Update 630 — A Signal, Suddenly Sick Sector

But More Espousing than Acting on Housing

Almost overnight, the housing market is seeing a rapid cool down with no trough in sight. The market for both sales and rentals is in a tailspin aggravated by the Fed’s tightening monetary policy. This volatility only emphasizes the instability within the housing sector. The danger here arises from the size and centrality of the sector to the economy. No need to point out where the last financial crisis originated.

Structural, chronic, and circumstantial problems afflict the U.S housing sector. Despite multiple hearings in the past two months on ways to combat the housing crisis, Congress has not acted. A Build Back Better Act provision proposing $150 billion in investments to boost housing production and increase affordability was removed by the Senate. In this update, we cover the cooling housing market, the supply shortage and need for congressional action.

Good weekends all,

Dana

_________________

Current Conditions

At the start of the pandemic, home buying demand skyrocketed concurrently with the collapse of interest rates. Average home prices rose steadily before reaching a peak of $430,120 in May— a big departure from pre-pandemic levels, when home prices rose gradually at an annual rate of five percent. But in the last few months, home prices declined 0.77 percent from June to July, the first monthly fall in almost three years and the largest single-month decline in prices since January of 2011.

Mortgage rates are also finding their way back to the five percent mark following their peak of 5.7 percent in June. As of this week, the average 30-year fixed interest rate is sitting just above 5.1 percent, suggesting that the housing sector is cooling rapidly. Nevertheless, continued fluctuation in rates are worrisome enough, and the Fed’s tentative agenda for three more aggressive hikes can change the game at any time. Home sales are down almost 6 percent from June and over 20 percent from a year ago, illustrating the impact that rising mortgage rates have on prospective buyers. But the falling rates could make housing marginally more affordable for those looking to purchase or sell.

Renters make up nearly one-third of households and are equally impacted by volatile movement in the housing market, if not more. As of June, 2022, rental costs in the United States were moving at their fastest pace in more than three decades, exceeding a median of $2000/month for the first time in history, up 15.2 percent from last year. Although this market is still seeing record rents, all signs point to a slight cool down. With only a 1.1 percent increase in July, compared to 1.4 percent in June, rent growth is slowing month-over-month, yet continues to remain above pre-pandemic levels.

Renters and homeowners alike have endured unprecedented hardship in the sector, but those most vulnerable continue to be low-income renters seeking out affordable housing. In January of 2019, the US had a shortage of seven million affordable homes for low-income renters, indicating the lowest affordability metrics since 2007. These individuals face a severe shortage in almost every state or major city, where there are approximately 18 available and affordable rental homes for every 100 lowest-income renters. This crisis is a direct result of the inadequate policy choices and severe underfunding normalized in our political system.

Chronic and Root Causes of the Problem

Housing instability long predated COVID-19, and the pandemic exacerbated the severe shortage of homes plaguing the nation. Supply chain issues, labor shortages and record-high inflation rates contribute immensely to the near 3.8 million unit shortage, double the number from 2012. Economists say the last housing crash marked the beginning of a decade-long underproduction streak whose ramifications can certainly be felt today. COVID-19 sparked the migration of many into new economically productive cities, where the demand for housing far outpaced production and availability.

Several factors have stalled U.S. housing construction, which dropped almost 10 percent in the month of July. Aside from higher mortgage rates and elevated inflation, a few factors contributing to the housing shortage can be traced back to:

- Lack of Inventory: Lack of inventory, or number of active listings, is one of the biggest challenges in the housing sector. The current housing inventory in the United States sits at around 748,000, compared to over 1.4 million two years ago.

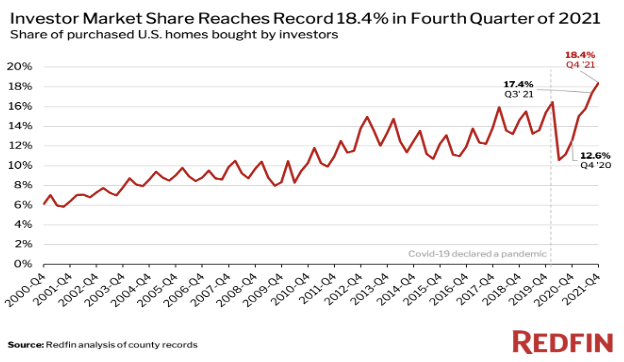

- Institutional Investors: Real estate investors bought a record 18.4 percent of the homes that were sold in the U.S. during the fourth quarter of 2021, up from 12.6 percent a year earlier. Owning approximately a third of the rental market, real estate investors often beat out many first time home buyers, work to transform these properties into overpriced rentals and use abusive practices to squeeze renters.

