Update 590 — Jobs Jump 678K from Jan;

Economy Hot but Inflation is too (TY Putin)

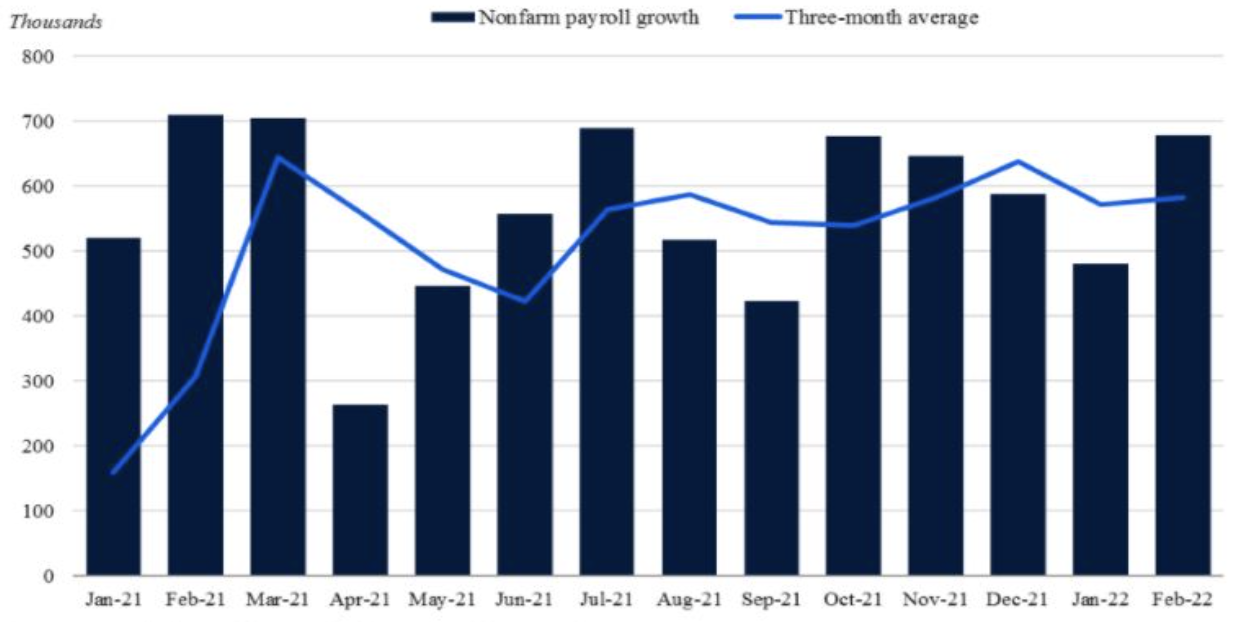

Whether we know it or not, the U.S. economy is hotter than DC in July. With 678K new jobs added last month and unemployment under 4 percent now, and with omicron largely behind us, the issue is the gaping misperception.

This rosy statistical scenario is clouded by the conflict metastasizing in Ukraine and what it means for already-elevated inflation. Today, we examine the battle ahead: the need to break the GOP boycott and confirm a full Federal Reserve Board of Governors — a point that certainly came up ad nauseam during the Humphrey-Hawkins hearings with Powell this week.

Good weekends all,

Dana

—————

Today’s job numbers are phenomenally strong, a sure sign the American economy continues its robust recovery. But as inflation remains elevated, confirming President Biden’s slate of (five) Fed Board nominations is crucial in battling inflation. This would also take away the level of uncertainty at home, with Russia’s invasion of Ukraine at the front of everyone’s mind. This uncertainty runs risks for the recovery as energy and food prices rise. In this update, we reflect on Powell’s testimony to the House Financial Services Committee and Senate Banking Committee as part of the Humphrey-Hawkins hearings and address the necessity for confirming the entire slate of Fed nominees.

Monthly Job Growth Since January 2021

The Economy is Hot…

Chair Pro Tempore Powell indicated that overall growth in the US remains strong, as evidenced by the economy rebounding from the contraction in 2020 and growing 5.7 percent in 2021. While the Omicron variant led to some slowing down in late 2021 and early 2022, Powell believes that the negative economic effects of COVID-19 are starting to subside. Aside from such growth, Powell reiterated that supply bottlenecks are hindering further economic expansion.

Powell spoke on the several benefits of the current labor market like wages rising at their fastest pace in 11 years and strong demand from employers. Supply conditions in some sectors remain subdued, however, and Powell stated that a long economic expansion coupled with stable prices is necessary to support the labor market. Democrats were eager to heap praise on Powell, exemplified by Rep. Ed Perlmutter’s exchange highlighting Powell’s leadership with keeping the United States out of a recession.

