Update 618 — Housing en Fuego:

Our Domestic Supply Chain Crisis

The Fed’s attack on inflation — rapidly ramped-up rate hikes and mortgage-backed asset sales — is running headlong into and exacerbating the nation’s chronic housing shortage. Housing and construction are big economic sectors but are having an even greater impact on inflation than usual, contributing 40 percent to May’s month-over-month core reading. Mortgage rates have almost doubled since the start of the year, adding to costs before the rates cool the market, decrease demand, and… prices. Powell is on the horns of a dilemma, trying to cure a persistent disease with imprecise medicine.

Housing issues are generally addressed at the state and local levels but the lag in housing supply, especially affordable housing, is something Congress can address. Given 20 housing hearings in the House Financial Services Committee this Congress (two just this week), there is an appetite to act, but too much Republican opposition.

Today, we discuss the housing market, the impact of the Fed’s monetary policy on it, and how Congress could act to increase supply and provide relief to households, owners and renters alike, were it of a mind to.

Good weekends, all…

Best,

Dana

——————

Housing Market Dynamics

The housing market has been running record hot over the last couple of years, capped by the quick pace of rising home prices. Since the pandemic began, the median sale price has climbed from $289,243 in January 2020 to $430,695 in May 2022, a 48 percent increase. Over the last 12 months, median sale prices rose by 14.7 percent, making it tougher to buy a home. While homeowners make up two-thirds of households, the remaining one-third, renters, are facing serious price shocks too. The average rent for the nation just surpassed $2,000 per month, a 15.2 percent increase over the last 12 months.

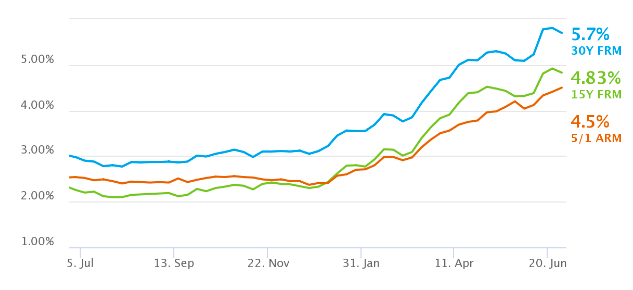

Mortgage rates on top of rising prices have locked many out of access to homeownership as the 30-year-fixed mortgage rate increased to 5.7 percent, a level not seen since the 2008 financial crisis. The rise in mortgage rates has added to costs for homeowners or is passed on to tenants.

U.S. Weekly Average Mortgage Rates as of 6/30/2022

Source: FreddieMac

The hot housing market persists, but is cooling-off following the launch of the Fed’s monetary tightening. The number of homes for sale decreased by 1.8 percent over the last year, a sign the Fed’s actions may be discouraging activity in the sector. This approach may be self-defeating as supply chain disruptions in the housing market exacerbate the secular trend of underbuilding. The number of new housing starts followed a similar pattern as sales, decreasing by 3.5 percent over the last 12 months. Without sufficient supply, prices will face continuing upward pressure despite efforts from the Federal Reserve to tame inflation.

Cooling Off to Come

In the May Consumer Price Index report, housing accounted for 40 percent of the month-over-month core inflation rate, or 24 basis points of the 0.6 percent month-over-month reading. The inflation index showed the cost of housing has grown 5.5 percent over the last year due to demand heavily exceeding the intense supply constraints already present in the sector.

During the pandemic, the Fed drove up housing prices as a byproduct of purchasing mortgage-backed securities to stave off economic collapse. These policies help depress mortgage rates, inducing demand to purchase housing. The induced demand pushed prices up as the pre-existing mismatch between demand and supply got worse.

Now trying to reverse this dynamic, the Federal Reserve is hiking interest rates and selling off mortgage-backed securities to reduce demand for housing. The hope is to bring demand down enough to at least slowdown, if not reverse, house price appreciation. As a result, mortgage rates have shot up between 1.5 to 2 percentage points since the Fed adopted its new policy path in March. And it seems the Fed may be getting what they want: the higher mortgage rates have started to slow the housing market down as housing starts and sales have fallen precipitously.

Cooling down the housing market is a critical step in fighting inflation, but there is a long-term downside to cooling down the housing market as constricted supply will continue to push housing prices up in the long run.

