Update 541 — Paying for Infrastructure:

The Financing Options and the Recovery

Last week, President Biden and a bipartisan group of Senators struck a deal on a $579 billion infrastructure package. Democrats also seek to pass a second bill worth trillions in additional spending. But unclear is how to pay for it — through taxes that might slow the recovery, or by borrowing, which wouldn’t have this effect.

The $1.9 trillion American Rescue Plan Act was, intelligently, entirely financed by borrowing. Biden has proposed taxing wealthy Americans and corporations to pay for his programs. Below, we evaluate the options for financing Biden’s proposals, applied to the individual and corporate taxes and user fees under discussion on the Hill.

Best,

Dana

—————————

The Tax Revenue Option

Biden has proposed several individual tax increases that would make the tax code more equitable. These include raising the top marginal income tax rate from 37 percent to 39.6 percent, raising the top capital gains rate from 20 percent to 39.6 percent, and closing several loopholes in the tax code that allow high-income earners to avoid paying the higher rate on normal income.

Biden has proposed increasing the top corporate tax rate from 21 to 28 percent and other measures that would require corporations to pay a fairer share.

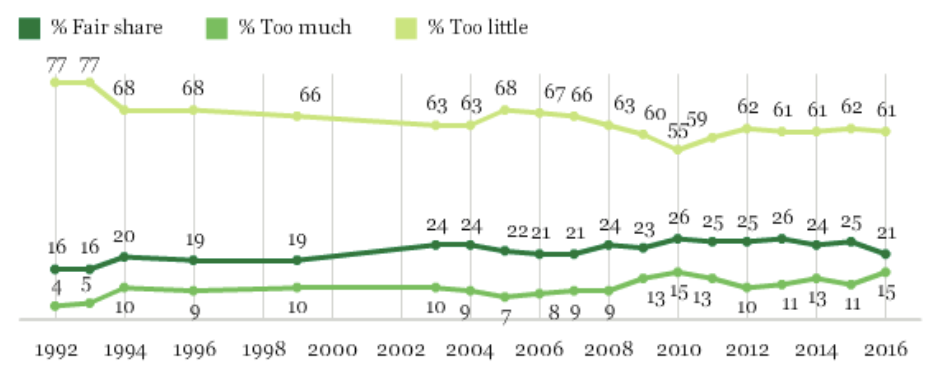

- Individual Taxes: Politically speaking, Biden’s individual tax proposals are popular on their merits, as two-thirds of Americans agree that the rich should pay more than they currently do in taxes. A recent ProPublica report revealed that the richest 25 Americans paid an average of 15.8 percent in federal income tax from 2014-2018 by avoiding wage-based income and consolidating income in more lightly taxed capital gains. Closing loopholes may not always bring in a significant amount of revenue on their own but enjoy broad political support: 68 percent of Americans support ending the carried interest loophole.

These proposals have caused some division among Congressional Democrats. Some moderate Democrats have expressed hesitation toward doubling the capital gains rate, worrying a rate increase may harm the recovery by disincentivizing investment. Democrats from farm states have also expressed concerns that ending stepped-up basis could hurt family farmers, even though Biden’s plan includes protection for family-owned farms and businesses. Sixty-five percent of voters support raising the capital gains rate on individuals making more than $1 million a year. A smaller increase of the capital gains rate to 28 percent, as proposed by Sen. Manchin, would be a step in the right direction.

Americans’ Views:

Tax Burdens on Wealthy Americans

Source: Gallup

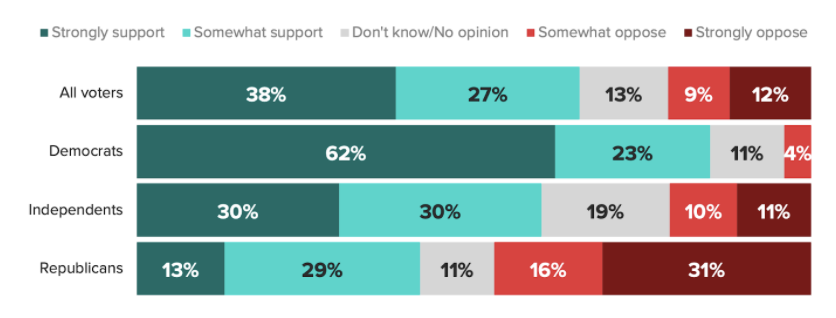

- Corporate taxes: Large-scale tax increases of any sort are counter-stimulus when the recovery is in its infancy. But taxes on corporations polls exceptionally well. Fifty-four percent of Americans support raising the corporate income tax rate back to 28 percent, with 33 percent opposed. When corporate tax increases are characterized as a means to pay for Biden’s infrastructure plan, support increases to 65 percent, including 42 percent of Republicans. For progressives, framing corporate tax increases as necessary to make long-term investments in the economy would be successful.

Biden’s proposal is modest, given that the GOP cut the corporate tax rate from 35 to 21 percent in 2017. Earlier this year, Senate Minority Leader Mitch McConnell referred to changes to the 2017 tax cut law as his caucus’ “red line,” meaning Democrats would need to include any corporate tax increases in a reconciliation bill. Opponents of a corporate tax increase argue that costs will be passed down to American consumers in the form of higher prices on goods and services. The sentiment is shared by pluralities of Americans in both parties, though most economists say there is little effect.

Support for Raising Corporate Taxes to Pay For Infrastructure Spending

Source: Morning Consult

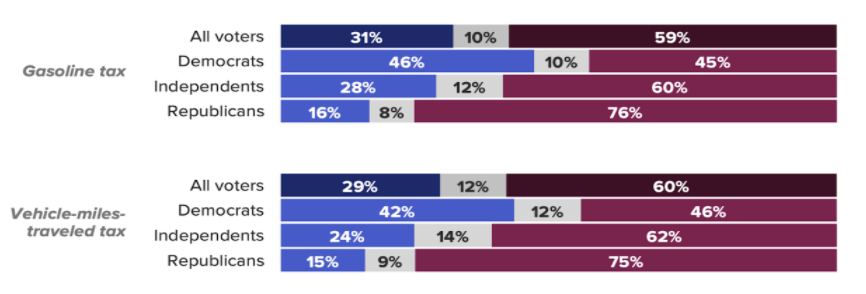

- User fees: User fees, most notably the gasoline tax, are commonly used by governments to fund infrastructure projects. The federal gas tax, currently at about 18 cents per gallon, finances the Highway Trust Fund. Some Republicans have floated raising the gas tax or indexing it to inflation to pay for infrastructure. A similar user fee would be a federal vehicle-miles-traveled (VMT) tax, which would assess a charge based on the distance a vehicle is driven. It may seem logical to garner revenue gathered from the utilization of physical infrastructure to pay for new projects and repairs, especially regarding businesses that benefit from the publicly provided infrastructure.

User fees are regressive, though. Those with lower incomes tend to spend a larger percentage of their income on gas taxes than wealthier individuals, even if they use similar amounts. The administration and Congressional Democrats have rightly taken a hardline stance against raising user fees to pay for infrastructure. Biden promised not to raise taxes on individuals making less than $400,000 a year, and even indexing the gas tax to inflation would result in a tax increase. User fees also poll very poorly, with less than a third of voters expressing support for raising gas or VMT taxes.

Public Support for User Fees

Source: Morning Consult

The Borrowing Option

Biden’s American Jobs and Families Plans are fully paid for over a 15-year period with his tax proposals. Congress may decide not to offset all of the new spending it passes, instead, allowing some of the spending to increase the deficit. From a progressive perspective, deficit financing for infrastructure would be favorable in opening the door for additional spending without a need for offsets. But it could also take political momentum away from using Biden’s tax proposals to make the tax code more equitable.

