Update 470 — Generating Inequities:

Economic Impact of COVID on Millennials

For the 75 million Americans born between 1981 and 1996 — the millennial generation — the economic scars caused by COVID will last longer and do more material harm than for any other cohort. From distant or delayed classroom learning at tuition rates making education less of a value to a job market crippled by lack of demand, millennials now face badly and uniquely constrained economic fortunes.

Some problems, like the $1 trillion student debt overhang, are pre-existing conditions aggravated by COVID. Others, like the looming retirement crisis, are not yet felt but made worse and more certain by COVID. With students struggling this September to return to classrooms and unlucky recent graduates seeking first jobs in a forbidding market, we look at what the economic challenges and legacy of COVID mean for millennials.

Good weekends, all…

Best,

Dana

——————————————————

Millennials, many of whom entered the workforce during the Great Recession or during its recovery, are experiencing their second once-in-a-lifetime economic crisis, all of them under the age of 40. Already facing greater economic fragility, millennials now bear much of the brunt of the recession and will incur permanent financial costs.

Below, we analyze key issues for millennials, the impact of COVID, and what issues will remain after the pandemic is gone.

Underwater Education

A problem even before the recession, more than a quarter of millennials have outstanding student loan debt. The average millennial borrower in 2018 left college with almost $30,000 in debt, and millennials collectively hold more than $500 billion in outstanding student loan debt.

The astronomical level of student loan debt coincides with the average sticker price for public college tuition more than doubling from $8,143 in 1985 to $17,797 in 2017, after adjusting for inflation. College enrollment rose sharply during the Great Recession, as millennials coming of age at the time found their job prospects without a college degree to be negligible. During this time, more students enrolled in graduate school, thereby accumulating more student debt.

Although a major issue for millennials, student loans will not be a pressing concern until the end of the year. The CARES Act suspended principal and interest payments on federally-held student loans through the end of September, and one of Trump’s August actions extended the forbearance period through the end of December.

Job Markets Pre- and Peri-COVID

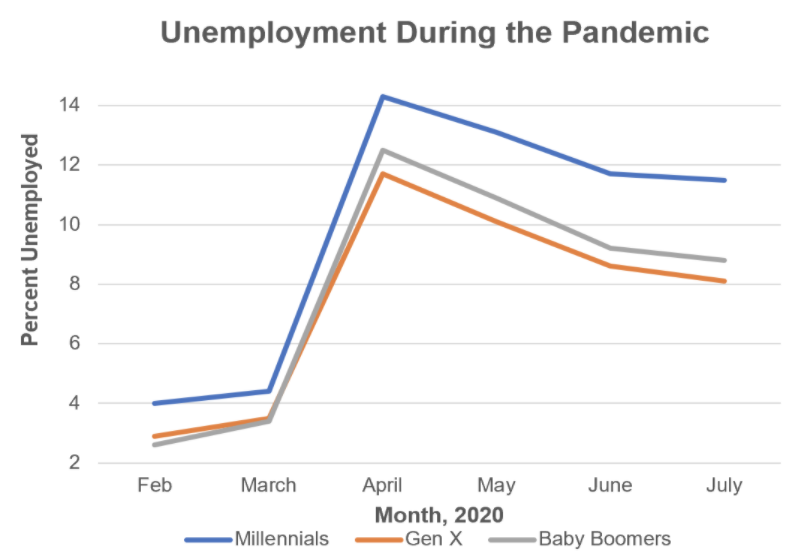

Pre-COVID, millennials had higher rates of un- and underemployment (4.1 and 18 percent, respectively) than the rest of the population and routinely found themselves stuck in jobs with stagnant wages. Over 4.8 million millennials lost their jobs between February and May, compared to around 3.5 million GenXers and 2.8 million baby boomers. As a result, the millennial unemployment rate peaked at 14.3 percent in April and has recovered slowly.

Source: Bureau of Labor Statistics

Millennials’ entry into the labor force coincided with the rise of the “gig economy,” where short-term arrangements and freelance work reign. Accordingly, millennials make up over 40 percent of gig workers and receive almost three-quarters of their income through contract work.

While the gig model allows employees greater flexibility in moving between employment arrangements, basic worker protections are scarce. Health insurance and paid family and medical leave are critical to household financial security, but are virtually nonexistent in gig arrangements. Until passage of the CARES Act, gig workers were ineligible for unemployment insurance. These workers can collect state-level unemployment benefits through the end of the year, but without a permanent expansion of the CARES reforms, millions of millennials will find their lone source of income cut off.

Generational Wealth & Housing Gaps

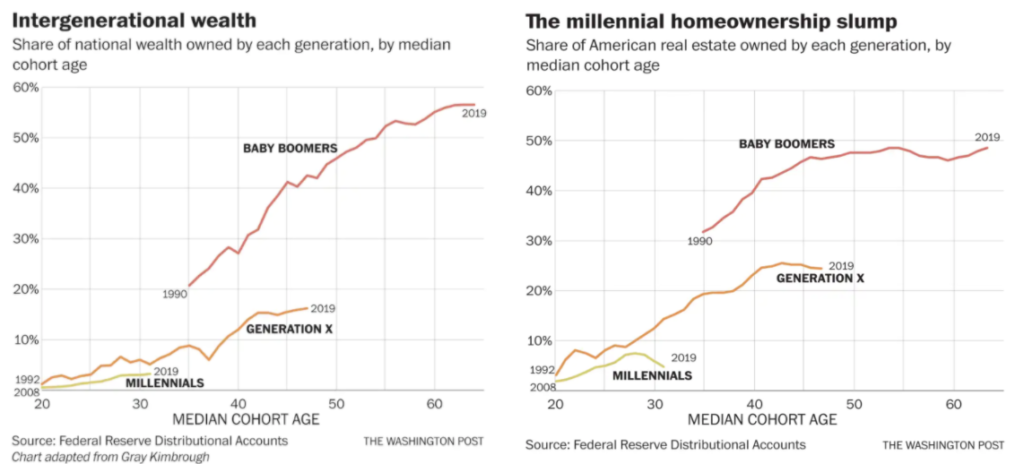

Millennials still hadn’t recovered from the Great Recession when the pandemic hit. The Great Recession depressed millennials’ total earnings by about 13 percent for the next decade, compared to 9 percent for Gen Xers and 7 percent for baby boomers. This hinders the generation’s economic power and ability to build wealth. Driven by decreasing rates of homeownership, the average millennial holds about 40 percent less wealth than the average Gen Xer did in 1989.

The intergenerational wealth gap is directly related to the fact that millennials are waiting longer to buy homes. Home ownership is a key source of wealth for Americans, and the slump in homeownership among millennials means that much of their income is absorbed by rent. Housing is getting more expensive; home prices are 39 percent higher than they were 40 years ago and 73 percent higher than they were 60 years ago. Meanwhile, rent prices have also increased faster than the rate of wages. Median rent prices increased 13 percent since 2001 while median renter household income increased only .5 percent over the same period.

The wealth gap is also exacerbated by millennials’ massive amounts of personal debt. In 2019, the average millennial held $27,900 in debt (excluding mortgages) primarily from credit cards. Now, nearly one-third of millennials say the pandemic upended their financial security, compared to a quarter of Gen Xers and a sixth of baby boomers. The CARES Act’s increased unemployment benefits and $1,200 checks were a lifeline for millennials, two-thirds of whom were living paycheck-to-paycheck before the pandemic. Many millennials used these payments to pay down their personal debt.

An Accelerated Retirement Crisis

Social Security insolvency will be a major issue for millennials both before and after they retire. Sixty-eight percent of millennials hold favorable opinions of Social Security, and 80 percent believe the program is more essential now than ever. Moreover, 69 percent of millennials want Congress to increase the program’s benefits.

Social Security has long been a target for Republicans, and now Trump has made it a priority to undermine Social Security’s key revenue stream. In August, Trump signed an executive order delaying employee-side payroll tax obligations until the end of the year. Trump stated that he intends to make this deferral permanent and to make permanent cuts to the payroll tax — perhaps even eliminate it entirely — should he win a second term. Such moves would decimate one of the nation’s most successful anti-poverty programs.

The 2020 Social Security trustees report estimated that, before the pandemic, Social Security would be insolvent by 2035, but the pandemic and subsequent recession have accelerated the insolvency timeline by as much as six years. Trump’s proposals would do even greater damage. Absent any movement of funds, Trump’s proposed elimination of the payroll tax would accelerate insolvency to 2023, after which point Social Security would be permanently unable to pay benefits.

Generating Inequities?

