate hikes have traditionally lagged by long and variable amounts. Powell highlighted the importance of risk-management moving forward, mindful of the risks of staying too high for too long and triggering a recession.

Hard Task Ahead for the Fed

With mixed signals on inflation and unemployment, the Fed has a hard balance to strike in setting short-term interest rate policy for the rest of this year. The next meeting of the FOMC is September 19-20, and it will have to examine the data above and “proceed carefully” in order to make the next decision on rates with a view to a soft landing that remains an achievable goal.

Thursday, September 7th

Senate Banking, Housing, and Urban Affairs Full Committee Hearing: Perspectives on Challenges in the Property Insurance Market and the Impact on Consumers

Friday, September 8th

Consumer Credit for July 2023

Other Related Articles

- Update 735: Shutdown Threat In Temporary Remission

- Update 729 — House Elects Speaker: Can Bipartisan Fiscal Policy Follow?

- Update 728 — Suspended Animation:House Left Behind as the World Turns

- Update 722 — From Strikes to Shutdown: Challenges to the Post-Covid Recovery

- Update 719 — Discretionary to Discount: Consumer Spending Trends and Trajectory