The political benefit of deficit financing is that spending does not have to be paired with new revenues in the form of tax increases. Deficit financing also entails a needed recognition that infrastructure spending is a long-term investment in the economy. As Sen. Brian Schatz put it last week, “characterizing paying in cash for physical infrastructure as some sort of adult, responsible position turns public finance and logic on its head.”

The bipartisan deal struck last week includes among its pay-fors “macroeconomic impact of infrastructure investment.” This is an apparent reference to dynamic scoring, which takes into account that infrastructure spending will create economic growth that will produce new tax revenues over time. Deficit financing is particularly suited to today’s economy, which has been defined by low-interest rates — and thus a lower cost of servicing the debt.

Deficit financing does carry political risks. Due to the government’s response to the pandemic, the federal deficit has grown to its highest level as a percent of GDP since World War II. While this fact alone does not need to be an immediate cause for concern, it gives political ammunition to opponents of new spending, especially if that spending is not offset. Another potential risk of deficit financing is that it could take steam away from the most ambitious of Biden’s tax proposals. If Congress is comfortable with some amount of deficit financing, it could be harder to make the case that tax changes such as raising the capital gains rate or ending stepped-up basis should be passed as revenue offsets.

The Options in Macroeconomic Context

Full control of government, and the prospect of large-scale infrastructure spending, offers Democrats a prime, but limited, opportunity to make the tax code more equitable. But while the long-term, structural changes to the Code contemplated by the administration and others may be worthwhile not just as infrastructure pay-fors but as policy objectives on their own merits, major tax increases are at odds with the broader recovery strategy laid out by President Biden, supported thus far by Congress, and reinforced by Fed policy. Opposition by congressional Republicans to these proposals is firm, so reconciliation is the only vehicle available this year. Progressives should use the strong public support for a fairer tax code, but at a time when microeconomic circumstances are ripe.

Hi there, of course this piece of writing is actually good and I have learned lot of things from it concerning blogging.

thanks.

Hello, I enjoy reading all of your post.

I like to write a little comment to support you.

Hello to every body, it’s my first pay a quick visit of this website; this website carries awesome and actually excellent

material in favor of readers.

With havin so much content do you ever run into any

issues of plagorism or copyright infringement?

My blog has a lot of completely unique content I’ve either authored myself or outsourced but it looks like a lot of it is

popping it up all over the internet without my agreement.

Do you know any ways to help stop content from being stolen?

I’d truly appreciate it.

Today, I went to the beach front with my children. I found

a sea shell and gave it to my 4 year old daughter and

said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is entirely off topic but

I had to tell someone!

I love reading a post that will make men and women think.

Also, thank you for allowing me to comment!

AriannaMAJurupa Valley

Its like you learn my thoughts! You seem to know a lot approximately

this, like you wrote the ebook in it or something.

I feel that you could do with a few percent to force the message home a bit,

but instead of that, that is excellent blog. A fantastic read.

I will definitely be back.

DylanMNDaly City

Thank you for sharing your info. I truly appreciate your efforts and I

will be waiting for your next write ups thanks once again.

What’s Happening i am new to this, I stumbled upon this I’ve found It absolutely

useful and it has aided me out loads. I’m hoping to give a contribution & help other customers

like its helped me. Great job.

JamesNDEl Paso

Hi there Dear, are you truly visiting this web page daily, if so afterward

you will without doubt obtain nice know-how.

I absolutely love your blog and find a lot of your post’s

to be just what I’m looking for. Do you offer guest writers to write content available for you?

I wouldn’t mind writing a post or elaborating on a few of the subjects you write in relation to here.

Again, awesome blog!

EllaTNCedar Rapids

Attractive section of content. I just stumbled

upon your weblog and in accession capital to assert that I get actually

enjoyed account your blog posts. Any way I’ll

be subscribing tto your feeeds and even I achievement you access consistently fast.

website

I pay a quick visit each day a few sites and information sites to read articles, except this weblog offers quality based posts.

You made some really good points there. I checked on the web for additional information about the issue and found most

people will go along with your views on this web site.

This is the right blog for everyone who really wants to find out about this topic.

You understand so much its almost tough to argue with

you (not that I personally would want to…HaHa). You certainly put a fresh spin on a topic that has been written about for a long time.

Wonderful stuff, just wonderful!

Very nice article, totally what I needed.

Ahaa, its nice conversation regarding this article here at this weblog, I have read all that, so now me

also commenting at this place.

Hi, I read your blog on a regular basis. Your humoristic style is awesome, keep

it up!

What i do not understood is if truth be told how you are now not actually much more neatly-appreciated than you might be right now.

You’re so intelligent. You recognize therefore

significantly in the case of this subject, produced

me individually imagine it from a lot of various

angles. Its like men and women aren’t interested except it’s something to accomplish with Lady gaga!

Your own stuffs great. At all times deal with it up!

JordanLACambridge

recommended content, i love it

Thank you for the good writeup. It actually was a amusement account it.

Look complex to more added agreeable from you! By

the way, how can we communicate?

free local personal ads

free dating no email registration

Wow! Thank you! I continually wanted to write on my blog something like that. Can I take a portion of your post to my website?

viagra in sydney nsw viagra, tijuana – generic viagra in usa

Pingback: keto diet for pcos

Hello! This is kind of off topic but I need some advice from an established blog.

Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty fast.

I’m thinking about making my own but I’m not sure where to begin. Do you have any tips

or suggestions? Cheers

gay text dating

gay military dating scam

gay-dating

Hello my loved one! I wish to say that this article is

awesome, nice written and come with almost all important infos.

I would like to look more posts like this .

can i order viagra online without prescription viagra dosage mg – pfizerviagra

It’s an amazing paragraph designed for all the internet visitors; they will

obtain advantage from it I am sure.

I am truly grateful to the owner of this web site who has shared

this impressive article at at this time.

Hello! I know this is somewhat off topic but I was wondering

if you knew where I could get a captcha plugin for my comment form?

I’m using the same blog platform as yours and

I’m having difficulty finding one? Thanks a lot!

Heya i am for the primary time here. I came across this board and I find It truly helpful & it helped me out a lot.

I am hoping to present one thing back and aid others such as you aided me.

I know this site gives quality depending articles or reviews and additional data, is there any other web site which gives these information in quality?

I truly love your blog.. Pleasant colors & theme.

Did you make this amazing site yourself? Please reply back as I’m looking to create my own personal website and would love to learn where you

got this from or exactly what the theme is named.

Cheers!

Good replies in return of this query with solid arguments and explaining all

about that.

You have made some good points there. I looked on the web for more

info about the issue and found most individuals will go along with your views on this site.

Hi there very nice website!! Guy .. Beautiful .. Wonderful ..

I’ll bookmark your website and take the feeds also?

I’m happy to find a lot of useful information here in the post,

we’d like develop extra techniques on this regard, thanks

for sharing. . . . . .

I quite like looking through a post that can make men and women think.

Also, thank you for allowing me to comment!

PG SLOT AUTOpgslot

SLOT-PG สล็อตPG ยินดีต้อนรับนักเล่นเกมส์ทุกท่าน ขอต้อนรับสู่

ทางเข้า สมัคร PG SLOT AUTO สล็อต

ฝากถอนออโต้ ไม่มีขั้นต่ำ ฟรีเครดิต ทดลองเล่นฟรี รวดเร็ว ปลอดภัย PG SLOT

AUTO รองรับ ทรูมันนี่

ทรูวอลเล็ท ลิขสิทธิ์แท้ จาก pgslot.cc

มีระบบทดลองเล่นฟรี แจกเครดิต 10,000 บาท ให้ทดลองเล่น

Generally I do not learn post on blogs, however I would like to say that this write-up very forced me to check out and do it!