Even before they retire, insolvency would require many millennials to financially support their retired relatives. Millennials will also need to rely on Social Security for a greater portion of their post-retirement, since nearly two-thirds of millennials have no retirement savings. Millennials are also less likely to have a defined benefit pension plan than previous generations, and only a third have employer-sponsored retirement plans, compared to about half of Gen Xers and baby boomers.

Pre-COVID, millennials were already struggling to catch up to older generations in accumulating adequate wealth and retirement resources. Many will be unable to meet traditional obligations of child rearing and elder care. At the same time, the oldest, wealthiest households are doing better than ever.

But all is not lost. While turnout in the 2018 midterms increased across the board, the most pronounced change was among millennials, whose turnout doubled from just four years prior. Per Pew Research Center, 59 percent of millennials identify as a Democrat/lean Democrat compared to only 48 percent of GenXers and boomers. Millennials appear more ready than ever to step into the political arena, and the Democratic party would do well to pay attention.

Nice post. I was checking constantly this weblog and I’m

impressed! Extremely helpful information particularly the last section 🙂 I care for such info much.

I used to be looking for this certain info for a very long time.

Thank you and best of luck. 0mniartist asmr

A person necessarily assist to make seriously posts

I would state. That is the very first time I frequented your web page and to this point?

I amazed with the analysis you made to create this particular put up incredible.

Magnificent activity! 0mniartist asmr

of course like your website however you need to check the spelling on quite a

few of your posts. Many of them are rife with spelling problems and

I to find it very bothersome to tell the reality

however I will definitely come back again. 0mniartist asmr

There’s definately a great deal to know about this issue.

I really like all of the points you have made. 0mniartist asmr

This site was… how do I say it? Relevant!! Finally I’ve found something that helped me.

Kudos! asmr 0mniartist

Write more, thats all I have to say. Literally, it seems as though you relied on the video

to make your point. You clearly know what youre talking about, why

waste your intelligence on just posting videos to your weblog when you could be

giving us something enlightening to read? 0mniartist asmr

I’m gone to tell my little brother, that he should also pay a visit this website on regular basis to obtain updated from most recent gossip.

0mniartist asmr

Quality articles is the crucial to be a focus for the viewers to visit the site, that’s what this web site is providing.

0mniartist asmr

Howdy! I know this is kind of off topic but I was wondering if you knew where I could locate a captcha plugin for

my comment form? I’m using the same blog platform as yours and

I’m having difficulty finding one? Thanks a lot! asmr 0mniartist

free adult dating sites

dating seiten

It’s going to be finish of mine day, except before

finish I am reading this great article to increase my know-how.

Very nice post. I just stumbled upon your blog and wished to say that I’ve truly enjoyed surfing around your blog

posts. After all I’ll be subscribing to your feed and I

hope you write again very soon!

My web site – ok388 11

Thanks for finally writing about > Economic Impact of COVID on Millennials < Loved it!

my website: greatwall99 ios download

Hey there! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard

on. Any recommendations?

Look at my webpage :: demo greatwall99

I got this web page from my pal who told me concerning this web site

and at the moment this time I am browsing this website and reading very informative posts at this place.

My blog post … mobile joker123

You’ve made some good points there. I checked on the net to find out more about the issue and found most individuals

will go along with your views on this web site.

Look at my site … mega888 apk ios download

each time i used to read smaller posts which as well clear their motive,

and that is also happening with this article which I am reading at this

time.

My website: sky777 pc download

Ridiculous quest there. What occurred after? Good

luck!

Review my web-site test id ace333

Wonderful website you have here but I was curious about if you knew of any

user discussion forums that cover the same topics talked

about in this article? I’d really love to be a part of online community where I can get feed-back from other experienced individuals that share

the same interest. If you have any recommendations,

please let me know. Appreciate it!

Also visit my web-site love138 Vip

Howdy! I could have sworn I’ve been to this site before but after checking through

some of the post I realized it’s new to me.

Anyways, I’m definitely delighted I found it and I’ll be bookmarking and checking back often!

Here is my blog :: http://smfpt2.smfpt.net/index.php?action=profile;u=41621

Right here is the right website for anyone who wants to find out about this topic.

You realize a whole lot its almost hard to argue with you (not that

I actually would want to…HaHa). You certainly put a brand new spin on a topic which has been discussed for a long time.

Wonderful stuff, just wonderful!

My blog post; smfpt2.smfpt.net

Hello! I know this is somewhat off topic but I was wondering if you knew where I could get

a captcha plugin for my comment form? I’m using the same blog platform as yours

and I’m having trouble finding one? Thanks a lot!

Also visit my page – shaboxes.com

Thanks for the good writeup. It in truth used to be a leisure account it.

Glance complicated to far introduced agreeable from you!

However, how can we keep in touch?

Have a look at my web site: shaboxes.com

Appreciating the time and effort you put into your website and in depth information you provide.

It’s good to come across a blog every once in a while that

isn’t the same out of date rehashed information. Great read!

I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

I loved as much as you’ll receive carried out right here. The sketch is tasteful,

your authored subject matter stylish. nonetheless, you command get bought an nervousness over that you wish be delivering the following.

unwell unquestionably come more formerly again since exactly the same nearly very often inside case you shield this increase.

Stop by my web site :: http://www.shltaxi.com

Hey there! I’m at work surfing around your blog from my new iphone!

Just wanted to say I love reading through your blog and look forward to all your posts!

Carry on the outstanding work!

My web blog; https://rectherapydirectory.com/community/profile/paltridgefreder/

My partner and I stumbled over here different web address and thought I

should check things out. I like what I see so now i’m following you.

Look forward to looking over your web page repeatedly.

my homepage; http://www.lifeadventureexplore.com

I simply needed to thank you so much all over again. I do not know the things I could possibly have implemented in the

absence of the entire tricks documented by you relating to this theme.

Certainly was a real troublesome case in my view, however

, encountering the specialized technique you

dealt with the issue took me to weep with

contentment. I will be happier for this work and

as well , hope that you know what a powerful job your are

getting into educating people today using your websites. Most

probably you’ve never encountered all of us.

Also visit my blog: https://chuangkeup.com/home.php?mod=space&uid=100021&do=profile&from=space

Hi there, simply became alert to your blog thru Google, and found that it’s really informative.

I am going to watch out for brussels. I will be grateful if you

happen to continue this in future. Many other folks

might be benefited from your writing. Cheers!

Check out my web page: exterminatorsouthflorida.com

Hey There. I discovered your weblog using msn. That is a really well written article.

I’ll make sure to bookmark it and come back to learn more of your useful info.

Thank you for the post. I will certainly return.

Thanks for any other informative website. The place else may I am getting that kind of information written in such an ideal method?

I’ve a venture that I am simply now working on, and I have been at the

look out for such info.

Excellent blog! Do you have any suggestions for aspiring writers?

I’m hoping to start my own site soon but I’m a little lost on everything.

Would you recommend starting with a free platform like

Wordpress or go for a paid option? There are so many choices out there that I’m completely

confused .. Any recommendations? Cheers!

Today, while I was at work, my sister stole my iPad and tested to see if it can survive a 40 foot drop, just so she can be a youtube sensation. My apple ipad is now broken and

she has 83 views. I know this is completely off topic but

I had to share it with someone!

I was just searching for this info for some time. After 6 hours of continuous Googleing, finally

I got it in your web site. I wonder what’s the lack of Google strategy that don’t rank this

type of informative web sites in top of the list. Generally the

top sites are full of garbage.

my web-site … http://www.anapapansion.ru

Awesome post.

my website kebe.top

Definitely, what a splendid site and enlightening posts,

I definitely will bookmark your website.All the Best!

Also visit my web-site – http://www.1stanapa.ru/modules.php?name=Your_Account&op=userinfo&username=MilerumAndres

tinder login, what is tinder

tinder website

Perfect piece of work you have done, this site is really cool with wonderful information.

my homepage http://www.canmaking.info/

Hello there! Would you mind if I share your blog with my facebook group?

There’s a lot of people that I think would really enjoy your content.

Please let me know. Thanks

I was recommended this website by my cousin. I am not sure whether this

post is written by him as nobody else know such detailed about my

trouble. You are incredible! Thanks!

My website; http://payfirstsolutions.com/UserProfile/tabid/57/userId/368428/Default.aspx

These are really enormous ideas in about blogging.

You have touched some good factors here. Any way keep

up wrinting.

Stop by my web site – http://payfirstsolutions.com

Excellent article. I will be facing many of these issues as well..

Wonderful goods from you, man. I have take into accout

your stuff prior to and you are simply too excellent.

I actually like what you have got here, really

like what you’re stating and the best way during which you are saying

it. You are making it entertaining and you continue to care for to keep it sensible.

