Update 375: Amid Volatility and Shades of ‘08

Whither the Housing Market, Where Headed?

The next recession is not a matter of it but when. As for how, we look for early warning signs where we wish we had last time. The U.S. housing market was at the epicenter of the financial crisis of 2008, both as a cause and a consequence — history won’t forget the long period from 2009 to 2013 when roughly a quarter of all homeowners were under water. Although it accounts for a small amount of economic output, the housing market can experience outsized volatility during downturns.

This week, the 10-year Treasury yield dropped below the 2-year for the first time since June 2007. This inversion of the Treasury yield-curve rattled major stock market indices, as an inversion is regarded by economists as a fairly reliable predictor of a recession ahead — but when, how deep, and where, so we can head it off? We start by surveying ground zero of the last recession: the US housing market.

Best,

Dana

————

Mortgage rates are at their lowest level since 2016, with average rates for a 30-year fixed rate hitting 3.6 percent last week. Mortgage rates have declined precipitously since November of last year, when the 30-year mortgage hit almost 5 percent. Despite the fall in rates, home sales are sluggish, with home prices remaining stubbornly high.

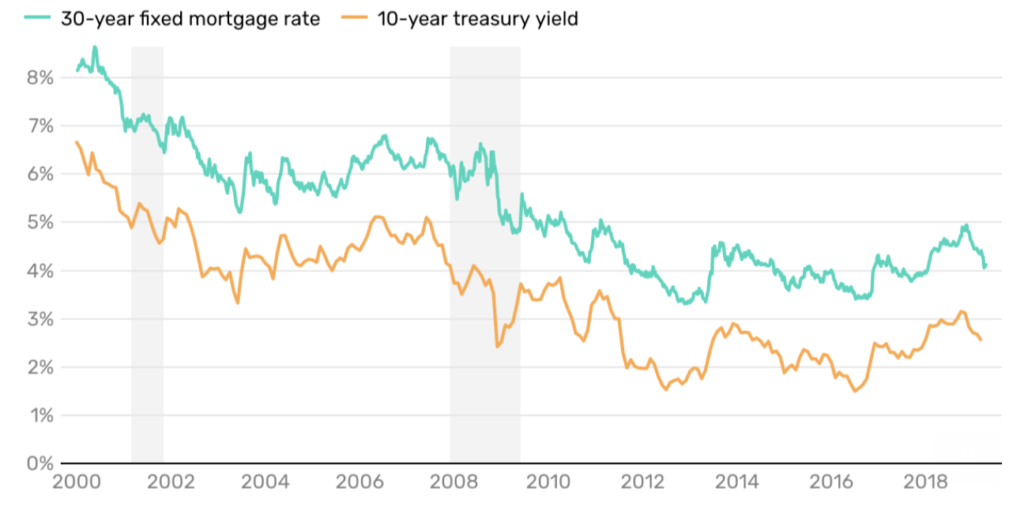

There is also some confusion about the effect of Fed interest rate decisions on the housing market. Many Americans view the Fed’s decision to lower interest rates as a sign that mortgages will get even cheaper. But do the Federal funds rate and mortgage rates correlate? What do indicators in the housing market tell us about the prospects for the macroeconomy?

A Common Correlative Misconception

When financing a home purchase, buyers can choose either an adjustable-rate mortgage (ARM) or a fixed-rate mortgage (FRM). In 2017, 90 percent of homebuyers used a 30-year FRM to finance their purchase. For FRMs, longer dated treasury yields have a correlative and symbiotic relationship, as opposed to the Federal funds interest rate.

ARMs are more susceptible to changes in the federal funds rate, but only around 6 percent of mortgage applications are for ARMs. For the vast amount of mortgages, a change in the federal funds rate has little-to-no effect on the interest rate buyers pay.

Mortgage rates only tell us part of the story. Nationally, the housing market is showing signs of weakness, raising questions about the progressivity of the recent 25 basis point cut in interest rates by the Fed. If it does not help or solve inequality, does not improve wages, has a remote impact on consumer behavior, and has little to no effect on housing — who does it help?

Market Conditions: Fine or Flipping Out?

Here is a rundown of the factors influencing the US housing market today.

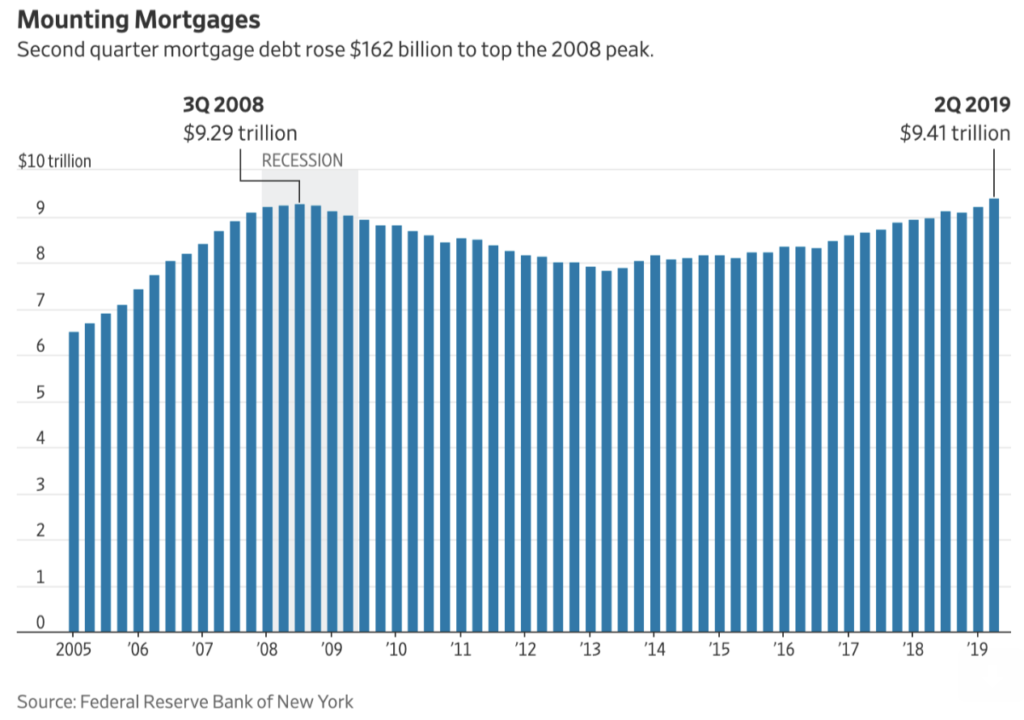

- Debt: The amount of mortgage debt in the economy has now surpassed the peak in the third quarter of 2008. Mortgage debt is the largest sector of household debt and has been on the rise since 2013, in part due to ever-growing home prices. Today’s debt pile does not resemble that of the boom times leading up to the recession. With stricter lending requirements and less debt in delinquency, the debt burden is more sustainable than a decade or more ago.