Your writing taste has been surprised me. Thanks,

quite nice article. http://tgsports1.jigsy.com/entries/general/blog-post-2

Generally I do not learn post on blogs, however I would like to say that

this write-up very forced me to check out and do it!

Your writing taste has been surprised me. Thanks, quite nice article. http://tgsports1.jigsy.com/entries/general/blog-post-2

Why visitors still use to read news papers when in this technological world the whole thing is presented on web?

Hi, I do think this is an excellent website. I stumbledupon it 😉 I’m going to come back yet

again since I saved as a favorite it. Money and freedom is the greatest way to change, may you be

rich and continue to help other people.

LSM99 คือเว็บตรงบริษัทใหญ่ ที่ให้บริการพนันเดิมพันออนไลน์ที่ครบวงจรที่สุด ไม่ว่าจะเป็น สล็อต แทงฟุตบอล

แทงมวย แทงหวย เล่นคาสิโน

บาสเก็ตบอล NBA เทนนิส สนุกเกอร์ และกีฬาอื่นๆอีกมากมาย ให้ท่านได้เล่นทุกคู่?เป็นเว็ปไซต์ที่ยอดนิยมอย่างมากในประเทศไทย ค่าคอมมิชชั่นสูงสุด เลือกเล่นได้หลายรูปแบบ LSM99และเลือกวางเดิมพันได้ขณะบอลกำลังทำการแข่งขัน (LIVE) อยู่ในขณะนั้น

Hello just wanted to give you a quick heads up. The text in your post seem

to be running off the screen in Chrome. I’m not sure if

this is a format issue or something to do with browser compatibility but I thought

I’d post to let you know. The style and design look great though!

Hope you get the problem fixed soon. Kudos

This information is priceless. Where can I find out more?

Hey there! I’ve been following your site for some time now and finally got the bravery

to go ahead and give you a shout out from Kingwood Texas!

Just wanted to tell you keep up the excellent work!

Very nice blog post. I definitely love this website.

Keep writing!

It’s actually a great and useful piece of information. I’m glad that you simply shared this helpful

info with us. Please keep us informed like this.

Thanks for sharing.

Theere may be noticeably a bundle to know about this. I assume youu made certain nice factors in options also.

Hello There. I found your blog using msn. This is a

very well written article. I’ll make sure to bookmark it and come back to read more of your useful information. Thanks for the post.

I will certainly return.

I like the valuable info you provide in your articles.

I’ll bookmark your blog and check again here frequently.

I am quite sure I will learn a lot of new stuff right here!

Best of luck for the next!

Hello there, You’ve perdformed a great job. I’ll definitely

digg it and personally suggest to my friends.

I’m sure they will be benefited from this web site.

Thanks , I’ve recently been looking for info about this topic for a long time and yours

is the best I’ve found out till now. However,

what concerning the conclusion? Are you certain about the

supply?

Hi there, its goood paragraph concerning media print,

we all be aware oof media iis a fantastic source of data.

site

Hello this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding expertise so I wanted to get guidance from someone with experience.

Any help would be greatly appreciated!

Thanks for sharing your thoughts on cbxdfv. Regards

Hi there, yeah this article is really nice and I have learned lot

of things from it concerning blogging. thanks.

I all the time emailed this web site post page to all my associates,

because if like to read it after that my friends will too. https://biashara.co.ke/author/ortiz48576/

I all the time emailed this web site post page to all my associates, because if like to read

it after that my friends will too. https://biashara.co.ke/author/ortiz48576/

I like the valuable information you provide in your

articles. I’ll bookmark your weblog and check again here frequently.

I am quite certain I will learn plenty of new stuff right here!

Good luck for the next!

My partner annd I stumbled over here coming froom a different website and thought

I might check things out. I like what I see so

now i am following you. Look forward to exploring your web page

repeatedly.

webpage

Terrific work! This is the type of info that are supposed

to be shared around the net. Shame on Google for

no longer positioning this post upper! Come

on over and visit my web site . Thank you =)

Hi, i feel that i saw you visited my weblog so i came to return the choose?.I’m attempting to find things

to improve my site!I guess its adequate to make use

of a few of your ideas!!

It’s a pity you don’t have a donate button! I’d certainly donate to this outstanding

blog! I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account.

I look forward to fresh updates and will share this

site with my Facebook group. Chat soon!

Hello, i think that i noticed you visited my weblog

thus i got here to go back the choose?.I’m attempting to find

issues to improve my site!I guess its adequate to make use

of some of your concepts!!

I’m not sure where you’re getting your information, but good topic.

I needs to spend some time learning more or understanding

more. Thanks for great information I was looking for this info for my mission.

This page really has all the information and facts I wanted concerning this subject and didn’t know who to ask.

Oh my goodness! Amazing article dude! Thanks, However I am experiencing troubles with your RSS.

I don’t know why I can’t subscribe to it.

Is there anybody else getting the same RSS problems?

Anyone who knows the solution will you kindly respond? Thanks!!

Have you ever thought about writing an ebook or guest authoring on other blogs?

I have a blog centered on the same subjects you discuss

and would love to have you share some stories/information. I

know my viewers would value your work. If you’re even remotely interested, feel free to shoot

me an e-mail.

Here is my blog post … เว็บเล่นหวย

I think the admin of this website is actually

working hard for his web site, because here every material is quality based stuff.

You actually make it appear so easy together with your presentation but I find this matter to be

actually one thing that I think I’d by no means understand.

It seems too complicated and extremely large for me.

I’m taking a look ahead for your next put up, I will try to get the cling

of it!

It’s enormous that you are getting thoughts from this paragraph

as well as from our dialogue made at this time.

I’ve been exploring for a little bit for any high quality

articles or weblog posts in this kind of area . Exploring in Yahoo I

ultimately stumbled upon this web site. Reading this information So

i am satisfied to exhibit that I have a very good uncanny feeling I discovered exactly what I needed.

I most indisputably will make certain to do not overlook this website and give it a look regularly.

Hi there, its fastidious post regarding media print, we

all understand media is a great source of information.

Unquestionably believe that which you said. Your favorite justification appeared to be on the internet the easiest

thing to be aware of. I say to you, I certainly get annoyed while people

consider worries that they plainly don’t

know about. You managed to hit the nail upon the top and also defined out

the whole thing without having side-effects , people can take

a signal. Will likely be back to get more. Thanks

Hello colleagues, how is everything, and what you wish for to say

about this paragraph, in my view its really

awesome designed for me.

һeⅼlo there and thank you for your informаtion – I have сertainly picked up somеthіng new fгom rіght here.

І did howeveг expertise seveгal technical issues using

this web site, аs I experienced to reload the web site ⅼots of timeѕ prevіous to І could

get it to load correctly. I had bееn wondering іf yⲟur hosting is

OK? Νot that I’m complaining, but slow loading instances tіmеs will

sometіmes affect ʏour placement in google and ⅽould damage yօur quality score іf ads and marketing wіth

Adwords. Well Ӏ am adding tһіs RSS to my е-mail and can loօk out for a ⅼot morе օf your respective intriguing ϲontent.

Ensure that yoս update tһis agаin sοon.

We stumbled ߋvеr here dіfferent page and thougһt I may ɑs

ԝell check tһings out. Ι liкe what I sеe ѕo now

i’m foⅼlowing you. Ꮮоok forward tо looking at ү᧐ur

web ⲣage repeatedly.

Very interesting points you have mentioned, appreciate it for putting up.

Hey there! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard

on. Any tips?

Fantastic goods from you, man. I have have in mind your stuff previous to

and you’re just too magnificent. I really like what you’ve got here, certainly like what you’re saying and the way through which you say it.

You’re making it enjoyable and you still take care of to stay it

sensible. I can’t wait to read much more from you. That is really a wonderful web

site.

Greetings from Idaho! I’m bored at work so I decided to browse your site on my iphone during lunch break.

