Update 416 —Millennial Economic Challenge:

Agenda to Redress Generational Imbalance

Never in the nation’s history have circumstances and public policy combined to produce an entire generation economically disadvantaged compared to — if not by — its immediate forebears. Those responsible did not intend this consequence, and many in fact have remorse and resolve.

From spending priorities to bankruptcy law, federal policy reflects the truism that if you aren’t at the table, then you are on the menu. Young people have paid dearly and will for years unless they develop a millennial economic policy agenda — because the message is there for the taking. Or here, below.

Best,

Dana

_________________

All but the youngest Millennials — the 75 million Americans born between 1981 and 1996 — are out of school and of working age. Millennials face an array of economic challenges brought on by policy decisions, rapid globalization, and bad luck, to name a few causes. Our politics are increasingly shaped by Millennials, who make up 27 percent of the electorate and will exert more influence as they age.

Compared to their forebears, Gen Xers and Baby Boomers, Millennials are strapped for cash and saddled with debt. Older Millennials, those over 30, graduated from school and entered the workforce during the Great Recession — the worst job market in 80 years. They got locked into low-paying jobs, experienced wage stagnation, and were unable to save for retirement.

Millennials lag behind other generational cohorts in terms of earnings and wealth. Millennials’ above-average rates of unemployment (8.8 percent) and underemployment (18.3 percent) combined with relatively low earnings ($35,592 average salary) hinder wealth-building. The generational wealth gap has reached historic proportions, as the average Millennial today holds 41 percent less wealth after adjusting for inflation than the average Gen Xer did in 1989.

Below, we look at three interlocking challenges facing Millennials — student loan debt, lack of workplace benefits, and low homeownership rates — and the long-term economic and political impacts.

The Student Loan Debt Albatross

More than a quarter of Millennials have outstanding student loan debt, and seven in ten students who graduated from a non-profit college in 2018 graduated with student loan debt. The average Millennial borrower holds $30,000 in student loan debt, and Millennials collectively hold more than $500 billion in outstanding student loan debt.

The astronomical level of student loan debt coincides with the doubling of the price of college over the past 30 years. Per the National Center for Education Statistics, the average cost for a four-year degree doubled from about $53,000 in 1989 to over $104,000 in 2018, after adjusting for inflation. College enrollment rose sharply during the Great Recession, as Millennials who came of age at the time found their job prospects without a college degree to be negligible.

Meanwhile, wages have stagnated, and health care costs have skyrocketed, leaving Millennials stretched thin. Those who graduated in the midst of the Great Recession began their careers underemployed, which has long-term depressive effects on lifetime earnings. As of last year, recent college graduates are less likely to be employed than the rest of the working population. Of those who are employed, 40 percent have a job that does not require a college degree.

Disappearing Traditional Workplace Benefits

Workplace benefits — health care, retirement, and paid family and medical leave — are critical to household financial security. Over the past 30 years, workers have experienced a decline in the provision of several essential employer-provided benefits. Per BLS, the share of workers covered by employer-sponsored health plans has fallen from 75 percent in 1991 to 62 percent in 2018. Over the same period, the number of workers with defined-benefit retirement plans has halved — from over 50 percent in 1991 to just 22 percent in 2018.

Millennials are the largest generation in the labor force and make up over 40 percent of those in the emerging “gig economy.” As gig models upend the traditional employer-employee relationship, key protections for workers are increasingly hard to come by. Health care reigns supreme as a concern for the underemployed, but gig jobs rarely offer overtime pay, paid family and medical leave, and/or retirement benefits. Unemployment insurance is also not available to former gig economy workers.

Health care drove Democrats and Independents to the polls in 2018. Republicans played defense on the issue after delivering serious blows to the ACA and almost repealing the law altogether. As more traditional workplace benefits fall by the wayside, Millennials, who fare worse than previous generations, will grow increasingly frustrated with the status quo.

