Update 610 — CBO: A Mean Reversion

Rapid Return to Pre-COVID Fiscal Status

Yesterday’s CBO report projects this year’s deficit will fall by $1.7 trillion — the single largest nominal one-year reduction in the federal deficit in American history. The deficit this year will be lower than CBO projected it would be before the passage of the American Rescue Plan (ARP). Our strong economic recovery, powered by President Biden and Congress’ economic support and COVID protection plans, actually improved our nation’s fiscal position and reduced our deficit.

This wasn’t automatic or inevitable. It is the product of an Administration that has designed, and managed, the pandemic economic response as well as a big jump in revenues, enabled by the strong recovery. For those who fear that fiscal deficits cause inflation, this and the CBO projections it will fall by half in the next year should offer a measure of reassurance.

Happy Memorial Day weekends, all…

Best,

Dana

——————

The Congressional Budget Office released its latest budget and economic projections yesterday, revising its 2021 estimates for both GDP growth and inflation upward over the next few years. The Budget and Economic Outlook: 2022 to 2032 lays out CBO’s projections of the deficit, debt, and the state of the economy over the next ten years if current policy remains unchanged. Future changes in monetary policy or fiscal policy could drastically alter the outlook, which is overall optimistic about growth, the labor market, and controlling inflation over the next two years. This optimism reflects the positive effects of pandemic stimulus programs.

Macro Outlook

Under current projections, the federal deficit will shrink to $1 trillion in 2022 as pandemic relief programs continue to expire, down from $2.8 trillion last year. The deficit will also shrink as a percentage of GDP to 4.2 percent in 2022 but increase to a record 6.1 percent by 2032. CBO’s projections put debt at 110 percent of GDP in 2032, higher than it has ever been.

In better news, CBO expects inflation to cool over the next two years. Inflation is projected at 4 percent in 2022, reflecting the high pace of inflation since mid-2021. In the latter half of 2022, energy prices are expected to decrease as supply-side conditions improve. Inflation is expected to fall to 2.3 percent in 2023 and then remain near the Federal Reserve’s target of 2 percent through 2026, throwing cold water on the idea that we are entering an inexorable inflation spiral. However, core inflation may be slightly higher than CBO projections, as the agency did not account for the full impact of the war in Ukraine.

Projected Rate of Inflation

CBO also projects 3.1 percent real GDP growth in 2022 driven by increases in consumer demand for services. After 2022, tightening monetary policy and waning fiscal support are expected to slow GDP growth to an average of 1.6 percent between 2023 and 2026. Today, the BEA revised its first-quarter GDP estimate slightly downwards to -1.5 percent (from -1.4 percent), despite Gross Domestic Income growing 2.1 percent.

Under CBO’s projections, the labor market will remain strong, with 3.8 percent average unemployment projected for this year. Employment will increase by 4.1 million jobs and surpass pre-pandemic levels in mid-2022. The average unemployment rate would continue to decline to 3.5 percent in 2023 and remain below or near 4 percent through 2026. The size of the labor force is expected to surpass pre-pandemic levels by the end of this year but grow more slowly thereafter as a result of an aging population.

Recovery for Me and Thee

Fiscal stimulus policies in 2020 and 2021 helped alleviate some of the hardships we’ve seen in previous recessions, the heaviest burden of which usually falls on already-disadvantaged households. They also put the US in a stronger overall economic position. Brookings’ Hutchins Center on Fiscal and Monetary Policy estimates that fiscal stimulus across federal, state, and local levels boosted GDP growth by 13.9 percentage points in the second quarter of 2020 alone. These programs provided households with essential resources and helped avoid an extended demand crunch.

Pandemic housing assistance in the ARP kept vulnerable and low-income households in their homes. Even in the eight months following the expiration of the CDC’s eviction moratorium, evictions stayed 30 percent below their historic averages. Over 80 percent of ARP emergency rental assistance went to families with incomes that were 50 percent or less of their area’s median income. Sixty percent of assistance went to black or Hispanic renters and two-thirds went to female-headed households.

As a sign of the recovery’s strength, the unemployment rate has fallen to 3.6 percent, nearly back to pre-pandemic levels. Though large disparities with White and Asian workers still exist, in 2021 black unemployment experienced the largest single calendar-year drop since 1983, and Hispanic unemployment experienced the largest single calendar-year drop on record. The black unemployment rate has now dropped below February 2020 levels.

