Update 691 — Landing Soft but S l o w

April CPI up 4.9%, Lowest in Two Years

President Biden had a tense meeting with Congressional leaders yesterday to discuss the debt ceiling. Staff will meet throughout the week to lay the groundwork for another meeting between Biden and leadership scheduled for Friday. No breakthroughs thus far.

This morning’s consumer price index (CPI) data showed a key macroeconomic breakthrough, with annual inflation dipping below five percent for the first time in two years – a sure relief for households, as food prices have remained constant over the last two months. And, the labor market remains resilient, as last week’s stronger than expected jobs report made clear. So how to account for polling that shows Americans remain pessimistic about the economy? See below.

Best,

Dana

CPI Data Shows Cooling Inflation…

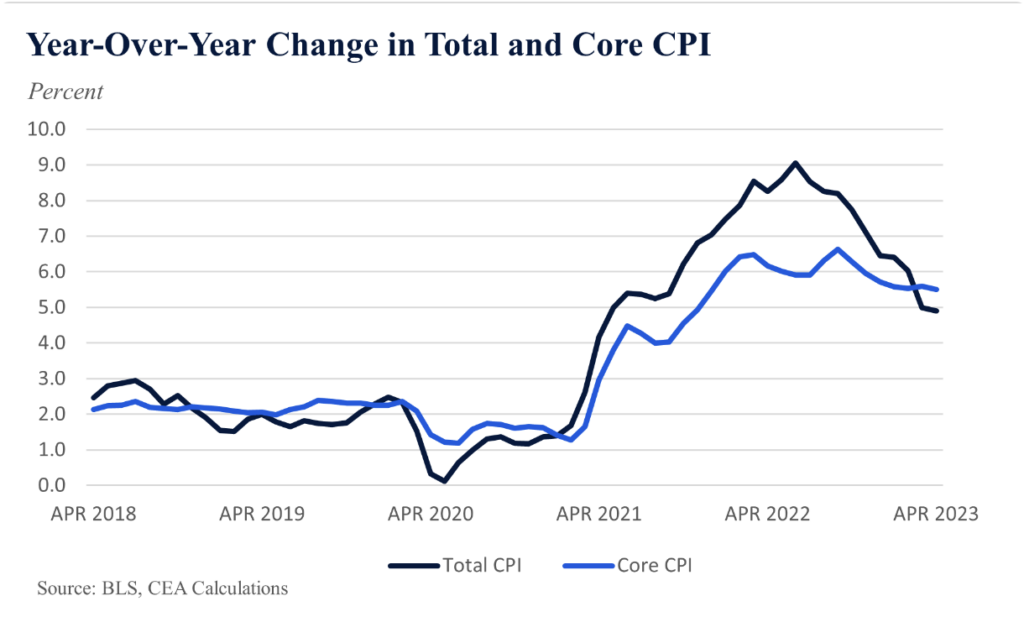

This morning, the U.S. Bureau of Labor Statistics released the latest Consumer Price Index data, which showed that headline inflation rose to 0.4 percent in April, an annual increase of 4.9 percent. Today’s CPI numbers marked the tenth consecutive monthly decline in inflation and the lowest annual inflation rate since April 2021. Core CPI rose 0.4 percent in April, just as it did in March, representing a 5.5 percent increase from a year earlier.

Source: Council of Economic Advisers

The rise in inflation was led by an increase in shelter costs. The energy index rose by 0.6 percent in April as an increase in prices for gasoline more than offset declines in other energy component indexes. The energy index saw a 5.1 percent decrease, year-on-year. Prices for used cars and trucks, motor vehicle insurance, recreation, household furnishings and operations, and personal care all increased over the month. Prices of airline fares and new vehicles fell in April. April’s report on food prices remained consistent with March’s, at zero percent, an example of the continued relief for households after the rapid inflation of last summer.

Continued falling inflation is a welcome signal for the Federal Reserve and the fate of interest rates in the coming months. Inflation seems to be cooling gradually without significantly disrupting the persistently strong labor market, although levels remain beyond pre-pandemic levels and the Fed’s target level of two percent.

… Following a Strong April Jobs Report

Although the April jobs report came in hotter than expected last week, the labor market remains vulnerable. The persistent strength of the labor market will likely put pressure on the Federal Reserve to keep interest rates high in its efforts to bring down inflation– despite the fact that wage increases are not running at inflationary levels. Chairman Jerome Powell has on multiple occasions expressed the position that labor market conditions must loosen before the Fed can relax its rate increases. However, if the Fed remains overly aggressive, it could tip the economy into a recession, jeopardizing historically-low unemployment even as inflation has already begun to cool.

The April jobs report showed that total nonfarm payroll employment increased by 253,000. Last month’s numbers mark a reversal from the slowdown of the previous few months, even as February and March were revised down to 248,000 and 165,000, respectively. Professional and business services, healthcare, government services, and leisure and hospitality all saw gains last month. However, employment in government services and leisure and hospitality remain below their pre-pandemic levels, and employment in temporary health services, often considered an indicator of future hiring, saw a decrease of 23,000 jobs over the month.

Average hourly earnings for all employees also increased more than expected: 0.5 percent over the month and 4.4 percent over the last twelve months.

Despite slowdowns in employment increases this year, the job market remains strong. Unemployment ticked down slightly to 3.4 percent, a 53-year low. The Black unemployment rate fell to a record low of 4.7 percent, and the unemployment gap between Black workers and white workers fell to 1.6 percentage points, the smallest on record since 1972.