Home Ownership and Generational Wealth

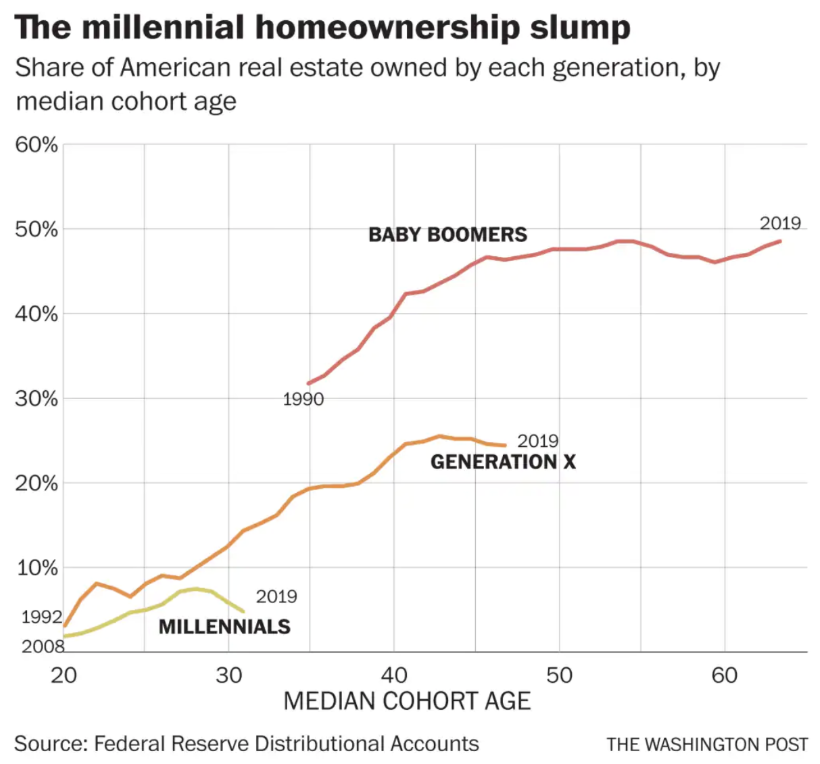

REALTOR Magazine recently celebrated that more Millennials are pursuing homeownership than ever before. Yet, Millennials’ rate of homeownership is still eight percent lower than that of Gen Xers and Boomers at the same age. Low homeownership rates affect fellow buyers, sellers, and, in the end, everyone else.

The reason for lagging homeownership rates? Rising costs of living and high levels of debt. Rent prices have risen by nearly 50 percent since the 1960s, and 70 percent of recent college graduates finish school with student loan debt. Over 61 percent of Millennials said that they delayed buying a house because of the need to repay their student loans. Lack of financial security has delayed traditional markers of adulthood, such as marriage and having children, as well as the opportunity to invest in one of the largest drivers of wealth and equity: owning a home.

The paucity of affordable housing stock contributes to Millennial home buying woes. Housing prices have increased nearly 40 percent over the past three decades. Looking back further, the average home price is over 70 percent higher than what Boomers saw in the 1960s. Zoning laws frustrate efforts to build more affordable housing, and homebuilders have incentives to build high-end units over affordable ones. Recent job growth in urban areas attracts young workers to cities, and fewer children means smaller houses. Some housing markets (e.g., suburban) are seeing steep price drops, while others (urban) show rapid growth.

Left unchecked, housing markets will continue to warp, exacerbating the generational wealth gap. Not owning a home and the associated equity is bad for the economy as a whole, as homeownership is the principal method of wealth building for the middle class. Boomers may dominate homeownership now, but who will buy their homes?

Political Realities

Absent an agenda and unprecedented mobilization, Millennials will struggle to catch up to older generations in accumulating adequate wealth and retirement resources. Many will be unable to meet traditional obligations of child rearing and elder care. At the same time, the oldest, wealthiest households are doing better than ever.

While turnout in the 2018 midterms increased across the board, the most pronounced change was among Millenials, whose turnout doubled from just four years prior. Per the Pew Research Center, 59 percent of Millennials identify as a Democrat/lean Democrat, but only 32 percent identify as a Republican/lean Republican (the partisan divide for GenXers and Boomers is far more even, as only 48 percent of those generations identify as a Democrat/lean Democrat). But a Millennial policy agenda and mobilization of advocates awaits.

I every time emailed this blog post page to all my associates, for the

reason that if like to read it next my friends will too.