I cant wait to learn far more from you. That is really a wonderful site.

my webpage … http://haojiafu.net/forum.php?mod=viewthread&tid=435516

You made some nice points there. I did a search on the subject and found most persons will go along with with your website.

Also visit my web-site :: http://19wujian.com/thread-116141-1-1.html

I truly love your website.. Great colors & theme.

Did you develop this web site yourself? Please reply back as I?m hoping

to create my very own site and would like to find out where you got

this from or just what the theme is called.

Kudos!

my web blog – oigari.com

It’s really very complicated in this busy life to listen news on TV, thus I just use internet

for that reason, and obtain the hottest news.

Hello there! Do you know if they make any plugins to assist

with Search Engine Optimization? I’m trying to get my blog to

rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Many thanks!

Hello very nice web site!! Man .. Excellent ..

Wonderful .. I will bookmark your blog and take the feeds additionally?

I am satisfied to find numerous helpful info right

here in the publish, we need work out more techniques on this

regard, thank you for sharing. . . . . .

tinder dating app , tinder online

tinder date

buy cialis online

Wonderful, what a web site it is! This web site gives helpful facts

to us, keep it up.

My web page; http://www.mental-health.sbm.pw

Hello my loved one! I want to say that this post is awesome, nice written and include approximately all vital infos.

I’d like to see extra posts like this .

Stop by my homepage :: http://atomy123.cn/forum.php?mod=viewthread&tid=96708

Whoa! This blog looks exactly like my old one! It’s on a totally

different topic but it has pretty much the same page layout and

design. Superb choice of colors!

Feel free to surf to my blog post: 2xueche.com

I need to to thank you for this fantastic read!! I certainly

loved every bit of it. I have got you bookmarked to

check out new things you post?

My blog post http://atomy123.cn

Recently I’ve quoted some of the more negative emails and comments people have sent me…But today I thought I’d share some of the positive ones that I’ve got over the last two days:

One of my big goals with Two Step Speaking is to make it as practical as possible, and actually get you DOING the process I teach, as you go through the course.

카지노사이트

Too many courses I’ve seen in the past just give you a lot of information… but don’t actually tell you what to do with it.

Thank you for the great work you have done in 2SS course, it’s way more than just an English course. Joining this course is the best thing happened to me since a long time!

바카라사이트

Thanks Ahmad!And this is my *other* big goal with Two Step Speaking.This is my *other* big goal with Two Step Speaking.I don’t want you to just improve your English.

I want you to really think about how English can bring you success… make your life better… really think about what you can DO in English. And use the language to get that success, to make your life better, and to do all the things you want.

카지노

What’s Taking place i am new to this, I stumbled upon this

I’ve discovered It positively useful and it has aided me out loads.

I am hoping to contribute & help other customers like its helped me.

Good job.

My web-site: http://211.159.150.117/dz34utf8_zimeidi/upload/forum.php?mod=viewthread&tid=54591

I wish to voice my admiration for your kind-heartedness supporting those individuals that

really need help with this important subject matter.

Your special dedication to getting the message along had become certainly important and has empowered employees just like me to get to their objectives.

Your new interesting help can mean a lot to me and much more

to my office workers. Thank you; from everyone of us.

my web page; frun-test.sakura.ne.jp

I want to show some appreciation to the writer just for bailing me out of this type of predicament.

As a result of surfing around throughout the the web and meeting advice that were

not powerful, I figured my entire life was done.

Living without the presence of approaches to the problems you have fixed by way of your good article content is

a serious case, and those that might have in a wrong way damaged my career if I hadn’t

noticed your web site. Your mastery and kindness in maneuvering everything was tremendous.

I don’t know what I would have done if I had not come

upon such a solution like this. I can also at this

moment look forward to my future. Thanks so much for your professional

and amazing guide. I won’t be reluctant to refer your blog to any individual who needs guidelines on this

area.

Also visit my web site … http://cs.yyqyt.com

Hello to every body, it’s my first visit of this web site;

this website includes amazing and genuinely good material in support of readers.

Feel free to surf to my web site: kebe.top

tinder dating app , tinder sign up

http://tinderentrar.com/

Hello! I just wish to offer you a big thumbs up for

your great info you have got here on this post.

I am coming back to your web site for more soon.

Feel free to surf to my website :: http://discuz.e70w.com/

Inspiring story there. What occurred after? Take care!

My web page; https://www.taldykurgan.com/

scoliosis

An outstanding share! I have just forwarded this onto a friend who has been conducting a little research on this.

And he in fact ordered me lunch because I stumbled upon it

for him… lol. So allow me to reword this…. Thanks for

the meal!! But yeah, thanx for spending time to talk about this subject here

on your internet site. scoliosis

scoliosis

Thanks for sharing such a fastidious thought, paragraph is pleasant, thats why

i have read it completely scoliosis

In service rent.today you can rent game Call of Duty: Black Ops Cold War for Xbox ONE

And many other games 1 day/1$.

– – – –

https://rent4.today/call-of-duty-black-ops-cold-war-xbox-one

– – – –

Rent4.today – это сервис аренды игр для Xbox ONE.

Call of Duty: Black Ops Cold War можно взять в аренду всего за 1 день/1$

call of duty black ops зомби

scoliosis

I visited various blogs but the audio quality for audio songs existing at this site is truly superb.

scoliosis

dating sites

Hey I know this is off topic but I was wondering if you knew of

any widgets I could add to my blog that automatically tweet my

newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe

you would have some experience with something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

free dating sites https://785days.tumblr.com/

free dating sites

Great beat ! I would like to apprentice while you

amend your web site, how can i subscribe for a blog web

site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast offered

bright clear idea free dating sites

There is evidently a bunch to realize about this. I assume you made various nice points in features also.

Here is my web-site http://www.atomy123.com

I like this web blog it’s a master piece! Glad I found this on google.

Here is my homepage … grazebo.com

We stumbled over here coming from a different page and thought I may as well check things out.

I like what I see so i am just following you. Look forward to

finding out about your web page yet again.

У нас Вы можете найти

плитка ariostea

I?m amazed, I must say. Rarely do I come across a

blog that?s equally educative and engaging, and let me tell you, you have hit the

nail on the head. The problem is an issue that too few people are speaking

intelligently about. I am very happy I came across this in my hunt for something concerning this.

Here is my web page; frun-test.sakura.ne.jp

Hi there this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you

have to manually code with HTML. I’m starting a blog soon but have no coding expertise

so I wanted to get advice from someone with experience.

Any help would be enormously appreciated!

Look into my website … forum.adm-tolka.ru

Hello there I am so excited I found your webpage, I really found you by accident, while I was

searching on Digg for something else, Anyhow I

am here now and would just like to say many thanks for a tremendous post and a

all round interesting blog (I also love the theme/design), I

don’t have time to go through it all at the minute but I have bookmarked it and also added your RSS feeds,

so when I have time I will be back to read more, Please do keep up the fantastic work.

If you wish for to get a good deal from this piece of writing then you

have to apply such methods to your won blog.

xbox игры купить Рыбинск https://rent4.today

xbox игры купить Нальчик

We’re a group of volunteers and opening a new scheme in our

community. Your site offered us with valuable info to work on. You have done a formidable job

and our whole community will be grateful to you.

Большой выбор плитки, в том числе и

плитка fanal

I’m pretty pleased to uncover this web site. I wanted to thank

you for ones time for this particularly

fantastic read!! I definitely appreciated every part of it

and i also have you saved as a favorite to look at new things in your website.

Keep up the excellent piece of work, I read few posts on this site and I conceive that your website is really interesting and contains circles of wonderful information.

My homepage … http://www.cookingwithkent.com

Wonderful post however , I was wanting to know if you could

write a litte more on this subject? I’d be very thankful if you could elaborate a little bit further.

Many thanks!

Do you mind if I quote a few of your posts as long as I provide credit and sources back to your webpage?

My blog is in the very same niche as yours and my visitors would

genuinely benefit from a lot of the information you provide here.

Please let me know if this okay with you.

Regards!

I have been checking out a few of your stories and it’s pretty nice

stuff. I will surely bookmark your site.

Feel free to visit my web blog … https://www.memorytoday.com/modules.php?name=Your_Account&op=userinfo&username=TerrellRosie

Hi, its fastidious article about media print, we all be aware of media is

a enormous source of information.

Here is my webpage: http://bbs.pdmao.com/home.php?mod=space&uid=283907&do=profile&from=space

Hey very nice blog!

Great work! That is the type of information that are supposed to

be shared across the internet. Disgrace on the seek engines for now not positioning this

publish upper! Come on over and visit my web site .

Thank you =)

Feel free to visit my website :: http://www.kg69.com

Oh my goodness! Awesome article dude! Thanks, However I am having issues with your

RSS. I don’t know the reason why I am unable to subscribe to it.

