Update 613 — Running on the Economy

Making the Best of an Inflated Situation

In part two of our outlook on running on the economy this midterm cycle, we cover the inflated elephant in the room. Americans continue to feel the pain of increased prices. Despite signs that inflation may have crested, the public mood is decidedly gloomy — in the face of a miraculous policy-driven recovery. The headline CPI rate came in at 8.6 percent year-over-year, up from April’s 8.3 percent won’t calm fears of worse to come.

It is against this backdrop that candidates for Congress are confronting voters who are making up their minds about the economy ahead of the midterms. If the narrative is to change, now is the time. Inflation is a global side effect of the post-pandemic economic disequilibrium. But that explanation will satisfy few voters. Americans are blaming President Biden and Democrats for inflation, so the goal is to neutralize it as a political issue. How can Democrats address voters’ woes?

In today’s update we discuss the CPI report, economic misperceptions, midterms messaging and offer an approach to neutralizing inflation.

Good weekends, all…

Best,

Dana

——————

The fluctuations in inflation readings are testing the Fed’s ability to tame inflation. But the White House is sticking behind the Fed per CEA Chair Cecilia Rouse’s comments this afternoon on Bloomberg. Despite the administration and Fed’s efforts, voters are not economists looking at the larger macro trends but everyday people assessing how they feel about their jobs and the prices of goods. Obscuring abundant good economic news elsewhere, reminders of inflation are ubiquitous. A Pew survey in May found 70 percent of Americans say inflation is a big problem in the country today, far more than any other issue. In contrast, 78 percent of Americans are confident in their personal financial well being, but only 24 percent are confident in the United States’ financial well-being.

For this reason, the White House and Congress have not sat idly and watched inflation harm consumers regardless of the incredibly strong labor market. Here’s what they can do:

- First, be responsive to voters’ concerns about inflation; meet them on the specific issue they raise, not on abstractions or excuses like Putin unless offered.

- Next, reaffirm their confidence in the Fed and that President Biden intentionally renominated Jerome Powell to lead the central bank’s inflation response.

Through these steps, Democrats will put together a message that shows voters they are taking inflation seriously and will follow through on those commitments to take meaningful action.

Slow and Steady

While month-over-month inflation rose to 1.0 from 0.3 percent, we should be careful not to overanalyze it. Month-over-month data can be extremely noisy, and this month, energy, food, and shelter contributed heavily to the inflation rate. The Russian invasion continues to put upward pressure on oil prices and exert spillover effects on natural gas and food prices, but Democrats cannot continue to push the blame solely onto Putin and his antics.

Energy costs have also driven airfare prices back up from their pandemic lows, contributing heavily to the core inflation rate. And similar to last month’s report, rent and owners’ equivalent rent continues to push inflation upward as the housing market is still running hot, despite some evidence of cooling down.

The rise in year-over-year headline inflation provides some struggles for the Federal Reserve as they seek to cool off the hot inflation numbers. Despite drawing down the accommodative monetary policy, many factors outside of the Fed’s control continue to exert upward pressure. The report will lock in another 50-basis point hike at the upcoming FOMC meeting next week. But the Fed is watching disinflationary pressures such as durable goods prices stabilizing and falling once more: automakers are expecting semiconductor supply to normalize their production by year’s end.

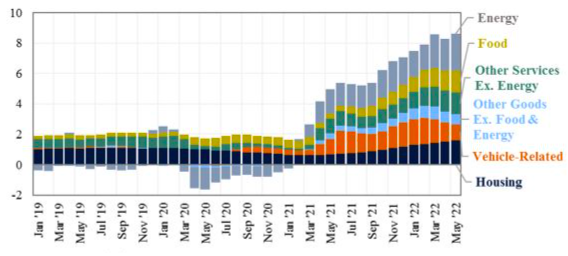

Contributions to Year-over-Year Headline CPI Inflation

Sources: Bureau of Labor Statistics, Council of Economic Analysis

Bringing inflation down won’t be linear, but progress is being made. This notion may not be fully appreciated by those who are outside of the policy world and did not wake up to analyze the CPI report this morning. Instead, they are seeing the prices at the gas station and the grocery store.

The Broader Recovery

There are bright spots in the economy less obvious to average consumers. Because low-wage workers have experienced faster wage growth, they have been the least harmed by inflation. Low-income households are generally more vulnerable to inflation as they have to spend a higher portion of their income on necessities and are less able to absorb rising costs. This is especially true for households on fixed incomes or workers who haven’t received the full benefits of rising wages. However, as low-wage workers’ real earnings have kept pace with inflation, or exceeded it early in the pandemic, full-time, low-wage workers have avoided the worst effects of inflation. Democrats can do a better job of touting the 5.2 increase in average hourly earnings over the last year and the historically low unemployment rate sitting at 3.6 percent.

As we mentioned in our previous update, pushing unemployment low helps everyone, contrary to orthodox thought. Low unemployment increases worker bargaining power and pushes up wages. High quit rates paired with a large number of open positions have forced employers to compete for workers with higher wages and full-time hours. Democrats can’t run on the rapid recovery from the pandemic alone, but paired with effective messaging that addresses inflationary concerns, they should be emphasizing their successes in keeping the labor market strong, particularly for historically marginalized groups.

Speculative markets have also been taking a hit as interest rates rise, which could push investment into the real economy. As the attractiveness of speculative investments diminishes, investors may be more easily enticed into investments in businesses or in real assets that aren’t subject to the same kind of volatility we’ve seen in the stock market or volatile assets like crypto. The venture capital environment has remained attractive, good news for entrepreneurs and start-ups seeking financing. Monthly business applications have also been high during the recovery and have remained above 400,000 since January 2021. Capital making its way towards more productive uses in the real economy will boost productivity and employment.

Window Closing on a Message Pivot

What does this mean for Democrats in November? Many voters have already decided that Democrats are responsible for inflation. Democrats can change this misperception if they act fast. Voters largely blame Biden for inflation. After all, Biden made the careful decision to renominate the Fed Chair, Jerome Powell, who has the tools to deal with inflation to a degree. It is critical for Democrats to show confidence in Powell and the Fed as they attempt to cool the hot economy and pursue a soft landing. Democrats must assure the population that the Fed is doing its role. But the Fed only has so much control over this bout of inflation. Congress and the White House should find ways to combat inflation via executive actions and legislation. Those running in the midterms can champion what they have done in delivering covid relief and creating jobs, while looking prospectively at what can still be done.

Being responsive to voters’ concerns about inflation, listening to their problems, and working to address them will be critical. The Fed can only go so far in its efforts to cool down the economy before they push the country into a recession. The President took it upon himself to renominate Fed Chair Powell last fall aware of the economic and political stakes in choosing someone to combat inflation. Late to the party, perhaps, but the Fed’s current course confirms the President’s priority here. A pivot toward credit taking may be the best available means of neutralizing this political deadweight. A pivot toward credit taking may be the best available means of neutralizing this political deadweight.