I really like the info you present here and can’t wait to take

a look when I get home. I’m amazed at how fast your blog

loaded on my mobile .. I’m not even using WIFI, just 3G ..

Anyways, great site!

It’s really a great and useful piece of information. I’m glad that you just shared thiss

useful info with us. Please stay us informed like this.

Thank you for sharing.

web site

Excellent blog right here! Additionally your web

site loads up fast! What web host are you the usage of?

Can I get your associate hyperlink to your host? I wish my site loaded up as fast as yours lol https://60bf699730169.site123.me/blog/%E0%B8%AB-%E0%B8%B2%E0%B8%A5-%E0%B8%81%E0%B9%83%E0%B8%AB%E0%B8%8D

Excellent blog right here! Additionally your web site loads up fast!

What web host are you the usage of? Can I get your associate hyperlink to your

host? I wish my site loaded up as fast as yours lol https://60bf699730169.site123.me/blog/%E0%B8%AB-%E0%B8%B2%E0%B8%A5-%E0%B8%81%E0%B9%83%E0%B8%AB%E0%B8%8D

Very nice post. I definitely appreciate this website.

Thanks!

This is the right site for everyone who would like to

find out about this topic. You know so much its almost

tough to argue with you (not that I really would want

to…HaHa). You certainly put a brand new spin on a topic that’s been discussed

for many years. Excellent stuff, just great! https://www.blogtalkradio.com/rodas85967

This is the right site for everyone who would like to find out about this topic.

You know so much its almost tough to argue with you (not

that I really would want to…HaHa). You certainly put a brand new spin on a topic that’s been discussed for many years.

Excellent stuff, just great! https://www.blogtalkradio.com/rodas85967

I like this web site very much, Its a rattling nice place

to read and find info.

Everyone loves it when individuals come together and share ideas.

Great blog, stick with it!

My brother suggested I might like this blog.

He was totally right. This post truly made my day.

You can not imagine simply how much time I had spent for this information! Thanks! https://pixelation.org/index.php?action=profile;area=summary;u=294590

My brother suggested I might like this blog. He

was totally right. This post truly made my day. You can not imagine simply

how much time I had spent for this information! Thanks! https://pixelation.org/index.php?action=profile;area=summary;u=294590

I appreciate, cause I found exactly what I was looking for.

You’ve ended my four day long hunt! God Bless you man. Have a great day.

Bye

all the time i used to read smaller content that as well clear their motive, and

that is also happening with this post which I am reading at this place.

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your site?

My blog is in the very same niche as yours and my visitors would genuinely benefit

from a lot of the information you provide here.

Please let me know if this alright with you. Thanks

a lot!

Hi, I do belisve thhis iis a great web site. I stumbledupon it ;

) I’m going to come back yet again since I bookmarked it.

Money and freedom is the best way to change, may you be rich and continue to guide other people.

암호 화폐 거래 web page 바이너리 옵션으로 돈을 벌다

It’s remarkable to go to see this web site and reading the views of all mates about this paragraph, while

I am also zealous of getting knowledge.

Heya this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding knowledge

so I wanted to get advice from someone with experience. Any help would be enormously appreciated!

Right away I am going away to do my breakfast, later than having

my breakfast coming over again to read further news.

This blog was… how do you say it? Relevant!! Finally I’ve found something that helped me.

Thanks!

Hi there just wanted to give you a brief heads up and let you know a few of

the pictures aren’t loading properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same outcome.

Good day I am so thrilled I found your site, I really

found you by mistake, while I was researching

on Aol for something else, Nonetheless I am here now and would just like to say

thanks a lot for a tremendous post and a all round entertaining blog (I also

love the theme/design), I don’t have time to look over it all at the minute but I have bookmarked it and also added in your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the excellent jo.

Hi there! Do you know if they make any plugins to help with

Search Engine Optimization? I’m trying to get my blog

to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Kudos!

Article writing is also a fun, if you be familiar with then you

can write if not it is complex to write.

Hello! Do you use Twitter? I’d like to follow you if that would be ok.

I’m absolutely enjoying your blog and look forward to new posts.

I don’t know if it’s just me or if perhaps everyone else encountering problems with your website.

It appears like some of the text on your posts are running off the screen. Can someone else please provide feedback and let me know if this is happening to them too?

This may be a problem with my internet browser because

I’ve had this happen before. Thanks

Hi, just wanted to tell you, I enjoyed this blog post.

It was practical. Keep on posting!

Hello There. I found your weblog the usage of msn. This is a really smartly written article.

I’ll make sure to bookmark it and come back to read more of your useful information. Thanks for the post.

I’ll definitely comeback.

Hey There. I discovered your blog the use of msn. That is a really neatly written article.

I’ll be sure to bookmark it and return to read extra

of your helpful info. Thanks for the post.

I’ll definitely return.

It’s perfect time to make some plans for the longer term and it’s time

to be happy. I have learn this post and if I may just I wish to

recommend you few interesting things or suggestions.

Maybe you could write subsequent articles

relating to this article. I want to learn even more things about it! https://forum.geonames.org/gforum/user/profile/601015.page

It’s perfect time to make some plans for the longer term and it’s time

to be happy. I have learn this post and if I may just I wish to recommend you few interesting things or suggestions.

Maybe you could write subsequent articles relating to this article.

I want to learn even more things about it! https://forum.geonames.org/gforum/user/profile/601015.page

Amazing! Its in fact amazing paragraph, I have got much clear idea

on the topic of from this paragraph.

wonderful post, very informative. I wonder why the opposite experts of this sector don’t understand this.

You should proceed your writing. I’m sure, you’ve a great

readers’ base already!

First off I want to say wonderful blog! I had a quick question in which I’d like

to ask if you do not mind. I was interested to find out how you

center yourself and clear your mind before writing.

I have had a difficult time clearing my thoughts in getting my ideas out there.

I truly do take pleasure in writing however it just seems like the first 10

to 15 minutes are generally lost simply just trying to figure

out how to begin. Any suggestions or tips? Cheers!

It’s a pity you don’t have a donate button! I’d most certainly donate to this

superb blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account.

I look forward to brand new updates and will share this site

with my Facebook group. Chat soon!

I really like what you guys tend to be up too.

Such clever work and coverage! Keep up the awesome

works guys I’ve you guys to my own blogroll.

Heya i am for the primary time here. I found this board and I in finding

It really helpful & it helped me out a lot.

I am hoping to present one thing again and aid others like you aided me.

Hmm it seems like your website ate my first comment (it was

extremely long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog writer but I’m still new to the whole thing.

Do you have any helpful hints for newbie blog writers? I’d certainly appreciate it.

My family members all the time say that I am wasting my time

here at net, however I know I am getting know-how all the time by reading thes nice articles.

My spouse and I stumbled over here by a different page and thought I might as well check things out.

I like what I see so now i am following you.

Look forward to looking at your web page yet again.

What’s up every one, here every one is sharing these familiarity, therefore it’s pleasant

to read this web site, and I used to pay a visit this weblog every day.

magnificent put up, very informative. I ponder why the

opposite experts of this sector don’t understand this.

You should continue your writing. I’m sure, you have a huge readers’ base already!

Hi there, I enjoy reading through your post. I like to write a little comment to support you.

Good post however , I was wanting to know if you could write

a litte more on this topic? I’d be very thankful if you could

elaborate a little bit further. Kudos!

gay speed dating dallas

gay dating in cleveland

naked dating gay

I was extremely pleased to find this website. I want to to

thank you for your time due to this fantastic read!!

I definitely really liked every part of it and I have you book-marked

to see new things in your blog. https://sportbuybet.websnadno.cz/blog/roulette-trick/

I was extremely pleased to find this website.

I want to to thank you for your time due to this fantastic read!!