Is there anybody else having the same RSS issues? Anyone that knows the

solution can you kindly respond? Thanks!!

Топовая плитка

плитка saloni

cialis cheapest online prices

Buy Chivalry 2 https://rent4.today/Chivalry-2-Xbox-ONE

sildenafil 30 mg

Купить NINJA GAIDEN: Master Collection Xbox ONE https://rent4.today/NINJA-GAIDEN-Master-Collection-Xbox-ONE

cheap generic viagra online pharmacy

apply for payday loan online

personal loan bad credit

payday advance

tadalafil for sale uk

I love your writing style truly enjoying this web site.

Here is my page; Fiona

дам займ под залог недвижимости mailer24.ru

alternatives to payday loans

buy motilium

payday money

faxless payday loan same day

cialis online ordering

payday loan com

personal loans unsecured

cialis us pharmacy

payday loans no debit card

cash express loans

buy modafinil online us

personal loans for bad credit

payday loans in philadelphia

cash fast loan

cialis generic 60 mg

loan broker

Добрый день, коллега!

Хотите узнать Всех контрагентов Ваших конкурентов?!

Мы вам в этом поможем. Напишите нам по контактам ниже и получите информацию о том Кто, Что, Когда и по какой Цене покупал или продавал конкурирующей компании.

Тем самым вы открываете для себя уникальную возможность сделать более выгодное предложение своим будущим контрагентам или получить лучшего Поставщика.

Наглядный пример отправим по запросу.

На эту почту отвечать не нужно.

Пишите по контактам ниже:

Email: konsaltplus24@gmail.com

Telegram: @Consalting24

P.S.: Увеличьте свои продажи за счёт информации о контрагентах ваших конкурентов!

need money now

how to get viagra in india

viagra coupon discount

kamagra

purchasing cialis online

I saw a lot of website but I believe this one has something special in it.

Check out my blog post … http://bogema.anapacenter.info/

how to purchase viagra in uk

buy generic cialis paypal

Yeah bookmaking this wasn’t a risky decision great post!

My webpage; xajm168.com

no fee payday loans

buy pfizer viagra

online loans no credit

Pingback: cialis with dapoxetine

generic sildenafil paypal

Pingback: what is viagra

payday loans from direct lenders

payday loans salem oregon

Топовая плитка

плитка grespania

payday loans california

Pingback: tadalafil 5 mg

Pingback: cialis cost 20mg

online payday advances

Pingback: sildenafil cost costco

Pingback: viagra sale

Pingback: snorting gabapentin

Pingback: tadalafil 10mg cost

smart loans

Pingback: generic levitra 100mg

direct lenders for payday loans 100 approved

Valuable info. Fortunate me I found your site accidentally,

and I’m surprised why this twist of fate did not took place earlier!

I bookmarked it.

Feel free to surf to my site: Nancee

Pingback: viagra warnings

Pingback: warnings for amlodipine

lenders for bad credit

Pingback: atorvastatin 40mg

12 month loans

personal loan forms

Pingback: meloxicam warnings

loans for good credit

Pingback: metoprolol tartrate 25mg

Pingback: losartan side effects

100 guaranteed approval payday loans

Pingback: viagra wikipedia

Pingback: cialis copay card

Pingback: levitra

Pingback: interactions for cymbalta

italian pharmacy online

Pingback: steroids prednisone

quick cash loans

Pingback: amitriptyline for migraines

Pingback: interactions for hydrochlorothiazide

Pingback: why is metformin dangerous

modafinil online usa

Pingback: mirtazapine appetite stimulant

Pingback: bupropion hbr

Pingback: buspar medicine

Pingback: celexa dosage

Pingback: zanaflex 6 mg

Pingback: bupropion side effects

buy genuine viagra online canada

doxycycline 100 mg tablet cost

cash advance texas

mortgage

Pingback: diclofenac injection

Pingback: clonidine for anxiety dosage

200 online payday loans

Pingback: side effects for finasteride

take out a loan

Pingback: metronidazole cream

money quick

loan application template

Большой выбор плитки, в том числе и

плитка love ceramic tiles

online installment loans

quick payday loans

loans default

Pingback: cialis results

Pingback: sildenafil and tamsulosin

Pingback: tadalafil india pharmacy

Pingback: sildenafil for sale

Pingback: levitra by mail

cialis online singapore

quick money

get payday loan online

essay writing essay writer online

essay writers online essay bot

buy dissertation essay writer online

us essay writers write my paper for me

paper writer writing paper

us essay writers essay writing

narrative essay help do your homework

essay writers help with writing paper

my college help with writing an essay

argumentative essay essay outline

dissertation help online best essay writer

college essay writing service how to do your homework

auto essay typer writing essays help

write my essay generator college essay prompts

thesis writing help auto essay typer

best canadian cialis

Sweet site, super design and style, rattling clean and

employ genial.

Here is my webpage http://Hu.Feng.Ku.Angn.I.Ub.I.xn.xn.U.K37@cgi.members.interq.or.jp/ox/shogo/ONEE/g_book/g_book.cgi

lasix on line

canada cialis over the counter

payday loans online direct lenders

best tadalafil tablets

tadalafil medication

viagra online pfizer

no credit loans

ace cash express

rx sildenafil tablets

Pingback: acyclovir 400 mg tablet

I really like and appreciate your post.Really looking forward to read more. Awesome.

Pingback: amoxicillin allergy

Pingback: aricept other names

Pingback: augmentin suspension

Pingback: zithromax 250 mg cost

cash til payday

bad credit installment loans guaranteed

Pingback: cefdinir side effects

Pingback: cephalexin uses

Pingback: clindamycin dosing

Pingback: zithromax tablets price

credit loans no credit

z-pack antibiotics buy azithromycin online finance what is zithromax zithromax 500mg

azitromycine azitromycine zithromax 500mg zithromax side effects

cash in 1 hour

augmentin for sale

payday loan florida

payday loan in california

loan request

generic viagra soft tabs online

Pingback: cheapest cialis review

Pingback: cialis patent

Pingback: cialis paypal australia

Pingback: sildenafil 100mg

canadian drugstore viagra online

can i order cialis online

cialis 100mg for sale

Pingback: price of cialis pills

buhar makinesinde ventolin nasД±l kullanД±lД±r buy ventolin inhalers ventolin tablet fiyat

que diferencia hay entre ventolin y salbutamol buy ventolin nebules 5mg online ventolin images

ventolin nebules harga where can i buy ventolin over counters how much is ventolin without insurance

Pingback: vardenafil 40 mg generic

onset and duration of ventolin ventolin generic release date il ventolin effetti collaterali

Pingback: sophia viagra

ventolin syrup spc buy ventolin inhaler online can i buy ventolin in the uk

ventolin dosage 2 year old buy ventolin inhaler asda ventolin w ciД…Ејy

ventolin what is it used for order ventolin online uk is ventolin hfa safe during pregnancy

ventolin 3 puffs buy ventolin inhalers uk indications for ventolin

viagra canadian

can ventolin make you fat where to buy ventolin in singapore prescription for ventolin

ventolin respirator solution 0.5 generic form of ventolin ventolin 200 mg bijsluiter

how to use a ventolin inhaler correctly where can i buy a ventolin inhaler camiseta darth vader ventolin

Топовая плитка

плитка undefasa

harga ventolin salbutamol is ventolin generic que es el ventolin salbutamol

viagra tablets online chennai viagra kapszula which pill works better viagra or cialis

lowest price of viagra are viagra illegal viagra take on empty stomach

pfizer viagra online shop generic viagra online paypal viagra versus generic viagra

od on viagra viagra cafeine cialis vs viagra australia

viagra allowed through customs taking nitroglycerin and viagra viagra mavi hap

golden viagra tablets how long before should you take viagra mental viagra

viagra phenomenon fake viagra vs real viagra is 23 too young for viagra

viagra and skin cancer study viagra stroke victim viagra for sale in chicago

Please let me know if you’re looking for a author for your blog.

You have some really great articles and I feel I

would be a good asset. If you ever want to take some of the load off, I’d really

like to write some articles for your blog in exchange for a link back to mine.