But… Americans Pessimistic on Economic Leadership

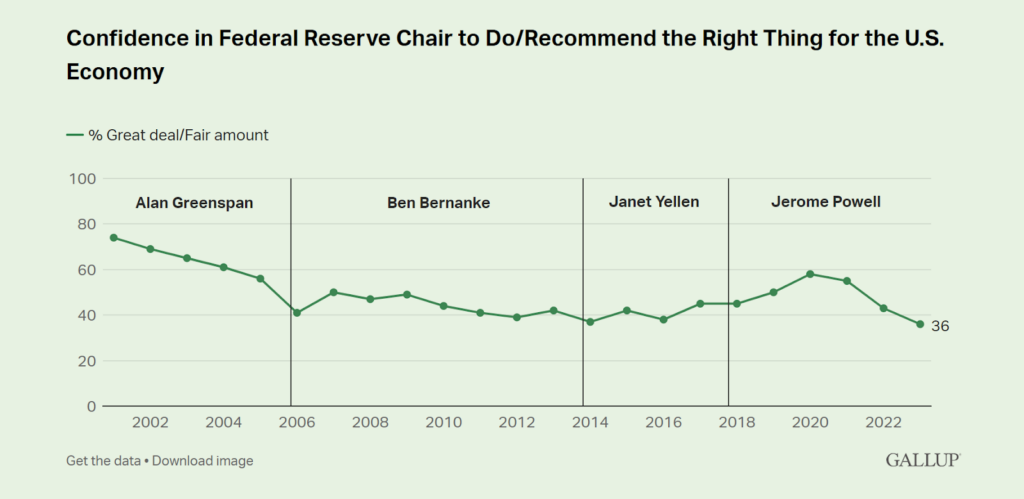

Despite cooling inflation, Americans are less optimistic about the state of the U.S. economy than they have been in recent months. Gallup’s annual Economy and Personal Finance survey, released yesterday, polled American adults across the country from April 3rd to 25th. The survey found that Americans’ confidence in economic leaders — President Biden, Federal Reserve Chairman Jerome Powell, Democratic leaders in Congress, and Republican leaders in Congress — is at least marginally lower than it was a year ago. Never before have confidence ratings in all four leaders fallen below 40 percent in one year since Gallup began asking the question in 2001.

Confidence in Fed Chair Powell to do/recommend the right thing for the U.S. economy was the lowest it has been over his six years as chair. His confidence rating was also lower than that of any Fed chair since 2001. The Federal Reserve has been aggressive in its campaign to tame inflation through higher interest rates despite the real risk of triggering a recession, pummeling small businesses and putting millions of Americans out of work. Last week, Powell signaled that the Fed would be open to finally pausing its most aggressive series of interest rate increases since the 1980s at its next Federal Open Market Committee (FOMC) meeting on June 13-14. The shift in the Fed’s language comes after a group of ten congressional Democrats called on the Fed to pause its campaign, citing the danger of going too far.

Source: GALLUP 2023 Economy and Personal Finance Survey

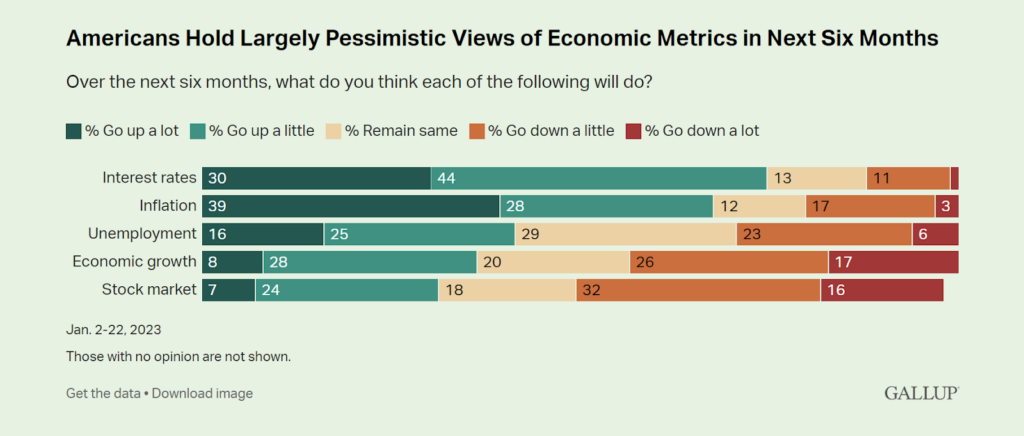

The findings of the new poll follow Gallup’s Mood of the Nation poll, conducted from January 2nd to 22nd, which found that Americans were more likely to predict negative rather than positive outcomes for five key aspects of the U.S. economy — interest rates, inflation, unemployment, economic growth and the stock market — over the next six months. At the time, mentions of inflation as the nation’s most important problem were elevated.

Source: GALLUP Mood of the Nation Poll

Since then, inflation has moderated but remains higher than the Fed’s target, and the Fed has increased the interest rate by 75 basis points, from the 4.25 to 4.5 percent range to the 5.0 to 5.25 percent range. Unemployment has remained relatively stable at around 3.4 percent, while jobs growth has remained strong. Data on GDP for the first quarter has shown that economic growth slowed to 1.1 percent from 2.6 percent in the fourth quarter.

A continued cooling of inflation while preserving the so-far resilient labor market and avoiding the risk of recession will be key to increasing confidence in economic leaders and outcomes moving forward, perhaps to a successful soft landing — subduing inflation without recession. Continuing to raise interest rates could, as the Fed knows, run the risk of upending the recent macroeconomic gains. While the path forward is precarious, economic leaders will have to demonstrate the flexible leadership that the moment demands to secure a soft landing.