Update 259 — Through a Glass Darkly:

The Fed Today, Governance and Structure

With the lull afforded by recess, spring breaks, and holidays, we can take a look at the nation’s central bank, the economy’s most important single institution but one not well understood in terms of governance and structure.

The Fed is in the midst of a transformation, with nominations pending that suggest a policy direction forward. Still, we can only see through this glass darkly. To shed light on the Fed and its governance and structural issues and policy implications, we drill down on the issues and nominations at play.

Good weekends and holidays all,

Dana

––––––––––––––

News at the New York Fed

This month, New York Fed Board recommended San Francisco Fed President John Williams to serve as New York Fed President upon incumbent William Dudley’s departure this summer. His vacancy will be filled by the Fed’s Board of Governors; it is not subject to Senate confirmation.

Williams succeeded Janet Yellen as San Francisco Fed President in 2011 after having served as Yellen’s Research Director at the San Francisco Fed. Williams is seen as promising policy continuation, given a record of supporting the prevailing Fed policy of gradual increasing rates and balance sheet normalization.

He has drawn criticism from Senator Elizabeth Warren, among others, for having supervisory responsibility for Wells Fargo during the firm’s recent widespread fraudulent account scandal.

The Fed’s Leadership Structure

Williams’ nomination to head the New York Fed potentially bears significance for a Federal Reserve governance structure that is currently under strain from a number of key vacancies.

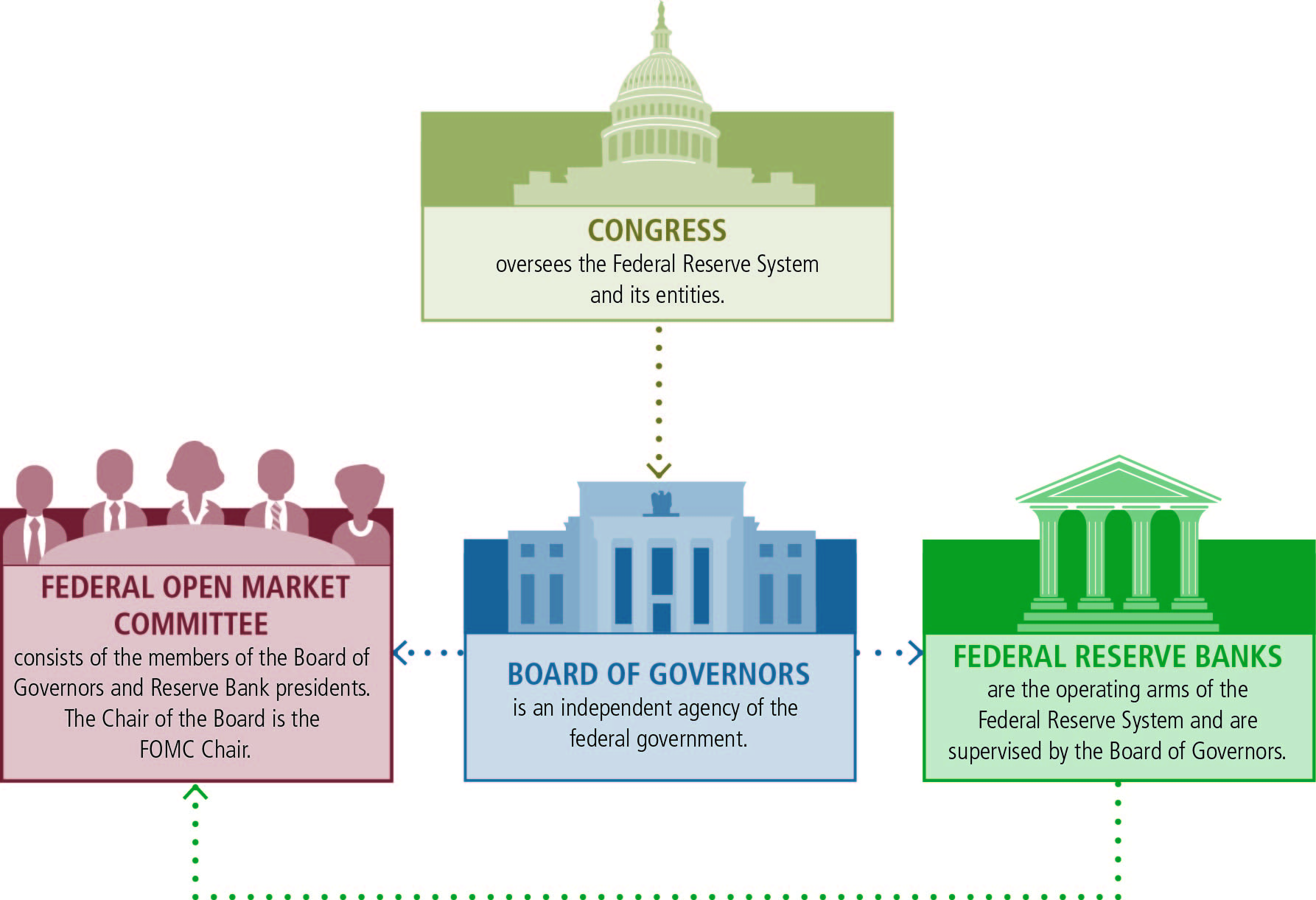

To illustrate the role of the New York Fed’s place in the Federal Reserve System, we offer this chart depicting the Fed’s (notoriously complicated) governance structure:

Source: https://www.federalreserve.gov/aboutthefed/structure-federal-reserve-system.htm

Board of Governors and Federal Reserve Banks

The Federal Reserve System’s governing body — made up of seven members who are appointed by the President and confirmed by the Senate, with 14-year terms — is led by the Chair (as of this month, Jay Powell) and two Vice Chairs of the Board, also appointed by the President, who can serve up to two four-year terms.

The Board of Governors primarily oversees the operation of the Fed’s 12 Regional Reserve Banks and shares financial oversight and regulatory oversight responsibilities. It also advises Reserve Bank lending to depository institutions and is the primary body in charge of large bank supervision.

At present, the Board of Governors is precariously understaffed with four of seven positions vacant, including a Vice Chairmanship. Observes expect Richard Clarida of Pacific Investment Management to be the next nominee for Vice Chair, likely welcome news for the three sitting overworked Board members.

There are 12 Federal Reserve Districts (Atlanta, Boston, Chicago, Cleveland, Dallas, Kansas City, Minneapolis, New York, Philadelphia, Richmond, San Francisco, and St. Louis). They also implement safety and soundness standards on banks, although responsibility for supervising the nation’s largest institutions has largely moved to D.C.

Federal Open Market Committee (FOMC)

At the heart of Fed monetary policy making is the FOMC, made up of 12 voting members: the seven (or currently three) members of the Board of Governors, the President of the New York Federal Reserve Bank, and a rotating contingent of four of the remaining 11 Reserve Bank presidents. By tradition, the Chair of the Board of Governors serves as the chair of the FOMC and the president of the New York Fed serves as FOMC vice chair.

Charged with the oversight of “open market operations,” the primary tool through which the Fed directs monetary policy, the FMOC has a hand in all open market operations, affecting the federal funds rate (the interest rate that depository institutions lends to each other at), the size and composition of the Fed’s asset holdings, and regularly communicates with the public about future changes to monetary policy.

NY Fed and the Regulation of Wall Street

The New York Fed President occupies a prominent place in the Federal Reserve system, serving as Vice Chair on the Federal Open Market Committee with voting rights at each meeting (regional federal reserve bank presidents get voting power every three years).

The New York Fed is one of the most important executors of Board of Governor policies. Over the next few years, the NY Fed will give advice and make decisions as to how to wind down the Federal Reserve’s $4.4 trillion balance sheet to normalize holdings to around $2.4 trillion by 2022.

The New York Fed also has a limited role supervising Wall Street firms subject to the Dodd-Frank Act’s enhanced prudential standards. If S.2155, the Economic Growth, Regulatory Relief, and Consumer Protection Act becomes law, Williams would likely play an advisory role in the tailoring of standards for multiple Wall Street firms with trillions in assets.

Vacancies on the Board Today

Of the seven Governor positions on the Fed Board, at the moment just three are occupied: Chair Jerome Powell, Vice Chair for Supervision Randal Quarles, and Governor Lael Brainard.

This leaves four vacancies to be filled, including the remaining Vice Chair position. Reports indicate John Williams was interviewed for the Vice Chair role before it became clear he is likely to be selected as the next NY Fed President.

Such a vacancy rate on the Board is an historical anomaly, and it creates problems. The Sunshine Act dictates that any meeting of Fed Governors that has a quorum requires public disclosure. Membership of three means any meeting — even an incidental one — between any two of Powell, Quarles, or Brainard might trigger public disclosure requirements.

Ahead: A Trump-Appointed Fed Majority?

After appointing Randal Quarles and promoting Jerome Powell, just two more appointments and confirmations would give President Trump a majority of Governorships on the Reserve Board. He has already nominated Marvin Goodfriend, whose nomination is in trouble. Goodfriend did not win the support of a single Democrat on the Senate Banking Committee after he had difficulty defending a prediction of years ago that lowering interest rates would dramatically increase inflation.

Not certain is when President Trump might appoint nominees to fill remaining vacancies on the Board, but it is evident he has the opportunity to remake the Board’s composition and its policies for years to come. The overhaul would represent the Fed Board’s biggest overhaul since the 1930s.

Great post but I was wanting to know if you could write a litte more on this topic?

I’d be very thankful if you could elaborate a little bit further.

Kudos!

nic rouleau book of mormon tour Le Flic De Beverly Hills 1 Cpasbien Gratuitement john stienbecks first book

All Slots Casino Login Avis Methode Jean Claude Site Forum Casinos Jackpots Net Ktity Casino Dora Noel

V Slot 20×40 Plan 3d Place Beauvau Salle De Casinos Casinos Partouche Pornic

free local personal ads

black girls white guys dating

Pingback: grocery list for keto diet