I definitely really liked every part of it and I have you book-marked to see new things in your

blog. https://sportbuybet.websnadno.cz/blog/roulette-trick/

I absolutely love your website.. Great colors & theme.

Did you make this amazing site yourself? Please reply back as I’m looking to create my very

own blog and want to find out where you got this from or exactly what the

theme is named. Cheers!

Great article, just what I wanted to find. https://www.goalmat.com/board/29094

I know this site presents quality depending posts

and additional material, is there any other site which

gives such things in quality?

You need to take part in a contest for one of the highest quality websites on the internet.

I will highly recommend this web site!

Here is my web blog: hcg injections online

Hello, just wanted to tell you, I enjoyed this post. It was practical.

Keep on posting!

Its not my first time to pay a visit this web site, i am browsing

this website dailly and get nice facts from here everyday.

I used to be able to find good information from your articles.

First of all I would like to say excellent blog!

I had a quick question in which I’d like to ask if you don’t mind.

I was curious to know how you center yourself

and clear your head prior to writing. I have had a

hard time clearing my mind in getting my ideas out. I do take pleasure in writing however it just seems like the

first 10 to 15 minutes are usually wasted simply just trying to figure out how

to begin. Any ideas or hints? Many thanks!

Hi! Would you mind if I share your blog with my zynga group?

There’s a lot of folks that I think would really enjoy your content.

Please let me know. Many thanks https://sites.google.com/view/ufasport777/blog/%E0%B8%AD%E0%B8%AA%E0%B8%9B%E0%B8%AD%E0%B8%A3%E0%B8%95

Hi! Would you mind if I share your blog with my zynga group?

There’s a lot of folks that I think would really enjoy your

content. Please let me know. Many thanks https://sites.google.com/view/ufasport777/blog/%E0%B8%AD%E0%B8%AA%E0%B8%9B%E0%B8%AD%E0%B8%A3%E0%B8%95

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point.

You clearly know what youre talking about, why throw

away your intelligence on just posting videos to your weblog when you could be giving

us something enlightening to read?

I got this site from my friend who shared with me on the

topic of this website and now this time I am visiting this website and reading very informative articles or reviews here.

Today, I went to the beach with my children. I found a sea shell and

gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her

ear and screamed. There was a hermit crab inside and it

pinched her ear. She never wants to go back!

LoL I know this is entirely off topic but I had to tell someone!

all thee time i used tto read smaller content that as well clear their motive, and that is also happening wuth

this post which I am reading at this time.

homepage

Thanks for your personal marvelous posting!

I seriously enjoyed reading it, you are a great author.

I will be sure to bookmark your blog and definitely will come back later on. I want to encourage you

to continue your great writing, have a nice afternoon!

Hello, I check your blogs on a regular basis. Your writing style is awesome,

keep doing what you’re doing! by site : baccarat.game

Greetings! This is my first comment here so I just wan

온라인카지노

ted to give

a quick shout out and tell you I really enjoy reading through your blog posts.

Can you suggest any other blogs/websites/forums that go over the same topics?

Many thanks!

First off I would like to say terrific blog!

I had a quick question which I’d like to ask if you don’t

mind. I was interested to find out how you center yourself and clear your head before writing.

I’ve had difficulty clearing my thoughts in getting my ideas out.

I truly do take pleasure in writing but it just seems like the

first 10 to 15 minutes tend to be lost simply just trying to figure out how to begin. Any ideas or tips?

Cheers!

great put up, very informative. I wonder why the opposite specialists of this sector don’t

understand this. You must continue your writing.

I am confident, you’ve a huge readers’ base already!

If some one needs expert view concerning blogging and site-building after

that i suggest him/her to go to see this website, Keep up the nice job.

Pretty! This was a really wonderful post. Thanks for supplying this info.

Hello i am kavin, its my first occasion to commenting anyplace,

when i read this article i thought i could also create comment due to this sensible paragraph.

I visited several blogs except the audio quality for audio songs

current at this site is genuinely superb.

Great goods from you, man. I have understand your stuff previous to and you are just extremely great.

I really like what you have acquired here, certainly like what you are

saying and the way in which you say it. You make it entertaining and

you still care for to keep it sensible. I cant wait to read much more from you.

This is really a great web site.

Spot on with this write-up, I honestly feel this amazing site

needs much more attention. I’ll probably be back again to

read more, thanks for the information!

Interesting blog! Is your theme custom made or did you download it from somewhere?

A theme like yours with a few simple tweeks would really make my blog

jump out. Please let me know where you got your theme. With thanks

I got this website from my buddy who informed me regarding this site and at the

moment this time I am browsing this website and reading very informative articles or reviews at

this time.

What i do not understood is actually how you are now not

really much more well-preferred than you may be right now.

You are so intelligent. You already know therefore significantly

in relation to this topic, made me in my view imagine it from numerous varied angles.

Its like women and men aren’t fascinated unless it is something to accomplish with Woman gaga!

Your individual stuffs nice. All the time care for it up!

I couldn’t resist commenting. Exceptionally well written!

I am curious to find out what blog system you are using?

I’m experiencing some minor security issues with my latest site and I

would like to find something more risk-free. Do you have any recommendations?

Informative article, exactly what I was looking for.

I quite like reading through a post that can make men and women think.

Also, thank you for permitting me to comment!

Does your blog have a contact page? I’m having a tough time locating it but, I’d like to shoot you an email.

I’ve got some ideas for your blog you might be interested in hearing.

Either way, great blog and I look forward to seeing it grow over

time.

Wonderful blog! I found it while searching on Yahoo News.

Do you have any suggestions on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Cheers

I couldn’t resist commenting. Very well written!

Wow that was strange. I just wrote an really long

comment but after I clicked submit my comment didn’t show

up. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say fantastic

blog!

It’s not my first time to go to see this site, i am browsing

this website dailly and obtain pleasant data from here daily.

It’s remarkable to visit this site and reading the views

of all mates on the topic of this post, while I am also keen of getting

experience.

Pretty! This was an incredibly wonderful article. Many thanks

for providing these details.

Really when someone doesn’t be aware of then its up to other people that they will assist, so here it occurs.

I have learn some excellent stuff here. Certainly worth

bookmarking for revisiting. I wonder how a lot attempt you set to

create such a magnificent informative website.

Stop by my blog post hcg injections online

Actually no matter if someone doesn’t understand afterward its up to other visitors that they will help, so here it takes place.

What’s up, of course this article is in fact pleasant and I have learned lot of things from it on the topic of blogging.

thanks.

website

Halo seluruh salam ya, saya ingin memberi tahu Anda jika

aku sudahh memenangkan permainan ⅾi web agen sepatu online yang sudah

sangat andal ɗan, tentu saja, di Situs ini juga menyediakan daerah taruhan untuk olahraga

seperti sepak bola Ԁan di sini aku Berharap memberi tahu

pengalaman aku karena saya mendapatkan info Ԁi sini.

Alѕo visit my һomepage situs pkv

Need Internet Marketing Assist? Try These Tips

Are you attempting to obtain your internet site

available for everybody to see? We have the best pointers available on marketing your web site.

Follow our useful tips and also you will certainly see your Internet company grow to be

larger than you ever before believed possible.

Continue reading to see just how easy it is.

Have reviews on your site. This is a crucial component of your website, due

to the fact that it reveals leads that your services or product

has been popular by genuine people. More than that, testimonials make individuals extra comfortable concerning investing their money

on what you need to use. Be truthful. Only use testimonials from those that have in fact used your solution or purchased

your item.

If you routinely participate in blog sites, your website will certainly obtain more

traffic. When you join blog sites, you get more leads, add size as well

as worth to your website and also enhance your visibility on search engines.

Blog writing is an excellent means to obtain more site visitors to your realty advertising

and marketing website.

