Update 614 — Penny Wise, Pound Foolish

How Underfunding Defeats Its Fiscal Goals

The unrelenting underfunding of vital federal agencies continues unabated, even as the FY23 is being negotiated on the Hill. This is thanks to fiscal policy made by default, without a fiscal policy future in mind. Rather tight domestic federal budgets fiscal and policy terms. Cuts to the IRS yield less revenue, for example. The 2011 Budget Control Act imposed a decade-long cap on additional federal discretionary spending.

“Penny wise and pound foolish” is the adage that applies here. In this update, we review some of the agencies historically and currently underfunded, consequences of chronic underfunding, and how revising domestic discretionary spending baseline levels offers an opportunity in FY23 and beyond to reverse course and restore long-deprived agencies as well as services, as mandated by Congress.

Best,

Dana

_______________

On the Hill this week, the House began markups on fiscal year 2023 appropriations bills starting with negotiations on 302(a)s and 302(b) budget allocation targets. As Congress determines the budget for the next fiscal year, it should keep in mind the lack of resources that has undermined agencies’ attempts to fulfill their missions.

The IRS — Less in Budgeting = Less in Revenues

Chronic IRS underfunding has left it operating well below the level taxpayers deserve. In FY2010, the IRS’s authorized budget was $12.1 billion. In FY2021, its legislated budget was only $11.9 billion dollars. Adjusting for inflation, this constitutes a 22 percent decrease in the IRS’s real budget. The agency’s staff have declined by 22 percent as vacant positions have gone unfilled. The IRS expects to support 74,200 FTEs this fiscal year, akin to the IRS’s staffing levels in 1973. These problems have been exacerbated by the pandemic, as the agency was forced to accommodate an increased workload: distributing three rounds of economic impact payments and numerous monthly child tax credit payments, while also navigating temporary changes in tax policy and pandemic-related office closures. This forced the agency to pull even more resources away from its ordinary responsibilities.

Estimates suggest the gap between taxes owed to the IRS and those collected amounts to about $600 billion annually, which could lead to approximately $7 trillion in lost revenue over a decade. The lack of resources for the agency’s enforcement arm leads to inequities in its auditing process. Audits of high-income taxpayers take significantly more time, resources, and expertise than audits of lower-income taxpayers. The number of revenue agents, who handle more complicated audits, has declined faster than the number of overall staff. As a result, audits have fallen across the board, but they have decreased more for high earners than for EITC recipients. To properly audit wealthier taxpayers, the IRS needs to hire more revenue agents and update its systems.

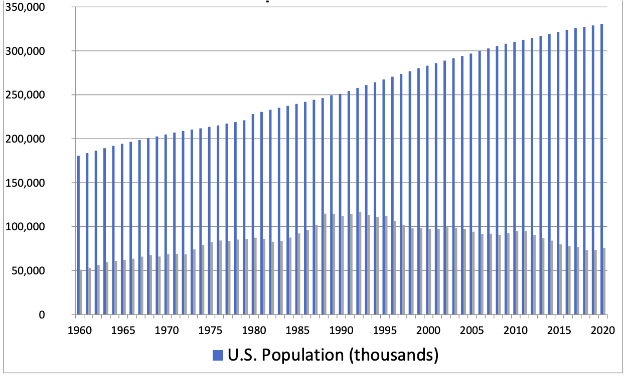

US Population vs. IRS Workforce

Source: IRS

During FY2021, the IRS received a record 282 million calls. In large part due to office closures and the added workload, call volume inflated to a point that customer service representatives were only able to respond to 11 percent of total calls. Even before the pandemic, the IRS lacked the centralized case management system and the number of CSRs it would need to provide quality service to taxpayers. The added call volume from pandemic policy changes made providing quality service virtually impossible. Addressing telephone service challenges requires increased staffing levels and technology enhancements well beyond what the IRS can afford. Providing additional funding for increased customer service capacity is essential, as many taxpayers, particularly lower-income taxpayers, rely on the IRS’s customer service representatives for help navigating the tax process.

Understaffing and increased workloads have also created a massive backlog of returns. At the close of the 2021 filing season, the IRS had 35.3 million returns still awaiting manual processing and relatively few staff to process them. IRS commissioner Charles Rettig told members of the House that he hoped the IRS would be able to clear its substantial backlog of returns by the end of 2022. This has left millions of taxpayers awaiting their returns well past the end of filing season.

Insecurity about Social Security

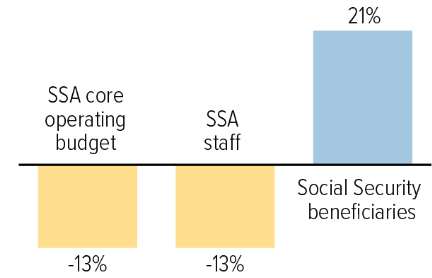

The Social Security Administration has been a target of rampant underfunding which has hindered the administration’s ability to quickly and effectively evaluate claims. The flagship agency for income based entitlement programs now faces an existential threat from chronic underfunding, staff shortages, and a nearly 21 percent increase in claims. This underfunding has led to longer waiting periods for benefits that many vulnerable Americans rely on, while decreasing the SSA’s flexibility to manage crises. This was underscored during the COVID-19 pandemic, which forced the administration to rethink the way benefits were distributed, resulting in fewer lower-income seniors seeking benefits. SSA field offices closed at the start of the pandemic and have largely remained closed.

Percent Change From 2010 to 2021, Inflation-Adjusted

Source: CBPP

The SSA continues to operate at a limited capacity and will need support to continue to protect vulnerable individuals. The agency was recently granted funding to help address systematic problems during the pandemic. However, this funding was only meant to avoid the worst of the crisis. The gap between claims and resources is only expected to grow as the American population continues to age. These problems will worsen if the administration’s funding is not increased. Increasing SSA funding is crucial to ensuring that life-altering benefits are protected not only during the next crisis but also during the fast-approaching systematic challenge of dwindling birth rates combined with higher life expectancy.

The CFTC

Regulatory agencies like the CFTC have also found themselves with a scope of responsibilities that far exceed their means. The CFTC’s regulatory duties have ballooned in the wake of the 2008 financial crisis, but its budget has not grown to match. In 2021, the CFTC had just $304 million and 718 full-time equivalent employees to regulate a domestic market of approximately $342 trillion in swaps and futures. By contrast, in 2010, the agency said that it would need 864 full-time equivalents to handle its new responsibilities after Dodd-Frank, 146 more than it had 11 years later. By failing to provide adequate funding, Congress runs the risk of leaving an important financial watchdog without the resources that it needs to perform investigations and protect the public.

Growing cyber threats, domestically and internationally, examinations of clearinghouses at home and abroad, and the rapid growth of the fintech industry present new, challenging issues — with possible mandates for the burgeoning crypto markets that the CFTC will not have the resources to address in a timely and adequate manner. The CFTC cannot responsibly innovate and meet the needs of rapidly evolving markets and market participants absent additional funding.

The Big Picture

If Congress wants federal agencies to do their jobs, then it needs to grant them sufficient budgetary authority to fulfill their mandates. Taxpayers should not be kept waiting or denied access to needed services and protections. Congress should remember that good governance isn’t just about passing the right legislation.

The coming years will bring new challenges that continue to push the bounds of what an understaffed, under-resourced agency can accomplish. If we want to create an effective government that can respond to the needs of the future, federal policymakers will need to craft a budget that allows agencies to increase their staff and modernize their systems. Not doing so will cost taxpayers in the long run by depriving them of access to important government services.