- Plummeting Confidence: The monthly confidence index for homeowners fell from 55 percent in June to 49 percent in August. Builder sentiment is weak and many believe they are in the midst of a full-fledged housing recession. The result is less willingness to sell, buy, or produce new housing.

Where Federal Government Needs to Step In

While this Congress may not have the bandwidth to tackle housing, stabilizing the sector should be a top priority for the next Congress. The current cooldown is another indicator that the federal government must step in to end the volatility and ensure long-term stability. This can be done through countercyclical production policy like incentivizing changes to zoning ordinances and investing in public and other types of affordable housing.

Zoning — Though zoning is generally a local issue, Congress can step in by providing incentives for high-density zoning and construction via reporting requirements and grants. The bipartisan YIMBY Act would encourage the recipients of Community Development Block Grants to develop high-density housing plans. The White House has endorsed incentives for localities to adopt high-density zoning policies alongside a much broader housing plan. A proposal from the White House — to use federal transportation funds to prod jurisdictions to reduce restrictive local zoning laws — is especially promising.

Public and Affordable Housing — Congress must preserve and increase the affordable housing stock. One way to do this is by repealing the Faircloth Amendment, a 1998 rule prohibiting HUD from funding new public housing construction if it helps local Public Housing Authorities secure new units. Investing significant resources to rehabilitate existing public housing units lays the groundwork for a net increase in public and aggregate housing supply, which would reduce the downward pressure on the housing stock and offer affordability for low-and-middle-income households. Congress should also invest in the national Housing Trust Fund, the most targeted federal program aimed at increasing the supply of rental homes affordable to people with the lowest incomes.

Zoning reform and federal housing investments would broadly increase the housing stock, but multiple elements remain that could provide relief in the sector:

- Private Equity and Other Corporations: Private equity is taking advantage of an already tight market by rapidly accumulating properties, targeting low-income communities. Congress recently held a hearing on private equity’s impact and could push for localities to limit their influence or enact federal renter protections to bar abusive practices used by some investor landlords.

- Universal Section 8 Vouchers: Due to lack of funding, only one-quarter of families eligible for Section 8 currently receive housing vouchers, and the average wait time for federal housing assistance is two years. Expanding Section 8 would make great strides in alleviating the eligibility problem and the wait time, providing relief to millions.

- Mortgage Interest Deduction: The mortgage interest deduction incentivizes larger, more expensive houses, constrains long-term supply, and increases housing demand. While the Tax Cuts and Jobs Act of 2017 cut the mortgage interest deduction, further cuts or outright elimination of the tax expenditure would incentivize smaller, cheaper homes, putting downward pressure on prices and allowing more supply. The savings generated from eliminating the tax expenditure could be redirected to expand housing investments for those with the greatest needs, including those experiencing or at risk of homelessness, through the national Housing Trust Fund.

- Stopping Rent Gouging: Limiting the impact of rent increases would help tens of millions of families as they face rising prices at the grocery store and at the pump. Poorly designed rent control policies can disincentive new construction, but when combined with adequate supply-side policies, rent control or anti-rent gouging measures can mitigate rising housing costs for states and localities.

These policies would introduce a necessary countercyclical element to housing policy that would continuously see the housing stock increase while mitigating the ongoing affordability crisis. A severe downturn or overheating of the housing market leaves the country reeling from volatility. Inaction from the federal level leaves tens of millions in jeopardy and must become a top priority after the new Congress is sworn in. Policymakers and advocates must keep a sharp eye on the health of the housing market to ensure the rapid cool down does not lead to an economic meltdown.

Other Related Articles

- FY24’s Bell Lap at Last

- Update 741 — Fed Holds Rates; CPI 3.1%: (When) Can Fed Pivot from Long Pause?

- Update 740 — A Supplemental Surprise: Political Timelines vs. Actual Emergencies

- Update 739 — SCOTUS Seems Moore Unsure: Re Congress’ Authority to Tax Certain Income

- Update 738 — Immaculate Disinflation: Felt or Not, Prices Nearer Fed’s Target