Update 306: Economic Generational Justice Salient Issues for Millennials in the Midterms

The generation of millennials, Americans born between 1983 and 2000, consists of 80 million people and accounts for 25 percent of the population, 35 percent of the workforce. Millennials receive lower relative wages, take on more debt, face higher housing costs, and pay expensive college tuition, with Trump administration policy aggravating a condition many call a generational injustice.

Millennials’ economic plight affects how they vote, and it is becoming increasingly important to advocate for policies that address these generational imbalances. Many Democratic candidates are campaigning with progressive social and economic messages that resonate with younger voters — but will millennials turn out en masse at the ballot box next month?

Best,

Dana

——————

Highly Educated, but Perennially in Debt

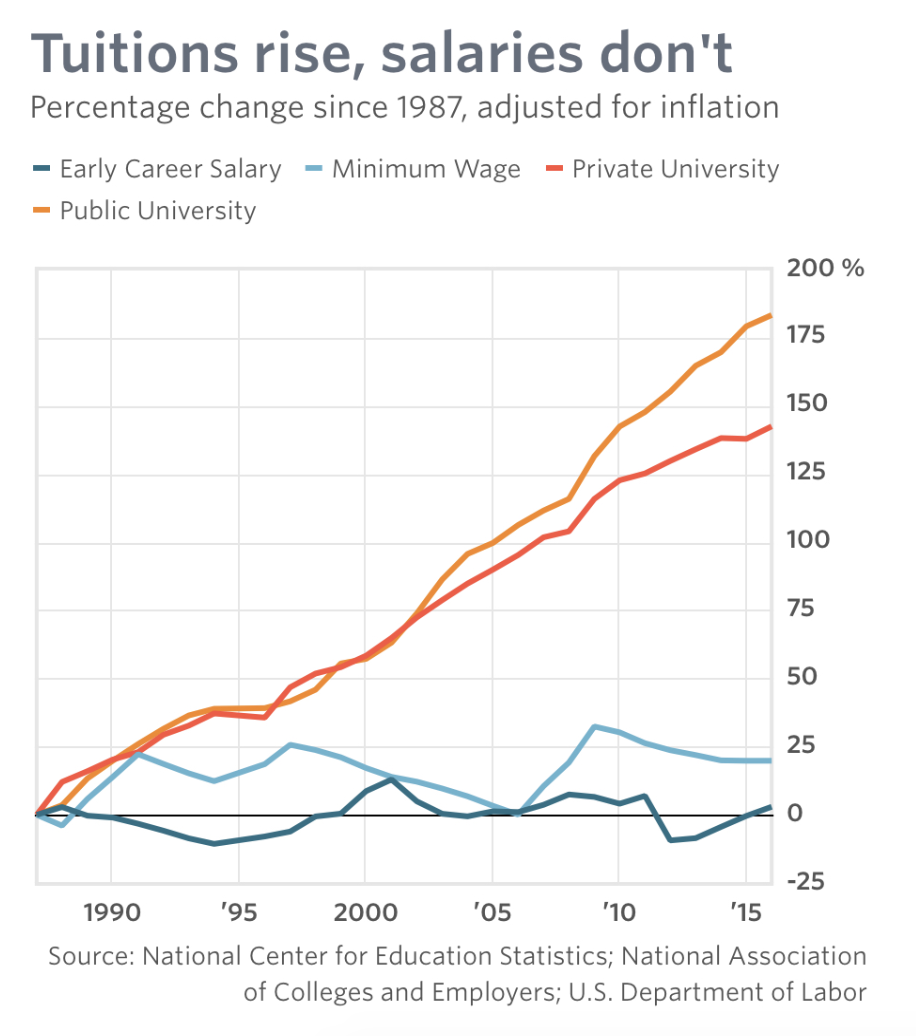

Millennials are the most educated generation to date. Women age 18 to 33 today are particularly better educated, with 27 percent attaining a bachelor’s degree or higher in 2014, compared to just 14 percent in 1980. This educational attainment comes at a price. Adjusted for inflation, the average cost of an undergraduate degree has risen over 160 percent from 1987 to 2016.

The increased cost of college has led to an increase in borrowing. The average debt burden of a recent graduate is over $37,000 — $20,000 more than it was over a decade ago. The average monthly student loan payment has skyrocketed over 70 percent, from $227 in 2005 to $393 in 2016. Rapidly rising tuition and burgeoning debt have stymied millennials’ full participation in the broader economy.

Underpaid and Underemployed

Millennials may be the largest generation in the workforce to date, but they are underpaid and underemployed compared to their Baby Boomer counterparts a generation earlier. A 2017 Young Invincible’s report found that millennials’ net worth is about half that of the Boomers’ net worth at the same age. Young workers’ wages have also fallen 20 percent since the Boomer era.

Those born in 1950 had a 79 percent chance of out-earning their parents; that chance has slipped to 50 percent for people born after 1980. Although educational attainment is still the best route to financial security, the report concludes that a market flooded with four-year-degree holders has caused employers to raise hiring standards, even for entry-level positions.