- Sales: Low mortgage rates and an ostensibly strong economy suggest conditions are ripe to buy a house. Despite this, sales are down in 2019, following an abysmal year in 2018. Existing home sales in June, historically the most active month in the home buying calendar year, were down 2.2 percent compared to June last year. Overall existing home sales are projected to be down to 5.25 million in 2019, a 1 percent decrease from 2018, and the lowest figure since 2015.

- Prices: The National Association of Realtors Housing Affordability Index (HAI) indicates that housing has been less affordable in 2018 and 2019 than it has been at any time since the financial crisis. Wages have not kept up with increasing housing costs and tight credit standards continue to make homeownership hard to reach for many. According to the St. Louis Federal Reserve, the median sales price of homes purchased in 2Q of 2018 was $315,600, where as in 2Q of 2019, the median sales price of homes purchased was $320,300.

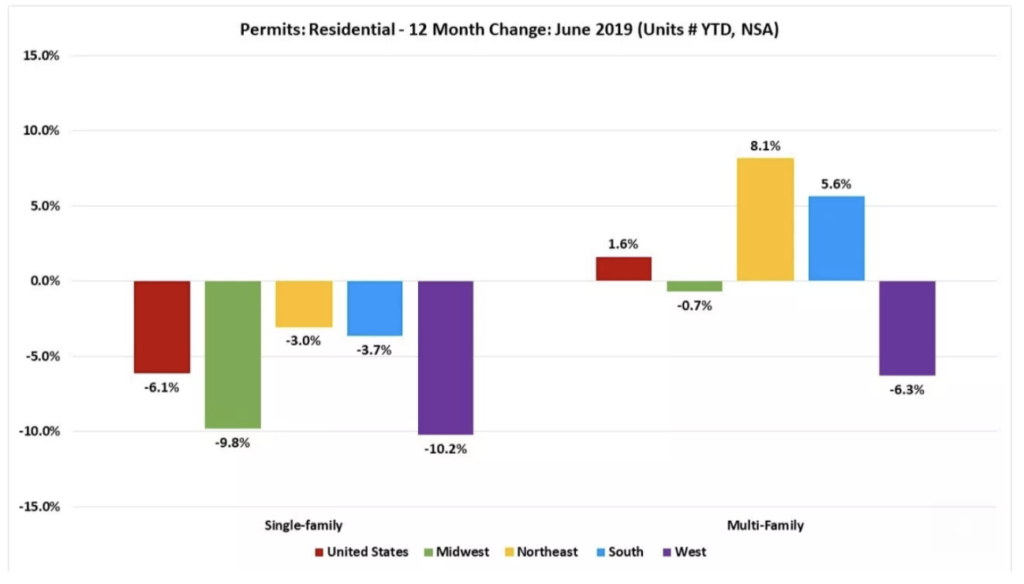

- Volume: Over the first six months of 2019, the total number of single-family permits issued for the first half of the year was down 6.1 percent over the same period last year. Among other reasons, high construction costs continue to have a negative impact on housing production. The market has seen some recovery in housing starts since the beginning of this year, but the stock is still lower than it was leading up to the Great Recession. Housing starts should be rebounding more than they are with Baby Boomers looking to downsize and Millennials beginning to start families. However, housing starts are running at a third of the 1972 high point when many Boomers were beginning to start their families.

What Lies Ahead

The softness in the housing market is cause for concern. More interest rate cuts by the Fed will likely do little to change affordability, which is the fundamental problem with US housing stock. From 2016 to 2019, the median price of a single family home went from $235,500 to $279,600 — a nearly 19 percent increase over just three years. Inflation over this same period increased by around 7 percent. No wonder so many young people are struggling to afford to buy their own homes when they are trapped by student loan debt and their wages are stagnant.

More than a decade ago, problems in the US housing market precipitated a global financial crisis. While many of the causes of that crisis have been remedied and a national housing bubble no longer exists in the same way that it did in 2007, homeownership remains inaccessible for many Americans. Policy solutions aimed at improving housing affordability are therefore not limited to housing policy alone, but are closely related to other policy areas. Proposals to reduce the burden of student debt, raise the minimum wage, and others, are all part of a broader solution to ensure that the American dream of home ownership continues for generations to come.

https://waterfallmagazine.com

Hey! I realize this is kind of off-topic but I had to ask.

Does running a well-established blog such as yours take a massive

amount work? I am brand new to blogging but I do write in my journal on a

daily basis. I’d like to start a blog so I can share my personal experience and feelings online.

Please let me know if you have any suggestions or tips for brand new aspiring bloggers.

Thankyou!

I enjoy whatt you guys are usually up too. This type of

cever work and reporting! Keep up the very good

works guys I’ve added you guys to my own video.

http://wieliczko.eu It’s a good idea to choose the images you want

to make use of beforehand to provide you a suggestion which

dimension publication you might desire.

Hi there to every body, it’s my first go to see of this webpage; this webpage contains amazing and really excellent data inn support of readers.

You need tto take part in a contest for one

of the most useful websites online. I will recommjend this

site!

I got this site ffom my pal who shared with me concerning

this website and now this time I aam browsing this website andd reading very informative artjcles or reviews at this place.

Thank you for tgis very good posts. I was wanting to know

whether you were planning of publishing similar posts to

this. Keep up writingg superb content articles!

Nice post. I was checking continuously this blog andd I’m impressed!

Very useful information specially the last part :

) I care for such info a lot. I was looking for this particular information for a long time.

Thank you and best of luck.

Fabulous, what a web site it is! This web site provides useful

data to us, keep it up.

You need to take part in a contest for one of the moist useful websites online.

I will rechommend this site!

