Update 656 — Fed Boosts Rate 50 BPs

Is Soft—and Swift—Landing in Sight?

Today, the Federal Reserve announced a 50 basis point interest rate increase, bringing the borrowing benchmark up to a targeted range of 4.25-4.5 percent. This rate hike, a slowdown after four consecutive 75 point increases, suggests the Fed believes it may have a handle on inflation. November’s CPI report of a 7.1 percent year-on-year increase in price is the lowest since last December, hinting at a soft landing, reversing inflation without recession.

If the Fed policy eases to neutral over the next year, the economy could help the Democrats powerfully in 2024. Democrats had the best party-out-of-power performance in this year’s midterms in 88 years — despite the worst bout of inflation in 40 years. Without that albatross, and with strong current macroeconomic fundamentals, prospects for 2024 improve. A soft landing would also suggest that the Fed is pursuing its dual mandate even-handedly, not sacrificing unemployment for the sake of price stability.

In today’s update we cover November’s CPI report, the Fed’s rate hike, and what a soft landing could mean for the economy and politics.

Best,

Dana

—————————

The Federal Open Market Committee (FOMC) closed out its final meeting of the year today by announcing a 50 basis point hike in interest rates. Markets rose Tuesday morning following the release of November’s CPI report, a sign of optimism from investors that the central bank will slow down its rate increases in the coming year. Previous signals from the Fed that it is ready to slow the pace of policy rate increases combined with a positive CPI report are good news for those who were worried about the Fed continuing to pursue overly aggressive rate hikes.

Cooler Price Index

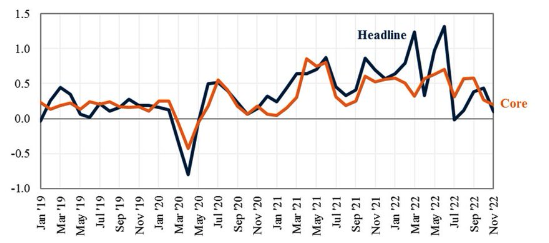

The Consumer Price Index (CPI) increased .1 percent month-over-month in November and 7.1 percent year-over-year, down from .4 percent month-over-month in October. Core CPI, the index for all items less food and energy, rose by .2 percent, down from .3 percent the previous month — the second straight month that inflation cooled more than expected, a sign that inflation may be moderating. Growth in both headline and core CPI ticked down compared to October, and the month-over-month rate of inflation has averaged only .2 percent over the last five months. A month-over-month rate of .2 percent would result in an annual rate of inflation of 2.43 percent, a welcome change after the high inflation of 2021 and the first half of 2022.

Monthly CPI Inflation (Percent, Month-to-Month)

Source: BLS

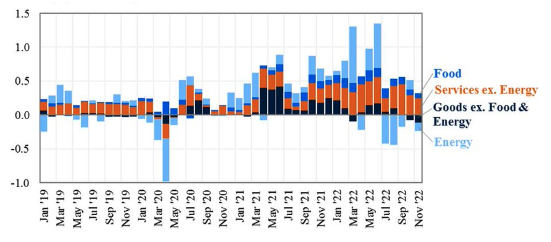

Falling prices for energy and goods strongly contributed to the relatively low inflation we saw last month. Energy prices fell 1.6 percent in November while prices for commodities other than food and energy fell by .5 percent. Although the future of energy prices remains uncertain due to the Russian invasion of Ukraine, gas prices have now fallen below where they were when Putin’s invasion began. The indexes for used cars and trucks, medical care, and airline fares all fell this month as well, and the index for new vehicles remained unchanged. In other good news, the food index rose more slowly in November than in previous months, increasing just .5 percent, with inflation for food away from home falling substantially.

Shelter was once again the largest contributor to the monthly increase in CPI again in November, rising by .6 percent for the month. The rent index rose .8 percent, with owners’ equivalent rent rising by a slightly smaller .7 percent. But these are lagging indicators. Private-sector data shows rents for tenants signing new leases rising less quickly over the last few months than they had been and even falling in some markets, another sign that inflation is already beginning to cool down.

Contributions to Monthly Headline CPI

2019-22 (Percentage Points)

Source: BLS, CEA

Soft Landing Hopes Rising

This week’s CPI data is an encouraging sign that the Fed may be able to achieve a soft landing after all. As inflation starts to cool down and supply chain issues stemming from the Russian invasion of Ukraine and the pandemic begin to abate, there is little evidence to suggest that the Fed will need to tip the country into a recession in order to bring inflation under control.

Inflation expectations declined again in November following a slight uptick in October, another positive sign that the Fed may not feel the need to keep moving as aggressively to stamp out high inflation. November’s Survey of Consumer Expectations showed decreases in inflation expectations across the short, medium and long terms. This change in expectations cut across education and income groups. Falling expectations help put to rest fears that consumers’ inflation expectations will become a self-fulfilling prophecy.

Consumer demand has remained solid, as has the robust labor market. Despite some high-profile layoffs, largely concentrated in the tech industry, the labor market has consistently stayed strong in recent months. Total nonfarm payroll employment increased by 263,000 jobs in November, and the unemployment rate remained steady at 3.7 percent. With inflation already starting to cool and with the full effects of previous rate hikes not yet realized, the Fed shouldn’t need to keep raising rates quite so aggressively or drive up unemployment too much in order to bring inflation under control in 2023.

The Fed is expected to continue to raise interest rates early in 2023 and then hold rates at a high level for some time thereafter in order to fully tamp down inflation. History illustrates the difficulty of achieving a soft landing — nine recessions have followed the last 12 rate hike regimes — but analysts are more optimistic about the Fed’s ability to avoid a hard landing. Interest-rate futures following the CPI release on Tuesday suggested that traders anticipate smaller, 25 basis point increases at the next two meetings stopping short of a 5 percent federal funds rate.

Business and Electoral Cycles

If the Fed is able to pull off a soft landing, the economy and Democrats could be the beneficiaries. The Fed’s most rapid and aggressive monetary policy moves we’ve seen in decades raised significant concerns that the central bank was willing to send unemployment up, causing “pain” in Powell’s words, in the name of bringing down inflation.

“Higher interest rates, slower growth, and a softening labor market are all painful for the public that we serve,” Powell said, “but they’re not as painful as failing to restore price stability and then having to come back and do it down the road again and doing it at a time when, actually, now people have really come to expect high inflation… We want to act aggressively now and get this job done and keep at it until it’s done.”

While true to some degree, nevertheless the Fed is bound by law to balance both sides of its dual mandate – price stability and maximum employment. As we have outlined in previous updates, high unemployment hurts vulnerable workers and has ripple effects throughout the economy. The possibility remains that Powell and the FOMC favors one of its mandates at the expense of the other, creating a new economic issue for politicians to tackle.

Democrats spent the last election cycle being hammered by Republicans on inflation and the economy. Democratic pollster Celinda Lake said of the midterms:

“Democrats and Biden were 20 points behind on the economy on Election Day… I don’t know that Democrats won because of the economy so much as despite the economy. But the persistence of the administration, and the focus and constant work to improve, is finally breaking through, both in results and in perception.”

Current trends could present an opportunity to restore some of the trust lost, probably unfairly, by the Democrats as a result of inflation. This week’s encouraging CPI report and the Fed’s softening stance should offer hope to Democrats that their constituents won’t feel the worst effects of overly tight monetary policy. A soft landing, and the solid economy that would come with it, would be a strong point in Democrats’ favor the next time voters are at the ballot box, and help to correct the chronic perception deficit Democrats face.