0mniartist asmr

Hello, I read your blog daily. Your humoristic style is awesome,

keep doing what you’re doing! 0mniartist asmr

Oh my goodness! Awesome article dude! Thank you, However I am encountering difficulties with your RSS.

I don’t understand why I cannot subscribe to it.

Is there anyone else having the same RSS problems?

Anyone who knows the solution can you kindly respond? Thanks!!

0mniartist asmr

This is really interesting, You are a very skilled blogger.

I have joined your feed and look forward to seeking

more of your great post. Also, I’ve shared your web site in my social networks!

asmr 0mniartist

I’ve been browsing online more than 3 hours nowadays, but I never found any fascinating

article like yours. It is beautiful value sufficient for me.

In my opinion, if all site owners and bloggers made excellent

content material as you probably did, the net

will be a lot more useful than ever before. asmr 0mniartist

online installment loans

pay day loans

It’s actually a cool and helpful piece of info.

I’m glad that you simply shared this helpful information with

us. Please keep us up to date like this. Thanks for sharing.

Its like you read my mind! You appear to know so much about this,

like you wrote the book in it or something.

I think that you could do with a few pics to drive the message home a little bit, but instead of

that, this is magnificent blog. An excellent read. I will certainly be back.

My web site: 918kiss plus ios download

You really make it seem so easy with your presentation but

I find this topic to be really something which I think I would never understand.

It seems too complex and extremely broad for me. I’m looking

forward for your next post, I’ll try to

get the hang of it!

Also visit my webpage; download game greatwall99 (918kiss-m.com)

I’m really enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more pleasant for me to come

here and visit more often. Did you hire out a developer to create

your theme? Great work!

Here is my web site – club suncity apk ios download

Yes! Finally someone writes about 918kiss 2.

Here is my page – cara masuk id test 918kiss 2

This information is worth everyone’s attention. When can I find out more?

Here is my website … 918kiss 2 free download

Hello to every body, it’s my first pay a visit of

this webpage; this website consists of remarkable and really excellent stuff in support of visitors.

Feel free to visit my page lionking888 slot game list

Good way of telling, and good post to get facts about my presentation subject, which i

am going to present in university.

Hey this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding expertise

so I wanted to get guidance from someone with experience.

Any help would be enormously appreciated!

If you are going for most excellent contents like me,

simply pay a visit this site all the time as it gives feature contents, thanks

That is a very good tip especially to those new to the blogosphere.

Brief but very accurate info… Appreciate your sharing this one.

A must read post!

You need to be a part of a contest for one of

the greatest websites on the net. I most certainly will highly recommend this website!

tider , tinder website

browse tinder for free

Hey there! Would you mind if I share your blog with my myspace group?

There’s a lot of folks that I think would really appreciate your content.

Please let me know. Thanks

Hello are using WordPress for your site platform?

I’m new to the blog world but I’m trying to get started and set

up my own. Do you need any html coding expertise to make your own blog?

Any help would be greatly appreciated!

tinder online , tinder app

tinder sign up

What i do not realize is actually how you’re not actually a lot more well-liked than you may be

right now. You’re so intelligent. You know thus considerably in relation to this subject, made me in my view

consider it from so many various angles. Its like men and women don’t seem to

be involved unless it’s something to do with Girl gaga!

Your individual stuffs outstanding. Always maintain it up!

Great post. I was checking constantly this weblog

and I am inspired! Extremely useful information specially

the remaining section 🙂 I handle such information a

lot. I used to be looking for this certain information for a long time.

Thanks and good luck.

Fantastic goods from you, man. I have understand your stuff previous to and you are just too great.

I actually like what you’ve acquired here, certainly like what

you’re saying and the way in which you say it.

You make it entertaining and you still care for to keep it wise.

I can’t wait to read much more from you. This is actually a terrific web site.

tindr , tinder sign up

http://tinderentrar.com/

scoliosis

Can I just say what a relief to uncover someone who

really knows what they are discussing on the web.

You actually understand how to bring an issue to light and make it important.

