Update 698 — Poised to Press Pause?

How Fed is Weighing Halt to Rate Hikes

The Federal Reserve has raised interest rates for a record high of ten consecutive times in a forceful campaign to subdue inflation that remains stubbornly sticky. Inflation finally dipped just below five percent last month, leaving the Fed’s two percent target a long way off. The unintended consequences of the campaign — think banking crisis and a spate of big bankruptcies — are a reminder of its dangers.

What are the data and circumstances the Fed is weighing as it meets next week to consider its next move on rates? What are the stakes of the decision for the real economy, firms, and individuals? Does the Fed’s dual mandate — price stability and full employment —and the available data argue for a pause or a resumption of rate hikes? We discuss below.

Best,

Dana

Hike or pause? That’s the decision officials will face next week when the Federal Open Market Committee (FOMC) meets to decide the fate of the federal funds rate. The Fed has raised the rate ten consecutive times since last March, taking interest rates from near zero early last year to a target range of 5 to 5.25 percent today. The FOMC’s decision to hike or to pause, even temporarily, will no doubt flow from recent data on jobs and inflation, which may tilt the FOMC towards a further hike. But there are other considerations as well…

Jobs Numbers Remain Strong

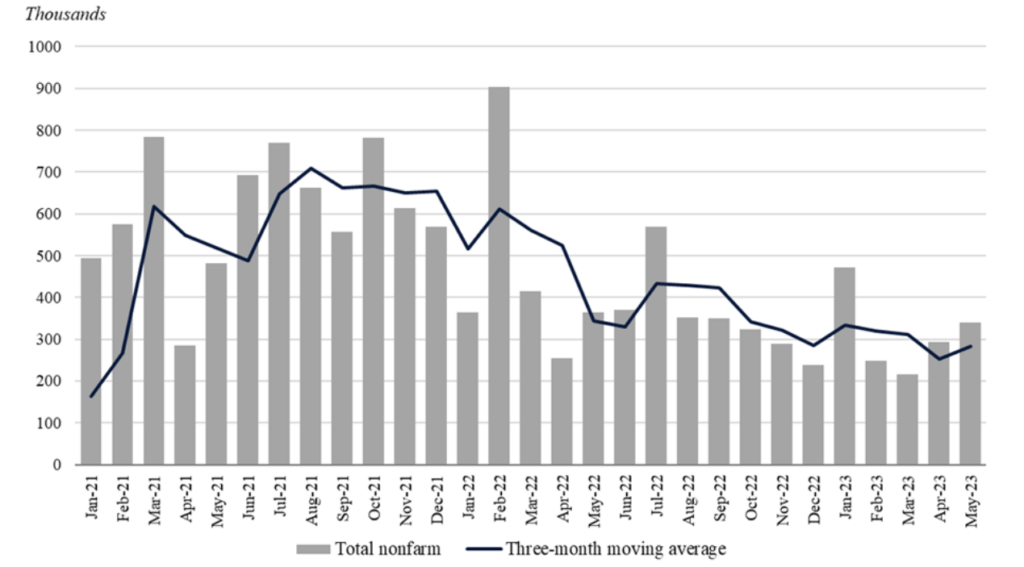

… Like the labor market, which is proving remarkably resilient. Friday’s jobs report showed that the strong job gains of the past few months are not over, with nonfarm payroll employment increasing by 339,000 in May — beating expectations yet again, and by a big margin. Monthly job gains have averaged 283,000 over the past three months. The job growth seen from 2021 to present is impressive, and recent numbers reflect an economy still recovering after steep declines at the onset of the pandemic. This month’s numbers were likely stronger than the Fed expected and may suggest to Fed officials that more action is needed.

Gains in professional and business services, government employment, and health care spurred the job growth . As the labor market continues its post-pandemic recovery, employment in leisure and hospitality – which increased by 48,000 last month – remains below its February 2020 level by 349,000 or 2.1 percent. Such a persistently robust labor market would disincline the Fed from halting its rate hikes.

U.S. Job Growth (January 2021 – May 2023)

Source: Bureau of Labor Statistics,

(graph compiled by the Council of Economic Advisors)

The unemployment rate inched up by 0.3 percent in May to 3.7 percent, representing the largest monthly increase in seven years outside of the dramatic shifts seen during the pandemic. Over the last year, unemployment has ranged between 3.4 and 3.7 percent. Rising unemployment and job growth in the same month may seem contradictory, but this is not uncommon. The Bureau of Labor Statistics’ jobs report contains data from two separate surveys: the Establishment Survey – a survey of workplaces, the results of which give us data on payroll count and wage growth – and the Household Survey – as the name suggests, a survey of households, which provides the unemployment rate and labor force results.

