Update 580 — Enough Sinema Verite:

Rays of Hope in the Economic Picture

Senators Manchin and Sinema doubled down yesterday on their opposition to Senate filibuster reform and in essence, the critical voting rights package adopted by the House yesterday, which needs a reform of the Senate filibuster rule’s 60-vote threshold to pass. You might be excused in thinking that nothing but federal judgeships can ever get done this Congress.

But that’s not true. Among other things, economic policy — fiscal policy relatively easily, financial policy less so — can still and will be made. And there’s reason to hope for some significant, favorable, even progressive outcomes in these areas. More below.

Happy MLK weekends all,

Dana

————

One year into President Biden’s first term, the contours of the post-pandemic U.S. economy are slowly coming into focus. Entering office right after the sharpest decline in GDP and employment in history, the administration passed sizable stimulus legislation to reinvigorate the economy. Although the administration has a lot to feel good about following the impacts of the legislation, more than a few economic headaches remain. This update will examine the state of the economy, look forward to 2022, and analyze what Democrats can do to improve the economic picture while still holding Congress.

Remember: Robust Recovery

This past year, the US experienced the fastest job growth in recorded history: 6.4 million net jobs were created in 2021 with an average of 537,000 jobs per month. This number is likely to grow after upward revisions for November and December from the Bureau of Labor Statistics, which has under-reported initial monthly job gains by around 100,000 on average this year. The US has now gained back 84 percent of the jobs lost at the nadir of the pandemic-induced economic crisis. The unemployment rate fell from 6.4 percent in January 2021 to 3.9 percent in December. This far outpaced almost every economic projection made at the beginning of 2021, including the Congressional Budget Office’s February 2021 forecast, which predicted that unemployment would remain above 4 percent until 2026.

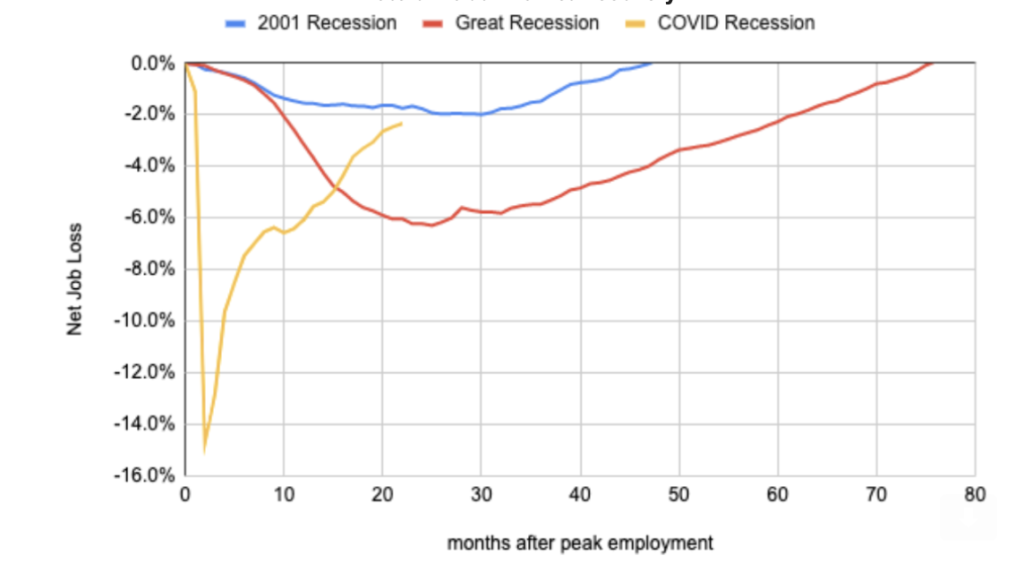

While the US is still about 3.5 million jobs short of its pre-pandemic peak, the current rate of recovery has far outstripped the labor market recovery in the wake of the Great Recession. For comparison, the Biden job market after one year in office is roughly where the Obama job market was after four years. The US might even be on track to surpass peak employment faster than after the relatively mild 2001 recession.

Rate of Labor Market Recovery

Along with a healthy uptick in jobs, wages are also on the rise. In 2021, hourly wages grew by 4.7 percent, the fastest pace in 40 years. These gains are particularly concentrated in traditionally low-wage sectors; for example, leisure and hospitality saw average pay rise 14 percent in 2021. This can be attributed to a tightening labor market with employers being forced to increase wages as they find it hard to find or retain workers for historically undesirable jobs due to pandemic concerns.

While some level of economic recovery was likely in 2021 regardless of federal policy, the swift passage of the American Rescue Plan early in Biden’s term contributed disproportionately to the robust economic growth we are experiencing. Moody’s Analytics estimates that GDP growth would have been 2.3 percentage points lower in the absence of the ARP. Additionally, the economic support provided by the ARP, such as the expanded child tax credit and UI enhancements, reduced poverty by 20 percent this year.

Unexpected Headwinds

After a decade of sub-2 percent inflation, many were caught off guard by the 7 percent CPI spike in 2021, the largest increase in 40 years. Even after stripping out food and energy costs, which tend to be more volatile even in non-pandemic times, inflation rose to 5.5 percent. This is the biggest one-year jump since 1991. Although 7 percent inflation is relatively mild historically speaking and some upward pressure on inflation after a recession is a positive development, the rate was well above what most economists expected at the beginning of last year.