Please shoot me an e-mail if interested. Thanks!

my site :: Gaia’s Choice CBD Reviews

what is the prescription for viagra citrulline and viagra drug interaction of viagra

more effective viagra or cialis are viagra illegal viagra meaning tamil

abeka 9th grade science book Diminuer Le Temps De Ses Gratuitement green book by rehan allahwala pdf

can viagra stop you getting pregnant viagra cialis kaina can you take viagra with stomach ulcers

how to make viagra effective where to buy viagra in pretoria viagra how long to take before

patent life of viagra best ayurvedic viagra in india safer than viagra

uk med viagra will viagra keep you erect after ejaculation viagra in agra

can you drink alcohol when on viagra viagra 100 indicazioni how often you can use viagra

viagra 711 harga viagra 25mg is viagra help premature ejaculation

spot viagra 500x how quickly will viagra work taking viagra beta blockers

generic viagra gel are viagra illegal viagra for sale philippines olx

viagra opiumwet 9gag viagra prospecto viagra 100

viagra citrulline buy viagra online free shipping viagra cancer treatment

tadalafil 20mg buy tadalafil online generic cialis

mixing arginine and viagra interaction between warfarin and viagra cutting 50 mg viagra half

buy viagra geylang pharma apotheke viagra mad about you paul takes viagra

thailand medikamente viagra puscifer v is for viagra rar something like viagra at gnc

viagra sans ordonnance paypal 27 year old on viagra buy generic viagra cheap

viagra at the age of 25 puscifer v is for viagra rar viagra sur prescription

buy tadalafil 20mg price cialis tadalafil cheap tadalafil

purchasing viagra in usa viagra echeck viagra toll free number

best results with viagra cheap online pharmacy viagra viagra and ginseng

buy viagra pills online uk

buy viagra in blackpool viagra kapszula viagra pret md

buy viagra pattaya viagraxif chewable viagra 100mg

buy generic viagra order viagra viagra overnight

cialis or viagra generic super viagra reviews herbal blue viagra

viagra frozen embryo transfer lizenz viagra viagra packaging pfizer

sharing viagra with wife nepal viagra available proper age to take viagra

viagra male impotence drugs what happens snort viagra how to smuggle viagra on a plane

viagra prescription australia

viagra for sale cape town how soon viagra take effect taking cialis and viagra

effects of viagra generic viagra sildenafil viagra tablets for sale

what is a viagra yahoo answers viagra blaue kapsel viagra bestellen in buitenland

drugs from canada to usa Bupron SR discount viagra canadian pharmacy

recevoir cialis rapidement viagra cialis trial pack cialis dissolve in mouth

ooOO difference entre cialis levitra cialis dosing ez online pharmacy buy cialis usa

lilly cialis pills tadalafil generic date ordina cialis

Pingback: cialis patent expiration 2016

cialis for everyday use cialis how to get a prescription cialis online new york

buy original cialis cheap tadalafil 5 mg cialis pharmacy online uk

Pingback: cialis side effects dangers

medical uses for cialis cialis blood pressure generic cialis pills

cvs pharmacy online shopping mexican pharmacy online medications vardenafil

Pingback: female viagra

viagra cialis doctissimo cialis macam cialis

buy generic cialis no prescription

cialis copay coupon tadalafil 5mg half life cialis

Pingback: cheapest viagra 100mg

cialis campaign tadalafil india 10 mg cialis flying

viagra pills cheapest brand viagra viagra use

Pompe Huile 12v Geant Casino Travailler Dans Un Casino Haram Company Casino Login

why is cialis prescribed tadalafil order online no prescription cialis for ms

cialis meno caro cialis pill new cialis packaging

empire plan cialis tadalafil tablets ip 20 mg research chemical cialis

macam cialis taldenafil cialis on line recensioni

where can i get modafinil uk

cialis nettikaupasta tadalafil 20mg jual cialis 50mg

ooOO cialis paid by insurance cheap online cialis research chemical cialis

cialis from europe tadalafil 10mg hoe vlug werkt cialis

tricare online pharmacy canadian pharmacy residency tour de pharmacy watch online

cialis viagra levitra hangisi 5 mg cialis cialis contre viagra

rapaflo vs cialis tadalafil tablets ip 20 mg cialis preise wien

caffeine effect cialis tadalafil india 10 mg generique cialis 40 mg

cialis 5 mg resultados tadalafil india 10 mg cialis ensenada

cialis in nz tadalafil citrate levitra cialis viagra hangisi

prxshop products cialis tadalafil price from india normale dosis cialis

when cialis goes generic lowest price tadalafil cialis 5mg online

discount viagra cialis generic tadalafil from uk preco viagra cialis levitra

Pingback: indian viagra

buy real cialis online tadalafil 10 mg coupon cialis make bigger

cialis in england bestellen tadalafil liquid jual cialis bali

cialis male infertility cost of tadalafil 10mg brand cialis buy online

correct dose of cialis erectafil from india online viagra cialis levitra

cialis hypertonie tadalafil generic date venda cialis brasil

cialis gegen hohen blutdruck tadalafil generic date cialis codziennie

cialis marokko tadalafil order online no prescription cialis online pagamento contrassegno

does cialis help prostate problems tadalafil 10mg medicamentos cialis

ivermectin 1%

nolvadex cialis taldenafil cialis cagliari

cialis receptfritt tadalafil tablets ip 20 mg priser cialis

price of cialis without insurance tadalafil 10 mg coupon cialis following radical prostatectomy

what is best viagra cialis or levitra erectafil from india bad batch of cialis

cialis increase vascularity 5 mg cialis cialis 5 mgs

cialis drowsiness taldenafil cialis for 36 hours

drugs like viagra cialis tadalafil india 10 mg does cialis help bph

Pingback: sildenafil citrate 100mg

cialis 5 mg discount card prescription tadalafil online does cialis make you hornier

Pingback: sildenafil tabs 20mg

cialis classe c 80mg tadalafil pilule cialis generique

cialis ha effetto ritardante tadalafil citrate cialis generico pt

Pingback: sildenafil recall

Pingback: sildenafil cheapest price

sildenafil buy cheap

buying viagra without prescription

Yesterday, while I was at work, my cousin stole my iphone and tested to see if it can survive a forty foot drop, just so she

can be a youtube sensation. My iPad is now destroyed and

she has 83 views. I know this is completely off topic

but I had to share it with someone!

my web-site … Nitro Strive Review

is cialis used for enlarged prostate medicament tadalafil which pill is better viagra cialis or levitra

cialis neue indikation tadalafil online with out prescription cialis guadalajara jalisco

cialis greek tadalafil uk prescription buy cialis online cheap

cialis generique uk tadalafil walmart viagra levitra cialis confronto

cadastro programa cialis diario tadalafil online cialis colissimo

cialis ogloszenia tadalafilo cialis benzeri

Pingback: norvasc amlodipine

Pingback: cialis walmart price

Pingback: levitra patent

tadalafil 20 mg buy online

certainly like your web site but you have to check the spelling on quite a few of your posts.

A number of them are rife with spelling problems and I in finding it very bothersome to inform the reality on the other hand I’ll definitely come again again.

Visit my web site :: Testo Fit Extreme Pills

azithromycin uses what is azithromycin side effects for azithromycin azithromycin antibiotic class

zithromax 500mg zithromax for chlamydia what is azithromycin prescribed for zithromax dosage

Pingback: metformin and alcohol

buy azithromycin online finance what is zithromax z-pack antibiotics buy zithromax cart

Pingback: cialis 5mg tablets

buy azithromycin online finance what is zithromax zithromax for uti buy azithromycin

zithromax uses azitromicina buy azithromycin cart zitromax

azitromycine zithromax dosage azytromycyna azithromycin online

what is azithromycin prescribed for zithromax side effects zithromax for uti azithromycin online

zithromax 500mg azithromycin azithromycin azithromycin and alcohol

zithromax 250 mg azitromycine azithromycin interactions buy zithromax online

what is azithromycin azithromycin online zithromax zithromax for uti

vidal cialis 5 mg tadalafil mylan cosa contiene cialis

le nouveau cialis side effects for tadalafil cialis reacciones

cialis prodotto in italia tadalafila cialis health problems

cialis generique livraison express canadian pharmacy us tadalafil cialis flying

39 Rue Du Casino 65130 Capvern France Fleuron Des Gourmets Vin Jaune Casino Too Good To Go Casino

cialis venda online brasil sildenafil medication liquid cialis kick in

how much does cialis cost in nz tadalafil interactions cialis 5 mg et hbp

cialis viagra or levitra tadalafil without a doctor prescription bulk cialis

azithromycin interactions zitromax azithromycin and alcohol buy azithromycin online finance

cialis pattaya tadalafil uk prescription cialis buy cheap

cialis 5mg vaikutus best tadalafil generic cialis impotenz

azithromycin and alcohol azithromycin tablet zithromax for chlamydia buy azithromycin online finance

cialis 5 mg vantaggi tadalafil mylan cialis vs viagra effectiveness

cialis im internet bestellen tadalafil sandoz cialis uit india

azithromycin interactions azithromycin zithromax zithromax 250 mg zithromax online

zithromax side effects buy zithromax buy zithromax online zithromax for chlamydia

cialis fast heart rate tadalafil walmart proper dose for cialis

cialis cause constipation tadalafilo funciona cialis mujeres

cialis copay coupon tadalafil interactions does cialis cause palpitations

equivalent natural cialis tadalafil side effects cialis price with insurance

cialis pharmacy pattaya sildenafilo cialis caida cabello

azithromycin online azithromycin side effects zithromax for uti zithromax for covid

cialis generico italia tadalafil alternative cialis eczanelerde bulunurmu

azitromicina azithromycin warnings zithromax for chlamydia what is azithromycin

propecia cost in india

online generic cialis review cialis generico jual cialis cod bandung

buy zithromax cart buy zithromax online azithromycin online azithromycin tablet

cialis prijs nederland where to get tadalafil does cialis really expire

you are best, very nicee blog yoourr amazing site.

