Update 634: CPI Moves Sideways

The Good News in Inflation Picture

Looking at news headlines about and the markets’ response to yesterday’s Consumer Price Index Report for August, you might think inflation is skyrocketing unabated. That might sell, but under the hood are a vertical drop in consumer gas prices, a drop in producer prices, and investors expectations of a soft landing… just not quite yet.

Meanwhile, the macroeconomy is showing remarkable resilience in the face not just of inflation but of the Fed’s full-throttle monetary policy to combat it. Much more of the credit for the robust recovery should go to Congress. Without the ARP, BIF, and IRA, we could be in recession with dire midterm prospects for Democrats.

In this update, we break down the CPI report with a focus on what the report means for the Federal Reserve’s policy and midterms.

Best,

Dana

–––––––––––

Inflation picked up in August with the Consumer Price Index report showing a 0.1 percent increase month-over-month in prices, above the expected 0.1 percent decrease in prices, while the August Producer Price Index fell by 0.1 percent over the month. A dramatic fall in gas prices continues, offsetting some of the pain for Democrats, as gas prices are the most salient for voters forming their inflation expectations and sentiments about the economy.

The daily fall in national gas prices continued from July, giving President Biden and Democrats hope that this could bolster the odds of returning the Democratic trifecta to power in the November midterm elections. The Federal Reserve, seeing increases in food costs and rents and watching for impending labor strikes (which we will cover Friday), will be less happy with the news.

The central bank seeks evidence of broader inflation reduction before easing up on its aggressive interest rate policy path. The hot report will lock in a 75-basis point interest rate hike at next week’s FOMC meeting – the last meeting until the week before the midterms. Some market analysts are even predicting a 100 basis point rate hike. The aggressive policy path could revive concerns of triggering a recession.

Fed Watching for Cooling

Despite only coming in at 0.1 percent, month-over-month inflation ran hot above the expected 0.1 percent decrease in prices with shelter, food, and medical care contributing the most to the index, reflecting broad price increases across the economy. In fact, inflation numbers were worse when taking out food and energy: core CPI clocked in at 0.6 percent month-over-month, distressingly higher than the 0.3 percent forecast.

The shelter index is seemingly reluctant to fall with a 0.7 percent increase over August despite the Federal Reserve’s aggressive interest rate hikes dampening the industry, reflected in other housing market indicators. Data on housing prices tends to lag market developments which is why the shelter index is continuing to climb despite robust efforts from the Fed.

Even though the central bank has aggressively increased interest rates since March, core CPI accelerating means the Fed’s tools are thus far having only a limited impact. The same is true for the labor market: the Fed’s policy has only marginally dampened the labor market which still produced another 300,000+ jobs report in August. But the hotter-than-expected report will push the Fed to continue its harsh medicine for inflation through sizable interest rate hikes which could spark an economic crisis.

Down to $3/Gallon by the Midterms?

Falling gas prices prevented the headline inflation read from coming in too high. Mostly offsetting other broad price gains, the gasoline index fell by 10.6 percent through August, continuing last month’s 7.7 percent decrease. And fuel oil also fell by 5.9 percent over the month, continuing its downward trend since June.

The August CPI report coincided with a 90-day streak of falling gas prices, the longest declination streak since 2015. At its peak, the national average for regular gas clocked in at $5.02 per gallon. Since that peak in mid-June, the average has fallen to $3.71 per gallon, a 26 percent decline in three months. Gas prices have fallen due to a mixture of some recession concerns, the President’s Strategic Petroleum Reserve policy, declining demand from China, and the alleviation of refinery capacity shortages.

But declining gas prices hide steady increases in other energy prices. Energy prices overall fell by 5 percent month-over-month due to the gas and oil drops, but other energy services somewhat offset those decreases. Electricity prices rose by 1.5 percent in August, and natural gas utility prices rose by 3.5 percent after a 3.6 percent fall in July. Driven by global events, such as the war in Ukraine, and substitution effects, electricity and natural gas inflation may remain elevated for quite some time. Additional energy capacity through the construction and deployment of green energy could offset this trend in the long run, but consumers need help now.

