Update 597— Biden FY 23 Budget:

Balance, Parity in Appeal to Center

President Biden submitted his FY23 budget saying that budgets are statements of values. The statement here is muted, with an increase in domestic spending and an increase in military spending by about 10 percent, a puzzling nod to austerity of all things, investments in many things, and lots of open questions.

A good first one is why rough parity between domestic and defense spending remains a value. Another is whether Biden’s proposed billionaires tax and a corporate tax rate hike are DOA in the Senate and where that leaves deficit reduction. And what does it mean for a reconciliation bill? We look at these and other questions about the midterm implications of Biden’s budget below.

Best,

Dana

—————

On Monday, the White House released its $5.8 trillion budget proposal for fiscal year 2023, which begins on October 1, 2022.

The White House is requesting:

- $1.6 trillion in discretionary funding

- $813.3 billion in defense spending

- A minimum income tax for billionaires

- Funding to combat climate change

- Policies to lower costs for families

- Manufacturing investments to address supply chain issues

$795 billion of that discretionary spending is designated for non-defense spending, a nine percent increase above the $715 billion in non-defense discretionary funding included in the 2022 Consolidated Appropriations Act. With changes to mandatory spending, this constitutes an 11 percent hike in total non-defense spending. The White House’s request for defense spending shows an increase of $31 billion, or four percent, from FY 2022.

BBB progeny — climate change and family priorities, along with other policies — is not budgeted specifically but intended to be part of a deficit-neutral package of revenue and program policies. The budget assumes such a package will reduce future deficits rather than being neutral but the neutrality estimate is conservative. The budget noticeably shifts away from pandemic-era funding, toward a more centrist agenda for the next stage of the recovery.

The President’s budget proposal only serves as a guide for the Congressional appropriators, tax writers, and committees that write entitlement laws. The House and Senate Budget Committees convened Tuesday and Wednesday to question OMB Director Shalanda Young on the President’s request. In the coming weeks, Congressional leadership will continue to work on an agreement on the top-line numbers with the goal of getting 12 appropriations bills done by the end of the summer.