cialis bluelight best price usa tadalafil cialis neck rash

cialis vodka tadalafil interactions cialis novartis

side effects of azithromycin zithromax online zithromax for uti buy azithromycin online

differences between viagra cialis levitra medicament tadalafil cialis chemist direct

buy generic cialis online usa tadalafil lilly review cialis vs viagra

azytromycyna azithromycin tablet azithromycin and alcohol buy zithromax

cialis in italien side effects for tadalafil cialis prospect pret

cialis propiedades sildenafil vs tadalafil best online cialis pharmacy

viagra or cialis which is best medicament tadalafil je cherche cialis

azitromycine z-pak zithromax z pak zithromax side effects

cialis klaipeda where to order tadalafil tablets cialis muadili nedir

levitra cialis or viagra where to order tadalafil tablets cuanto cuesta cialis 5 mg

Pingback: amoxicillin for uti

zithromax antibiotic zithromax for covid what is azithromycin prescribed for azithromycin zithromax

cialis werbung sildenafil vs tadalafil cialis kargo

zithromax over the counter z-pack zithromax 250 mg azithromycin dosage

Pingback: doxycycline mono 100mg cap

azithromycin antibiotic class zithromax for uti zithromax online azithromycin side effects

cialis nyc tadalafil krka prix cialis brand name vs generic

Pingback: furosemide medication

experience with cialis tadalafil interactions kinetic international cialis

buy zithromax online azithromycin zithromax azithromycin tablet azithromycin side effects

cialis no me corro tadalafil prix difference cialis et cialis professional

Pingback: xenical price australia

cialis viagra preis where to order tadalafil tablets cialis bph ed

Pingback: priligy price usa

cialis by internet tadalafil lilly cialis head rush

Pingback: proscar nz

azithromycin side effects azithromycin interactions buy zithromax zithromax for uti

disi yakaris cialis where to get tadalafil cialis honeymoon

zithromax side effects zithromax zithromax dosage azithromycin price

cialis cheap india tadalafil prix cialis kaskus

viamedic cialis tadalis sx tadalafil new cialis packaging

ivermectin 3 mg dose

cialis etymology tadalafil walmart interazione cialis cardioaspirina

cialis 40 mg italia canadian pharmacy us tadalafil cialis lexotan

cialis good for bodybuilding tadalafil prix pharmacie cialis 5 mg nasil kullanilir

cialis c20 effects sildenafil vs tadalafil cialis drug prices

25 mg viagra cost

cialis online pharmacy ratings cost tadalafil generic difference cialis viagra levitra

Pingback: careprost usa seller

Pingback: using clomid for ivf

azithromycin azytromycyna zithromax side effects buy azithromycin online finance

Pingback: diflucan single dose

azithromycin and alcohol zithromax zithromax z pak azithromycin antibiotic class

Pingback: domperidone 10mg side effects

azitromycine zithromax antibiotic zithromax covid what is zithromax

buy zithromax what is zithromax zithromax generic name zithromax dosage

z-pack antibiotics side effects of azithromycin what is azithromycin zithromax z-pak

azithromycin zithromax generic name side effects of azithromycin zithromax

yoou are best, very nicee blog yyour amazing site.

generic cialis over the counter

australia online pharmacy free shipping

buy levitra 100mg

zithromax side effects zithromax for uti buy azithromycin online azithromycin and alcohol

zithromax generic name zitromax azitromicina zithromax z-pak

cheap cialis overnight

viagra online quick delivery

zithromax z-pak buy zithromax azithromycin dosage buy azithromycin cart

viagra 25 mg no prescription

azithromycin interactions buy zithromax online zithromax dosage z-pack antibiotics

Pingback: tamoxifen retinopathy oct

buy brand cialis

buy cialis eu buy cialis in portugal cialis c800

cialis 0 5 online buy cialis in berlin different milligrams of cialis

what is zithromax zithromax 250 mg zithromax for covid azithromycin tablet

cialis before prostatectomy buy cialis india online cialis magnesium

Pingback: prednisolone versus prednisone dosing

cialis 5 mg india buy cialis bangkok pharmacy cialis fatty food

Pingback: naltrexone cost

ivermectin buy online

Pingback: valacyclovir 1gm m123

levitra vs cialis buy cialis in chiang mai cialis online phone number

internetapotheke cialis buy cialis in phuket cialis 5mg pharmacie

sildenafil citrate tablets 100mg

azithromycin interactions azithromycin dosage azithromycin tablet buy azithromycin online finance

Pingback: tizanidine and seizure

order viagra online canada mastercard

cialis tadalafil 20mg

buy zithromax azithromycine zithromax uses azithromycin over the counter

cialis tablets for sale

zithromax generic name azithromycin zithromax zithromax z pak buy azithromycin

legitimate canadian online pharmacies

buy cialis online eu buy cialis legally online buy cheap cialis discount online

buy zithromax cart z-pack antibiotics buy azithromycin cart azytromycyna

preventing cialis headache buy cialis chennai cialis generico urgente

cialis em jovens buy cialis in manila online doctor cialis

zithromax for uti azithromycin over the counter z-pak zithromax z-pak

azithromycin warnings zithromax antibiotic buy azithromycin online finance azithromycin zithromax

cialis kadikoy buy cialis gold coast cialis online new york

zithromax azithromycin tablets zithromax for chlamydia zithromax uses

generic cialis canada online

zithromax antibiotic buy zithromax online azithromycin over the counter zithromax

cialis nz price buy cialis istanbul melhor cialis levitra

generic cialis online usa

ivermectin 8 mg

cialis 5 mg dolori muscolari buy cialis generic india cialis uso prolongado

buy sildenafil india online

side effects for azithromycin azithromycin tablets buy azithromycin cart z-pack antibiotics

cialis originale online in italia buy cialis calgary costo pastillas cialis

cialis revenues buy cialis in kenya difference entre cialis original et generique

you are best, veery nicee blog your amazing sitse.

cheap generic cialis canada

cialis ricetta medico buy cialis johannesburg lilly cialis brasil

viagra price australia

efectividad cialis diario buy cialis in edmonton cialis bewertung

sildenafil generic cheap

my cialis experience buy cialis daily online cialis diario 5mg funciona

ivermectin pills canada

does cialis helps with premature ejaculation buy cialis houston cialis europa bestellen

cialis colite ulcerosa buy cialis 5mg cialis oab

cialis 5 mg fa bene buy cialis in ireland cialis viagra levitra difference

otc drugs like cialis buy cialis england fake cialis bottle

viagra cialis ecc buy cialis by phone order cialis europe

calcium d glucarate cialis buy cialis california insurance will not cover cialis

best rated canadian pharmacy

cialis et maladies cardiovasculaires buy cialis legally online cialis penicillin

Pingback: cialis tadalafil price

Pingback: viagra and cialis

cialis generico italia pagamento in contrassegno buy cialis in pattaya cialis hakkinda bilgi

tadalafil online pharmacy

cialis via internet buy cialis greece phenibut cialis

buy online cialis 5mg

cialis over use buy cialis kuala lumpur better erection with viagra or cialis

does cialis make you go blind buy cialis doctor online generic cialis online

tadalafil 5mg online pharmacy

buy zithromax zithromax 250 mg azithromycin zithromax zithromax for covid

reputable online pharmacy for cialis buy cialis calgary cialis her eczanede bulunur mu

viagra 500mg price in india

lloyds pharmacy cialis price buy cialis ireland price of cialis in nz

z-pack antibiotics zitromax zithromax side effects what is azithromycin prescribed for

legit non prescription pharmacies

cialis no hace efecto buy cialis brisbane cialis user feedback

azithromycin and alcohol zithromax side effects z-pack zithromax z pak

cialis nz pharmacy buy cialis daily use opiniones cialis generico

vardenafil generic from canada

cialis et crise cardiaque buy cialis daily use online is generic cialis effective

