Update 559 — The Payfor Package:

Necessity is the Mother of Taxation

A reflexive assumption of national opposition to taxes, and support for tax cuts, seemed to have had an axiomatic grip on fiscal politics from the nation’s birth. But the conventional wisdom was seriously challenged by Trump’s $1.9 trillion tax cut of 2017 and left the waters muddied as to the national consensus on taxation. The payfor package being negotiated on the Hill sends a clear message, however, and presents a sharp reversal in course from Trump’s bill.

Tax policy in the abstract is just half the fiscal story. The package of payfors making its way through Congress is designed precisely for the infrastructure and reconciliation bills’ provisions for long-neglected investment. Fiscal balance and equity are also served — tax cuts this time go to lower-income earners — but the genius of the proposal emerging is its pro-cyclicality: it aids rather than impedes the macroeconomic recovery on which so much depends.

How so? We look at the components of the proposal, which and when taxes would be raised, what is the labor/capital share, and how fairness is served.

Good weekends all,

Dana

———————

Last week, the House Ways and Means Committee approved a $2.3 trillion revenue package. The House is expected to vote on it as part of the Build Back Better Act in the coming weeks. On Thursday, Speaker Pelosi and Majority Leader Schumer announced an agreement on a revenue framework for the final reconciliation package, though they did not elaborate on details.

The Good

There is a good deal to be proud of in the revenue package put forward by the Ways and Means Committee. While it is not exactly what President Biden asked for, some of the key tax provisions raise significant revenue, make the tax code fairer, and reward work instead of wealth:

- Income Tax ($170.5B): Democrats plan to reverse the temporary income tax cut for high-income earners implemented by Republicans in the TCJA. The Ways and Means package would return the top marginal tax rate to 39.6 percent for households earning more than $500,000, up from the 37 percent that would have been in place through 2025.

- Capital Gains ($375.6B): The top capital gains rate would be boosted to 25 percent from the current 20 percent. In addition, Ways and Means is expanding the 3.8 percent Net Investment Income Tax to pass-through entities that currently avoid paying it. Despite being less than what President Biden called for, raising rates on capital gains is a feat in itself of overcoming a powerful lobby.

- Corporate Tax ($540.1B): Ways and Means decided to shift away from the flat 21 percent rate back toward a graduated rate structure for corporate taxation. The first $400,000 of income would be taxed at 18 percent; income up to $5 million would be taxed at the current 21 percent, and above that, the rate would jump to 26.5 percent.

- GILTI and FDII ($96.4B): Democrats decided to take advantage of the tax on global intangible low-taxed income (GILTI) created in the TCJA by hiking the rate from 10.5 percent to 16.5 percent. Democrats want to raise the rate on foreign-derived intangible income (FDII) from 13.125 percent to 20.7 percent. Both provisions are also being altered to capture more income. The goal is to prevent profit shifting to overseas holdings while also maintaining a substantial minimum tax on foreign income for US multinational corporations.

- Three-Percent Surtax ($127.3B): To make up for some missing revenue in other parts of the plan, Ways and Means decided to propose a three percent surtax on individuals making more than $5 million. The tax also could lay the groundwork for future taxes on the wealthy and high-income earners.