Chronically Constricted Supply

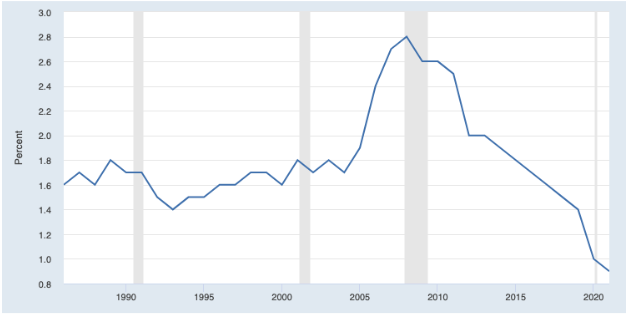

The housing shortage continues to wreak havoc across the nation as there are too few homes relative to the considerable demand, especially among households with the lowest incomes. The housing supply gap, the difference between the demand for affordable housing and the supply of affordable housing, sat at 1.5 million units as of March 2021, and has likely worsened since then. The gap for extremely low-income households is 7 million units, according to the National Low Income Housing Coalition. The historically low vacancy rate acts as a proxy for the shortage: the lower the vacancy rate, the greater demand is outstripping supply.

Vacancy Rate for the United States

Source: U.S. Census Bureau, Federal Reserve Economic Database

Exclusionary zoning ordinances have been responsible for numerous metropolitan areas only being able to build single-family units. Though zoning is not mainly a federal issue, Congress can step in by providing incentives for high-density zoning and construction via reporting requirements and grants. The bipartisan YIMBY Act is one proposal that would encourage the recipients of Community Development Block Grants to develop high-density housing plans. The White House has also endorsed incentives for localities to adopt high-density zoning policies alongside a much broader housing plan.

The House Financial Services Committee proposed $150 billion to address housing needs in an early version of Build Back Better. The package included $65 billion to preserve public housing stock and $15 billion to build new homes through the national Housing Trust Fund. Rehabilitating public housing and building new units targeted to households with the lowest incomes would reduce the downward pressure on the housing stock. The Committee also proposed an exemption to the Faircloth Amendment, a 1998 rule prohibiting HUD from funding new public housing construction if it helps local PHAs secure new units. Lifting the prohibition from the Faircloth Amendment lays the groundwork for a net increase in public and aggregate housing supply..

Zoning reform and federal housing investments would broadly increase the housing stock, but multiple elements remain that could provide relief in the sector:

- Private Equity and Other Corporations: Private equity is taking advantage of an already tight market by rapidly accumulating properties, targeting low-income communities. Companies like Airbnb exert similar pressures by transforming multiple units into short-term rentals. Congress recently held a hearing on private equity’s impact and could push for localities to limit their influence.

- Universal Section 8 Vouchers: Due to lack of funding, only one-quarter of families eligible for Section 8 currently receive housing vouchers. And the average wait time for federal housing assistance is two years. Expanding Section 8 would take a great stride in alleviating the eligibility problem and the wait time, providing relief to millions.

- Tax Reform: One way Congress can reduce demand for housing without harming low-income families is to target the mortgage interest deduction. The deduction costs the government $38.7 billion per year as of 2021. The tax expenditure incentivizes larger, more expensive houses, constrains long-term supply, and increases housing demand. While the Tax Cuts and Jobs Act of 2017 cut the mortgage interest deduction, further cuts or outright elimination of the tax expenditure would incentivize smaller, cheaper homes, putting downward pressure on prices and allowing more supply. The savings generated from eliminating the tax expenditure could be redirected to expand housing investments for those with the greatest needs, including those experiencing or at risk of homelessness.

- Rent Control: Limiting the impact of rent increases would help tens of millions of families as they face rising prices at the grocery store and at the pump. However, poorly designed rent control policies can disincentive new construction, as seen in Saint Paul, Minnesota. But when combined with adequate supply-side policies, rent control or anti-rent gouging measures can mitigate rising housing costs for localities.

Unfortunately, none of these issues are likely to be addressed during the remainder of this Congress, thanks mainly to Senate gridlock. The housing market requires serious policy intervention to reduce demand and increase supply. But the policy of fighting inflation by reducing housing demand without increasing supply runs a recessionary risk and is a bandage for a deeper problem, inadequate housing stock. The Fed’s actions are having some success but at the expense of the financial well-being of many. We need to focus on building housing, in general, to build enough affordable housing for all.