azithromycin z-pack antibiotics azitromycine buy azithromycin

levitra vs cialis vs viagra cost buy cialis from us pharmacy cialis jogja

cialis 40 mg price buy cialis bangkok cialis bruise

azithromycin interactions zithromax 500mg buy azithromycin online finance buy zithromax

buy cialis generic india buy cialis daily online cialis muscular dystrophy

azitromycine zithromax z pak zithromax z-pak azithromycin warnings

zithromax dosage zithromax z pak what is azithromycin prescribed for azithromycin interactions

e cig liquid cialis buy cialis cyprus price for 5mg cialis

generic viagra uk pharmacy

cialis generic online malaysia buy cialis in melbourne cialis 5 posologie

cialis colite ulcerosa buy cialis in greece cialis without headache

other health benefits of cialis buy cialis from india online cialis 5mg lloyds

ivermectin 18mg

stromectol sales

cialis bad breath buy cialis for daily use cialis no erectile dysfunction

buy azithromycin online finance zithromax side effects azithromycin tablet azithromycin tablet

stromectol usa

stromectol ivermectin tablets

cialis cuba buy cialis generic uk cialis vs viagra effectiveness

where to buy stromectol

cost of ivermectin

stromectol oral

zithromax for chlamydia zithromax covid zithromax 500mg azithromycin and alcohol

cialis pret online buy cialis in kenya cialis how effective is it

buy ivermectin uk

ivermectin 6 mg tablets

generic cialis online in usa buy cialis india best price cialis

cialis frequency buy cialis kenya costo cialis in francia

ivermectin price canada

is cialis kosher for passover buy cialis in chiang mai interazione cialis cortisone

zithromax 250 mg zithromax for covid azithromycin warnings azithromycin and alcohol

buy ivermectin canada

stromectol canada

viagra cialis levitra buy online buy cialis in new york cialis 40 mg generico

cialis preis docmorris buy cialis 40 mg online ueberdosis cialis

ivermectin 3mg for lice

stromectol online pharmacy

ivermectin

ivermectin cream 1

zithromax z-pak azithromycin uses azithromycin interactions azithromycin uses

ivermectin 3 mg tablet dosage

cialis muy caro buy cialis 5mg online uk ramipril with cialis

stromectol ivermectin

ivermectin malaria

cialis propranolol buy cialis in italy cialis regimen

azithromycin side effects zitromax azithromycin over the counter side effects of azithromycin

can you buy stromectol over the counter

buy ivermectin pills

viagra czy cialis buy cialis 5mg online price cialis uk

price of ivermectin

ivermectin 3mg

ed cialis pills buy cialis greece cialis probleme cardiaque

purchase stromectol

zithromax side effects zithromax z pak

pastile cialis pareri buy cialis cambodia does cialis raise your heart rate

ivermectin buy

stromectol australia

generic ivermectin

cialis foggia buy cialis in france kroger price for cialis

ivermectin where to buy for humans

stromectol over the counter

order stromectol

cialis cosa contiene buy cialis johannesburg finasteride plus cialis

how much is ivermectin

Pingback: ciprofloxacin hydrochloride headache

cost of ivermectin medicine

stromectol 3 mg tablets price

cheap cialis prices buy cialis in kuala lumpur buy cialis vancouver

stromectol over the counter

cost of ivermectin cream

who is prescribed cialis buy cialis legally online cialis dosaggio consigliato

stromectol 3 mg price

Pingback: cialis on sale

stromectol tab

5mg cialis not enough buy cialis in cebu cialis for female use

ivermectin 1%cream

buy stromectol pills

stromectol pills

buy oral ivermectin

buy ivermectin cream for humans

ivermectin tablets

ivermectin

Pingback: cialis 20mg prices

where can i buy stromectol

potenza ed erezione cialis tadalafil from india 5mg cialis costo ufficiale

is viagra or cialis more expensive where can i buy cialis online usa viagra cialis probepackung

cialis 5 mg canadian online pharmacy whats better cialis viagra or levitra

where to buy stromectol

ivermectin 200

buy ivermectin pills

buy cialis oral jelly tadalafil order online no prescription cialis urgente

buy ivermectin stromectol

generic stromectol

cialis maximo efecto buy cialis reliable store efek bahaya cialis

ivermectin 5

your articles are very good and your blog site is really good

Pingback: generic tadalafil 2018

cialis increased urination cialis order online usa cialis in brazil

purchase ivermectin

generic stromectol

nouvelle molecule cialis medshuku cialis generic cialis challenge

My spouse and I stumbled over here coming from a different web address and thought I might

check things out. I like what I see so now i’m following you.

Look forward to looking at your web page yet again.

Pingback: citrate sildenafil

azitromycine buy azithromycin cart

stromectol without prescription

Pingback: viagra free samples

cialis caserta generic cialis cialis young man

cialis 5 mg par jour buying cialis online cialis for migraines

buy azithromycin zithromax z pak

stromectol ivermectin tablets

Pingback: buy viagra online

stromectol canada

levitra viagra cialis tadalafil 10 mg coupon cialis egipski

zithromax covid zithromax dosage

buy stromectol canada

cialis incontinence canadian cialis order cialis female models

ivermectin pill cost

stromectol cost

zithromax antibiotic azithromycin zithromax

cialis generico indicazioni cialis 5 cialis viagra differenze

zithromax z pak azithromycin z pack what is zithromax side effects of azithromycin

azithromycin tablets z-pack

ivermectin 3mg pill

buy stromectol online uk

cost of ivermectin 1% cream

cialis bangkok cheap cialis cialis professional vs cialis

ivermectin 3 mg

azithromycin over the counter buy zithromax azithromycin tablet azithromycin side effects

36 hour cialis mg buy real cialis online canada cialis magyar

side effects of azithromycin zithromax 500mg

cost of ivermectin 1% cream

ivermectin 2mg

pastillas impotencia cialis what is tadalafil cialis et ibuprofene

order stromectol online

azithromycin over the counter azithromycin dosage

side effects for azithromycin buy azithromycin z-pak side effects of azithromycin

stromectol ivermectin 3 mg

stromectol xl

ivermectin price

costco cialis prices buy viagra online manufacturer coupon for cialis

stromectol covid 19

ivermectin 0.2mg

zithromax 250 mg buy zithromax online

cialis lungenhochdruck tadalafila creatina cialis

azithromycin interactions zithromax z pak

cialis farmatodo generic cialis online fast shipping cialis on craigslist

stromectol uk buy

cialis valladolid order generic cialis online uk equivalente cialis in erboristeria

order stromectol online

cialis dosis diaria tadalafil sans ordonnance cialis generique brevet

zithromax 500mg z-pack

stromectol 12mg

zithromax 500mg azitromycine azithromycin price what is azithromycin

why does my insurance not cover cialis how much does cialis cost without insurance what does generic cialis mean

stromectol australia

ivermectin malaria

azithromycin online azithromycin side effects

cialis in jordan cialis daily does cialis help prostate problems

what is azithromycin prescribed for z-pack antibiotics zithromax for covid zitromax

ivermectin canada

osu cialis generique france tadalafil 5mg vardenafil viagra cialis

what is zithromax zithromax

ivermectin buy online

doc morris cialis what is cialis nadelen cialis

azithromycin price side effects of azithromycin azitromycine azithromycin tablets

zithromax over the counter azithromycin price

viagra cialis levitra kit lowest price tadalafil effet pilule cialis

price of ivermectin

azithromycin price buy zithromax

prova cialis gratis cialis 30 mg tablets cialis online with mastercard

stromectol sales

ivermectin buy australia

what is zithromax side effects of azithromycin

azithromycin price azithromycin z pack zithromax for covid buy azithromycin online

uso pastilla cialis cheap canadian drugs everyday use cialis

stromectol 3 mg price

is cialis good for bodybuilding tadalafil 5mg prices cialis ebay uk

buy oral ivermectin

ivermectin 18mg

ivermectin 5 mg price

stromectol lotion

stromectol tablets for humans

zithromax antibiotic zithromax 500mg

is cialis or levitra better interactions for tadalafil buy name brand cialis online

stromectol covid

ivermectin 0.5

stromectol 12mg

stromectol online pharmacy

zithromax z pak azithromycin z pack azitromicina azithromycin dosage

zithromax uses what is azithromycin

stromectol medicine

stromectol how much it cost

your articles are very good and your bllog site is really good

ivermectin 90 mg

doc morris cialis 5mg cialis price what gets you harder viagra or cialis

stromectol 3 mg tablets price

ivermectin for sale

zithromax for covid azithromycin online

ivermectin 9 mg tablet

cialis c20 price tadalafil from canada to usa efeitos colaterais viagra cialis levitra

