Update 570 — Just a Head at the Fed:

Powell’s Chair and the Other Seats Up

This morning’s passage of the Build Back Better Act (BBB) by the House in a 220-213 vote sends the $1.65 trillion in spending initiatives — overhauling federal health care, education, climate, and tax laws, after months of negotiation — to the Senate for consideration.

Within days, President Biden is expected to nominate Jerome Powell to serve a second term as Chair of the Federal Reserve Board. Powell’s term ends in February. Biden has other Fed Board nominations to make and we review the political and economic dynamics behind Biden’s decisions, and as well as the key policy decisions currently confronting the Fed and its head.

Good weekends all,

Dana

————

Evaluating Biden’s Choices

Powell’s four-year term as Fed Chair does not end until February, but the timing of Biden’s nomination announcement is later than previous presidents’, underscoring the difficult choice Biden has to make here. And Biden has as many as three additional positions to fill at the Fed, on top of that.

The majority view among market participants and analysts has long been that Powell is favored for renomination. But Lael Brainard is a compelling, qualified candidate with experience in the Treasury Department and Fed. The debate has split Democrats, including those on the Banking Committee, with Sen. Tester explicitly supporting Powell and Sen. Warren vociferously opposing him. Some key Congressional Republicans have indicated support for Powell. Treasury Secretary Yellen recently praised Powell, with reports indicating she privately supports his renomination.

The following factors may be weighing on Biden’s decision:

Why Biden Might Renominate Powell:

- Continuity: In reappointing Powell, Biden might wish to signal to the market that he wants the Fed to stay the course amid a still-ongoing recovery and uncertain inflation outlook.

- Precedent: In recent decades, Presidents have typically renominated Fed Chairs after their first term. However, President Trump broke this tradition when he replaced then-Chair Janet Yellen with Powell in 2018.

- Monetary Policy: Powell’s record on monetary policy has been generally laudatory, particularly in keeping interest rates low and taking significant actions at the start of the pandemic to prevent a worse economic downturn.

- Senate Confirmation: A number of Republican Senators have indicated support for Powell’s renomination, meaning his confirmation will likely be relatively smooth in the Senate.

Why Biden Might Nominate Brainard:

- Political Leanings: Brainard is the only Democrat currently serving on the Fed Board, and her overall views on economic policy are more closely aligned with Biden’s than those of Powell — a registered Republican. Biden might opt to use this opportunity to shape the ideological leaning of the Board in a more liberal direction. Also, if Biden nominates Brainard for Chair, Powell may choose to resign soon rather than serving the remainder of his term as Governor, opening up another seat on the Board for Biden to fill.

- Financial Regulatory Policy: The clearest area of divergence between Powell and Biden is on financial policy. Powell’s tenure saw a significant amount of deregulatory actions initiated by Vice Chair for Supervision Randal Quarles that ran counter to the Biden administration’s generally progressive stance on bank regulatory policy. As Governor, Brainard dissented on many of those actions. Appointing Brainard would signal Biden’s interest in the Fed taking a more prudent approach to its important, but often overlooked, supervisory role over the nation’s largest banks, clearinghouses, and payment systems.

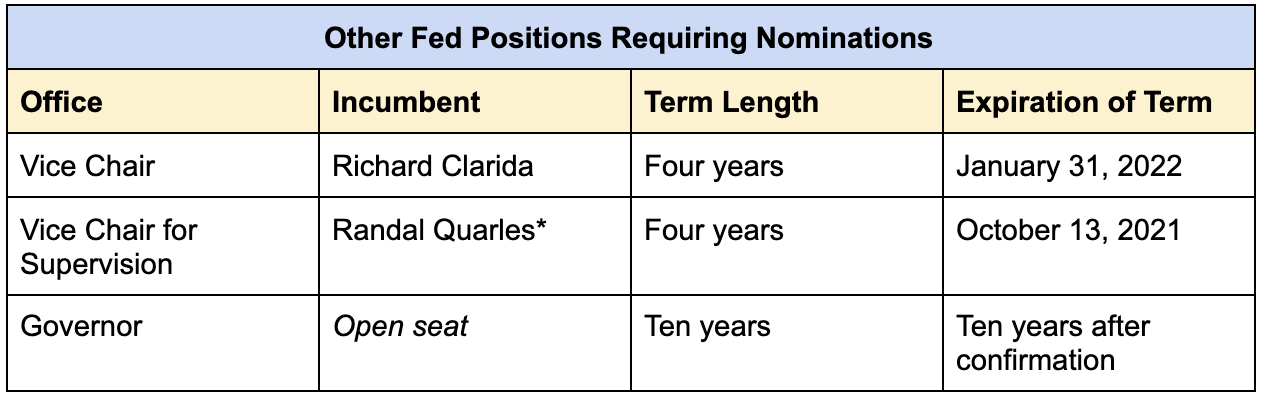

In addition to the Chair nomination, Biden will also have a number of other decisions to make for the Fed:

*Quarles plans to resign from his term as Governor by the end of this year.

