Update 596 — Arsenal of Democracy:

Debating (How) America COMPETES

The America COMPETES Act making its way through Congress could leave an indelible stamp on competitiveness, manufacturing, workforce provisions, and industrial policy generally. COMPETES provides overdue investments for the US to set standards for the global economy and to expand economic opportunities domestically.

The bill rejects the frequent blind eye of the United States and other democratic nations to multinational corporations, state enterprises, authoritarians, oligarchs, etc. This is the chance to engage in informed industrial policy — currently policy by default rather than by intelligent and intentional design — and reduce our reliance on anti-democratic supply, product, and financing sources. We take a look at the history, status, and future of COMPETES, below.

20/20 Vision has a position open for an Economic Policy Analyst. If you are or know of anyone who may be interested, please forward this link or contact us at dana@2020visiondc.org.

Good weekends all,

Dana

—————

Senate Majority Leader Schumer is guiding the Senate version of the America COMPETES Act into a rare bicameral conference with the House to iron out the differences between their respective bills. A vote on the Senate’s bill is expected early next week. A conference committee will likely work over April recess, with a final floor vote currently expected in May. The infrequent nature of conferences in a 50-50 Senate should not go unnoticed, a measure of the bill’s magnitude. House Republican leadership is determined to defeat any compromise bill, but House Republican opponents may be outnumbered by supporters on both sides of the Capitol. We’re currently waiting for the appointment of conferees.

The Senate first passed this bill last July. Then the House passed its version in pieces, which were then folded into the American COMPETES legislation that passed the House in early February following a markup by the Committee on Science, Space, and Technology. The Senate and House bills include $52 billion in funding for the CHIPS Act, initially authorized as part of the FY21 NDAA. Senator Todd Young, the lead Republican sponsor in the Senate, has helped deliver over a dozen Senate Republican votes, in part by arguing for the need for the CHIPS provision.

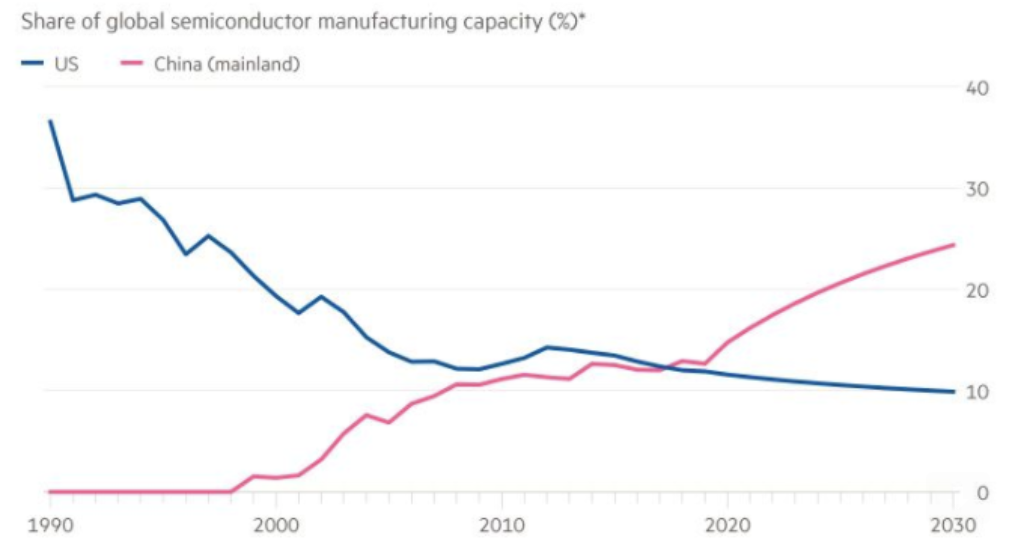

US Chip Capacity Has Declined as China Has Risen

Our Fragile Supply Chains

The COVID-19 pandemic exposed gaps in domestic manufacturing capacity in the United States and vulnerabilities in global supply chains. Volatile demand, manufacturing disruptions, the lack of surge capacity, and insufficient domestic production capacity contributed to shortages of critical medical supplies needed to combat the COVID-19 pandemic. A critical shortage in semiconductors — chips needed for the fabrication of electronic devices — has forced manufacturers to idle or significantly reduce production. The global shortage has led to severe price increases for vehicles and durable goods that have been the primary drivers of elevated inflation over the last year.