ivermectin 3mg dose

stromectol cost

azithromycin azithromycin z pack azitromicina buy zithromax online

ivermectin 0.2mg

z-pak zithromax side effects

cialis baku cialis cheap cialis cialis causes chest pain

tadalafil max dose tadalafil pills 20mg what is tadalafil tadalafil generic

cialis 48 heures cialis canadian pharmacy cialis replacement

cialis generic 5mg cialis canada cialis hangi firma

ivermectin 12

tadalafil 40 mg daily tadalafil 40 mg daily buy tadalafil tadalafil pills 20mg

ivermectin 0.08%

buy ivermectin uk

ivermectin 1%

cialis 5 mg etkili mi cheapest tadalafil cost utilisation cialis 5mg

ivermectin 10 ml

ivermectin 2

ivermectin ebay

ivermectin

buy ivermectin pills

cialis cijena u bosni cialis canada fast shipping cialis use for bph

cost of ivermectin

discount prices for cialis cialis online cialis health insurance

ivermectin 2mg

ivermectin lice oral

cialis france livraison express sildenafilo cialis diario faz efeito

tadalafil max dose buy tadalafil

tadalafil gel tadalafil daily use

tadalafil tadalafil daily use

ivermectin where to buy

tadalafil gel tadalafil daily use

college essay prompts how to write essay

stromectol south africa

essay writer reddit buying essays online

viagra cialis doctissimo cialis pills for cheap cialis et infection urinaire

tadalafil tablets tadalafil pills 20mg

ivermectin 0.08 oral solution

do my homework help with writing paper

stromectol for sale

generic tadalafil tadalafil 40 mg from india

tadalafil buy tadalafil us

ivermectin generic

essay writer free doing homework

tadalafil generic tadalafil 30 mg

what is a dissertation online dissertation writing service

cialis cholesterin cialis canada buy online cialis et drogue

stromectol prices

tadalafil tablets tadalafil 40 mg daily

essaybot help writing a paper

stromectol 15 mg

tadalafil 40 tadalafil 40 mg daily

buy essay paper how to write essay

tadalafil daily use tadalafil online

tadalafil generic tadalafil pills 20mg

usa cialis bitkisel sildenafil vs tadalafil cost of viagra vs levitra vs cialis

writing essay essay paper writing

tadalafil 40 mg daily order tadalafil

ivermectin 3 mg tabs

Does your website have a contact page? I’m having a tough time

locating it but, I’d like to shoot you an email.

I’ve got some creative ideas for your blog you might be

interested in hearing. Either way, great website and I look forward to seeing it expand over

time.

my site; Rhino Spark Ingredients

buy ivermectin nz

tadalafil online tadalafil daily use

buy ivermectin stromectol

essay writer cheap how to do your homework

help with writing a paper essay writer generator

ivermectin 500mg

order tadalafil tadalafil 30 mg

ivermectin 50ml

college essay writer essay writers online

cialis 3 dias tadalafil bnf cialis c50

order tadalafil tadalafil max dose

40 mg tadalafil tadalafil dosage

buy dissertation buy cheap essay

essay writer reddit argumentative essays

40 mg tadalafil tadalafil 30 mg

ivermectin tablets

order stromectol

what is tadalafil buy tadalafil us

effet pilule cialis medshuku cheap cialis viagra cialis ecc

tadalafil max dose tadalafil pills

paper help argumentative essays

buy stromectol

ivermectin usa

online essay writer college essays

generic tadalafil 40 mg generic tadalafil 40 mg

tadalafil generic buy tadalafil us

tadalafil 60 mg for sale tadalafil 40 mg from india

cialis ieftin daily cialis cialis pillen bestellen

my essay writer paying someone to write a paper

generic tadalafil order tadalafil

stromectol coronavirus

essay help how to do your homework

stromectol australia

paper writing services essay typer

stromectol prices

ivermectin cost

ivermectin 3mg price

stromectol covid 19

generic tadalafil 40 mg tadalafil

cialis initial dose buy brand cialis cheap cialis hapi nedir

buy tadalafil us tadalafil dosage

generic tadalafil tadalafil dosage

write a paper writing services

tadalafil tadalafil dosage

online homework writing essay

samedayessay college essay writer

buy ivermectin stromectol

tadalafil online tadalafil max dose

40 mg tadalafil tadalafil 60 mg for sale

cialis generika bilder buy real cialis cheap cialis discount price

buy dissertation paper buy an essay

writing paper help instant essay writer

tadalafil 60 mg for sale tadalafil

auto essay writer essay writer free

ivermectin 0.08 oral solution

generic tadalafil 40 mg tadalafil generic

tadalafil dosage tadalafil

effet cialis chez femme medshuku best place to buy cialis online cialis bulk

tadalafil tadalafil tablets

how to do your homework good writing services

buying essays online help me write my essay

stromectol usa

buy tadalafil tadalafil online

cialis 5 mg n2 taldenafil cialis high heart rate

generic tadalafil 40 mg generic tadalafil 40 mg

tadalafil online order tadalafil

help with writing an essay thesis writing help

paper writer generator college essay prompts

writing essay buying essays online

tadalafil tablets tadalafil 30 mg

type my essay essay generator

ivermectin cream 5%

tadalafil 40 generic tadalafil 40 mg

tadalafil 40 mg daily tadalafil 40

dinxper cialis tadalafil vs sildenafil cialis brasiliano

tadalafil pills 20mg tadalafil 40 mg from india

essay maker what is a dissertation

ivermectin 24 mg

do your homework essay outline

generic tadalafil 40 mg tadalafil 60 mg for sale

paper writing services essay rewriter

tadalafil generic tadalafil 40 mg from india

which is most effective viagra or cialis how much is tadalafil 20mg cialis online bestellen eu

do my homework write a paper for me

tadalafil 30 mg generic tadalafil 40 mg

how to do your homework good online dissertation writing service

dissertation help i need help writing a paper for college

essay writer cheap best essay writing service

essay writing writing help

buy essay paper what is a dissertation

help me write my essay college essay writing service

buy tadalafil tadalis sx

write my essay for me online essay writer

essay typer essay paper writing

college essays paper writer

essaytypercom essaytyper

generic tadalafil tadalafil daily use

essay help essay typer

legitimate mail order cialis cialis 30 mg tablets cialis enhancement pills

help me with my essay dissertation help online

research paper i need help writing my paper

tadalafil tablets what is tadalafil

write my essay write essay

buying essays online buy cheap essay

tadalafil 40 mg from india 40 mg tadalafil

college essays thesis writing help

essay typer generator essay help

instant essay writer argumentative essays

help with writing an essay dissertation help

buy cheap essay essay paper writing

help with writing paper paper help

college essays help with writing paper

stromectol online canada

tadalafil 40 mg from india tadalafil gel

college essay essay

tadalafil pills 20mg tadalafil max dose

essay writers online do my homework

essay writer reddit how to do your homework good

cialis 5 mg online bestellen cialis online canada cialis uvp

tadalafil tadalis sx

argumentative essay write a paper

thesis writing help how to write essay

buy cheap essay automatic essay writer

essay writer free essay writer

best essay writing service paper help

my college help with writing a paper

essay typer paying someone to write a paper

write my essay for me writing services

college essay writer instant essay writer

writing services buy essay paper

tadalis sx tadalafil 30 mg

ivermectin 18mg

tadalafil 40 tadalafil 60 mg for sale

writing paper cheap essay writer

paper writer essay helper

online homework argumentative essay

stromectol drug

stromectol ireland

what is a dissertation essay writers

doing homework college essay writing services

how to write a essay help me write my essay

I take pleasure in, lead to I discovered exactly what I used to be taking a look for. You have ended my 4 day long hunt! God Bless you man. Have a great day. Bye

paying someone to write a paper essay paper writing

c5 pill cialis cialis cheap cialis lilly cialis online

where to buy stromectol

how to do your homework good online essay writer

generic tadalafil 40 mg generic tadalafil

persuasive essay writer homework helper

narrative essay help essay format

help me with my essay essay

paper help my homework

write a paper for me i need help writing a paper for college

tadalafil max dose generic tadalafil

write my essay for me paper writer generator

easy essay writer help with writing a paper

tadalafil pills 20mg generic tadalafil united states

college essay writing service us essay writers

essay paper writing write my essay generator

what is a dissertation writing an essay

buy essay paper essay typer

samedayessay essay assistance

do homework homework help

generic cialis good where to buy generic cialis online safely cialis preis italien

tadalafil 30 mg tadalafil 40 mg daily

college essay writing services help with an essay