Update 599 — Eyes on the Pump Price:

Energy Costs and Biden’s Inflation Fight

Hearings on the Hill this week focused on elevated gas prices Americans are facing at the pump, causing and affecting elevated energy prices amounting to a third of headline inflation. President Biden has taken up the battle against inflation. Some responses he has undertaken unilaterally. Others, ones requiring Congressional approval, he has put on the table. Which of these are viable, which are “trivial,” which are panders, which might make a difference, and which might make it into law?

The problem with sorting out profiteering and price-gouging from routine product pricing is a chicken-and-egg problem at this point: what came first and what comes next, producer or consumer-driven inflation? The energy sector led with the most outsized price surges now reverberating most broadly. Today, we discuss why gas prices are elevated, various solutions proposed and enacted, and how we can achieve energy independence in the future.

Best,

Dana

—————

The policies laid out during this week’s Congressional hearings were ineffective or could backfire. Demand-side subsidies, like gas tax holidays, would do nothing to alleviate the global volatility of gas, and new drilling could create substantial environmental damage. On top of that, new domestic production does not guarantee a shift in global oil prices as any new supply would be only a fraction of the global market. Our way out of this crisis, in the long run, is to invest in clean energy and public transit to build a truly secure energy future.

Elevated Prices

Before COVID-19 engulfed the world, Brent Crude oil prices hovered around $60 per barrel, roughly $2.50 per gallon of gas. But as the pandemic set in and tens of millions of Americans stayed home, the demand for oil and gas plummeted. Prices fell through the floor with oil hitting a trough of $9.12 per barrel and gas falling to $1.87 per gallon. As a result, oil and gas producers immediately pulled back on production as there was too much supply in the market. While prices stabilized, they were still significantly lower than their pre-pandemic levels.

As the economy reopened and people hit the roads once more, demand for oil and gas bounced back. But producers were not ready for the rapid rebound in demand. Prices began rising steadily through 2020 and 2021. Russia’s invasion of Ukraine pushed prices up as the global supply of oil and gas was thrown into turmoil. Oil prices skyrocketed to $133 per barrel and gas prices hit a record $4.41 per gallon. Prices still remain volatile over the last month as oil has fluctuated between $104 and $127 per barrel while gas has fallen slightly to $4.33 per gallon.

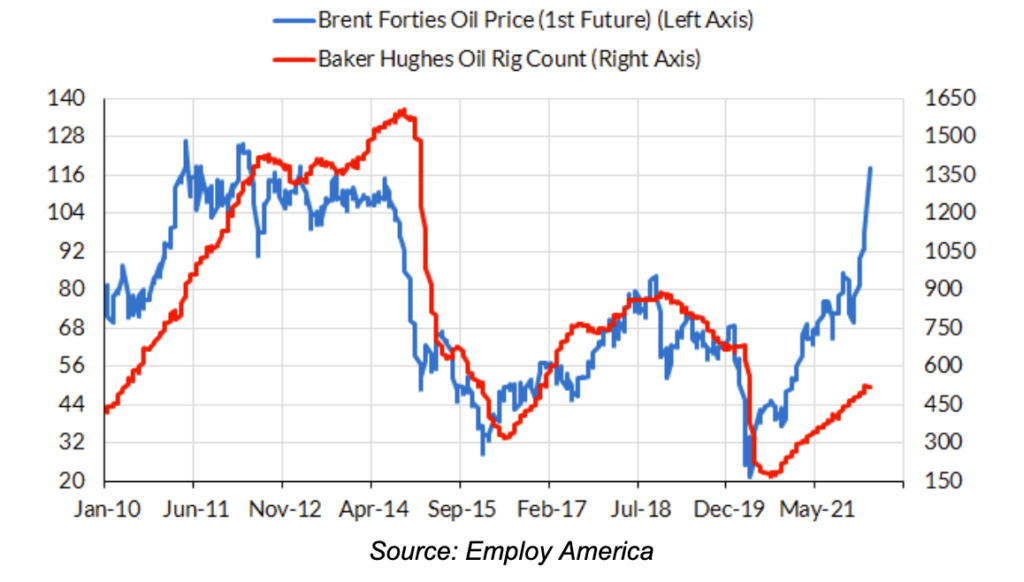

High prices should be encouraging producers to increase production and introduce new supply, right? Not when investors say otherwise. The Dallas Federal Reserve Bank found that 59 percent of oil and gas executives say investors exerting pressure is the leading reason for the lack of investment to increase production. Large oil and gas companies are reaping the profits of high prices, recouping losses from periods of low prices, and barely spending anything to increase the supply. Even if we increased domestic production, global prices would barely move.