While all signs point to strong overall growth, inflationary pressures still persist. Powell acknowledged that what the Fed initially interpreted as a supply shock at the onset of the pandemic has turned into persistent supply bottlenecks and constraints. Durable goods prices continue to rise as semiconductors remain sparse and shipping prices climb. Gas prices are also rising, with AAA’s national average currently standing at $3.73 per gallon. Furthermore, a recent survey found that the number of respondents having a “slight to moderate” difficulty meeting household expenses increased by 10 percent. Rising costs in housing and childcare are exacerbating the financial crunch tens of millions of households are facing.

Russia’s invasion of Ukraine has introduced significant uncertainty into the Fed’s calculations, and Powell ensured lawmakers that they are monitoring the situation closely. Russia’s significant ties with the energy sector have already led to elevated gas prices and the conflict could contribute to greater inflation in the short term. Powell also pointed out that the war has impacted the palladium, corn, wheat, and neon markets. Russia and Ukraine contribute over 25 percent of global wheat exports, and with exports limited from the war-engulfed region, food prices are likely to jump as well. Further inflation in the commodities markets will hurt Americans’ pocketbooks, but the Fed still anticipates reining in a growing economy throughout the year.

Rates are Rising…

Powell outlined a sizable agenda for the Fed. The headline grabber was Powell’s effective endorsement of a 25 basis point interest rate hike. HFSC Ranking Member Patrick McHenry asked Powell directly what his views were after noting almost every member of the FOMC had made their views clear for the March FOMC meeting. Powell’s announcement doesn’t come as a shock to the markets which have already priced in a 25 basis point increase, but it did completely rule out the prospects of a 50 basis point hike, a move priced in by some investors.

Cryptocurrency and the prospects for a Central Bank Digital Currency (CBDC) were also large parts of the hearings. Multiple members inquired about the volatility of cryptocurrencies and progress on the Fed’s development of a CBDC. While Powell continued to assert the Fed needs Congressional authorization to develop a CBDC following the Fed’s request for comment on the matter as per a January report, members such as Rep. Stephen Lynch expressed a desire for more instruction from the Fed. Powell responded that this will have to be a joint venture over the next few years to develop the best possible CBDC — if Congress and the Fed decide to pursue one.

Various risk concerns were brought up by both sides of the aisle. Rep. Chuy García proposed a moratorium on bank mergers until the bank regulators updated their bank merger guidelines, a suggestion that Powell seemingly bristled against as he stated the Fed already has the tools to address mergers as they come. Powell also responded to multiple questions about cyber security in the wake of Russian aggression saying the Federal Reserve System was on high alert for cyberattacks. Powell also reassured the committees that there is enough liquidity in the United States’ financial system to withstand a shock from the Russo-Ukrainian War.

… yet Fed Remains Unfilled

While the hearings were largely routine, the shadow of the unfilled Fed Board loomed large. This was the first time a Chair Pro Tempore of the Fed had testified before Congress at the Humphrey-Hawkins Hearings due to the Senate Banking Republicans’ blockade of the entire slate of Federal Reserve nominees. Powell refused to interject himself into the middle of the politics of confirmations, but with the uncertainty created by the Ukraine-Russia conflict on top of the already perilous tightrope of inflation and the pandemic recovery, the lack of a formal Fed Chair, let alone full Board, needs to be addressed.

Powell has been serving as the Chair Pro Tempore since his formal title expired on February 5. Nearly a month later, Powell has not received a vote out of the Banking Committee as Republicans hold his confirmation, along with the rest of the slate’s, hostage in an effort to sink the nominee for the Vice Chair of Supervision position, Sarah Bloom Raskin.

While the Fed is technically capable of operating without a formal Chair or a full Board, the lack of both undermines the Fed’s efficacy and public trust. Powell laid out timelines for multiple projects led by the Fed, but those may be altered so long as the Board remains unfilled. It will be difficult for the Fed to make significant reforms to the Community Reinvestment Act or properly develop recommendations for a CBDC. Without the Vice Chair for Supervision, regulatory policy from the Fed will slow to a crawl, a victory for regulation skeptics but a loss for those concerned about the systemic risks facing the financial sector. The Board needs the knowledge and wisdom of the nominees — especially Raskin.

Agenda Ahead

Powell’s testimonies laid out a broad agenda for the Fed over the next year. There are numerous issues to address from inflation to digital assets to systemic risk, but Congress must allow the Fed to pursue its agenda. The Senate Banking Committee should reconvene to vote through the Fed nominees, whether that means one Republican ending the blockade or addressing this incorrect interpretation of the organizing rules of the Senate. Either way, the Fed Board needs to be filled or there will be greater uncertainty injected into the economy, a risk we cannot afford.