Update 569 — BBB and Equity:

What the Tax Provisions Mean

Six months ago, the Treasury Department released the Green Book detailing President Biden’s vision for a more equitable tax system, aimed at getting large firms and the very wealthy to pay their fair share. The key elements of this initiative are pending in Congress in the Build Back Better Act. This update will examine the recent BBB revenue changes and how these changes affect the bill’s overall fiscal and equity value.

Meanwhile, Speaker Pelosi has told members of House Democratic leadership not to leave Washington for Thanksgiving without passing the Build Back Better Act. Today, Sen. Brian Schatz said Democrats may be on the 1-yard line with Build Back Better but added, “The 1-yard line thing — sometimes it takes four downs to score.”

Best,

Dana

——————

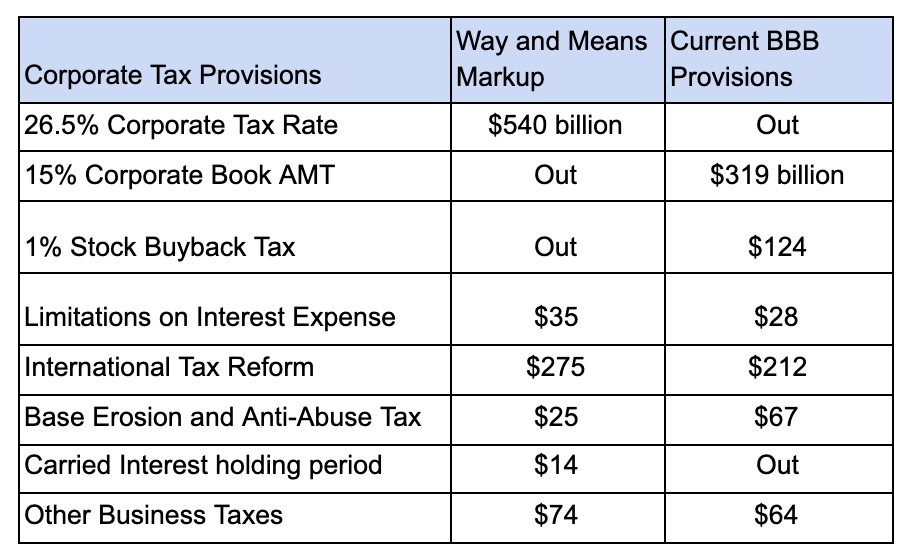

Corporate Tax Provisions

At the beginning of the reconciliation process, Congressional leadership planned to raise revenue by partially reversing the Tax Cut and Jobs Act corporate tax changes. The Ways and Means Committee proposed raising the top corporate tax rate from 21 percent to 26.5 percent for corporate incomes over $5 million, affecting fewer than one in ten corporations. While this new corporate rate would have been well below the pre-2018 35 percent rate, Sen. Sinema’s insistence on no rate increases forced Democrats back to the drawing board.

To make up the revenue shortfall, the BBB framework now includes two novel domestic corporate tax provisions that raise more revenue on a narrower base of companies:

- 15 percent Alternative Minimum Tax: Under current law, there are large discrepancies between the earnings that corporations report to shareholders (book income) and the taxable income they report to the IRS. This discrepancy allowed 55 of the largest companies to pay $0 in federal corporate taxes last year. The AMT provision would apply to corporations with an adjusted financial statement in excess of $1 billion, only around 450 companies, preventing them from using many (though not all) of the federal deductions and credits starting in 2023.

- One percent Stock Buyback Tax: After the TCJA passed, corporations have used their tax windfall to repurchase shares instead of investing in workers. In 2018, stock buybacks rose by 55 percent while median wages grew by less than two percent. This provision would disincentivize such transitions by imposing a one percent excise tax on publicly traded U.S. corporations for the market value of any stock repurchased.