Oil Investment Has Been Less Responsive To Oil Prices

State and Federal Solutions

Connecticut, Georgia, Florida, and Maryland have suspended their gas taxes, and lawmakers in over twenty additional states have proposed similar legislation. The appeal of gas tax holidays is obvious — they’re a simple, immediate solution that voters can easily understand. They would be perfect, if only they actually helped.

Most of the savings from a gas tax holiday will not be passed on to the consumer. Producers will be able to keep raking in record profits without providing consumers with the intended benefits. Furthermore, gas taxes represent a significant source of revenue for state departments of transportation. Maryland’s 30-day gas tax will funnel $94 million away from its Transportation Trust Fund in exchange for only about $15 in expected savings for consumers. Lawmakers have promised that this money will come out of the state’s budget surplus, which avoids disaster for Maryland’s infrastructure.

Idaho, Georgia, Indiana, and New Mexico have chosen to address rising prices by providing tax rebates or credits directly to their residents. In California, Governor Gavin Newsom proposed up to two $400 dollar rebates for car owners — a more efficient way to deliver relief, although it still incentivizes drivers to keep consuming gasoline without doing anything to help residents without cars. Newsom’s plan also calls for free public transportation for three months. Not only would this reduce demand for gas at the pump, but it is also a climate-friendly maneuver to incentivize cleaner forms of transportation.

Despite the flaws in these plans, similar ideas have gained traction at the federal level.

- Senators Mark Kelly and Maggie Hassan’s Gas Prices Relief Act would suspend the federal gas tax through the end of the year. If the bill had been implemented in March, it would have reduced revenues destined for the Highway Trust Fund by roughly $20 billion.

- Speaker Nancy Pelosi dismissed the idea of a gas tax holiday, though some Democratic lawmakers persist in supporting one.

The rebates and tax credits on the table at the federal level, though imperfect, would at least defray rising costs by placing windfall taxes on large oil producers.

- Senator Sheldon Whitehouse, sponsor of the Big Oil Windfall Profits Tax, estimated that his bill would offer a rebate of roughly $240 for single filers by imposing a 50 percent tax on the difference between the current price of Brent crude oil and an average from 2015 to 2019.

- Other proposals, like Rep. Peter DeFazio’s Gas Price Gouging Tax and Rebate Act, would tax excess income instead.

These proposals are good steps, but they will still not address supply-side concerns. So what can lawmakers do to increase supply? Not much. President Biden recently authorized the release of one million barrels of oil per day from the Strategic Petroleum Reserve — one of the few the president can take unilaterally to affect oil prices, but with limited efficacy. The administration’s previous releases of 50 million barrels last year and 30 million barrels in February failed to significantly move the needle on oil prices, mainly because they comprised such a small percentage of global supply. This new release, totaling up to 180 million barrels, could have a greater impact, but it will still have a limited effect on prices.

Long-Term Independence

Despite the United States remaining the largest oil producer in the world, our production and prices are still dictated by the global market. And when our own fracking rigs take six to eight months to produce oil, the short-run answer cannot be “drill, baby, drill.” The environmental damage from a massive expansion of drilling would introduce new risks into the economy and further our reliance on fossil fuels. There are short-term stabilization policies worth pursuing, but the long-term goal is true energy independence, moving away from fossil fuels.

Americans are held hostage by the global oil market. Public mass transportation, electric vehicles, and stronger fuel economy standards will help us wean off of fossil fuels. Clean energy would allow us to ensure a more democratic trade regime by removing some of our reliance on anti-democratic nations. While Congress focuses on fixing today’s problem, circumstances give us a moment to consider longer-term solutions.