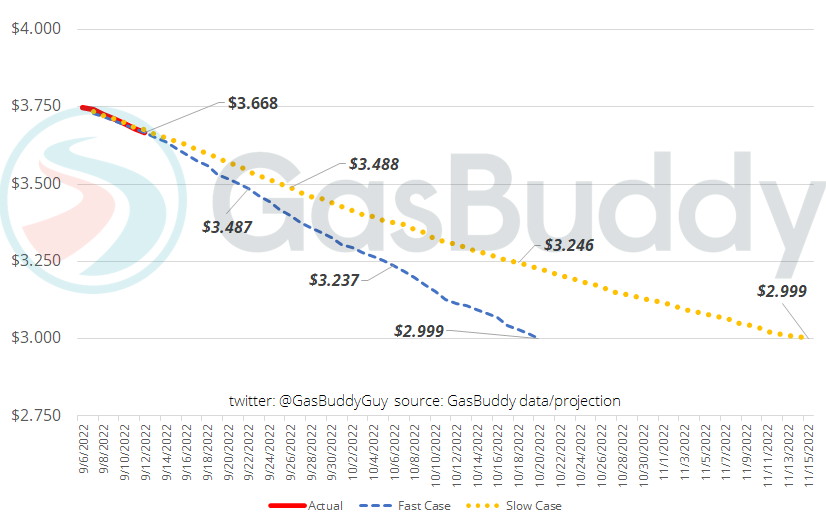

Continuously falling prices are not a given; global events or market changes could alter the trajectory of prices. Barring those disruptions, gas could hit a national average of $3 per gallon by mid-to-late October or early November, a milestone of relief for consumers right as they lock in their decisions for the November midterm elections.

National Average Price of Gasoline, Projected ($/gal)

Source: Patrick De Haan (@GasBuddyGuy)

Impending Fed Hike

Even before the August CPI report dropped, the Federal Reserve was leaning toward a 75 basis point interest rate hike at next week’s FOMC meeting, but broad inflation and accelerating core CPI guarantees that decision, if not an even larger rate hike. This will be the last rate hike the Fed makes that will be fully digested before the midterms.

While recession fears have been tamped down over the last few weeks, the hot inflation report paired with another aggressive interest rate hike could very well revive those fears. The hotter-than-expected report could even push the Fed to raise interest rates by 100 basis points, a move that would raise the risk of a Fed-induced recession in the next 12 to 18 months.

Next month’s CPI report will be the last one before the November elections and may be the last chance for the central bank to convince the public it is on track to bring down inflation. The response from voters does not change the Fed’s trajectory, but it could complicate the relationship between the central bank and federal policymakers if a much more hawkish Congress is sworn in next year. A Republican Congress would likely not do much to avoid or mitigate a recession in hopes of claiming the White House in 2024.

Midterms Closing In

With Fed action and recession fears still looming, crafting an economic message for the midterms is still a difficult task ahead for Democrats. The average household budget feels the persistent strain of inflation, despite lower prices of gas. But consumer expectations temper the challenge.

While the overall picture on inflation may not be the good news Democrats were hoping for two months out from the midterms, there are auspicious aspects. Falling gas prices will improve voter confidence in the economy as they are one of the most salient indicators of inflation for consumers. It will nevertheless be critical for candidates to listen to voters’ concerns about the economy and continue their focus on cutting costs and investing in the economy.

Democrats passed the Inflation Reduction Act just last month, which will need time to work. Meanwhile, they should continue a cost-cutting focus and sing the praises of the recovery they enabled. Inflation will be the Republicans’ spear-top this fall regardless of the facts and the consumer experience at the pump. Democrats can flip the script, address the issue, and demonstrate that they are the party that invests in the economy by producing jobs and steering the country clear of recession.