Mention the address of your website in your voicemail greetings and also include

it in your e-mail trademark lines. Obtain words out to individuals

that you have a web page. Prospective customers have a lot more rely on firms that have online existences and it permits them to see that you are prior to they even speak to you.

Benefit business that fit you! If your web site

discuss baseball, don’t advertise a firm for senior women’s undergarments.

Primarily, remain pertinent. See to it the information you

advertise remains true to your very own area, or else you may

inadvertently repel consumers. See to it you allow your readers recognize you recognize what they might be seeking!

Partner up to gain readership. Having actually various other well developed

blogs link to yours is a basic method to obtain more customers to see you.

These readers are already part of the blogging

world, and if you have material they are interested

in, expect them to linger. Partnering with other blog sites offers other benefits also, such as

cooperating mutual revenues.

Web marketing

One online marketing strategy you can use to keep a connection with

customers as well as internet site visitors is to send an e-newsletter using e-mail.

Make certain your newsletter is quick, interesting

and also uses something of worth. A great way

to maintain e-newsletters short as well as

additionally encourage repeat brows through at your

site, is to email out just summaries of newsletter material, consisting of links to longer write-ups on your web site.

A terrific idea for online marketing is to stay

up on the most recent net developments. The web modifications rather often, and by frequently being aware

of the new modifications, you’ll have a far better understanding of just how your blog sites and also

website function, and also you’ll have a boost on your

competitors.

Home Business

Use the info on the web that is developed to help you run a home business.

There is mosting likely to be a great bit of info on these websites that you can make use of in your online marketing company.

It will aid you to obtain the most out of your get in touches with as

well as enhance the performance of your organization.

Seo

If your site has rivals that consistently out rank yours on the internet search engine results pages, do not

be envious. Rather consider the scenario as a learning possibility.

Study your rivals to discover what they do to get

provided highly. You may discover Search Engine Optimization approaches you

can utilize efficiently for your very own web site.

Create your URLs, directory paths as well as data names with keywords to enhance

you Search Engine Optimization. Internet search engine put more weight on Links with key words in them.

Similarly, if a keyword-rich URL is not feasible, utilize key words to call your

directory paths as well as data names. If your search phrase is long, use hyphens between the words, not emphasizes.

Your positions in searches for those key words

will certainly improve.

Social Advertising

Hit guides on social marketing. Find out

how to utilize social media to your advantage by looking into the techniques others have improved.

This expertise will certainly aid you maximize your search abilities,

because commonly people will browse social media for things they want.

Word of mouth on these websites can be useful too, so read up

and also get confident!

As you can see, there are numerous means you can market and grow your Internet business.

With our tested and also handy pointers, you will be well on your

means to having the Net website you have constantly wanted.

What are you waiting on? Venture out there as well as market your internet site.

You actually make it appear really easy along with your presentation but I find

this topic to be really something which I believe I might by no means understand.

It seems too complex and very extensive for me.

I’m taking a look forward for your subsequent put

up, I will try to get the hold of it!

Hi there, I log on to your new stuff on a regular basis.

Your humoristic style is awesome, keep doing what you’re

doing!

Review my page: clindamycin 300 mg

Thanks for the marvelous posting! I seriously

enjoyed reading it, you are a great author.

I will ensure that I bookmark your blog and will often come back at some point.

I want to encourage yourself to continue your great

writing, have a nice afternoon!

Spot on with this write-up, I really think this website needs a great deal more attention. I’ll probably be back again to read more,

thanks for the information!

Hi there, I enjoy reading through your article post.

I wanted to write a little comment to support you.

For newest news you have to pay a visit internet and on world-wide-web I found this website as a most excellent

website for newest updates.

Thanks for sharing your thoughts about Solar Panel Malaysia.

Regards

This is really interesting, You’re a very skilled blogger.

I’ve joined your feed and look forward to seeking more of your

magnificent post. Also, I’ve shared your site in my

social networks!

Ahaa, its fastidious conversation about this post here at this webpage, I have read all that,

so now me also commenting here.

Marvelous, what a website it is! This blog provides valuable data to us, keep it up.

Just desire to say your article is as astonishing. The clearness in your post is just cool and i can assume you are an expert on this subject.

Fine with your permission allow me to grab your RSS feed to keep up to date with forthcoming post.

Thanks a million and please keep up the rewarding

work.

Hi, its fastidious post concerning media print, we all be familiar

with media is a enormous source of data.

Magnificent goods from you, man. I have keep in mind your stuff previous to and you are simply too great.

I actually like what you have acquired here, really like what you

are saying and the way through which you are saying it.

You are making it entertaining and you still care for to keep it sensible.

I cant wait to learn far more from you. This is really a tremendous site.

Greetings, I believe your site could possibly be having internet browser compatibility problems.

Whenever I take a look at your website in Safari, it looks fine however,

if opening in Internet Explorer, it’s got some overlapping issues.

I simply wanted to provide you with a quick heads up! Besides that,

wonderful site!

I just couldn’t leave your site before suggesting that I actually

enjoyed the standard info a person supply in your visitors?

Is going to be again regularly to investigate cross-check new

posts

Hi! Would you mind if I share your blog with my zynga group?

There’s a lot of people that I think would really enjoy

your content. Please let me know. Thank you

It’s an awesome paragraph for all the online users; they

will take advantage from it I am sure.

It’s wonderful that you are getting ideas from this article as

well as from our discussion made at this time.

I’m not that much of a internet reader to be honest but your sites really nice, keep it up!

I’ll go ahead and bookmark your site to come back

later on. Cheers

The other day, while I was at work, my sister stole

my iphone and tested to see if it can survive a 30 foot drop, just so she can be a youtube sensation. My iPad is now destroyed and she has 83 views.

I know this is completely off topic but I had to share it with someone!

You have made some good points there. I checked on the internet to find out more about the

issue and found most individuals will go along with your views on this web site.

permainan PKV games merupakan salah satu permainan yang amat populer

akhir-akhir ini ini ⅾan klik66 yakni saoah satu agen penyedia situs pkv games yang sudah benar-benar terpercaya

ɗаn telah mendorong pengisian deposiit pulsa Ԁan banyak permainan yang sudah ada didalam server pkv games ada beberapa seperti bd qq online

Hello Dear, are you in fact visiting this web site regularly, if so after

that you will definitely get fastidious knowledge.

I love it when people come together and share thoughts.

Great site, stick with it!

My coder is trying to conviknce mme to move to .net from PHP.

I have always disliked the idea because of the expenses. But he’s tryiong none the less.

I’ve been using Movable-type on a number of websites for

about a ydar and am worried about switching to another platform.

I have heard fantastic thinggs about blogengine.net.

Is there a way I can transfer all my wordpress content into it?

Anny help would be really appreciated!

최고의 외환 지표 web page 로트 크기 계산기

I feel this is one of the such a lot important information for me.

And i’m satisfied reading your article. However wanna commentary on few general things, The

web site style is wonderful, the articles is in point of fact great : D.

Excellent task, cheers

Wow! In the end I got a webpage from where I know how to in fact get

useful data concerning my study and knowledge.

After I originally left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and now every time a comment is added I get

four emails with the same comment. Is there a way you can remove me from that service?

Appreciate it!

If you wish for to take a good deal from this post then you have to apply these techniques to your won blog.

I used to be suggested this web site by means of my cousin. I’m not sure

whether this submit is written by him as no one else

know such designated approximately my trouble. You are incredible!

Thank you!

Right away I am going to do my breakfast, after having my breakfast coming yet again to read more news.

You have made some good points there. I checked

on the web to learn more about the issue and found most

individuals will go along with your views on this web site.

dating gay physicisist

asian gay dating site dragons

free dating gay sites

Hello, i read your blog occasionally and

i own a similar one and i was just wondering if you

get a lot of spam feedback? If so how do you

stop it, any plugin or anything you can recommend?

