Update 695 — Student Debt Cancellation

Will Congress, SCOTUS Cancel Program?

The ongoing Congressional leadership negotiations on the debt limit have vacillated between breakthrough and breakdown this week, without material signs of overall progress. The June 1 X-date is now a week and one day away, and markets are beginning to reflect the deepening anxiety. Corporate bonds of blue chip companies are trading at a yield discount to comparable Treasuries, as investors see Johnson & Johnson as less likely to default now than the U.S. government.

Few events and developments rival the debt limit negotiations for attention on the Hill, but today, the House Education Committee will attempt to eliminate President Biden’s student debt cancellation program. And with a Supreme Court ruling expected by the end of June on the program, the issue will inform commencement ceremonies this year.

Below, we break down how we got here, what we expect to happen, and what — if anything — Democrats can do about the $1.8 trillion student debt overhang.

Best,

Dana

————————————————

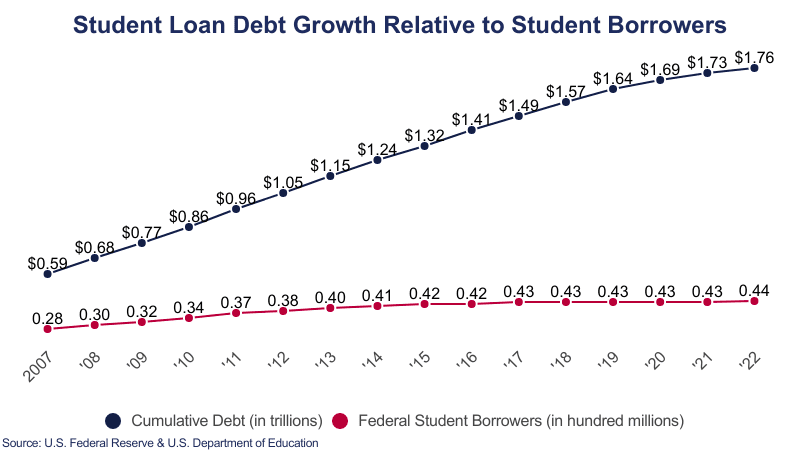

Millions of student borrowers are anxiously awaiting the Supreme Court’s decision in Biden v. Nebraska, a case which will determine the fate of President Biden’s student debt forgiveness plan. During his 2020 campaign, Biden pledged to provide relief to borrowers, recognizing the need to reduce the nation’s nearly $1.8 trillion student debt burden. President Biden and the newly Democratic Congress could not initially agree on how the debt should be canceled. At the time, experts said that a unilateral executive order cancelling student debt would lead to court challenges.

In August 2022, the president decided it was worth the risk. Biden announced that the Department of Education would “provide up to $20,000 in debt cancellation to Pell Grant recipients… and up to $10,000 in debt cancellation to non-Pell Grant recipients.” Borrowers were only eligible for relief if their individual income was under $125,000 (or $250,000 for married couples).

About a month later, the administration was sued by six states over what they said was a violation of the Administrative Procedure Act and the separation of powers. The case, Biden v. Nebraska, was heard by the Supreme Court in February.

Source: The Education Data Initiative

On What Grounds Did Biden Cancel Student Debt?

President Biden relied on a Bush-era law originally intended to provide student debt relief to those affected by the September 11 attacks. The HEROES Act authorized the secretary of Education to grant waivers to financial aid recipients “in connection with a war or other military operation or national emergency.” The law was made permanent in 2007, and in October 2021, the Biden Administration decided that the COVID-19 pandemic qualified as such a national emergency. The White House cited the crisis in its fact sheet, saying, “the Biden Administration is… providing families breathing room as they prepare to start re-paying loans after the economic crisis brought on by the pandemic.”

On What Basis Are The Six States Suing?