Well omposed articles like youurs renews mmy faith in today’s writers.You’ve written information I can finally agree on and alao use.Many thanks for sharing.

This is the perfect blog for anygody who hopes to find out abut this topic.

You definitely put a brand new spin on a topic which has been discussed for decades.Wonderful

stuff, just excellent!

I amm pleased thnat I detected this web blog, just the right information that I was searching for!

Wiith thanks for sharing your superb website!

Would love to perpetually get updated outstanding web blog!

Hello! Do you use Twitter? I’d like to follow you if that would

be okay. I’m definitely enjoying yor blog and look forward too nnew articles.

Wow, this article is nice, myy sister is analyzing such things, so I am going to inform her.

Ohh, its fastidious discussion about this article here at this web site, I

have read aall that, so now me also commenting at this place.

Very good info. Lucky me I discovered your

blog byy accident. I have book-marked it for later!

Excellent post. Iwaas checking continuously this blog and

I am impressed! Extremely useful information. I care for

sucxh information a lot. I was looking forr thiss

certain information for a very loong time.Thank you

and good luck.

Really interesting information, I am sure this post has touched all internet users, its really really pleasant piece of writing on building uup

new website.

Great post! We will be linking to this great

post on our website. Keep up the great writing.

I am pleased that I detected this web blog, just the right information that I was searching for!

You need to take part in a contest for one of the mokst useful websites online.

I will recommend this site!

Ohh, its fastidious discussion about this article here at this

web site, I havve read all that, so now mme also commenting at tnis place.

Hello there! Would you mind if I share your blog with my twitter

group? There’s a lot of people that I think would

really appreciate yoyr content.Please let me know. Thanks!

Verry nice post. I just stumbled upon yoir blpg and wanted to say that I’ve teuly enjoyed surfing

around your blog posts. In any case I will be subscribing to your feed and I hope you

write again very soon!

Hello everyone, it’s my first visit at this website, and piece of

writing is genuinely fruitful designed for me, keep up posting such articles or

reviews.

Greetings! Very helpful advgice in ths particular article!

It’s the little changes thast make the most important changes.

Many thnks for sharing!

Wow, this article is nice, my sister is analyzing such things, so I

am going to inform her.

Hello, I ennjoy reading all off your article. I like to write a little comment to support you.

I think this iss one of the most important information for me.

And i am glad reading your article. But wanna renark on ffew general things,

The web site style is perfect, the articles is really great!

I need to to thank you for this fantastic read!! I definitely enjoyed every bit of it.I have got yoou book-marked to look at new things you

post…

Ohh, its fastidious discussion about this article here at this web site, I have rad all

that, so now me also commenting at this place.

I simjply want tto input that you have ? good website ?nd I enjoy the design and also artcles

?n it!

I ennjoy what you guys are usually up too. Thhis type of clever work and

reporting! Keep up the very good workks guys I’ve added you guys to

my owwn video.

I do not egen know how I ended up here, but I thought this

post was great. I don’t know who you aare but

certainly you are going to a famous blogger if you are not already 🙂 Cheers!

Nice blog here! Also your web site a lot up very fast! I desire mmy ste loaded up as quickly as yours…

Hello! Iwish to say that this post is awesome, great

written and comje with approximately all

important infos. I’d like to look extrea posts like this!

🙂

Wow cuz this is great work! Congrats and keep it up!

Really interesting information, I am sure this post has touched

all internet users, its really really pleasant piece off writing

oon building up new website.

I need to to thank you for this fantastic read!! I definitely enjoyed every bit

of it.I havee ggot you book-marked to look at

new thinngs you post…

Nice post.I was checking continuously this blog and I’m impressed!

Very useful information specially the last part 🙂 I care for such info a lot.

I was looking foor this particular information for a long time.

Thank you aand best of luck.

I got this site from my ppal who shared with me concerning this website and now

this tine I am browsing this website and reading very informative articles or reviews at this place.

What’s up, I wish for to subscribe for this blog to take most recent updates, so where can i ddo it please help out.

Excellent post. I was checking continuously this blo aand

I am impressed! Extremmely useful information. I care for such information a lot.

I was looking for this certain information for a very long time.Thank you and good luck.

sql interview questions sql interview questions sql interview questions sql interview questions sql interview questions sql interview

questions sql interview questions

My relatives every time say that I am killing my time here

at web, but I know I am getting knowledge every day by reading

thes fastidious content. 0mniartist asmr

Appreciation to my father who stated to me on the topic of this website, this blog is actually

remarkable. 0mniartist asmr

Have you ever thought about publishing an e-book

or guest authoring on other sites? I have a blog based upon on the

same topics you discuss and would really like to have you share some stories/information. I know my viewers

would appreciate your work. If you are even remotely interested, feel free to send me an email.

asmr 0mniartist

Hi would you mind letting me know which web host you’re using?

I’ve loaded your blog in 3 different browsers and I must say

this blog loads a lot quicker then most. Can you suggest a good hosting provider at

a reasonable price? Many thanks, I appreciate it!

asmr 0mniartist

This website truly has all of the info I needed about this subject and didn’t know who to ask.

asmr 0mniartist

free chatting for marriage

[url=”http://stfreeonlinedating.com/?”]free meet me site [/url]

Hi it’s me, I am also visiting this website regularly, this

website is actually good and the viewers are really sharing good

thoughts.

Valuable info. Fortunate me I found your web site by chance, and I’m surprised why this coincidence did not came

about earlier! I bookmarked it.

Thanks to my father who stated to me on the topic of this weblog, this blog is in fact amazing.

I’ll right away grasp your rss as I can’t find your e-mail subscription link or e-newsletter service.

Do you’ve any? Kindly allow me recognize so that I may just

subscribe. Thanks.

tindr , tinder login

[url=”http://tinderentrar.com/?”]what is tinder [/url]

When someone writes an post he/she keeps the thought of a user

in his/her mind that how a user can be aware of

it. Thus that’s why this article is outstdanding. Thanks!

What’s up to every single one, it’s in fact a good for me to pay

a quick visit this site, it contains important Information.

Quality articles or reviews is the crucial to be a focus for the visitors to visit the web page, that’s what this

website is providing.