Millennial unemployment is double the national average — about seven percent, while the national average is 3.7 — with 11 percent for African American and 7.5 percent for Latin millennials in 2017. Though millennial unemployment is a serious issue, millennial underemployment — involuntarily working part time or being overqualified for a position — is widespread, severe, and, for the most part, not talked about.

In 2013, 41 percent of millennials between the ages of 22 and 27 reported underemployment, with the number rising to 51 percent in 2016. As millennials continue to pursue degrees and low-paying, entry-level jobs require more and more experience, this problem will only get worse.

The Rent is Too Damn High

Millennials are categorically less likely to own a house, preferring instead to rent. A recent report by the Urban Institute showed the millennial homeownership rate at 37 percent in 2015, approximately 8 points lower than that of Gen Xers and Baby Boomers at the same age. There are three main economic factors that contribute to this trend:

- High rent costs: Nearly half the people polled spent more than 30% of their income on rent, classifying them as rent-burdened. Those classified rent-burdened are more likely to be in financially precarious situations and less likely to be able to buy a home.

- Student loan debt: Student debt delays millennial homeownership for seven years. Many millennials, even older members of the generation, do not feel financially secure enough to buy homes because they are unable to save.

- The Great Recession: Memories of the 2008 financial crisis, during which time many millennials entered the workforce or tried to, have had pervasive effects on their ability to achieve financially stability — one Morgan Stanley analyst told Business Insider that the financial crisis left an entire generation with a “significant psychological scar.”

Larger Premiums, Worse Coverage

Although initiatives under the ACA, such as staying on parents’ plans until 26, have reduced the total of uninsured millennials, 16 percent of young adults still went uninsured in 2016. Millennials make up nearly half of all uninsured people in the U.S. A 2016 poll found that 20 percent of adults aged 18-36 cannot afford routine healthcare expenses, with 26 percent saying that they can, but with difficulty. The most cited reason for delaying treatment was a lack of affordability. Even monthly premiums as low as $200 pose a financial hurdle for many millennials whose budgets are already constrained by mandatory student loan payments and high housing costs.

Not Entitled to Entitlements?

By 2022, Social Security will be paying more out in benefits than it is gaining from revenue, and it is predicted that by 2034, all of its asset reserves will be exhausted. Generally, the way to increase funding for programs is to increase tax revenues and/or lower the federal debt. Instead, Congress passed a tax bill that will add $1.5 trillion to the federal debt and reduce tax revenue.

The recent tax cuts were a large transfer payment to older, wealthier Americans. Providing immediate relief for taxpayers now and over the course of the next ten years amounts to fiscal theft from the younger generation. The added debt and the resulting higher interest payments come at an opportunity cost to investment in entitlements and programs that would otherwise have benefited the millennial generation.

51 percent of millennials don’t expect to receive anything from the program when they retire. Per Bloomberg, “any solution that would rectify [Social Security’s] finances will probably require more taxes and more benefit cuts—all coming out of the pockets of younger workers.” As things stand, millennials will face a large federal debt burden and will either get less Social Security benefits than their parents, or will have to retire much later than previous generations.

Through the Midterm Lens

For Democrats to win the House this cycle, millennials are going to have to show up as a greater percentage of the vote than they did in the last midterm election. In 2014, 22 percent of voting-age millennials voted, accounting for 16 percent of the vote — a historic low. The Cook Political Report describes millennials as “volatile” in terms of turnout and, along with Latinx voters, the likeliest to drop out of the electorate. Democrats are trying to advocate for issues that matter to millennials, such as reducing the cost of higher education, entitlement security, and healthcare, in an effort to turn them out. Many 2018 Democratic House candidates are putting these issues at the forefront of their campaigns.

These efforts appear to be working. An NBC poll from August found that 55 percent of millennials say they will probably or definitely vote in this year’s midterm election. Republicans haven’t exactly helped their cause with millennials, enacting regressive tax cuts that will harm future generations and attempting to bring down a healthcare system that benefits young workers. Democrats are hoping that by appealing to these young people, they will be able ride the millennial voter wave come November.

Other Related Articles

- Update 741 — Fed Holds Rates; CPI 3.1%: (When) Can Fed Pivot from Long Pause?

- Update 740 — A Supplemental Surprise: Political Timelines vs. Actual Emergencies

- Update 739 — SCOTUS Seems Moore Unsure: Re Congress’ Authority to Tax Certain Income

- Update 738 — Immaculate Disinflation: Felt or Not, Prices Nearer Fed’s Target

- Update 737 — Undersupply and Costs: Problems Besetting the Housing Market

Nice post. I learn something totally new and challenging on websites I stumbleupon everyday.

It’s always useful to read through articles from other writers and practice a little something from

other websites. asmr 0mniartist

Quality articles or reviews is the key to invite the users to pay a visit the web page,

that’s what this web page is providing. asmr 0mniartist

It’s a pity you don’t have a donate button! I’d certainly donate to this brilliant

blog! I suppose for now i’ll settle for book-marking and adding your RSS feed

to my Google account. I look forward to fresh updates and will share this blog with my Facebook group.