As supply chain disruptions have created economic misery for working families, large corporations and consolidated industries have decided to take advantage of the situation to raise their prices. Three alliances of shipping companies, all of them foreign, now dominate 80 percent of global container ship capacity. They have increased costs for their services which have also spilled over into the costs for goods, estimated to increase consumer prices by nearly 1 percent over the next year. And this has extended to other industries as executives boast about high profits as a result of price increases.

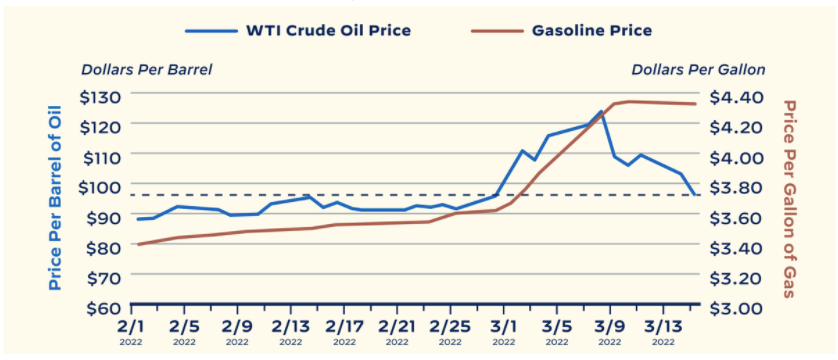

While oil prices were already on a steady rise over the last year as the economy reopened, Russia’s invasion of Ukraine threw the global energy network into turmoil. Numerous nations decided to reject further supply of Russian oil and gas, leading to the highest prices at the pump in American history. The price spike has been exacerbated by gas companies keeping prices elevated at the pump.

Changing the Course

These crises are the logical conclusion of an economic system based on underinvestment, cutting corners, and engaging with those who reject the basic principles of democracy. But there are signs this paradigm is falling apart under the Biden administration.

The Infrastructure Investment and Jobs Act (BIF) is pumping hundreds of millions of dollars into clean energy R&D over the next five years. The historic investments highlight the national security and competitiveness concerns from our reliance on fossil fuels, particularly from authoritarian regimes. These investments will help the US seek energy security and independence, depriving authoritarian regimes of American consumers.

With $52 billion in proposed investments for domestic semiconductor manufacturing, the CHIPS Act as part of COMPETES would overhaul the global semiconductor supply chain. Taiwan’s significant controlover the semiconductor industry is a national security and competitiveness risk as supply chain disruption would cut off American manufacturers. Concerns over the CHIPS Act as corporate welfare can be addressed by giving the federal government non-voting equity shares in semiconductor companies, analogous to what Congress did for airlines in CARES. Bringing semiconductor manufacturing to the US will improve global competition and security, especially with China’s share of semiconductor production on the rise.

Congress and the White House are taking on Covid, war, and even inflation profiteering and corporate concentration. The White House has released numerous executive orders to crack down on multiple industries including shipping, meatpacking, and oil and gas. Congress has held hearings and pushed legislation on antitrust and corporate gouging to rein in multinational corporations which have exerted too much control over American economic production.

Oil vs. Regular Unleaded Gasoline

What More Can Be Done

The White House and Congress ought to continue reassessing our investments in supply chains and economic production. The nation needs a fix for our current supply chains but can also learn lessons for the supply chains of tomorrow. A good start as proposed by Carnegie Mellon Professor Erica Fuchs: make more common-design semiconductor chips that would help alleviate bottleneck concerns while also increasing global competition. US investment in rare-Earth mineral extraction will cut our reliance on countries with shaky commitments to democracy to provide access to supplies for key goods.

As we have seen from Russia’s invasion of Ukraine, Putin’s power over Europe comes from Russia’s oil and gas production. If we transition to clean energy and help other countries do the same, we reduce the influence authoritarian regimes have on democratic nations. As Former Navy Secretary Ray Mabus said to the Senate Environment and Public Works Committee this week, “clean energy is a peacekeeping investment.” We should end our dependence on fossil fuels to ensure large oil companies cannot gouge our citizens while contributing to one of the largest national security risks we face: climate change.

But all of these investments are for naught if we do not expand, educate, and train our labor force for the future. The House version of COMPETES encourages more high-skilled immigration, but we must continue to liberalize our immigration system. We must also invest in community college, vocational school, childcare, and workforce development so that we have an economy that leaves nobody behind.

The COMPETES Act represents the investments we need, and as Congress works on finalizing the text of the bill over the next couple of months, advocates and policymakers must ensure all industrial and R&D investments are maintained. Only through these investments can we return to the mission left to us by President Franklin D. Roosevelt: “We must be the great arsenal of democracy.”