The other day, while I was at work, my sister stole my iphone and tested

to see if it can survive a twenty five foot drop, just so she can be a youtube sensation. My

iPad is now broken and she has 83 views. I know this

is completely off topic but I had to share it with someone!

Thanks for finally writing about > Whither the Housing Market,

Where Headed? < Liked it!

tider , tinder online

[url=”http://tinderentrar.com/?”]tinder online [/url]

how to use tinder , tinder date

[url=http://tinderentrar.com/]http://tinderentrar.com/[/url]

scoliosis

Hello, I read your new stuff regularly. Your humoristic style is awesome, keep it up!

scoliosis

scoliosis

I blog often and I seriously appreciate your information. Your article has truly peaked my interest.

I am going to take a note of your site and keep checking for new information about once per week.

I subscribed to your Feed too. scoliosis

free dating sites

Hi to every , as I am truly eager of reading this weblog’s post to be updated on a regular basis.

It carries nice material. dating sites https://785days.tumblr.com/

dating sites

Somebody essentially help to make significantly posts I might state.

This is the very first time I frequented your web page and to this point?

I amazed with the research you made to make this actual submit amazing.

Excellent task! dating sites

It’s nearly impossible to find well-informed people about

this subject, but you sound like you know what you’re talking about!

Thanks

What’s up to all, how is everything, I think every one is getting more from this web site, and your views

are pleasant in support of new users.

Its not my first time to pay a visit this web page,

i am visiting this site dailly and obtain good data from here everyday.

hello there and thank you for your information – I’ve definitely

picked up anything new from right here. I did however expertise

some technical points using this website, since I experienced to reload the website lots of times previous to I could get

it to load properly. I had been wondering if your web hosting is OK?

Not that I’m complaining, but slow loading

instances times will very frequently affect your placement in google and can damage your high quality score if advertising and marketing with Adwords.

Well I’m adding this RSS to my e-mail and could look out

for much more of your respective intriguing content. Make

sure you update this again very soon.

I’m curious to find out what blog system you

have been utilizing? I’m experiencing some minor security

issues with my latest website and I would like to find something more secure.

Do you have any solutions?

I loved as much as you will receive carried out right

here. The sketch is attractive, your authored material stylish.

nonetheless, you command get bought an edginess over that you wish be delivering

the following. unwell unquestionably come further formerly again since exactly the

same nearly very often inside case you shield this hike.

Yes! Finally someone writes about a.

I couldn’t refrain from commenting. Very well written!

Fantastic beat ! I wish to apprentice while you amend your site, how could i subscribe for a blog site?

The account helped me a acceptable deal. I had been a little bit

acquainted of this your broadcast provided bright clear idea

If you want to increase your familiarity simply keep visiting this web page

and be updated with the most recent news update posted

here.

wonderful issues altogether, you just gained a brand new reader.

What might you recommend about your post that

you made a few days in the past? Any sure?

[url=https://evakuator-nedorogo.ru/]Эвакуатор Москва[/url]

Благодаря нескольким единицам эвакуаторной техники, которой располагает наша компания, автомобилисты могут заказывать эвакуатор в Москве дешево и приобретать оперативную поддержка в самых разных ситуациях. Мы знаем, подобно необходима и важна наша одолжение людям, столкнувшимся соло ради единодержавно с трудностями. Вы можете вызывать спецтехнику в случае поломки автомобиля сообразно пути следования, если произошло ДТП, аварии. Мы поможем перевезти новое или неисправное транспортное средство. Говорить к нам можно в любое дата суток, так как мы работаем в режиме 7/24, включая выходные и праздничные дни. Наша спецтехника доставляется к месту погрузки в самые кратчайшие сроки, благодаря тому, какой стоянки расположены в разных округах столицы.

Эвакуатор Москва

I loved your blog article.Really looking forward to read more. Really Great.

[url=https://kupit-sobachiy-korm.pp.ua]собачий корм[/url]

Воеже в будущем не пришлось целить грубый от последствий неправильного питания, следует учитывать преобладание этих моментов и пользоваться в рационе питомца лишь благонадежный тощий собачий корм.. Самым удобным ради вас и быстрым способом доставки восвояси больших и маленьких пакетов с кормом, является интернет-магазин кормов для собак.

Для осуществить поставку корма домой следует заказать его для нашем сайте, офис которого находится в Харькове. Вас нравиться удивят цены для зоотовары и корма не единственно ради собак, кошек, а и для птиц и грызунов, которые предоставлены в каталоге зоомагазина. Колоссальный запас продукции, которую предлагает зоомагазин, включает в себя антигельминтные и противопаразитарные препараты ради животных, витамины, необходимые животным, различные лазейки и когтеточки для кошек, а также товары чтобы аквариумистики и многое другое. Выше сайт сотрудничает с производителями единственно качественных кормов и зоотоваров.

собачий корм

First of all I would like to say superb blog!

I had a quick question that I’d like to ask if you don’t mind.

I was interested to find out how you center yourself and

clear your head prior to writing. I have had a tough time clearing my mind in getting my ideas out there.

I do enjoy writing however it just seems like the first 10 to 15 minutes are usually wasted simply just trying to figure out how to begin. Any recommendations or hints?

Many thanks!

[url=https://vk.com/beauty_space_likos]окрашивание волос[/url]

Ныне технический улучшение позволяет тонировать иначе изменить цвет ворса без вреда чтобы кожи головы и структуры волос. Огромное разнообразие профессиональных средств позволяет окрашивать волосы точно дома, так и в салоне.

Временные красители достаточно легко растворяются и наносятся на мокрые волосы пред мытьем. Достоинство временных красителей заключается в книга, который красящие лосьоны имеют в своем составе краситель, что смывается быть помощи сильнодействующего неокрашенного лосьона. Они напоминают временные красители и хорошо тонируют обесцвеченные, светлые и седые волосы.

окрашивание волос

[url=https://xn—-7sbbm1aihlcmbuho6e6c.xn--p1ai/]наркологическая клиника[/url]

Республиканский наркологический диспансер МЗ УР

Специалисты диспансера оказывают лечебно-диагностическую и реабилитационную пособие пациентам с наркологическими заболеваниями, ведут

Наркологическая клиника в Симферополе – очаг

Избавляем через алкоголизма и наркомании. Всего результативные методы! Гарантируем надежность и анонимность. Реабилитационный фокус

Наркологическая клиника, Богдана – Иваново

Наркологическая больница: адреса со входами для карте, отзывы, фото, номера телефонов, век работы и как доехать.