Wages grew once again in May. Average hourly earnings rose by 11 cents or 0.3 percent, a 4.3 percent increase over the past year. This is down from a 0.4 percent increase in the previous month. Wage growth has slowed sharply from its pace in early 2022. Meanwhile, overall labor force participation has held steady at about 63 percent, with the participation rate for workers between the ages of 25 and 54 rose to over 83 percent.

Inflation Hotter Than Hoped For

Trends in inflation are paramount considerations. Prices remain elevated with modest relief, with the latest data coming in hotter than the Fed would have hoped for. The personal consumption expenditures (PCE) index – the Fed’s preferred measure of inflation – increased by 0.4 percent in April, a 4.4 percent increase from the year prior, up from March, when the PCE index rose 0.1 percent month-on-month, following a 0.3 percent monthly increase in February and a 0.6 percent monthly increase in January. The tentative downward trend appears stuck or stalled.

This month’s 0.7 percent rise in energy prices, which fell overall 6.3 percent over the past year, was the main culprit despite the month-on-month increase. Housing and rental prices remain high and also contributed a great deal. Over the month, prices for goods and services rose 0.3 percent and prices of services rose 0.4 percent. Meanwhile, food prices fell very slightly by under 0.1 percent in May in a sure sign of continued relief for households, following a spike in food prices last year. Year-on-year, food prices have risen 6.9 percent. Core PCE, which strips out food and energy costs and is generally a better predictor of future overall inflation, rose 0.4 percent in May and 4.7 percent from a year ago.

Another factor that may push Fed officials to seek further rate hikes as necessary is last month’s reacceleration of consumer spending, which increased by 0.8 percent.

The Fed’s Potential Paths Ahead

The Fed’s monetary policy effort to cool both measures has not yet had the intended results. Recent data released on inflation and the labor market are short of what the Fed wants to see at this point in its campaign — the most aggressive series of interest rate hikes since the 1980s. The Fed’s monetary policy effort to cool both measures has not yet had the intended results.

Last month, the Fed signaled for the first time in its campaign to cool inflation that it would be open to a pause in June following signs that inflation was finally coming down. Minutes from the FOMC’s May meeting show that officials were keeping an eye on a credit crunch following recent turmoil in the banking sector, due to the collapses of banks that failed to effectively manage their interest rate risk. Mid-sized banks remain weaker than they were at the beginning of the year. The resulting slowdown in lending may be amplifying the effect of interest rate hikes on economic activity.

Officials also recognized that a lag exists before their monetary policy decisions fully set in to slow economic activity and drive inflation down. Overall, many FOMC members favored a data-dependent approach ahead of next week’s decision. While the committee may have been open to a pause, recent data suggests that the FOMC will likely take one of the following potential paths:

- Increase the interest rate by 25 basis points, bringing the federal funds rate to a target range of 5.25 to 5.5 percent

- Pause in June, then raise interest rates once again in late July

- Pause in June and July, then raise interest rates once again in late September

New inflation data, set to be released on Tuesday, the first day of the FOMC’s two-day meeting, is sure to be central to the Fed’s decision. According to the Cleveland Fed’s nowcast, headline consumer price index (CPI) data is expected to show inflation slowing in May, continuing a trend of falling inflation that began last summer. Core CPI, however, may remain sticky and stay far higher than the Fed would prefer. This could further tilt Fed officials in the direction of yet another 25 basis point hike, but the likelihood of a pause remains strong nevertheless.

The Fed is walking a fine line, seeking to balance its dual mandate of controlling inflation and maintaining a strong labor market. The path forward is turbulent. A 25 basis point increase could risk overcorrecting as recent interest rate hikes and tightening in the lending market take hold. But a pause may signal to some that the Fed is losing resolve in terms of driving inflation down before it reaches its target.

As Federal Reserve Chair Jerome Powell noted in his March testimony before the Senate Committee on Banking, Housing and Urban Affairs, “the process of getting inflation back down to two percent has a long way to go and is likely to be bumpy.” After ten consecutive rate hikes, the Fed must keep front of mind the risk posed by overcorrecting and tilting the economy into a recession. A pause would give this cycle of rate hikes a further chance to set in and the results to become evident in new data. This moment will be crucial and potentially defining for the country’s economic future.