Update 261 – K Street Prowess on Full Display

In the Drafting and Influencing of the TJLA

Experts and veteran observers were horrified at how quickly the Republicans pushed the massive Tax Cuts and Jobs Act (TCJA) through Congress. Tax legislation is notoriously complicated and witnesses to the sausage making braced themselves for unconsidered but devastating consequences.

The Republican haste should hardly be surprising: their donors and the K Street lobbyists they employ saw a once in a generation chance to change the tax code to their advantage and they were not going to miss out. A drill-down on the $1.5 trillion deficit-financed feeding frenzy follows.

Happy Friday,

Dana

—————————————

A few Republicans were honest about where the pressure for such rapid legislation came from. Sen. Lindsey Graham expressed concern that “contributions will stop” if the TCJA was not passed, and Rep. Chris Collins said that “donors are basically saying ‘get it done’ or don’t ever call me again.”

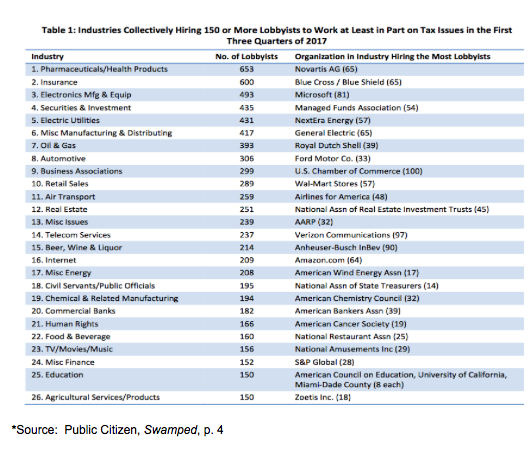

In all, more than half of D.C.’s 11,000 lobbyists worked on the tax bill, donating $9.6 million to members of Congress during the first nine months of 2017. 20 corporations and trade associations have hired at least 50 lobbyists apiece. The U.S. Chamber of Commerce hired the most lobbyists to work on tax issues, and the Business Roundtable, an association of CEOs of the nation’s largest corporations, hired 51 lobbyists.

Who Got Goodies

It is common for large and complex pieces of legislation to come with a handful of provisions that were clearly intended to help one specific industry. The TCJA, written by Republicans behind closed doors with more contact with K Street lobbyists than their Democratic colleagues, might well set records in this regard. Here are some of the most blatant giveaways.

• Craft brewers: Trade organizations representing the craft beer and wine industry got a welcome handout from Senator Rob Portman who slipped in the “Craft Beverage Beer Modernization and Tax Reform” provision into the bill, lowering the tax rate on American-based alcohol producers.

• Aircraft owners: The TCJA provided a generous expensing provision for aircrafts. It replaced the longstanding “like-like” exchange provision with a short-term provision that allows for immediate expensing. Beyond this, the Act stipulated that a federal excise tax is not due on amounts paid by aircraft owners to aircraft management companies.

• Oil and Gas Industry: The oil and gas industry’s long standing wish finally came true when Sen. Lisa Murkowski pledged her support for the bill in exchange for the opening up of the Arctic National Wildlife Refuge for drilling. The provision, which opens up the 19.6 million acre reserve oil and gas exploration, will certainly be a boon for the industry. Experts estimate the region could hold as much as 20 billion gallons of oil.

• Real Estate: The doubling of the standard deduction left homebuilders concerned that fewer tax day itemizers would translate into more expensive homes and fewer new homebuyers. While at this point it is unclear just what effect the decline in itemizers will have on home buying, real estate interests got more than enough goodies elsewhere in the bill to make up for market rouble. Real estate firms won special treatment regarding the limits on the deductibility of interest expense, and an eleventh hour addition gave them special access to the 29.6 percent pass through rate. And real estate investment trusts (REITs) got special treatment under the law, also thanks to a last minute addition.

Shootout @ PayGo Corral — Lobbying for Loopholes

K Street’s greatest impact, however, may have been in the loopholes they were able to save as Republicans rushed the TCJA towards the finish line. In order to keep costs in line with their $1.5 trillion dollar spending limit, Republicans had to find a number of ways to raise revenues by closing existing loopholes. For lobbyists, this turned into a scramble to protect their industry’s favorite loopholes and pass the pay-fors off to someone else (typically middle class taxpayers).

• GE and Friends: The House’s version of the then-bill sent lobbyists for General Electric (GE) scrambling. A provision in that version of the bill would have disallowed GE and other firms from deducting the losses from some overseas units from the one-time repatriation tax on foreign earnings. Lobbyists mobilized quickly and the provision did not make it into the final Act.

• Oil and Gas win again: Oil and gas companies have long been able to immediately deduct the cost of their drilling operations from their taxable income. At various points tax drafters considered eliminating the tax break that opponents deride as a warrantless handout. Yet the industry’s lobby was fierce, and the deduction survived.

• Private equity payment protection: President Trump had long railed against the carried interest preference, making the loophole a central feature of his campaign rhetoric. Despite this, the provision made it through the TCJA mostly unscathed. The required period that fund managers must hold their stock to gain access to the loophole was extended from one to three years, but many observers see this as window dressing (see update 260).

The End Result

All this lobbying paid dividends for corporations, but little of the gains have found their way to rank and file workers. Leaders from the nation’s largest unions have argued that low wage workers have received little benefit from the TCJA. February did see strong job gains, with the economy adding 313,000 new positions, but wage growth has remained flat since passage of the Republican tax overhaul. While it is unclear whether wages will pick up in the coming months, it is clear that shareholders have benefited mightily. Corporations have spent $218 billion buying back their own stock since the passage of the TCJA, with more share repurchases on the way.

Republicans in Congress have also been able to cash in on their efforts as donor contributions have continued to pick up since November. Frustrated with Washington gridlock and the GOP’s inability to accomplish longstanding legislative goals during President Trump’s first year in office, several Republican mega donors began to withhold fundraising dollars. Getting the TCJA over the finish line was enough to turn the campaign-finance spigots back on.

Shortly after the tax Act became law, Charles and Elizabeth Koch wrote the first big check of the midterm cycle, giving $1 million in late November. Other large donors quickly followed suit.

Ahead: Technical Corrections Lobbying

While last month’s omnibus included an important fix for the grain glitch, there is still substantial work to do before the tax code is rid of the unintended consequences in the TCJA. However, opening up the hood to tinker with the bill will be an uphill battle for Republicans, because it is seen as dangerous by Democrats, and would give K Street another opportunity to run up the score.

While the TCJA was passed through reconciliation, only requiring 51 votes, any alterations will have to beat back a Democratic filibuster. For reference, after the Democrats passed Obamacare they were never able to conduct a thorough correction process because Republicans held ranks and filibustered. It is unlikely that either side will compromise on taxes this far into the election year.

House Speaker Paul Ryan seems appropriately skeptical of Tax 2.0’s chances this cycle, but Kevin Brady has suggested he will introduce it by tax day, April 17 this year; consider it a two-day extension for free.

singles near me free

dating online dating

tinder online , how to use tinder

tinder login

tider , tinder online

http://tinderentrar.com/