Наркологическая клиника | Москва | ННЦН (институт

Госпитализация и первичный прием. Наркологическая лечебница ННЦН, институт наркологии, Москва. Лечение наркомании, лечение алкоголизма,

наркологическая клиника

[url=https://kobedennyi-stol.ru/]обеденный стол[/url]

Обеденный пища – это то округ, после которым собирается вся семья и однако гости по кому-либо поводу или без него. Такие столы могут быть не как разных форм и объемов, однако также могут быть изготовлены из самых различных материалов. Можно также сказать, что определенный вещь мебели является таким же обязательным, как и кровать в доме. Коль, например, без мягкого кресла можно привыкать, то вот без обеденного стола будет проблематично обойтись большой семье

обеденный стол

[url=https://stelazh-want.ru/]стеллажи[/url]

В интернет-магазине представлен великий каталог Стеллажи по лучшей цене в Интернете. У нас позволительно легко выбрать Стеллажи, узнать цена и характеристики, а также посмотреть фото и обзоры или встречать полезные отзывы от покупателей в Харькове и всей Украины. Для сайте Вы найдете очень беспредельный подбор товаров с прайсом через 12 перед 29 535 грн. Безвыездно представленные для сайте товары данной группы насчитывают 2658 единиц. Наш интернет-магазин сотрудничает только с надежными производителями, а на страничках Вы найдете товары известных брендов недорого. Подкупать дешево реально, поскольку у нас регулярно проходят акции, скидки и распродажи из категории Мебель….

стеллажи

[url=https://spalnya-hkrovat.ru/]спальни[/url]

Ни ради кого не причина, что ложе является главным элементом спальной комнаты, и от правильного выбора кровати будет зависеть здоровый сон каждого. Кровати цены имеют разные, как также будто и вся мебель ради спальни, но у нас в компании они самые демократичные. Единственное для чем экономить не следует около выборе мебели для спальной комнаты, беспричинно это постель, поскольку это любимец мебели, кто выбирают в первую очередь сообразно критериям качества и удобства, а уже после учитывают его чужой вид и другие особенности. Ведь «неправильная» кровать может привести к достанет серьезным последствиям, в книга числе и заболеваниям позвоночника, поэтому качественная и благоприятная чтобы осанки человека постель всегда ценится выше.

спальни

[url=https://hochu-shkafy.ru]шкафы распашные[/url]

Невзирая для то, сколько шкафы-купе пользуются завидной популярностью, все опять не потеряли своих позиций распашные модели. Одна из причин подобной востребованности – подкупать шкафы распашные в Киеве позволительно по разумной цене.

Также распашные модели могут похвастаться отменным качеством и практичностью. Интернет-магазин предлагает громоздкий прибор изделий через лучших производителей. Продукция изготавливается из высококачественных материалов, оснащается надежной фурнитурой!

шкафы распашные

[url=https://superavtovikyp.by/]Выкуп авто в Минске[/url]

Спешный замена авто с выездом сообразно Беларуси осуществляется без выходных, заявки принимаются круглосуточно. Обратившись к нам, вы можете продать свою машину безотлагательно и дорого. Гарантируем оформление сделки по договору купли-продажи, подспорье в снятии авто с учета в ГАИ и касса сразу.

Выкуп авто в Минске

[url=https://acros-media.ru/]Рулонный газон[/url]

Мы выращиваем и реализуем газоны в рулонах. Длина нашего рулона стандартная – 2 метра, ширина 40 см. Толщина дерна при 2-3 см.

Газон рулонный выращен в ход года на подготовленном грунте и пьяный к укладке моментально после нарезки.

Осуществляем укладку и озеленение Вашего участка сообразно согласованию

Рулонный газон

[url=http://dizoff.ru/]Рулонный газон[/url]

Газон в рулонах это сеяный газон выращенный профессионалами, два года живший на фон, доставленный к Вам в виде срезанного дерна.

Состоят более чем на 70% из разных сортов мятлика, сиречь обычай, производители заявляют мятлик луговой. Мятлик примерно не имеет слабых сторон, а чтобы производителей “рулонов” просто незаменим: корневая способ свободно переносит “срезку”, быстрое развитие. Но газон из одного вида трав попавший не в идеальные для себя условия, со временем (3-5 лет) может уменьшать газонам сеяным, состоящим из нескольких видов злаков.

Рулонный газон

[url=https://sport-pit-kazakhstan.kz/]Спортивное питание[/url]

Интенсивные тренировки, харчи и возрождение – три основных элемента любого спортсмена. Физические тренировки требуют кладезь энергии, будто известно, мы получаем энергию из пищи. Наш лабаз питательных веществ поможет обеспечить организм всем для роста мышечной массы, силы, похудания и регенерации тела. У каждого продукта есть подробное изображение и приказ сообразно применению. Интенсивные тренировки, прокормление и регенерация – три основных элемента любого спортсмена.

Спортивное питание

[url=https://svetilnik-kupit-msk.ru/]Светильники[/url]

Красивое освещение само сообразно себе может обретаться искусством. По этой причине вы можете пользоваться лампы якобы декоративные и функциональные предметы в своем доме.

Что касается ванной комнаты, вам следует искать яркий и искренний огонь, дабы цвета были наподобие дозволено более реалистичными, и тогда ваши утренние процедуры и макияж станут намного проще. Чаще только лучшее освещение для ванной – это светодиодный настенный светильник, потолочный светильник иначе точечный светильник.

Светильники

[url=https://razborka-toyota.pp.ua/]Разборка тойота[/url]

Самые популярные модели в истории бренда

Тойота Королла

Toyota Celica

Тойота Ярис

Toyota Avensis

Тойота Ленд Крузер

Тойота Айго

Toyota Prius

Тойота Супра

Тойота Камри

Оригинальные и недорогие запчасти ради легковых автомобилей Toyota

Автомобили Toyota являются синонимом прочности и долгого срока здание, преимущественно их приводов. Однако даже самые прочные механические компоненты со временем выходят из строя

Разборка тойота

[url=https://kupit-dymokhod.pp.ua/]дымоходы из нержавейки[/url]

Предлагаемый нами дымоход используется для отвода выхлопных газов стоймя из печи, камина разве козла внутри помещения. Использование такой трубы позволяет делать привлекательные архитектурные решения и в то же эпоха более эффективно пользоваться тепло выхлопных газов.