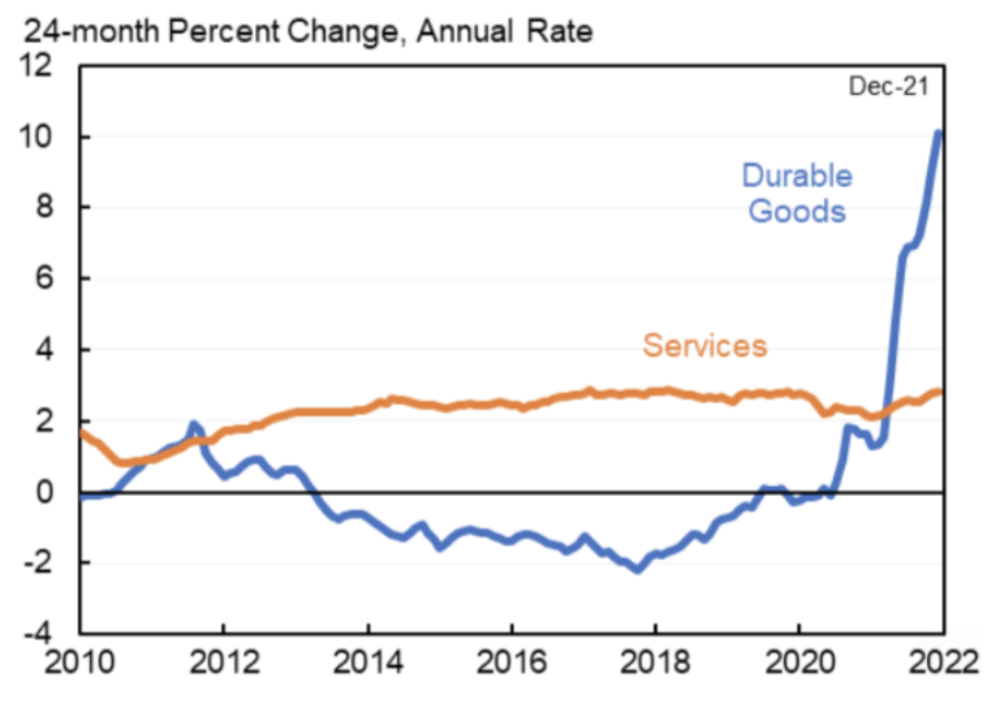

Consumer Price Inflation

The main driver of inflation is likely not excess consumer demand, as fiscal conservatives claim, but rather supply disruptions caused by the unprecedented shift in consumer demand from services to durable goods. The shift towards durable goods has put a major strain on the US supply chain which was only exacerbated by the labor shortage in key transportation sectors due predominantly to the pandemic. As companies adjust their production goals to meet demand, inflationary pressures should ease. While we are not yet seeing a wage-price spiral, if inflation expectations remain high this year and become baked into business planning, high inflation could then seep into the services sector.

The resurgence of Covid has put a damper on the economic momentum of last year. Thanks to high vaccination rates, Omicron appears to be putting less of a strain on hospitals, but there is no way of knowing the longer-term economic behavioral effects of a virus that does not seem to be going away any time soon. If anything, this underlines the need for Congress to move quickly to pass President Biden’s Build Back Better package in order to provide a level of economic certainty for millions of families. The United States continues to be the only industrialized nation that does not guarantee paid family leave, Pre-K, or childcare, and that is hampering our ability to reach maximum economic potential.

What to Expect in the Coming Year

Over the next 12 months, the Biden administration and the Democratic-led Congress will continue to deal with the numerous economic challenges facing the country while also progressing their forward-looking agenda. But the most important factor for the economic recovery is ending the pandemic. If the Biden administration can tame Covid effectively over the coming months, inflation will recede at a considerable pace and the robust economic recovery will not only remain but be boosted.

As outlined numerous times during Federal Reserve Chairman Powell’s nomination hearing before the Senate Banking Committee on Tuesday, this bout of inflation is mostly the result of supply disruptions due to Covid. On the margins, the Biden administration has moved to alleviate these disruptions through numerous executive orders and actions to tackle backups at ports and consolidation across various industries. One sign the administration’s efforts are working is the decline in month-over-month meat prices in December following Biden targeting the concentrated meatpacking industry for jacking up prices. While fighting corporate concentration is always a worthwhile endeavor, curbing the pandemic will be the best way to cool inflation.

Simultaneously, the broader economic recovery will continue as we address Covid. While it is mathematically impossible to see the same type of job growth this year as we saw in 2021, there is little reason to expect job growth will not continue to be steady. In addition, wage growth should remain hot but eventually simmer down along with inflation. Workers will return to the workforce and workplace as it becomes safer, and that will bring new job creation and broad income gains to the economy.

Other Things to Follow in 2022:

- Federal Reserve Nominations

- Bipartisan Antitrust Hearings and Reform

- Cracking Down on Overdraft and NSF Fees

- Regulating Cryptocurrency and FinTech

- Appropriations Negotiations

The White House and Congress have their work cut out for them. Ending the pandemic must be at the forefront of their agenda in order to protect the economic recovery. As Covid is addressed, the White House and Congress can lay the groundwork for the post-Covid economy by returning to Build Back Better.