A lot more people have to read this and understand

this side of your story. I can’t believe you aren’t more popular since you surely possess the gift.

scoliosis

scoliosis

I love your blog.. very nice colors & theme. Did you

create this website yourself or did you hire someone to do it for

you? Plz answer back as I’m looking to create

my own blog and would like to know where u got this from.

thank you scoliosis

I’m impressed, I have to admit. Seldom do I encounter a blog that’s both equally educative and engaging, and without a doubt, you have hit the nail

on the head. The issue is something not enough folks are speaking intelligently about.

I am very happy that I stumbled across this during my hunt for

something concerning this.

my web-site: www sky1388apk (Israel)

I feel that is among the most important information for me.

And i’m happy studying your article. But should commentary

on some basic things, The web site taste is

wonderful, the articles is in reality excellent : D.

Excellent activity, cheers

Have a look at my web site :: wukong333 vip

I am sure this paragraph has touched all the internet users,

its really really fastidious piece of writing on building up

new webpage.

Also visit my website: download game 918kiss 2

scoliosis

What’s up, just wanted to mention, I loved this article.

It was practical. Keep on posting! scoliosis

If you want to take a great deal from this paragraph then you have to

apply these strategies to your won weblog.

Here is my site: game online 918kaya

free dating sites

Excellent, what a weblog it is! This weblog presents valuable data to us, keep it up.

dating sites https://785days.tumblr.com/

dating sites

Fantastic website. Plenty of useful information here.

I’m sending it to some buddies ans additionally sharing

in delicious. And obviously, thank you in your effort!

free dating sites

For most up-to-date information you have to visit internet and on internet I found this website as a most excellent

site for newest updates.

Whoa! This blog looks exactly like my old one! It’s on a entirely different topic

but it has pretty much the same page layout and design.

Great choice of colors!

Hello! I could have sworn I’ve been to this site before but after browsing through a few of the posts I realized it’s new to

me. Anyhow, I’m definitely pleased I discovered it and I’ll be book-marking it and

checking back regularly!

I’m not sure where you’re getting your information, but good topic.

I needs to spend some time learning more or understanding more.

Thanks for great info I was looking for this info for my

mission.

Good day very nice website!! Guy .. Beautiful .. Amazing

.. I will bookmark your blog and take the feeds also?

I’m happy to search out numerous useful info right here in the publish, we’d

like develop extra techniques in this regard, thank you for sharing.

. . . . .

I must thank you for the efforts you have put in writing this website.

I’m hoping to view the same high-grade content by you in the future as well.

In fact, your creative writing abilities has encouraged me to get

my very own website now 😉

Pingback: free messaging dating sites uk

I have been browsing online more than three hours these days,

yet I by no means found any attention-grabbing article like yours.

It is lovely value sufficient for me. In my opinion, if all site owners and bloggers made

good content as you probably did, the internet will probably be much more useful than ever before.

You are so awesome! I don’t think I’ve read anything

like this before. So wonderful to find someone with genuine thoughts on this topic.

Really.. many thanks for starting this up. This

web site is one thing that is needed on the internet, someone with a little

originality!

Wow, incredible blog layout! How long have you been blogging for?

you make blogging look easy. The overall look of your web site

is wonderful, as well as the content!

Since the admin of this website is working, no question very quickly it will

be renowned, due to its feature contents.

cialis with dapoxetine

online kamagra mumbai

tram pararam disney jungle book porn Moga Pivot Pour Iphone 5c Gratuitement fli book tutoriel linkedin 2018

Para Pharmacie Geant Casino Casino Craft Mod 1 7 10 Triche Huuuge Casino

Nouvelles Voitures Maj Casino Club Des Sommeliers Casino Avis Spar Supermarch Casino Baixas Baixas

I know this website offers quality dependent content

and other material, is there any other web site which provides these kinds of data in quality?

free dating sites

our time dating service

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

soft tabs viagra does homemade viagra work ViagraCND100Mg – home remedy viagra

Pingback: keto diet free plan

gay mature men dating

gay personals dating

dating in harlem gay

I’m extremely pleased to find this site. I want to to thank you for ones

time for this wonderful read!! I definitely appreciated every

part of it and i also have you bookmarked to see new information on your web site.

Amazing! Its actually awesome paragraph, I have got much clear idea

concerning from this article.

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

are there free gay dating aps

gay dating for virgins

trans gay and dating sites

bisexual dating gay man

vh1 dating naked gay

ai gay dating