Update 260 — Unpacking the 2017 Tax Cut:

A Potpourri of Unintended Consequences

For millions of Americans, April is the cruelest month because it requires time spent with the federal income tax code. This year (or tax year 2017) may top them all for annoyance, confusion, and surprises. And for billable hours for accountants and tax preparation specialists.

Today, we look at the surprises — the tax outcomes that could not have been anticipated by the beneficiaries and victims among sectors and firms, or just about anyone else including drafters of the legislation. Next time, we’ll take a look at those drafters and cases of perverse or just outsized windfalls that haven’t gained much attention.

Best,

Dana

––––––––––––––––––––––

Republicans ended 2017 in a mad dash to pass the Tax Cuts and Jobs Act (TCJA), the largest-scale reform of the U.S. tax code since 1986. The Reagan-era tax reform passed after two years of painstaking drafting and redrafting as Congress debated the consequences of changing the tax system. This time around, Republicans pushed their tax bill into law at breathtaking speed, jamming it through Congress in less than two months without any overtures towards bipartisanship.

The Act is riddled with typos and mistakes. Members voted on provisions that were literally hand-written on the margins of the bill. Republicans may have claimed that the TCJA was aimed at making the tax code fairer and more efficient. But in their haste to pass the legislation, they accidentally wrote a number of provisions that inordinately benefit some industries while hurting others, creating economic inefficiencies along the way.

Below, we examine a number of industries affected by the sloppy legislation.

Typos Surprise Renovators and Restaurateurs

Small businesses and real estate companies that expected to deduct the cost of renovations over the short term might be on the hook for more than they expected in coming tax seasons. Under prior law, improvements to real estate that are typically made by restaurants and retailers qualified for bonus depreciation with the balance of the investment depreciated over 15 years. Due to a typo in the TCJA, such improvements made in 2018 or later will be depreciated over 39 years.

Municipal Bond Markets Starved

Just prior to passage of the Act, local government borrowers rushed to secure funding for development projects. These entities were concerned about two pieces of the TCJA: the corporate rate cut and the end to tax rules allowing municipalities to issue tax exempt advance refunding bonds.

- The Act’s corporate rate cut reduced the incentive for banks to invest in bonds issued by state and local governments at lower interest rates than a corporation with a comparable credit rating. Historically, such bonds were issued at low rates because banks were not taxed on income earned from these loans. With lower tax rates, the relative advantage municipal bonds have over corporate bonds is reduced.

- The Act ended the tax rules permitting municipalities to issue tax-exempt advance refunding bonds. Those rules allowed state and local governments to take advantage of falling interest rates by refinancing existing tax-exempt bonds with new tax-exempt bonds, even though the proceeds of the new bond issuance were not used for capital spending. The loss of this fiscal flexibility will also make it more challenging for state and local governments to fund much-needed infrastructure projects.

Nonprofits Not Happy

Perhaps no other provision in the TCJA was more widely touted than the doubling of the standard deduction, but this provision is certain to have unintended consequences. One of the most troubling is the impact it may have on a nonprofit sector that depends on charitable giving. Estimates suggest that doubling the standard deduction will mean that 90 to 95 percent of filers will not itemize their tax returns, meaning that only five to ten percent of taxpayers will be eligible for charitable giving deductions.

Moreover, the TCJA more than doubles the threshold that the estate tax applies. The estate tax creates a strong incentive for very wealthy individuals and families to give to charity rather than having assets subject to the estate tax at the time of the owner’s death. A significant reduction in the number of estates subject to the estate tax will translate into a significant reduction in the large charitable donations that colleges, hospitals, performing art centers, etc. rely on.

S-Corp Shell Games

President Trump made the carried interest loophole a central plank of his faux-populist campaign, blasting Wall Street for “getting away with murder” and promising to close the loophole on the campaign trail. The TCJA made a half-hearted attempt to address this promise by extending the required holding period for the preferential capital gains tax rate from one to three years. But, a mistaken provision in the legislation that excludes corporations from the change is allowing fund managers to side-step even this modest and practically ineffectual limitation.

Republicans claim they meant for this provision to only apply to C-corporations that pay corporate taxes, but drafting imprecision means that S-corporations that do not pay the corporate rate can also avoid the enhanced waiting period. As a result, funds began creating scores of new shell companies to take advantage of the mistake by allowing their executives to drop their interests into new S-corporations. Secretary Mnuchin’s Treasury moved to block the companies from gaming the new tax law, but some fund managers may argue that Treasury lacks the statutory authority to block their maneuvering. For the time being, the S-corporation shell games have been halted, but litigation is certain and it is not clear how long this stasis will hold.