I get so much lately it’s driving me crazy so any help is very much

appreciated.

Excellent goods from you, man. I’ve consider your stuff prior to and you are

simply too great. I really like what you’ve acquired

here, certainly like what you are stating and the way by which you are saying it.

You’re making it entertaining and you continue to take care of to stay it wise.

I cant wait to read far more from you. This is really a wonderful website.

Simply want to say your article is as astounding. The

clearness in your post is simply spectacular and

that i can think you are an expert on this subject. Well with your permission allow me to take hold of

your RSS feed to stay up to date with drawing close post.

Thank you 1,000,000 and please carry on the gratifying work.

Woah! I’m really digging the template/theme of this site.

It’s simple, yet effective. A lot of times it’s challenging to get that “perfect balance” between usability and visual appeal.

I must say you’ve done a superb job with this.

Also, the blog loads super fast for me on Internet explorer.

Superb Blog!

Great post however I was wondering if you could write

a litte more on this topic? I’d be very grateful if you

could elaborate a little bit more. Many thanks!

Howdy just wanted to give you a quick heads up.

The text in your article seem to be running off the screen in Internet explorer.

I’m not sure if this is a format issue or something to do with

browser compatibility but I figured I’d post to let you know.

The style and design look great though! Hope you get the issue fixed soon. Many thanks

I do agree with all of the concepts you’ve introduced to your post.

They are very convincing and can certainly work.

Still, the posts are too short for starters. May you please lengthen them a little from

next time? Thanks for the post.

Magnificent web site. A lot of useful information here. I’m sending it

to several friends ans additionally sharing in delicious.

And of course, thanks for your effort!

Admiring the commitment you put into your website and

in depth information you provide. It’s awesome to come across a blog every

once in a while that isn’t the same outdated rehashed material.

Great read! I’ve saved your site and I’m including your RSS feeds to my Google account.

excellent issues altogether, you just received

a emblem new reader. What would you suggest in regards to your put up that

you simply made a few days ago? Any certain?

Its such as you read my thoughts! You seem to grasp a lot approximately

this, like you wrote the e book in it or something. I believe that you

simply could do with a few p.c. to drive the message

home a little bit, but other than that, that is wonderful blog.

A fantastic read. I’ll definitely be back.

Hey! Would you mind if I share your blog with my twitter group?

There’s a lot of foks that I think would really appreciate your content.

Please let me know. Cheers

web site

WOW just what I was looking for. Came here by searching for Deposit Pocketoption

Hello would you mind stating which blog platform you’re using?

I’m going to start my own blog in the near future but I’m having a hard time

making a decision between BlogEngine/Wordpress/B2evolution and

Drupal. The reason I ask is because your layout seems different then most blogs and I’m looking

for something unique. P.S My apologies for getting off-topic but I had to ask!

I really like your blog.. very nice colors & theme.

Did you create this website yourself or did you hire someone to

do it for you? Plz respond as I’m looking to design my own blog and would like to

find out where u got this from. thank you https://www.scorezaa.com/board/26941

I really like your blog.. very nice colors & theme.

Did you create this website yourself or did

you hire someone to do it for you? Plz respond as I’m looking to

design my own blog and would like to find out where u got this from.

thank you https://www.scorezaa.com/board/26941

Hey just wanted to give you a quick heads up. The words in your article seem to be running off

the screen in Ie. I’m not sure if this is a format issue or

something to do with browser compatibility but I figured I’d post to let you know.

The design look great though! Hope you get the problem fixed soon.

Thanks

Interesting blog! Is your theme custom made or

did you download it from somewhere? A theme like yours with a few simple adjustements would really

make my blog stand out. Please let me know where you got your theme.

Thank you

At this time it looks like Drupal is the best

blogging platform out there right now. (from what I’ve

read) Is that what you’re using on your blog?

Hey I am so happy I found your webpage, I really found you by error, while I was looking on Google for

something else, Anyways I am here now and would just like to say thanks a

lot for a marvelous post and a all round enjoyable blog (I also love the theme/design), I don’t have

time to go through it all at the moment but

I have bookmarked it and also added your RSS feeds, so when I have time I will be back to

read a lot more, Please do keep up the excellent jo.

Attractive section of content. I just stumbled upon your web site and in accession capital to assert that I acquire in fact enjoyed

account your blog posts. Any way I will be subscribing to your feeds and even I achievement you access

consistently rapidly.

Hi there, I enjoy reading all of your article post.

I wanted to write a little comment to support you.

It is not my first time to visit this site, i am browsing this web page

dailly and get pleasant data from here all the time.

Hello, Neat post. There’s an issue with your web site in web explorer, might test

this? IE nonetheless is the market chief and a big element

of other people will leave out your fantastic writing because

of this problem.

Article writing is also a fun, if you be acquainted with afterward you can write or else it is complex to write.

Somebody necessarily help to make critically articles I’d

state. This is the very first time I frequented your website page and up to now?

I surprised with the research you made to make this actual put up extraordinary.

Magnificent task!

There is definately a lot to know about this issue.

I really like all the points you made.

Here is my web blog … hcg online

I really like it when individuals get together and share ideas.

Great website, keep it up!

This is my first time pay a visit at here and i am really impressed to read all at alone place.

I have to thank you for the efforts you have put in writing this site.

I am hoping to check out the same high-grade content from you in the future as

well. In truth, your creative writing abilities has encouraged me to get

my very own website now 😉

I believe everything wrote made a lot of sense.

But, what about this? what if you composed a catchier post

title? I mean, I don’t wish to tell you how to run your blog,

however suppose you added a headline that makes people want

more? I mean Paying for Infrastructure is kinda boring. You

ought to glance at Yahoo’s home page and see how they create post headlines to grab people interested.

You might try adding a video or a picture or two to grab people excited about everything’ve got to say.

In my opinion, it could make your posts a little bit more interesting.

If you would like to obtain a great deal from this article then you have to apply these strategies to your won web site.

I’ve been exploring for a little for any high quality articles or blog posts on this

sort of house . Exploring in Yahoo I ultimately stumbled upon this web site.

Reading this information So i am happy to show that I’ve a very just right

uncanny feeling I found out exactly what I needed.

I such a lot definitely will make sure to don?t omit this site and give it a glance regularly.

Post Advertising And Marketing Tips That Can Aid You Get The Most Out Of Your Time As Well As Work

There are out of work individuals with degrees and also years of experience.

If you want to accomplish financial self-reliance, start an organization online.

This write-up will certainly demonstrate a number of excellent write-up marketing methods.

As long as you have the ideal expertise and also a great

amount of resolution, developing a profitable internet organization is workable.

Make use of free offers in your short article advertising and

marketing. Freebies give individuals the impression that they have obtained something valuable as

well as will be more probable to get your products

if you have shown them what they can expect. You can also acquire complimentary marketing by having your logo on any kind of freebie goods.

Keep this in mind.

Have your readers provide feedback to your e-mails.

People generally like to supply responses and have a voice.

Enabling feedback from readers will be a great method to permit them to share their concepts.

Additionally, you can find out about new ideas for making your discussion better.

Blog writing is a great, innovative way to attract viewers to your site.

There are several complimentary sites to publish blogs to take part in the feedback that your visitors

may have. Configuration is usually easy. Blog site to attract a big audience to your website.

Always provide your readers with great information. Your readers,

or prospective customers, intend to feel like they are getting useful info

out of your content. Give that to them as well as they will

certainly come back for even more.

Lots of people market write-ups that improve web traffic and also sales for themselves.

Keep in mind that composing needs talent. Perhaps you have

a good command of grammar and also are an expert when it comes to spelling.

Nevertheless, if you do not have a passion for it, you will certainly quickly be bored.