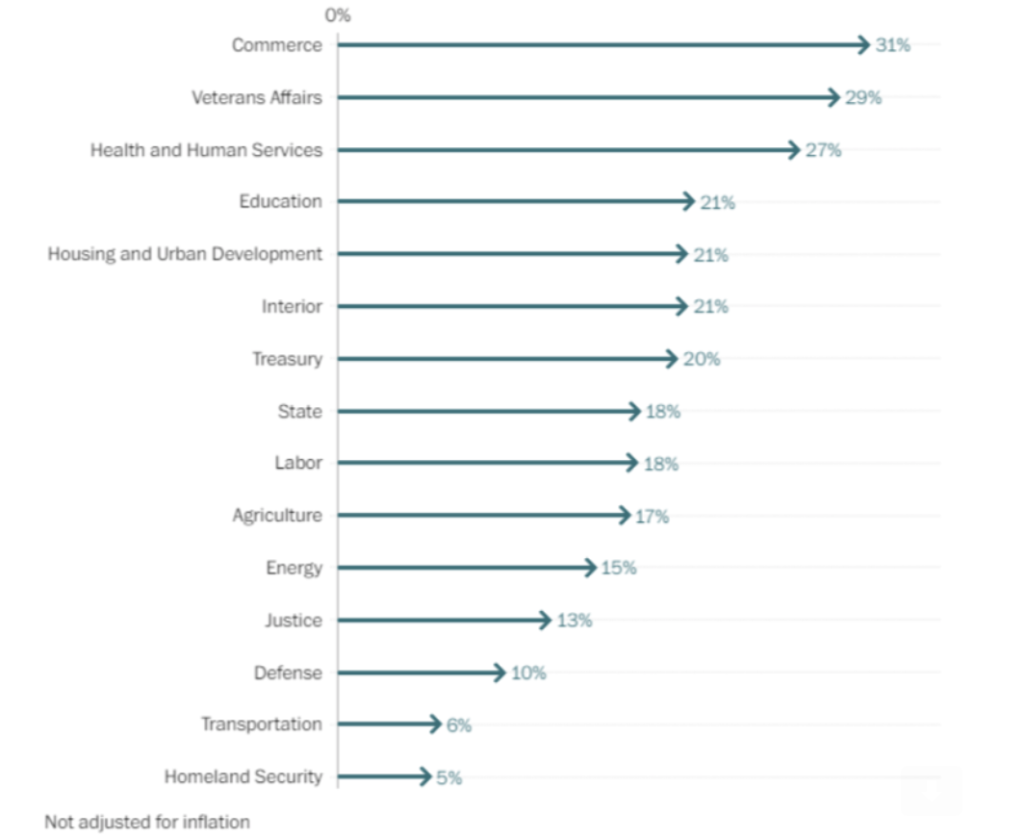

Proposed Changes from FY21 to FY23

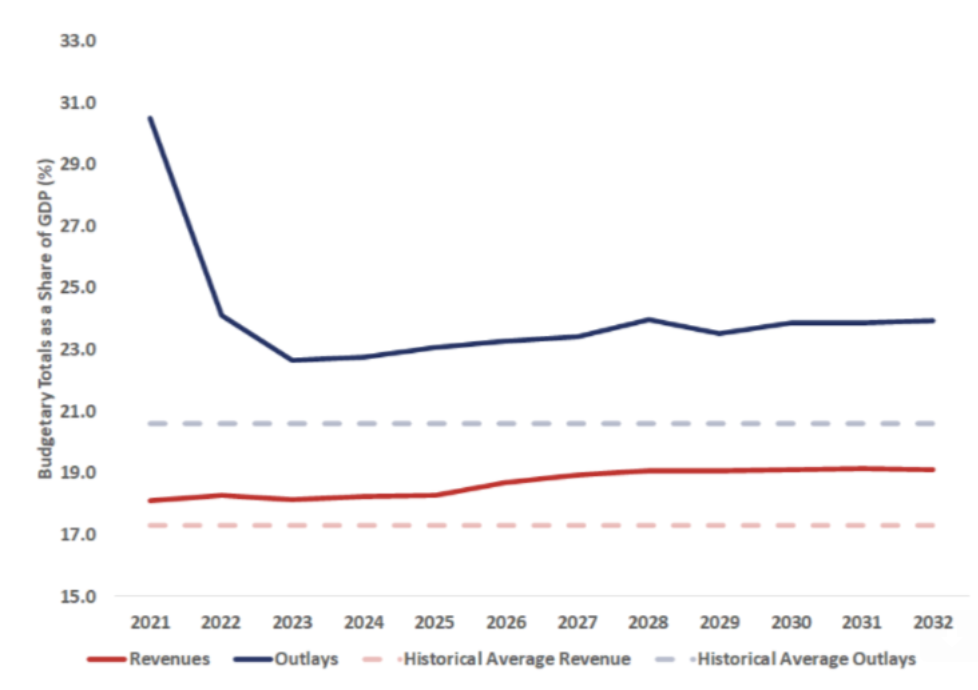

Fiscal Responsibility via Deficit Reduction

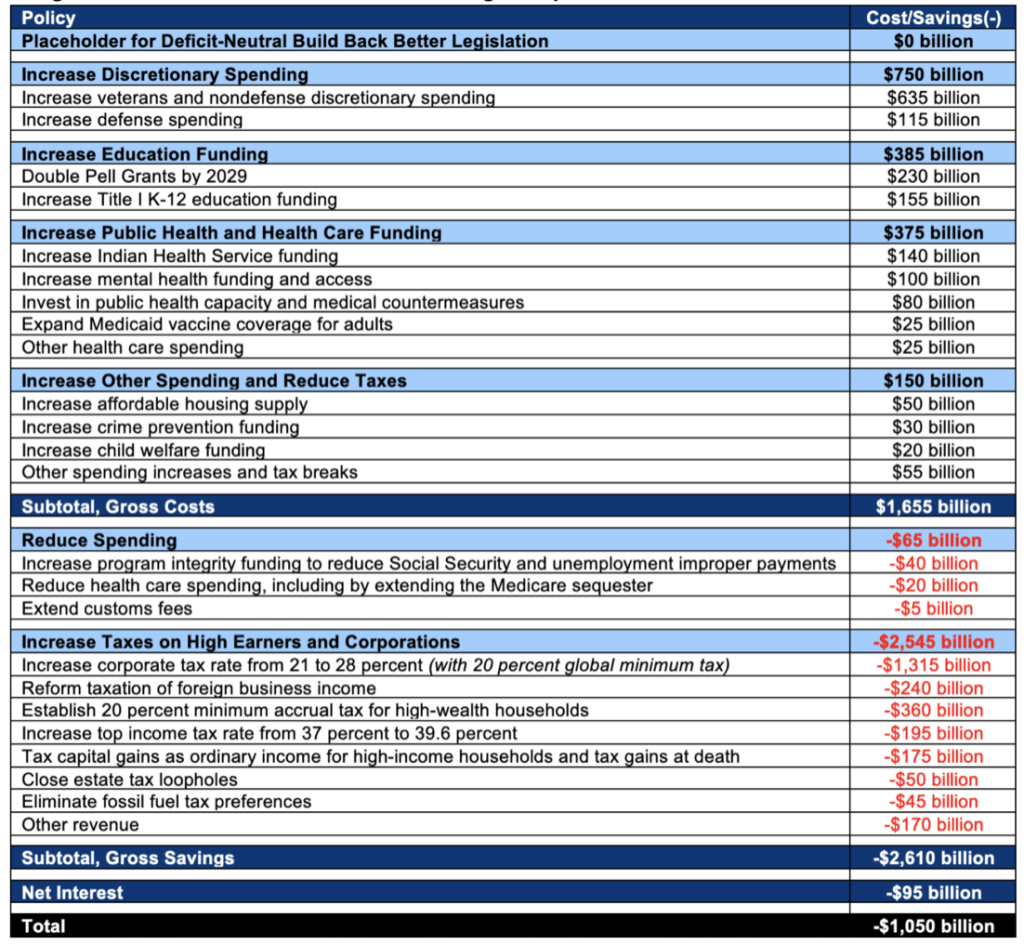

The administration touted deficit reduction as a key feature of its proposal. The budget would cut the projected deficit by $1 trillion over ten years. This is in large part possible due to increases in revenue from taxes on corporations and the ultra-wealthy and the end of the pandemic-era stimulus.