Most of the international tax provisions stayed intact even as the effective start date was moved back to 2023 in accordance with the global tax deal Treasury Secretary Yellen helped negotiate last month. The Ways and Means Committee had proposed a 16.6 percent Global Intangible Low-Taxed Income (GILTI) rate and 20.7 percent Foreign-Derived Intangible Income (FDII) rate, but those were scaled back to 15 percent and 15.8 percent, respectively. Meanwhile, the Base Erosion Tax (BEAT) was strengthened in the Rules Committee, increasing from 15 percent to 18 percent. These changes will improve the underlying equity of the international tax system and generate billions in new revenue.

The Joint Committee on Taxation projects that, if fully implemented, the BBB corporate tax changes will generate $814 billion over the next decade.

Fiscal Effect of BBB Corporate Tax Changes

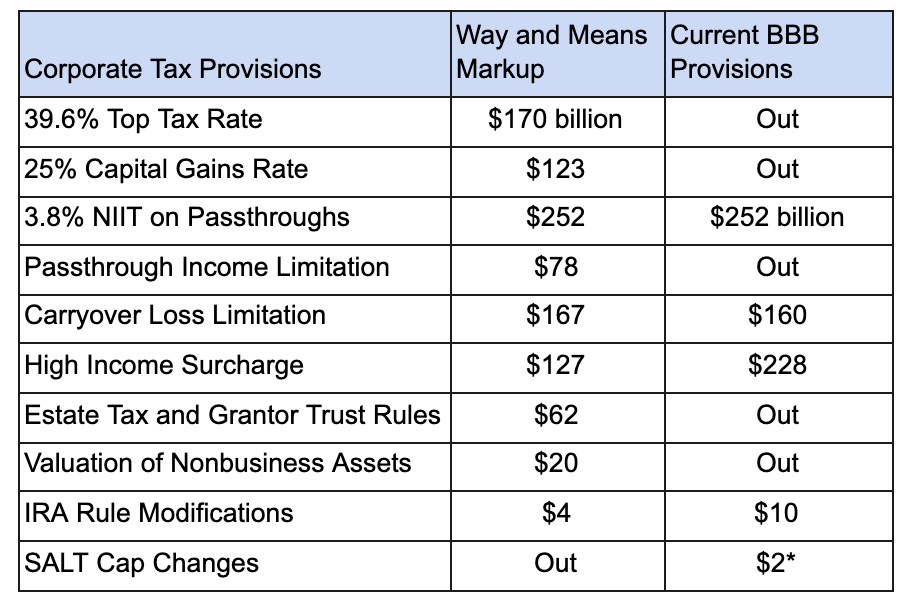

Individual Tax Provisions

The Ways and Means Committee originally proposed nearly $1 trillion in revenue from rolling back the parts of TCJA that most heavily benefitted wealthy households — while maintaining President Biden’s promise not to raise taxes on families earning less than $400,000. This included increasing the top tax rates for ordinary and capital income, capping the pass-through deduction for high-income earners, and returning to Obama-era estate tax thresholds. While the vast majority of Democrats in Congress supported these changes, Sen. Sinema’s objections scuttled all of the mentioned proposals.

In the revised BBB package, almost every tax that would have hit households earning between $400,000 and $10 million was stripped out. The current provisions still make the tax code more equitable, but fall on a very small number of earners.

- Multi-Millionaire Surcharge: The Rules Committee altered the Ways and Means’ preliminary 3 percent surcharge on all incomes over $5 million to a 5 percent surcharge on incomes over $10 million and an additional 3 percent on incomes over $25 million. While this would technically make the top tax rate 45 percent — the most progressive since 1986 — the surcharge would affect as few as 23,000 households.

- Net Investment Income Tax: Created as a pay-for in the Affordable Care Act, the NIIT levies a 3.8 percent tax on high-income capital gains, but pass-through entities and sole proprietorships were unintentionally exempted. This provision would remedy that oversight and will likely be the most broad-based part of the revised BBB tax package.

The Joint Committee on Taxation projects that the BBB individual tax changes will generate $650 billion over the next decade.