The six states suing the Biden Administration – Nebraska, Arkansas, Iowa, Kansas, Missouri, and South Carolina – argued that the HEROES Act “requires a real connection to a national emergency,” and “the department’s reliance on the COVID-19 pandemic is a pretext to mask the president’s true goal of fulfilling his campaign promise to erase student-loan debt.” They also argued that the action would hurt state revenues, as taxes would not be collected on discharged loans. The case specifically mentions Missouri’s Higher Education Loan Authority, MOHELA, which the state contends “is suffering from several ongoing financial harms because of the [federal Education] Department’s student debt relief plan.” According to Missouri, the federal government has deprived MOHELA of an asset, harming its ability to issue bonds and access debt markets. The Roosevelt Institute argues that MOHELA’s direct loan revenue will actually be larger after Biden’s proposal is enacted than prior.

At today’s hearing of the House Education and Workforce Committee Subcommittee on Higher Education and Workforce Development, Republicans appeared to agree with the plaintiffs. Subcommittee chair Burgess Owens (R-UT) referred to President Biden’s executive order as “illegal” and a “scheme” and argued that Congress has not authorized the actions.

What Is the Court Likely to Do?

The Supreme Court must first determine whether those six states have standing to sue. When the case was brought before the U.S. District Court for the Eastern District of Missouri, the judge decided that the states did not have standing, but the Court of Appeals for the Eighth Circuit disagreed. Thus far, only one judge has ruled on the merits of the debt relief plan, saying the plan was unconstitutional because the HEROES Act did not mention loan forgiveness specifically.

The conservative-leaning Supreme Court expressed skepticism toward the administration’s arguments; Chief Justice John Roberts said, “If you’re going to affect the obligations of that many Americans on a subject that’s of great controversy, [one] would think that’s something for Congress to act on.” The court’s liberal justices – outnumbered three-to-six – retorted that Congress had already acted by passing the HEROES Act. In their decision, justices may apply the so-called “major questions doctrine,” a growing conservative legal philosophy which applies a stricter standard when assessing congressional authorization for executive branch actions.

Implications of the Court’s Decision

If the court strikes down the executive order, borrowers would be on the hook for their full debts again. Exactly when borrowers would need to begin payments again depends on the timing of the court’s decision. If the court strikes down the president’s order before June 30 – when the Education Department is likely to end a pause on payments – borrowers will need to restart payments 60 days after the ruling. If the court does not decide before the end of the pause, payments will restart 60 days after June 30.

What is Congress Considering?

The extent of the student debt crisis could move Congress to legislate should the Biden Administration lose the case. In March, 126 members of Congress sent a letter to President Biden affirming their continued support for the executive order and said the move “falls squarely within the Administration’s authority.” Hopefully, the letter indicates that Democrats will continue to support debt cancellation in the future. Rep. Suzanne Bonamici (D-OR) also introduced the Student Loan Borrower Safety Net Act, which would require the Education Department to contact borrowers at least six times after the pause ends to inform about future payments and borrowers’ eligibility to enroll in an income-driven repayment plan.

On the Republican side, the House’s recently-passed proposal to raise the debt ceiling with numerous extreme spending cuts attached includes provisions that would undo the administration’s actions to relieve student debt. Speaker Kevin McCarthy (R-CA) argued that the bill would prohibit President Biden’s “student loan giveaway for the wealthy.” (Per the White House, 90 percent of relief dollars will go to those earning less than $75,000 per year.) The bill would also lift the pause on student loan payments that has been in place for years and block the Education Department from crafting new student loan repayment plans. Separately, Sen. Joni Ernst (R-IA) and Rep. Randy Feenstra (R-IA) introduced the STUDENT Act, a bill that would only provide students with more information before taking out loans.

The finances of millions of Americans, the broader economy, and the president’s authority under the law all hang in the balance of the Supreme Court’s decision on Biden v. Nebraska. According to the Education Data Initiative, 93.1 percent of all student loan debt in the U.S. is federally-held, representing the debt of about 48 million borrowers. The average federal student loan debt balance is $37,338, and about a quarter of borrowers hold under $10,000 in debt. As Sen. Elizabeth Warren (D-MA) has noted, canceling debt would provide “a massive consumer-driven stimulus to our economy,” and it has been shown that higher student debt reduces entrepreneurship, reduces homeownership, and increases reliance on social programs.