Update 631 — Overhaul Talks Over for Now,

What’s Next on Democrats’ Tax Agenda?

When Congress passed and President Biden signed the Inflation Reduction Act into law, numerous tax provisions were included — increased funding for the IRS, a 15 percent corporate minimum tax, a 1 percent excise tax on stock buybacks — but they did not amount to comprehensive tax reform.

Democrats in Congress narrowed their tax agenda to ensure the passage of IRA and other important spending bills but important priorities are still on the table. In this update we discuss three popular tax priorities we commend as responsible, equitable policy and a winning midterm message: the Child Tax Credit, a Billionaire Minimum Income Tax, and closing the carried interest loophole.

Best,

Dana

———————————————————

Permanently Expand the Child Tax Credit

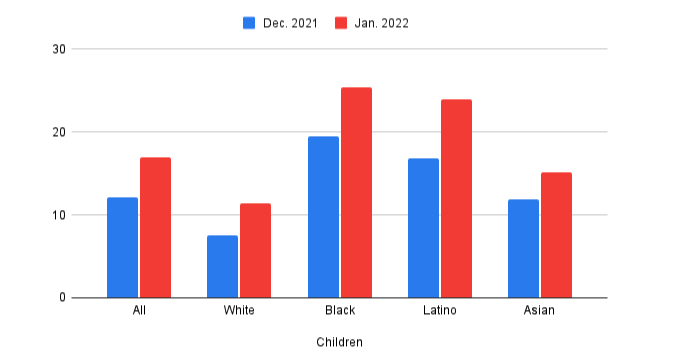

When the Child Tax Credit expansion from the American Rescue Plan expired at the end of 2021, an important pandemic-era lifeline for millions of families disappeared. The expansion temporarily raised the maximum credit from $2,000 per child to $3,000 per child for children ages six to seventeen and $3,600 per child for children under six, made the credit fully refundable, and paid the credit out in monthly installments rather than one annual lump sum. The expansion helped cut child poverty in the U.S. by nearly 30 percent until payments halted in December 2021. Within a month, 3.7 million more children were living in poverty.

Child Poverty Rate (%) Before/After Expiration of CTC Expansion

Source: Columbia University Center on Poverty and Social Policy

Restoring monthly CTC payments would help reduce child poverty and improve family well-being. After the first payments arrived in July 2021, food insufficiency and financial hardship dropped in households with children. The most common way families planned to spend their monthly CTC payments were on necessities like bills, food and groceries, and rent or mortgage payments. Three in ten families that received CTC payments used them to pay for school expenses, and one in four families with young children used the money to cover child care costs.

The CTC achieves these goals without meaningfully reducing incentives to work. A National Academy of Sciences report estimated that after the implementation of a $3,000-per-child allowance, nearly all employed people in low- and moderate-income families with children would continue to work and 82 percent would not reduce their work hours. Those who reduced their hours would be expected to do so at an average of only about one hour per week. Lawmakers therefore should not believe assertions that the tax credit will cause parents to quit working, making burdensome work requirements superfluous.

The next opportunity to pass an expanded Child Tax Credit will likely come this Congress as part of negotiations over year-end tax extenders. There has been bipartisan interest in a permanent CTC expansion, including a proposal from Senator Mitt Romney. While the Romney proposal would increase the maximum per child benefit and create a faster phase-in, it would also require both parents and children to have social security numbers to qualify, an even harsher requirement than current law.

The Romney plan would pay for expanded benefits by cutting the EITC and eliminating the head of household designation. Consequently, the Romney proposal would lift an estimated 1.3 million children out of poverty while leaving 10 million children in families with incomes under $50,000 worse off. By contrast, simply making the CTC fully refundable, allowing taxpayers to receive a credit in excess of their tax liability, would lift 1.7 million children out of poverty without cutting other benefits. As they negotiate a compromise, Congress should include a fully refundable CTC with monthly payments, which is overwhelmingly popular: a May poll found that voters favor the expanded Child Tax Credit from the American Rescue Plan 72-21 percent, an added bonus for Democrats in a tough cycle.

Pass a Billionaire Minimum Tax

The 400 wealthiest families in America pay an estimated average tax rate of only 8.2 percent, far lower than the rate ordinary Americans are required to pay. This is largely due to the ultra-wealthy deriving very little of their income from work. Instead, they are able to borrow against their unrealized capital gains, allowing them to avoid capital gains taxes indefinitely. When the wealthy borrower dies, they are able to pass their assets down to their heirs at a stepped-up basis, effectively wiping the slate clean on their gains and allowing the heir to repeat the process.

The Billionaire’s Minimum Income Tax Act, introduced last month by Congressmen Steve Cohen and Don Beyer, would address this disparity by requiring households with a net worth greater than $100 million to pay an annual 20 percent minimum tax on their full income, including unrealized capital gains. Tax payments made on unrealized capital gains would serve as a type of prepayment on future capital gains tax liability, which would prevent the ultra-wealthy from putting off paying taxes on that income indefinitely.

Treasury estimates that President Biden’s wealth tax proposal, after which the bill is modeled, would raise over $360 billion in revenue over ten years. This money could help pay for a number of progressive priorities that would help low- and middle-income households, including a permanent expansion of the Child Tax Credit or expanding access to healthcare and childcare.

A recent poll found that voters overwhelmingly supported a Billionaire Minimum Income Tax in the style of the Biden administration’s proposal by a margin of 72 to 16 percent. And this support is not limited to Democrats – 63 percent of Republicans surveyed supported the tax. It is time for Congress to act on this broad public support and pass legislation to ensure that the wealthiest Americans pay what they owe.

“Do you support or oppose: A Billionaire Minimum Income Tax, which would require American households worth more than $100 million to pay at least 20% of their annual income in taxes?” (%)

Source: RealClear Politics

Close the Carried Interest Loophole

A previous version of the IRA included a provision which would have narrowed – but not closed – the carried interest “loophole”, which allows hedge fund and private equity managers to pay the preferential capital gains tax rate on their earnings. But this provision was stripped out in exchange for Senator Kyrsten Sinema’s support for the larger bill. Despite the fact that no legislative action was ultimately taken, the incident did stoke renewed public interest in carried interest. Even GOP heavyweights from Donald Trump to Jeb Bush have called for its repeal. Democrats should eliminate carried interest once and for all before the GOP does.

Supporters of carried interest say that the tax break is necessary to encourage investment. But hedge fund managers needn’t invest a penny of their own money into the fund to receive the preferential tax rate. Workers in other professions, like teachers, do not receive preferential tax rates for their labor, and unlike hedge fund managers, there is a massive shortage of teachers in this country.

The Path Ahead

Enacting these three policies seems borderline impossible this Congress. There’s the narrowest of windows for Democrats to keep control of the House in November. This scenario would pave the way for Congress to take up carried interest and the Billionaire Minimum Income Tax next year— if Democrats also manage to extend their majority in the Senate and can bypass opposition from Senators like Sinema and Manchin. Regarding a spending package from earlier this Congress, progressive leader Rep. Mark Pocan observed “Trying to tie something as big as tax reform to this [bill] would just bog down the process and not get the funding out to the economy as quickly;” this still applies.

Some members may have concerns about tax reform debates bogging down a future reconciliation bill, as some did during the debates over BBB and the IRA, but these concerns should not outweigh the benefits of passing meaningful tax reform if the political math is in place. Even if Democrats fail to hang onto their majorities following the midterm elections, though, they should nevertheless continue to fight for reform. Building a more equitable system will be a long-term endeavor, not limited to the policies outlined above. Voters are waiting for Congress to step up to support average Americans and make sure that the wealthy pay their fair share.