Unemployment (incl. Black and Hispanic Rates)

The Federal Reserve’s Report on the Economic Well-Being of U.S. Households, also released this week, found that in late 2021, self-reported financial well-being had increased to its highest level since the Survey of Household Economics and Decisionmaking (SHED) began in 2013. The share of adults who could cover a $400 emergency expense in cash or its equivalent rose to 68 percent, the highest level since 2013. However, the SHED reflects attitudes from late October and early November of last year, before the Omicron wave hit and before the enhanced Child Tax Credit expired.

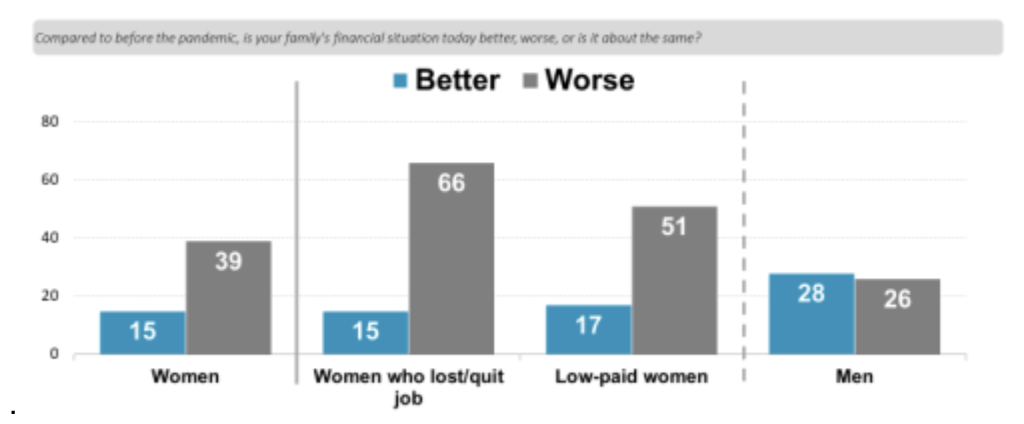

Although this recovery has been more equitable than others in some aspects, there is room for improvement. Women, particularly women of color and women in low-paying jobs, have not experienced the same recovery as men or wealthier white women. A survey by the National Women’s Law Center found that women are less likely than men to have returned to work and are more likely than men to report being financially worse off than at the start of the pandemic. Public investments in care infrastructure, like childcare and paid leave, would help spur more equitable growth.

Women Worse Off Financially Since Pandemic

Source: NWLC, GQR

Lessons Learned

The pandemic highlighted necessary policies for weathering not only the pandemic but the next recession and beyond. These policies include:

- Expanded and modernized unemployment insurance

- A fully-refundable Child Tax Credit with monthly payments

- Expanded health care subsidies

Despite implementation challenges, the unemployment insurance system was a valuable counter-cyclical tool in this recovery. UI expansions were highly progressive and delivered much-needed benefits to low-income and gig workers, including many who would otherwise have been ineligible for benefits. With the rise of gig work and independent contractors leaving many ineligible for regular UI benefits, coverage for these workers will need to be addressed permanently so we don’t leave them behind in the next recession.

UI will need serious reforms to weather the next crisis. State systems are still running on outdated technology and are generally unprepared to manage a massive influx of applications like those seen in 2020. At the federal level, Congress could institute a floor on benefits to ensure that sufficient benefits are getting to the workers who need them. Congress can also consider making benefits automatically responsive to the state of the economy, avoiding the need to pass a specific UI expansion in a coming recession.

The Child Tax Credit expansion is needed beyond the recovery. The benefits of monthly payments on food insecurity and child nutrition are well documented. Keeping children out of poverty is not just a counter-cyclical measure. Meeting families’ basic needs helps promote children’s growth and development. It must remain a priority if we are going to invest in American families and our future.

The ARP also expanded eligibility for ACA health insurance subsidies and increased the size of credits for those already eligible for assistance under the ACA. Healthcare marketplace consumers saved an average of $67 per person per month in premiums and the number of people eligible for a subsidy through the marketplace increased by 20 percent. If ARP subsidies are allowed to expire, premiums will double for millions of enrollees, and low-income enrollees will see the steepest increases. Even when COVID-19 is under control, families will still need access to quality, affordable healthcare, which has long been a barrier for too many.

The quick recovery supported by programs like the ARP has helped prevent previous recessions’ scarring and long-term effects. It’s clear Democrats learned valuable lessons from the Great Recession, but they need to ensure that they do not forget the lessons learned from 2020 and 2021. Adequate aid for individuals and families experiencing economic hardship helped lift up our economy and strengthen households and bring home pay. Increasing access to healthcare and putting money into families’ pockets has been a net good. Congress should remember this as we face down a future recession — sooner or later — and resist familiar appeals to austerity.