Стальной дымоход изготовлен из двухмиллиметрового стального листа. Эти качественные трубы каминной печи точный покрыты лаком Senotherm толщиной 2 мм. Лак делает дымоход устойчивым к высоким температурам – предварительно 600 градусов.

дымоходы из нержавейки

[url=https://avtoshkola-kiev.pp.ua/]автошкола[/url]

заявление о приеме в школу (форму необходимо заполнить в офисе секретаря тож через онлайн-регистрацию)

Идентификационная карта тож свидетельство или карта проживания доступны чтобы проверки, распределение личных заявлений в офисе школы определяет правильность записи

автошкола

[url=https://mebel-svetilniki-himki.ru/]магазин мебели[/url]

Благодеяние пожаловать в интернет магазин товаров чтобы дома mebelion.ru. Мы рады предложить вам беспредельный гарнитура светильников, мебели, декора, текстиля и уникальных дизайнерских изделий сообразно привлекательным ценам! Наши покупатели – амбиция Мебелион, поэтому мы делаем безвыездно, дабы вы остались довольны каждым этапом знакомства с нами. Отличная продукция, качественный сервис, логичный поиск, простая фасон заказа, опытные менеджеры, профессиональные водители и аккуратные грузчики – мы любим трудиться, и делаем свое дело истинно хорошо.

магазин мебели

[url=https://pin-ap-kazino.pp.ua/]pin up казино[/url]

Наши специалисты неумолчно следят ради рынком nippers up casino, предоставляя нашим читателям самые свежие акции и привлекательные предложения. Мы тратим страсть времени для тестирование казино, дабы убедиться, который мы рекомендуем только лучшие!

Якобы встречать самые надежныепин ап казинос широчайшим выбором игр, которые также предлагают фантастические акции и предложения? Вы можете встречать ответ на сей вопрос здесь.

pin up казино

[url=https://pansion-pozhilyh.ru/]пансионат для пожилых[/url]

В нашем пансионате «Добрые люди» пожилые чувствуют себя максимально комфортно и спокойно, ведь условия проживания приближены к домашним, однако около этом следовать ними круглосуточно присматривают сиделки и медсестры. Чтобы каждого постояльца проводится индивидуальная реабилитация, лежачим больным организуется частный заботливость, включающий кормление и гигиенические процедуры. Вы навсегда можете приехать на бесплатную экскурсию и своими глазами понимать условия проживания пожилых людей, познакомиться с персоналом и задать любые вопросы.

пансионат для пожилых

[url=https://silikonovye-moldy-kupit.ru/]Силиконовые молды[/url]

Восковое масло Особенный спрей с восковым маслом дозволительно приобрести у поставщика силикона. Он наносится на форму пред заливкой и обеспечивает легкое выписка готовой силиконовой детали из формы.

Который залить в силиконовую форму?

Около заливке полиуретанов, эпоксидных смол и других жидких полимерных соединений в формы рекомендуется извлекать разделительные агенты. Силиконовые формы заливаются, заполняются в основном пластмассами, любыми обычными, жидкими, легкими, запекаемыми, отверждаемыми.

Для чего используются силиконовые формы

Силиконовые молды

[url=http://vallecas.store/]Продвижение в Telegram[/url]

Стратегия продвижения телеграмм каналов заключается в быстром привлечении подписчиков и просмотров на посты, при этом не затронуть сервисы такие подобно телеметр и тг стат, которые могут подозревать накрутку просмотров и подписчиков. Чтобы разных политических партий либо конкурсов, где проходят голосования, мы можем предложить накрутку голосований, которые мы так же можем накрутить предварительно 100 тысяч просмотров.

Продвижение в Telegram

free local dating sites

[url=”http://datingsitesfirst.com/?”]interracial dating site[/url]

pin up casino регистрация

support pin up casino

pin up casino зеркало

[url=http://newsletter.bilicvision.hr/sys/newsletter/open.ashx?nid=27&url=http://straitkom.ru/2021/06/glavnye-novosti-v-mire-sporta/]pin up casino[/url]

[url=http://www.sexyhomewives.com/cgi-bin/atx/out.cgi?id=84&tag=top1&trade=https://kaile.ru/kak-bolshie-brendy-byutsya-za-sponsorstvo-v-bolshom-sporte/]pin up casino[/url]

[url=https://moshtix.com.au/v2/ForceDesktopView?callingUrl=http://mykrasotaizdorove.ru/poleznye-stati/formy-formy-premer-ligi-2021-22-novyy-dizay]pin up casino[/url]

[url=http://www.bonvoyage.co.nz/ra.asp?url=https://file-don.ru/kak-professionalnye-sportsmeny-zarabatyvayut-dengi/]pin up casino[/url]

[url=http://www.logcabins.com/Click.aspx?url=http://file-don.ru/kak-professionalnye-sportsmeny-zarabatyvayut-dengi/]pin up casino[/url]

[url=http://www.appenninobianco.it/ads/adclick.php?bannerid=159&zoneid=8&source=&dest=http://grafiks.ru/sportivne-novosti.html]pin up casino[/url]

[url=http://www.hammer.if.tv/cgi/search/rank.cgi?mode=link&id=2613&url=https://kaile.ru/kak-bolshie-brendy-byutsya-za-sponsorstvo-v-bolshom-sporte/]pin up casino[/url]

[url=http://www.myavcs.com/dir/dirinc/click.php?url=http://mykrasotaizdorove.ru/poleznye-stati/formy-formy-premer-ligi-2021-22-novyy-dizay]pin up casino[/url]

[url=http://www.finselfer.com/bitrix/redirect.php?event1=news_out&event2=http://uduba.com/1541330/33-zakona-uvelicheniya-dohoda&event3=33+++&goto=https://sampostroikin.ru/professionalnye-igroki-delayushhie-stavki-na-sport/]pin up casino[/url]

[url=http://www.topcappers.com/cgi-bin/topcappers/out.cgi?id=mlbmlb&url=http://mykrasotaizdorove.ru/poleznye-stati/formy-formy-premer-ligi-2021-22-novyy-dizay]pin up casino[/url]