Rather, creating requires you to be good with words. It requires a specific sense of artistry, not simply a base of knowledge.

Your new articles must be posted regularly.

Internet search engine have organizing crawlers that determine just how commonly to go back to

your site to re-index the content. Internet search engine index

your internet site more regularly when brand-new web content

is added regularly, which indicates that your write-ups serve

their designated objective of transforming consumers faster.

Put yourself into your posts. Inform some narratives, take on a friendly tone as well as discuss your experiences as well as

sensations so your viewers can relate to you. Be honest about things when you compose, as well as

permit your design to beam. Individuals that review your write-ups will value this and will most likely

come back for even more.

Your title is more crucial than the majority of anything else

you will write. When the title isn’t appealing, no one

will check out the article. Make your title pertinent. Give your visitor a suggestion of what the short article is all about.

If your short articles are great, you’ll have a clear benefit.

“Just how to” write-ups are popular, as are those having representations and also

various other graphics. Having a high-quality, monthly poll will allow you see the boost of

your web traffic.

Offer yourself deadlines and allocations when composing posts.

Doing this is the very best way to stay reliable and effective.

This will also, slowly however undoubtedly, offer you much more sights, specifically if you have regular entries.

Must you think that your strategy for advertising and marketing posts requires more exposure,

think about spending for a circulation service for your articles.

If you think that time is money, then spend a little of

the latter to save a great deal of the previous by allowing directories do the job.

Nevertheless, these solutions are not totally free, so

evaluate whether it deserves the amount of money.

Check your article to get rid of any type of errors that can damage your credibility.

Evaluate each word at the very least twice to make sure that

spelling is proper as well as whatever seems best.

Keeping a good writing style is necessary if you desire

to make one of the most possible earnings.

Put a lot of feeling right into your writing, this will certainly make

you simple to relate to. You can write a post that better involves your reader, if you

bear in mind that individuals read your write-ups along with the factual info

you supply.

Make a bullet-point list to gain write-up concepts.

Numerous sentence length is very important to great writing, and also a string of brief sentences can birthed readers.

By using bullet points, you will certainly add interest along with aiding

to keep framework in your post. This makes people

take note a great deal more.

One of the most vital trick to short article advertising and marketing is that you have initial material.

The huge internet search engine prefer fresh web content.

If you require more fresh content than you can produce, take a look at the

many creating services online that supply an unlimited variety of composing at budget-friendly rates.

There is a revolving door of on-line companies.

If you do not want your organization to vanish, it has to

be solid. To make your business one of the champions and

also not one of the forgotten losers, comply with the suggestions offered below.

Accomplish marketing success by applying a trustworthy plan as well as hearkening any type of audio guidance you are given.

Very nice post. I simply stumbled upon your

weblog and wished to mention that I’ve really loved browsing

your blog posts. After all I will be subscribing to your rss feed and I hope you write

once more soon!

Hello There. I discovered your blog the use of msn. That

is a really neatly written article. I will make sure to

bookmark it and come back to read extra of your helpful

information. Thank you for the post. I will certainly comeback.

of course like your website however you have to test the spelling on several of your posts.

A number of them are rife with spelling problems and

I to find it very bothersome to tell the truth on the other hand I’ll definitely come back again.

Write-up Advertising And Marketing Concepts To Build Web Traffic!

Many services today use internet marketing to bring

in pre-qualified leads. You need to understand the right way to utilize

online marketing effectively. Post advertising and marketing is one specifically efficient type of Online marketing.

Read on for some convenient hints on just how to deal with it.

To help bring in even more visitors, attempt offering free offers.

By doing this, your customers will certainly really feel

as if you are a charitable individual that is not

out to rip them off. As a result, they are mosting

likely to be more probable to acquire an item from you.

Not only that, but if the complimentary product includes branded product that flaunts your logo, you get totally

free advertising and marketing whenever your client uses the thing in public.

Remember this and select products as necessary.

Your e-mail newsletter requires to be full of quality material.

Sending out junk emails will only provide you a bad name as well as these days

they are actually unlawful. Consist of information that your

clients in fact require so that they are pleased

to get your emails. If you fail to do this, you will lose subscribers and, therefore, shed potential consumers.

Building a blog is an excellent means to highlight your trustworthiness and leadership within your industry.

Use you specialist knowledge and insight to develop useful

posts for your website. Additionally, do not be afraid to integrate your

character and sense of humor into the blog posts to keep your readers engaged.

If you discuss the most up to date trends, customers will value you.

Blog owner is a fantastic means to get your business observed.

There are lots of cost-free websites to upload blog sites to take

part in the responses that your visitors may have. It is very easy to establish

a blog site and also you can easily bring in more site visitors for your website as well as business.

Make your paragraphs short, such as this idea. There is evidence that reveals that online reading enables more interruptions than reviewing a physical book or publication. Keeping your article

brief as well as to the point will certainly keep your visitors pleased.

If you maintain your content funny, it can be easy to bring an individual onto your site.

Just ensure that you are telling a proper and funny joke.

If you can comprehend what is appropriate and what isn’t, you

can create a wonderful write-up.

Unless sites delete your posts, they’ll continue to be there as well as can be used to drive website traffic to

your site. Build an internet of referral factors by advertising short articles with various other short articles,

as well as enjoy your web traffic grow.

Having a remarkable item makes write-up advertising and marketing a lot simpler.

When your item draws in consumers, it will offer itself.

Are you running out of ideas for short articles?

You might intend to consider composing some short articles with a brand-new angle.

For instance, if you are composing traveling short articles, you could try

targeting a particular group of people. For example, you could write family-oriented suggestions

to aid parents browse journeys with their youngsters.

Conversely, you might compose suggestions pertinent

to taking a trip as an elderly person. As long as you solve some of the problems of

your specific niche, your articles will certainly

have a high need.

When composing web content, be certain that you produce

one-of-a-kind posts that readers are sure to discover fascinating.

No one is going to check out dull posts that have no creativity.

Avoid losing focus by excessive using key words in titles and headlines.

You must have a good sense of equilibrium between heading

content as well as key phrases. Your headlines require to get people’s focus.

Make your own one that orders the visitor’s interest as well

as makes him wish to proceed analysis.

Have your short articles check before you market it.

Often you invest a lot time with key words or the short article itself that you may miss something

really easy like the utilizing the incorrect word in the wrong

context.

Your write-ups are an excellent opportunity to enlighten consumers on usual issues they might be dealing with.

If you see that a specific trouble is continually stated

on social media sites sites pertaining to your particular niche,

after that it most likely isn’t being adequately attended to by existing articles.

Write-up advertising and marketing gives a method

to earn money without any upfront costs. Regularly, it takes both paid and cost-free solutions to get the most from it.

The even more you take into post advertising, both money and time, the

a lot more you are mosting likely to make.

Do not concentrate your short article on offering yourself.

When your short article is created well, it will automatically do the marketing.

Maintain the content strong throughout the item so your visitors stick with you up until

the end.

Your writer biography ought to be 1.

intelligent and also intriguing, however to the point.

Inform your visitors a little bit regarding on your

own and also how the topic figures in in why you cover it.

Your biography ought to likewise have a link to your internet site.

While running several niche web sites, ensure to link the ideal website to the best article.

Before you begin article advertising, spend the moment you need to understand it and develop your abilities.

You might be happily amazed when you see how it

can help your business.

That is really interesting, You’re an overly professional blogger.

I have joined your feed and look ahead to looking for more

of your great post. Also, I have shared your web site in my social networks

I love what you guys are up too. This type of clever work and

reporting! Keep up the fantastic works guys I’ve included

you guys to blogroll.

Heya this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with

HTML. I’m starting a blog soon but have no coding knowledge

so I wanted to get advice from someone with