Update 612 — Running on the Economy

The Part of the Glass That is Half Full

You run on the economy you have, not the one you had planned on. In part one of two perspectives on running in this economy, we start today with the glass-half full. Per Friday’s glowing jobs report, the U.S. added another 390,000 jobs in May, with unemployment holding at a svelte 3.6 percent. The labor market and growth remain strong after Democrats powered fiscal support through the pandemic recovery. A record to run on, not from.

But will it work? Democratic candidates who had hoped to run on the robust recovery may find it frustrating that voters don’t seem to care about things like low unemployment. Try telling constituents that actually, the economy is much better than it would have been without the Democrats when gas prices are going up 25 cents in a week. We offer a way to help shift the economic narrative quickly as voters begin to make up their minds for the midterms, below.

On Friday, a look at the macroeconomy glass-half-empty, aka inflation, and strategies to deal with it.

Best,

Dana

——————

May brought us another strong jobs report, adding to an impressive streak of good labor market news. This good news, however, comes at a time where voters are increasingly worried about an impending recession – or mistakenly believe that we’re already in one. Cardi B may not be an economist, but it’s worth noting when celebrities say that we’re in a recession if for no other reason than that they can reflect and amplify the concerns of their followers (in Cardi B’s case, almost 23 million of them).

An Almost Perfectly Good Jobs Report

Total nonfarm payroll employment rose by 390,000 in the month of May, and unemployment remained steady at 3.6 percent. Employment in leisure and hospitality saw the biggest gains, followed by professional and business services and transportation and warehousing. Employment in retail trade declined in May but is still above February 2020 levels.

Job growth did slow slightly compared to recent months, but that shouldn’t be a cause for concern. The labor market has been hot as the economy bounced back from the pandemic. The unemployment rate and number of unemployed persons are both almost back down to their pre-pandemic levels of 3.5 percent and 5.7 million.

Wages are still on the rise. Average hourly earnings for all employees on private nonfarm payrolls rose by 0.3 percent, or 10 cents, to $31.95. Average hourly earnings of private-sector production and nonsupervisory employees rose a bit faster, by 0.6 percent, or 15 cents. In the last twelve months, average hourly earnings of all employees have increased by 5.2 percent.

But What You See…

Seventy-eight percent of adults rated their personal finances as at least okay, but only 24 percent rated the national economy as good or excellent. The disparity illustrates the disconnect between peoples’ perceptions of the national economy and their own financial situation. Self-reported financial well-being was higher last year than at any other time since 2013, as was the number of adults who are able to cover a $400 expense in cash or its equivalent. Wage growth was especially high among low-income workers last year, a welcome departure from historic trends. So why then, does the public think that the economy is so bad?

Assessment of Own Financial Well-being, Local Economy, and National Economy

Source: Federal Reserve

One explanation is simply the sting of inflation. Although real wages did rise during the first two years of the pandemic, particularly for low-income workers, inflation has dampened some of that progress. Between April 2021 and April 2022, real average hourly earnings for all workers decreased by 2.6 percent and real weekly wages kept pace with inflation in the first quarter of 2022. If inflation cools down as expected, and wages continue to rise, real wages could rise again by the end of the year.

Additionally, most people aren’t waiting with bated breath for the latest release from BLS. They do at least see gas stations though, and they certainly buy food. Suffice it to say inflation is visible. No one can see the job they might have lost or the raise they might not have received in a slower pandemic recovery. They can see brand new stickers at the store marking up the price of their pantry staples.

If someone were to consider what might have happened if they lost their job during a period of high unemployment, they may never consider the full extent of the benefits that they received from periods of low unemployment. Former Fed chair Ben Bernanke recently said that “the difference between inflation and unemployment is that inflation affects just everybody.” And inflation does affect everyone, albeit unequally. But so does unemployment. A worker may only really notice the effects of high unemployment once they or a loved one lose their jobs, but they’ll feel the benefits of low unemployment whether they know it or not. A strong labor market boosts wages and increases workers’ bargaining power. Those who avoid long-term or youth unemployment now also avoid potentially life-long impacts on their careers and wages. Inflation may be what everyone knows affects them, but it’s not the only thing that does.

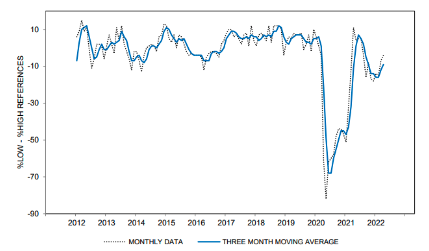

The University of Michigan Survey of Consumers suggests that many consumers don’t believe there’s good news about the economy because they haven’t heard any. They heard a lot about higher unemployment early in the pandemic, and are still hearing more about higher unemployment than lower unemployment. Consumers also heard more unfavorable mentions of government economic policies than they did favorable mentions.

It’s not surprising that voters’ opinion of the White House’s economic policies are so low. A recent ABC/Ipsos poll found that only 37 percent of Americans approved of Biden’s handling of the economic recovery. In today’s highly partisan environment, some voters could probably hear all of the positive economic news in the world and still think the president was bungling the economic recovery, but that wouldn’t explain the relatively low approval numbers he faces even among Democrats. Voters rely on their trusted news sources to contextualize the economy for them. When the primary narrative that they’re exposed to is that inflation is crushing American families, they are understandably wary of the state of the economy. Democrats will have to shift the economic narrative if they want to win back voters’ good opinions.

News Heard About Change in Unemployment Conditions (%Lower Unemployment – %Higher Unemployment)

Source: University of Michigan

…Not Always What You Get

Americans don’t feel the strength of the economy, just the sting of inflation. Democrats can tout these factors: job creation and higher wages, while still being responsive to inflation concerns. During the pandemic recovery, Democrats supported working families by keeping money in their pockets and energizing the economy. Democrats should run on a forward looking economic message.

To convince voters that Democrats are fighting not just to care for kitchen table needs but to move our entire economy forward, they need to put creating jobs, rewarding those who work hard, and expanding economic opportunity front and center. Their current strengths on issues like supporting working parents and making services more affordable are important but not sufficient to convince voters that electing Democrats will be best for their pocketbooks. Americans need to know that Democrats have the ideas and know-how to improve our economy.

Here are some examples how:

- Listen to and hear what voters are saying. Democrats need to be in their state and in district speaking with voters and listening to them as much as possible; meet the issue as presented (if they say pump price, don’t say Putin)

- Talk about gains in good jobs at higher wages, manufacturing more goods in America, including cars and semiconductors. Tout USICA/COMPETES once passed.

- Cap the costs of prescription drugs and insulin.

- Cut energy costs and combating climate change by helping people make their homes and cars more energy-efficient.

The economy is going to be a major factor in voters’ decision-making this year. Right now, the picture is pretty bleak. Voters aren’t currently buying the narrative that Democrats are selling. To win in November, Democratic candidates will have to seize a message that appeals to voters in their district, preferably one that highlights the good work Democrats have done for their constituents, as well as the work that they will do if voters keep them in the majority next year. But some issues like inflation are not local and felt universally. We will take it up next time.