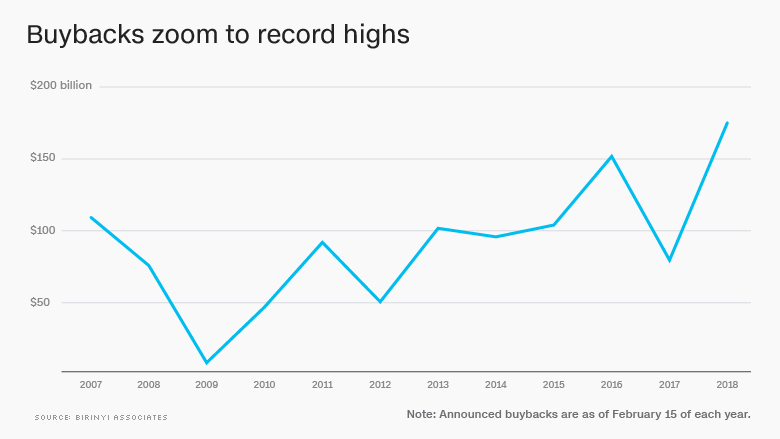

Buyback Bonanza

The centerpiece of the Tax Cuts and Jobs Act was the corporate rate reduction from 35 percent to 21 percent. Republicans argued this would boost worker wages and increase hiring. As it turns out, corporations are directing most of their windfall toward buying back shares in corporate stock. Relatively speaking, the amount invested in worker’s wages and one-time employee bonuses is paltry.

President Trump recently held an event with Cincinnati-based, Fifth-Third Bank where the President praised the firm for giving its workers a boost. A closer look at the numbers reveals the bank’s shareholders benefited much more. Fifth-Third bought back $2.8 billion in corporate stock shares in the wake of the TCJA. Next to that, $48 million in wage increases for 14,000 workers appears quite small.

Source: http://money.cnn.com/2018/02/16/investing/stock-buybacks-tax-law-bonuses/index.html

Minor Changes in the Omnibus

On February 9, the Bipartisan Budget Act of 2018 was enacted. As its name suggests, this act included some limited input from Democrats. Below we discuss three minor tax fixes included in that legislation. These changes are certainly important, but they pale in comparison to the gifts provided to corporate and high net worth constituencies by the TCJA.

- It provides farmers selling to cooperatives a 20 percent deduction with respect to their gross income from such sales. Sens. Hoeven and Thune worked a provision into the Bipartisan Budget Act that caps farmers’ deductions at 20 percent of net profits from such sales. The change came after pressure from businesses that purchase agricultural products from farmers to fix this “grain glitch.” They were concerned that farmers would demand higher prices when selling to buyers that are not cooperatives due to the lower tax benefits associated with such a sale.

- In exchange for the “grain glitch” fix, Sen. Cantwell won a 12.5 percent expansion in the available allocation of low-income housing credits. The low-income housing tax credit provision was part of the Democrats’ effort to try to reverse the damage the housing sector suffered at the hands of the TCJA.

What’s Ahead

Rep. Mark Meadows has targeted April 15 as the date for phase two tax legislation to be introduced. Ways and Means Chair Kevin Brady pledges a focus on making the individual cuts permanent like the corporate tax cuts, and Speaker Ryan has said he doesn’t expect any revision until after the November midterm election.

Last month’s Bipartisan Budget Act made marginal improvements to the TCJA, there are many aspects of the TCJA that merit either corrections or policy revisions. But don’t expect to see major fixes any time soon, as such a fix would require Democratic votes in the Senate. Leader Schumer: “We don’t have much of an inclination, unless they want to open up other parts of the tax bill that we think need changes, to just help them clean up the mess they made, because they created it.”

My brother recommended I might like this website. He was once entirely right.

This put up truly made my day. You cann’t consider just

how much time I had spent for this information! Thanks!

plenty of fish dating site of free dating

skype dating chat

Pingback: shakra keto diet

viagra pro viagra melbourne where to buy ppidvot – buy viagra south africa online

dating website for gay men

gay dating sites deutschland

reddit.com: gay dating

gay submissive sex dating

gay dating sit

gay dating trans men

dating games sites gay

free gay dating sites in canada

23 dating 19 gay