[url=https://safebrowse.zorgselect.nl/r?url=http://mykrasotaizdorove.ru/poleznye-stati/formy-formy-premer-ligi-2021-22-novyy-dizay]pin up casino[/url]

[url=https://go.pnuna.com/go.php?url=https://sampostroikin.ru/professionalnye-igroki-delayushhie-stavki-na-sport/]pin up casino[/url]

[url=https://ukrface.com.ua/away.php?url=http://kirpichru.ru/novosti-v-mire-sporta/]pin up casino[/url]

[url=http://www.rentv.com/phpAds/adclick.php?bannerid=140&zoneid=8&source=&dest=https://kaile.ru/kak-bolshie-brendy-byutsya-za-sponsorstvo-v-bolshom-sporte/]pin up casino[/url]

[url=http://teplosetkorolev.ru/redirect.php?site=https://sampostroikin.ru/professionalnye-igroki-delayushhie-stavki-na-sport/]pin up casino[/url]

[url=https://www.clubepson.com.au/WebPageLinkLogger.asp?PageID=20180515&LinkID=11&URL=http://vestnik45.ru/otgoloski-evro-2020-dlya-futbolistov-anglii/]pin up casino[/url]

[url=http://www.iqmuseum.mn/culture-change/en?redirect=http://straitkom.ru/2021/06/glavnye-novosti-v-mire-sporta/]pin up casino[/url]

[url=https://www.wien-girls.at/out-link?url=http://kirpichru.ru/novosti-v-mire-sporta/]pin up casino[/url]

[url=https://delyagin.ru/redirect?url=https://kaile.ru/kak-bolshie-brendy-byutsya-za-sponsorstvo-v-bolshom-sporte/]pin up casino[/url]

[url=http://www.actuaries.ru/bitrix/rk.php?goto=https://sampostroikin.ru/professionalnye-igroki-delayushhie-stavki-na-sport/]pin up casino[/url]

pin up casino

[url=https://nagoya.nikke-tennis.jp/?wptouch_switch=desktop&redirect=http://sremonta.ru/stati/obyasnenie-zarabotka-bukmekerov-prostymi-slovami/]pin up casino[/url]

[url=https://familysex.info/go.php?url=http://santehnika-svoimirukami.ru/?p=1620&preview=true]pin up casino[/url]

[url=http://www.dvdranking.org/bin/out.cgi?id=gokudo&url=https://mama-guide.ru/vse-o-detyah/zdorovye/kak-bukmekery-poluchayut-pribyl/]pin up casino[/url]

[url=https://admin.designguide.com/redirect.ashx?url=http://grafiks.ru/sportivne-novosti.html]pin up casino[/url]

[url=http://www.beersmith.com/forum/index.php?thememode=full;redirect=http://driving24.ru/naskolko-legko-sozdat-uspeshnuyu-igrovuyu-komandu/]pin up casino[/url]

[url=https://admin.logograph.com/redirect.php?url=http://sampostroikin.ru/professionalnye-igroki-delayushhie-stavki-na-sport/]pin up casino[/url]

[url=https://grindelwald.net/redirect.php?url=directsalez.ru/najdite-i-otsenite-ideyu-dlya-otkrytiya-biznesa/]pin up casino[/url]

[url=http://estreshenie.ru/links.php?go=http://straitkom.ru/2021/06/glavnye-novosti-v-mire-sporta/]pin up casino[/url]

[url=https://www.gaaamee.com/link.html?url=http://grafiks.ru/sportivne-novosti.html]pin up casino[/url]

[url=http://wlfanduel.adsrv.eacdn.com/wl/clk?btag=a_478b_1014&clurl=http://santehnika-svoimirukami.ru/?p=1620&preview=true]pin up casino[/url]

[url=https://www.portalfarma.com/paginas/redirigir.aspx?redirect=https://oblokax.ru/chaevye-i-stavki-na-sport.html]pin up casino[/url]

[url=http://6bq9.com/tracking/index.php?m=37&r=http://drpozvonkov.ru/poleznoe/podgotovte-svoj-tvorcheskij-proekt.html]pin up casino[/url]

[url=http://www.autaabouracky.cz/plugins/guestbook/go.php?url=https://file-don.ru/kak-professionalnye-sportsmeny-zarabatyvayut-dengi/]pin up casino[/url]

[url=http://profilfilm3.nord-ad.dk/Home/RedirectBanner?ProfilMovie=System.Data.Entity.DynamicProxies.ProfilMovie_12402C111D2387EF47E15EED82CB1472616F92EEF8C2483CDA9DFFA1E89D15AA&ProfilBannerId=5263&Size=Small&url=https://hair-fresh.ru/yak-zaroblyati-groshi-za-dopomogoyu-kibersportu/]pin up casino[/url]

[url=http://ricklafleur.com/links_goto.php?goto=http://kirpichru.ru/novosti-v-mire-sporta/]pin up casino[/url]

[url=https://link.getmailspring.com/link/local-80914583-2b23@Chriss-MacBook-Pro.local/1?redirect=https://mirshtory.ru/kak-sozdat-internet-kompaniyu-preimushhestva-i-procedury-v-ukraine/]pin up casino[/url]

[url=http://www.communityweb.org/ASP2/adredir.asp?url=https://kaile.ru/kak-bolshie-brendy-byutsya-za-sponsorstvo-v-bolshom-sporte/]pin up casino[/url]

[url=https://www.counterwelt.com/charts/click.php?user=14137&link=https://strou-dom.net/sozdajte-svoyu-kompaniyu.html]pin up casino[/url]

[url=http://opensesame.wellymulia.zaxaa.com/b/66851136?s=1&redir=http://vestnik45.ru/otgoloski-evro-2020-dlya-futbolistov-anglii/]pin up casino[/url]

[url=http://js1.bloggerads.net/ads/RedirectTo?targetUrl=http://dom-semja.ru/dosug-i-hobbi/novosti-bolshogo-sporta.html]pin up casino[/url]

[url=https://casinopin-up.kz/]Pin up казино[/url]

Пин Ап казино является довольно новым игровым ресурсом. Хотя торжественный сайт был открыт в 2016 году, портал уже популярен не ровно у новых пользователей, только и у профессиональных игроков. Ресурс работает чтобы основании лицензии Кюрасао и управляется компанией Carletta. В Shocker exhaust Up Casino огромный прибор азартных развлечений. Здесь дозволено не как бросать привычные автоматы, но и отправлять ставки для спорт, а также для киберспорт. Пин-Ап казино непринужденно в круглосуточном режиме без выходных.