President Biden noticeably endorsed a billionaires tax. The new proposed tax on households worth $100 million or more would impose a 20 percent minimum tax on income, including unrealized capital gains. The White House estimates that on average, billionaires pay an average tax rate of only eight percent. Including unrealized capital gains in this minimum prevents billionaires, who make the majority of their income from investment, from putting off their taxes indefinitely by simply borrowing money against their gains instead of selling. The proposal is projected to raise $360 billion over ten years.

Other tax increases in the proposal include raising the top individual tax rate to 39.6 percent, up from 37 percent, and increasing the corporate tax rate to 28 percent, up from 21 percent. These changes would partially roll back cuts from the Tax Cuts and Jobs Act of 2017. And these tax proposals are in addition to revenue increases that would be part of the deficit-neutral reserve fund.

FY2023 President’s Budget: Taxing and Spending

A More Moderate Agenda for the Midterms

The 156-page plan reflects the differences that persist in Biden’s coalition and the gaps between what is being offered here and the reality of what will emerge. With the exception of its sizable tax increases, Biden’s budget tacks toward the political center, bowing to endangered Democrats by bolstering defense and law enforcement spending and tackling inflation and deficit reduction in service of what he called a “bipartisan unity agenda.”

Republicans have sought to paint Democrats as responsible for an uptick in violent crime in cities governed by Democrats, conveniently disregarding the increase in crime across Republican-controlled cities, too. Biden’s budget aims to emphasize that Democrats still back funding for police. In the past, lawmakers in swing states have argued that voters’ affiliation with Democrats with the statement “defund the police” hurt them with moderate voters — though research on this isn’t conclusive.

The budget proposal indicates that Democrats are focused on reducing inflation, a central issue for voters that Republicans have been hitting as well. The proposal points specifically to investments in the supply chain as efforts that will help reduce the costs of products. It also reiterates backing for programs that would curb the amount that families would pay for services like child care and energy, although these policies are only vaguely included in the reserve fund.

As Andrew Prokop noted in a piece for Vox, it’s unclear how much these proposals will help in the near term because it will take time for them to be implemented and for their effects to be felt. The White House’s attempts to highlight how they are trying to address crime and inflation speak to Democrats’ acknowledgment that both issues could be weaknesses for them.

The Fight Ahead

Because the presidential budget request is merely a statement of the administration’s values and priorities, the real work of allocating funds falls to Congress, where much of the White House’s proposal may die. President Biden will likely not receive all of the funding he is hoping for to increase the size of Pell Grants or promote clean energy, key proposals of the President’s agenda. Initiatives from Build Back Better that are included in the administration’s deficit-neutral placeholder, including the expanded child tax credit, child care, and healthcare subsidies, and investments to tackle climate change, will also presumably end up on the chopping block unless Democrats can quickly come to a consensus on a new reconciliation package.

Meanwhile, the fight over defense funding parity has already begun. The White House has proposed a four percent increase over the 2022 approved levels, referring to them as “historic” investments. While progressives like Senator Bernie Sanders have criticized the budget for leaning too heavily into defense funding, Republicans have been critical of what they see as an effective cut to defense funding. Before Biden’s proposal was released, a group of Republican Senators released a statement calling for a five percent increase in defense funding over inflation, citing threats from China and Russia. As Congress negotiates defense spending, a number of domestic priorities will consequently be crowded out.

Without some of the pay-fors included in the request, even more, domestic priorities will have to be dropped. We’ll likely see the usual opposition to raising corporate tax rates from both Congressional Republicans and Democratic Senator Kyrsten Sinema. Sinema has rejected calls for increases to either the corporate tax rate or the top marginal tax rate. Beyond any political challenges the billionaire’s tax will face – Joe Manchin has already expressed his concerns – a tax on unrealized capital gains will also face significant constitutional challenges. If Democrats can secure enough votes in both chambers to enact the tax, the central question will then become whether Congress has the authority to tax unrealized capital gains as income. Sen. Ron Wyden billionaire’s tax proposal by pointing out that treating gains as income already appears elsewhere in the tax code.

Though the President’s budget will be inexorably altered through the appropriations process, it reflects an important political moment for the administration. With difficult midterm elections ahead, this may be Biden’s last chance to get a spending bill through a Congress controlled by Democrats. In the coming months, Democrats will need to fight hard for their new and ongoing priorities both on the Hill and on the campaign trail to avoid being left with inadequate spending bills or a continuing resolution for the coming fiscal year.