Fiscal Effect of BBB Individual Tax Changes

Though Democrats did not reverse the most regressive TCJA provisions, they are preparing to gut one of its few progressive provisions: the State and Local Tax (SALT) deduction cap. When SALT was capped at $10,000, it was perceived as a slap in the face to residents of states with high tax rates. With SALT caps expiring in 2025, Democrats have come up with an innovative way to provide massive short-term tax cuts by raising the cap to $80,000 but making it permanent. In the first five years, this policy will cost the Treasury $222 billion, with 75 percent going to households earning more than $250,000, but that revenue is made up in the back half of the decade with some dollars to spare.

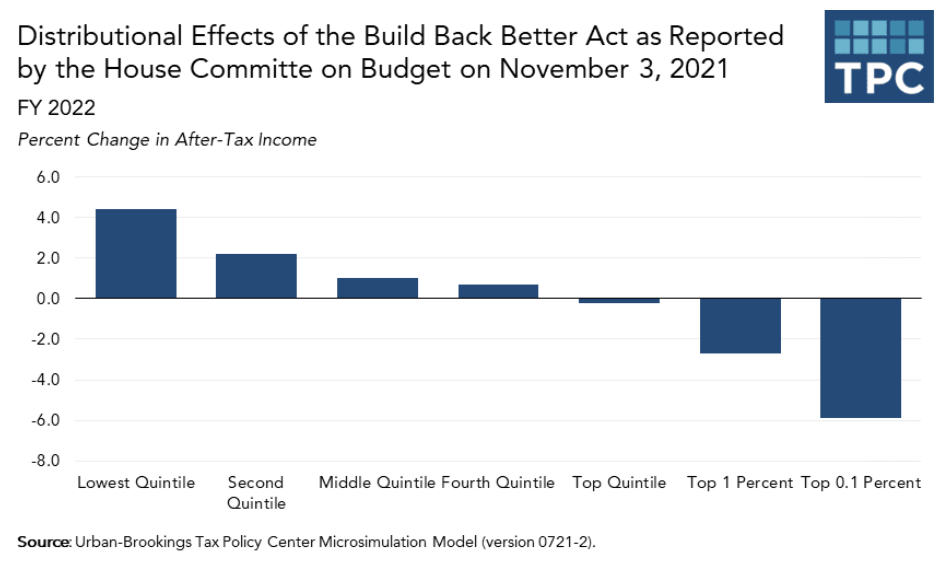

Equity Value of BBB

Overall, Democrats have cobbled together a decent, though not ideal, tax package. When included with the bill’s Child Tax Credit and Earned Income Tax Credit expansions, BBB constitutes the most progressive revision to the tax code in 30 years. The CTC expansion passed as part of the American Rescue Plan directly contributed to a 26 percent drop in child poverty, and extending this policy for an additional year would entrench these gains.

The Tax Policy Center projects that if BBB is passed, the average tax burden for the bottom 99 percent of filers will be reduced by $900 next year. In contrast, the top one percent of households would contribute an additional $100,000 next year to the public coffers.

While the wealthiest take a hit in this tax package, most single-digit millionaires will walk away mainly unscathed, mostly due to the raised SALT cap. The top 5 to 2 percent of households will pay on average $4,340 less in taxes, benefiting more than any other income group. However, this provision will likely be modified in the Senate. Sens. Menendez and Sanders appear to have reached an alternative SALT deal, choosing to cap the deduction for households earning more than $500,000. Doing so would both reduce the gross cost of the provision and make it significantly less regressive.

From the 1-Yard Line

As Democrats prepare to pass tax reform as part of Build Back Better, they will have to take stock of the various provisions left on the cutting room floor. Whether Sen. Sinema eases on her boundaries regarding rate hikes will shape the contours of a potential FY2023 reconciliation package, as the same deficit-neutral pledge will likely be taken. Regardless, Democrats should champion the reforms they secured and use them to build on their majority in 2022. With a larger majority, Democrats can consider higher rates and new taxes rejected in the current environment, such as a carbon tax and wealth tax.