Should Biden renominate Powell, his other nominations could still result in the Board having a liberal majority — a potentially dramatic shift away from its traditionally conservative orientation — giving the Fed a more progressive outlook. Biden might announce these nominations simultaneously with his Chair decision, but if he doesn’t, further delay in filling these vacancies is inadvisable. Reportedly, former Fed Governor Sarah Bloom Raskin’s paperwork has been sought and vetted by the White House for a Fed post; that of Lisa Cook, a Michigan State Professor, and Sherrod Brown favorite, has not.

One wild card that could affect the politics behind Biden’s decision is his nomination of Saule Omarova to be Comptroller of the Currency. Omarova’s progressive views and academic writings on financial policy have led her to be the subject of an unusually anti-immigrant, intense, and vitriolic campaign of opposition by the banking industry. As things stand, Omarova faces an uphill battle to Senate confirmation, which might have an unintended impact on Biden’s decision for Fed Chair.

Big Decisions Ahead: Interest Rates and the ‘I-Word’

The next Fed Chair will make critical decisions on monetary policy that could significantly impact the economy in the short term. Earlier this month, the Federal Open Market Committee announced a schedule for the Fed to wind down its monthly $120-billion asset purchases. The Fed is not expected to raise interest rates until after the tapering process concludes in the summer of 2022, with the latest projections having the Fed potentially raising rates only once next year.

Inflation could throw a wrench into this schedule. The Fed has continued to argue that long-term inflation is unlikely, but has backed off projections from earlier this year that price increases will only last for months. If price increases continue into next year, the next Fed Chair will likely face a critical decision whether to start raising interest rates earlier than planned.

Biden’s decision for Chair may not only hinge on monetary policy. Both Powell and Brainard have established dovish credentials. Powell has kept interest rates low throughout the pandemic. Brainard was a key mover (in addition to Powell) behind the Fed’s new monetary policy framework, which calls on the Fed to wait before raising rates amid inflation in order to support its full employment mandate.

Clear Contrast on Regulatory Policy

The most significant difference between Powell and Brainard is in regulatory policy. Powell’s tenure as Chair has been marked by mostly negative financial regulatory policy decisions, but these deregulatory decisions were initiated by Quarles in his capacity as Vice Chair for Supervision. Many insiders have expected that Biden will name Brainard to Vice Chair for Supervision while retaining Powell as Chair. If so, a key question is whether Powell would be as deferential to Brainard as he was with Quarles. If so, regulatory policy could move back in the direction of prudential regulation and supervision at the Fed.

Key policy areas the Fed will address include:

- Systemic Risk: During Powell’s tenure, the Fed weakened supervisory stress test programs, diluted liquidity and margin requirements, and softened living wills and risky investment restrictions. Brainard would undoubtedly be the better Fed Chair on financial regulation, as indicated by her dissents on many of these rollbacks of post-2008 reforms.

- Digital Assets: Besides saying earlier this year that the Fed will not ban cryptocurrencies, Powell has not taken a strong stance on digital assets. He has seemed much less enthusiastic about creating a Central Bank Digital Currency than Brainard, who has been the Fed’s most vocal proponent of CBDC. In the coming months, the Fed will likely play a role in addressing the systemic risks from stablecoins, especially if stablecoin issuers are placed under bank-like regulatory regimes.

- Climate Risk: Powell has reluctantly signaled an openness to incorporating the systemic risk posed by climate change into the Fed’s bank supervisory regime, but his record on bank regulation indicates he might not go along with stronger requirements — while Brainard has taken a more progressive stance on this issue. Sens. Whitehouse and Merkley just today announced their opposition to Powell’s renomination citing his positions on climate risk.

A Waiting Game

On the surface, Brainard would appear an obvious choice to replace Powell at the current moment, especially since Biden could give Democrats majority control over the Fed. But this isn’t a winner-take-all game. Between the politics of nominations and the fragile full employment consensus ushered in by Powell, the likelier outcome seems to be that Biden keeps Powell at the Chair while giving Brainard the Vice Chair for Supervision slot along with a pro-regulation majority. This outcome would ideally ensure political and policy victories for the administration but could cause rifts in the progressive and environmental left. The delay in the decision means the White House is seriously considering swapping out the Chair. With the realm of possibilities narrowed, all we can do is wait. The first shoe will drop shortly enough.