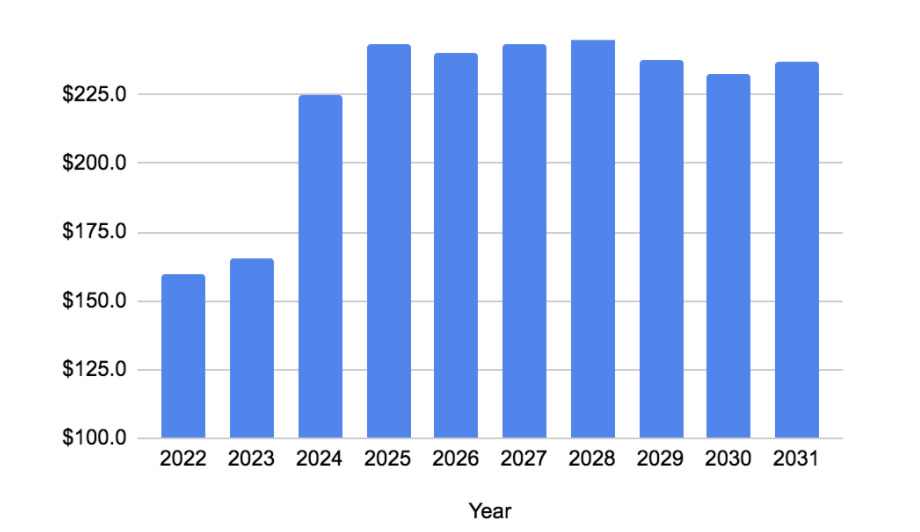

New Revenues Each Year from Ways and Means Package (Billions US$)

Source: JCT

The Bad

Despite many positive changes that will improve the tax system, the Ways and Means package leaves out some critical revenue improvements that the White House asked for:

- No Carried Interest Repeal: President Biden proposed fully closing the carried interest loophole, a tax provision used almost exclusively by private equity and hedge fund managers. This unpopular tax provision has proponents of repeal coming from all sides of the ideological spectrum. But lobbying by the finance sector convinced Chairman Neal to pursue more moderate reform, extending the holding period for assets from 3 to 5 years before carried interest can be claimed. While this change does raise $14 billion over the next decade, it allows the carried interest loophole to survive another year.

- No Step-Up Change: A cornerstone of President Biden’s tax plan to reduce intergenerational wealth disparities was ending the step-up in basis for inheritances over $1 million, but the proposal was left out of the House’s tax package. Under current law, when an individual inherits assets in the form of capital gains, they do not have to pay taxes on any gains accumulated at the time of the original owner’s death. It was estimated that eliminating this loophole would generate $220 billion in new revenue over the next decade. The failure to even include the more mild carryover basis impairs the overall equity value of the tax package.

This is not the final say, however: the most likely opportunity for improvements to the bill will be when the Build Back Better Act moves to the upper chamber, where Senate Finance Committee Chair Wyden has been a powerful champion for both step-up elimination and closing the carried interest loophole.

Equity and Political Value:

Despite some critical omissions, the equity value of the Ways and Means tax package should not be underestimated. If passed in its entirety, the revenue side of the Build Back Better Act would make the biggest improvement to the progressivity of the tax code since President Clinton’s 1993 Omnibus Budget.

According to the Joint Committee on Taxation, the tax package, which includes expansions to the EITC and CTC that benefit low to middle income families, would actually be a tax cut for the bottom 80 percent of households. Only households earning more than $500,000 (less than 1.5 percent of families) would pay a higher average effective tax.

Distributional Effects of the House Ways and Mean Reconciliation Mark-Up

Levying taxes on high-income earners and mega-corporations to pay for social spending and improved infrastructure is not only good policy but also good politics. Per recent polling:

- 61 percent support increasing the top tax rate on high-income households from 37 percent to 39.6 percent

- 60 percent support increasing the top corporate tax rate from 21 percent to 26.5 percent

- 61 percent support raising the capital gains tax rate from 20 percent to 25 percent

Behind Closed Doors

Two major issues still being hammered out are the state and local tax (SALT) deduction and IRS reporting requirements. There are several Democrats from wealthy blue districts who view the $10,000 SALT deduction cap passed under the TCJA as an economic attack on their states. While full SALT cap repeal is unlikely due to its astronomical price tag, there are deductions about lifting the cap or restoring the deduction to households earning less than $400,000.

A modest change in the SALT deduction could cost up to $120 billion, which is where the IRS reporting requirements come in. This could recover up to $473 billion in lost revenue, but it was suspiciously missing from the Ways and Means package. It is possible the provision will make a reappearance to cover the cost of potential SALT changes.

Clear majorities of voters, including independents and some Republicans, support the payfor package and each of its major provisions. Moreover, the design of the package, the phases-ins, and sunsets, the specific policy choices, the back-ended aggregate revenue all provide substantial support to recovery, in the interests of voters, of course, but of the members of Congress who vote for it.