Talk soon! asmr 0mniartist

Very good info. Lucky me I discovered your blog by accident (stumbleupon).

I have saved it for later! 0mniartist asmr

hello there and thank you for your info – I have definitely

picked up anything new from right here. I did however expertise some technical points using this website, since

I experienced to reload the site lots of times previous to I could get it to load correctly.

I had been wondering if your hosting is OK? Not that I am complaining, but sluggish loading

instances times will very frequently affect your placement

in google and could damage your high quality score if advertising and

marketing with Adwords. Anyway I’m adding this RSS to

my e-mail and could look out for much more of your respective fascinating content.

Ensure that you update this again soon. asmr 0mniartist

chat free dating site

chat free dating site

Hello there! This is my 1st comment here so I

just wanted to give a quick shout out and say I genuinely enjoy reading your articles.

Can you suggest any other blogs/websites/forums that deal with

the same subjects? Thanks!

Greetings! Quick question that’s totally off topic.

Do you know how to make your site mobile friendly?

My weblog looks weird when browsing from my iphone.

I’m trying to find a template or plugin that might be able to correct this issue.

If you have any recommendations, please share. Many thanks!

Amazing! Its really remarkable post, I have got much clear idea concerning from this piece of writing.

Excellent post but I was wanting to know if you could

write a litte more on this topic? I’d be very thankful if you could elaborate a

little bit further. Thanks!

tindr , what is tinder

tinder login

Having read this I believed it was rather informative.

I appreciate you finding the time and energy to put this content together.

I once again find myself spending a significant amount

of time both reading and posting comments. But so what, it was still

worthwhile!

When I initially commented I clicked the “Notify me when new comments are added” checkbox

and now each time a comment is added I get three e-mails with the

same comment. Is there any way you can remove me from that service?

Cheers!

Write more, thats all I have to say. Literally, it seems as though you relied on the

video to make your point. You obviously know what youre talking about, why throw away your intelligence on just posting videos to your weblog when you

could be giving us something enlightening to read?

It’s very simple to find out any matter on web as compared to books,

as I found this post at this web page.

Hi there colleagues, fastidious piece of writing and pleasant urging commented at this place, I am genuinely enjoying by these.

tindr , tinder date

tinder login

tinder app , tinder date

http://tinderentrar.com/

scoliosis

naturally like your web site but you have to take a look at the spelling on quite a few of your posts.

Many of them are rife with spelling problems and I to find it very troublesome to inform the truth however I will surely come again again. scoliosis

scoliosis

I am sure this piece of writing has touched all the internet people, its really really nice post on building up new web site.

scoliosis

free dating sites

Wonderful blog! I found it while surfing around on Yahoo News.

Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Appreciate it free dating sites

free dating sites

This post will assist the internet users for creating new website or even a blog

from start to end. https://785days.tumblr.com/ free dating sites

Howdy, i read your blog from time to time and

i own a similar one and i was just curious if you get a

lot of spam remarks? If so how do you protect against

it, any plugin or anything you can advise? I get so much lately it’s driving me crazy so any support is

very much appreciated.

Pretty! This was an extremely wonderful post.

Many thanks for providing this information.

Hi, Neat post. There’s a problem with your web site in web explorer, would test

this? IE nonetheless is the marketplace leader and

a huge component of people will pass over your wonderful writing due

to this problem.

Hi there! I know this is somewhat off topic but I was wondering which blog platform are you using

for this website? I’m getting fed up of WordPress because

I’ve had problems with hackers and I’m looking

at alternatives for another platform. I would be fantastic if

you could point me in the direction of a good platform.

Hi Dear, are you actually visiting this website on a regular

basis, if so afterward you will definitely

obtain good know-how.

Excellent article. I definitely love this site. Thanks!

This website was… how do you say it? Relevant!!

Finally I’ve found something which helped me. Cheers!

each time i used to read smaller posts that as well clear their motive, and that is also happening

with this post which I am reading at this place.

great points altogether, you just gained a emblem new reader.

What might you recommend about your publish that you

made some days in the past? Any certain?

Hi there, its good piece of writing concerning media print, we all be familiar with media is a great source of data.

Hi there, i read your blog from time to time and i own a similar one and i was just wondering if you get a lot of spam feedback?

If so how do you stop it, any plugin or anything you can advise?

I get so much lately it’s driving me crazy so any support is very much appreciated.

I do not know if it’s just me or if everybody else

experiencing issues with your site. It appears as though some

of the text in your posts are running off the screen. Can somebody else please comment

and let me know if this is happening to them as

well? This might be a problem with my internet browser because I’ve

had this happen before. Thank you

Wow, marvelous blog layout! How long have you been blogging for?

you made blogging look easy. The overall

look of your web site is excellent, let alone the content!