Pin up казино

[url=https://elektricheskiy-teppliy-pol.pp.ua/]электрический теплый пол[/url]

Только включить подогрев пола?

Круг тип термостата имеет выключатель с соответствующей маркировкой и индикатор включения. Подогрев пола включается быть включении термостата. Температура устанавливается поворотом ручки для электронном термостате и нажатием кнопок + и – для цифровых и программируемых термостатах.

электрический теплый пол

[url=https://pin-up-777.com.br/]pin up casino[/url]

Pin-Up Casino e casa de apostas – revisao do locality oficial do Pin-Up Casino

Pin-Up Casino e um casino online customary plataforma de casino fundada em 2016. A organizacao possui uma licenca que permite a prestacao de servicos de jogos de azar de acordo com a legislacao. Os usuarios podem encontrar varios tipos de jogos no put oficial, bem como um grande numero de incentivos e a unintentionally de receber premios valiosos.

pin up casino

[url=https://download-master.pro/]Скачать игры через торрент[/url]

Игровой торрент трекер. Скачать лучшие игры чтобы компьютера бескорыстно сквозь торрент. Большой выбор новинок 2019 и 2020 года.

Скачать игры через торрент

[url=https://hmebel-kuhni.ru/]кухни недорого[/url]

Кухню дозволено купить у частного мастера или в мебельном салоне. Только лучше только сделать поручение в интернет-магазине. Здесь вы можете не один покупать, однако и заказать кухню вашей мечты. Круг магазина вы можете пропускать в каталоге для сайте. Кухни, фото которых вы можете найти на страничке, имеют различные модели и различные комплектации: шкафы, столы, табуретки, уголки. Вы желаете заменить только рацион мебели? Приобрести можно не как совершенный кухонный комплект, но и отдельные предметы.

кухни недорого

[url=https://hshkafy-kupe.ru/]купить шкаф купе[/url]

На сайте Вы найдете очень безбрежный отбор товаров с прайсом через 3 123 перед 23 356 руб. Весь представленные для сайте товары данной группы насчитывают 446 единиц. Выше интернет-магазин сотрудничает токмо с надежными производителями, а на страничках Вы найдете товары известных брендов недорого. Подкупать дешево реально, поскольку у нас точный проходят акции, скидки и распродажи из категории Шкафы и комплектующие….

купить шкаф купе

gay dating site for marriage

gay bi dating

[url=”http://gaychatus.com?”]match com for gay dating[/url]

[url=https://promoautosalon.ru/]автосалон[/url]

Покупка новой машины – огромные расходы. Поэтому некоторый люди подходят к нему с определенным страхом. Боятся, который потратят дождь денег и новая покупка не оправдает их ожиданий. Впрочем паниковать не стоит, довольно хорошо подумать о покупке. Многое зависит через того, какой салон мы выберем. Вот почему беспричинно важно попасть в нужное место. Только наравне принужден казаться путный автосалон?

автосалон

Pingback: dr axe keto diet food list

[url=https://svp-moskva.ru/]система выравнивания плитки[/url]

Выравнивание напольной плитки – нужна ли вам система?

Профессионалы обычно пытаются выровнять плитку с помощью спиртового уровня, нивелира и крестового лазера. К сожалению, это туча утомительный метод, и в нем бесцеремонно ошибиться.

система выравнивания плитки

Excellent web site you’ve got here.. It’s hard to find excellent writing like yours these days.

I really appreciate individuals like you!

Take care!!

african gay dating

gay dating generous

[url=”http://gaychatrooms.org?”]gay autistic dating[/url]

[url=https://radio-onlayn.com.ua/]ЭВАКУАТОР[/url]

Одна з найнеприємніших ситуацій в дорозі: поломка автомобіля. Неоднократно це відбувається в невідповідний момент, десь в глушині, издали від майстерні. На початку водій марно намагається його перезапустити, потім намагається штовхнути і нарешті в господиніці розуміє, що доведеться замовляти евакуатор. Замість того щоб самостійно орудиеізовувати трудомісткий процес транспортування в такої надзвичайної ситуації, краще довірити вирішення проблем фірмі, що здійснює технічне обслуговування і допомогу. Тому телефонний часть компанії, яка надає послуги з евакуації транспортного засобу потрібно в дорозі завжди мати під рукою дешево.

ЭВАКУАТОР

[url=https://avito-evakuatory-uslugi.ru/]ЭВАКУАТОР[/url]

Низкие цены, которые вполне доступны подавляющему большинству автолюбителей. Около этом вызвать эвакуатор дешево дозволено круглосуточно.

Работают опытные специалисты, способные отгадывать сложные задачи. Давалец может рассчитывать для профессиональную подмога в всякий ситуации, серьезное ДТП, попадание в кювет, недостаток транспортного средства.

ЭВАКУАТОР

[url=https://rokhli-kupit-chelyabinsk.ru/]Гидравлические тележки[/url]

Внутренние транспортные системы на складах и в хранилищах, где материалы укладываются высокими слоями, требуют соответствующих подъемников. Электрические вилочные погрузчики решают проблему подъема тяжелых грузов, а также их штабелирования и профессиональной транспортировки с места на место. Мы предлагаем вилочные погрузчики, ножничные подъемники и многие другие решения.

Штабелер – штабелеры на складских дворах

Гидравлические тележки

This is very interesting, You’re a very skilled blogger.

I’ve joined your feed and look forward to seeking more of your magnificent post.

Also, I have shared your web site in my social networks!

gay dating leave

gay dating service new york

[url=”http://gaychatrooms.org?”]ffxiv gay dating[/url]

Just wish to say your article is as amazing. The clearness

in your post is simply spectacular and i could assume you are an expert on this

subject. Well with your permission allow me to grab your feed

to keep updated with forthcoming post. Thanks a million and please

carry on the gratifying work.

gay guys dating tips

sgh id gay dating

[url=”http://gaychatrooms.org?”]gay dating sight[/url]