Update 601 — Degrees of Debt:

Decision Ahead on Student Loans

The CPI Report for March, released yesterday, showed prices rose by 8.5 percent during the last 12 months. Energy prices moderated markedly during March. Some predict this will represent the high-water mark of an inflation rate that will remain elevated through the fall.

The Biden administration is currently struggling not just with inflation, but with the long-elevated price of education as well. Biden extended the student loan moratorium until August 31. But the relief is temporary and the decision to extend through the summer has made it uncertain if payments will restart or not. In this update we examine the student debt burden and what Biden can do to alleviate it.

Best,

Dana

——————

Memento Mori Moratorium

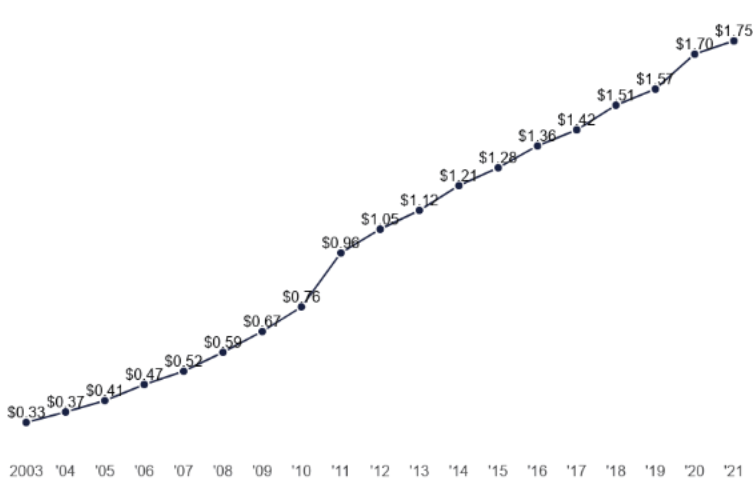

The unprecedented two year “pause” on student loan payments has provided relief to many Americans during the pandemic. One in eight Americans have federal student loan debt, 43.4 million people, with an average of $30,000 per borrower and an average monthly payment of $300. Millennials and Gen Xers are most affected by student loan debt, with 35 year olds on average having the most outstanding debt at $42,600. Their typical end balance is 287 percent higher than the value of their original loan.

Total Nation Student Loan Debt

(in $ trillions)

Per a recent report from Student Loan Hero, a typical borrower in active repayment has saved $6,949 in penalties and interest during the moratorium. The New York Federal Reserve Bank estimated the moratorium saved a total of $195 billion in payments, suggesting the fallout from the moratorium has been negligible.

Biden and his Department of Education have taken action to forgive the loans of certain borrowers, canceling over $16 billion in loans. He’s alleviated the debt of borrowers with disabilities and those defrauded by for-profit schools. At the end of March, Secretary Cordona expanded the pause to include the Federal Family Education Loan Program, privately held loans totalling $248 billion, held by 1.14 million Americans. Biden’s Department of Education is overhauling the Public Service Loan Forgiveness program, with the goal to provide more support to those in the public service sector.

Polling conducted shortly before President Biden announced the latest extension showed about 50 percent of voters supported an extension. The administration will either need to restart payments, or take some other action like student loan debt cancellation. Student loan cancellation may be more popular than the “pause” that’s now in effect. According to recent polling, 63 percent of voters support canceling some or all student loan debt for borrowers, and 66 percent support it for low- or middle-income borrowers.

Student loan cancellation is not without its share of critics. One frequent criticism relates to “moral hazard” and the overall impact of such cancellation on the economy. For example, the Committee for a Responsible Federal Budget (CRFB) claims cancellation would lead to increased inflation in our current economy. CRFB also argues that such a policy would be regressive since student loan borrowers are more likely to be higher income. Conversely, the Roosevelt Institute views student debt cancellation as more progressive since those from wealthy backgrounds rarely take out student loans.

What Can Biden Do Next?

While the president has been noncommittal overall, he stated that he would sign a bill from Congress that cancels $10,000 in debt, but Congress is unlikely to act on this issue. In the face of legislative gridlock, Biden has asked the Department of Justice and Department of Education to look at his authority to cancel student debt. The Department of Education wrote a memo last year about the President’s authority to cancel student loan debt but has yet to make the memo public, except in a redacted format.

President Biden has several smart policy options to pursue come August that would alleviate restarting of payments.

- Canceling Interest — Interest rate cancellation would be a middle of the ground policy, ensuring borrowers must only pay down their principal. This is an action the administration has already taken when it waived interest for student loans of service members.

- Canceling Debt — A popular call from the left, and something Biden campaigned on. He’s supportive of canceling $10,000 per borrower, although he defers to Congress to pass legislation. Progressive members of Congress are calling for $50,000 to be canceled per borrower, or to cancel all student debt, saying that Biden has unilateral authority to cancel student loan debt under the Higher Education Act.

- Increasing Affordability – Increasing or even doubling the amount of Pell Grants would greatly lessen the amount of student loan debt for future borrowers. Making community college free and increasing financial resources for student success programs would greatly lessen the amount of debt current students take on but would not impact borrowers who have already left higher education — policies Congress would have to approve.

Relief and Democrats’ November Stakes

Biden’s indecision on student loan debt could dampen turnout with a key constituency ahead of the midterms: younger voters. An additional extension of loan payments, may activate the younger voters who buoyed Biden’s 2020 presidential bid and helped deliver the Senate majority to Democrats. In 2020, voters under age 30 overwhelmingly supported Biden over then-President Donald Trump by a 60 percent to 36 percent margin, according to Edison Research. People under age 25 also had the greatest increase in turnout compared to other age groups in the 2020 presidential election.

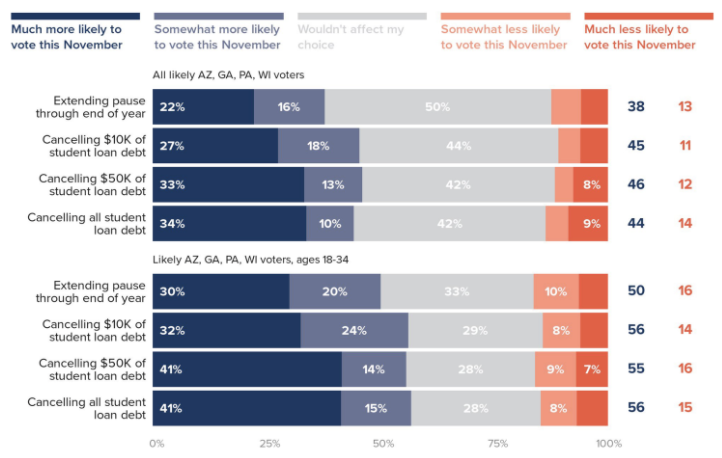

Biden is struggling with voters in that age demographic. Several polls conducted by the progressive organizations Data for Progress and NextGen America have found that more than 40 percent of people between the ages of 18 and 36 in key swing states list canceling student debt among their top five issues heading into the midterms.

Voters in Swing States are More Likely to Vote in 2022 if Student Loan Cancellation Takes Place

Were Biden to forgive debt, it’s still not a political slam dunk. The move could anger older voters who have paid off their student debt already or those who didn’t go to college. A poll from Vox and Data for Progress found that a majority of likely voters support forgiving some student loan debt up to a certain amount and in certain situations, but the popularity of the idea varies among voters based on age and other characteristics.

What could get older and the non-graduate voters’ attention would include:

- Investment in school vocational training and partnerships between high schools, community colleges, and employers.

- Partnerships that create programs allow students to earn an industry credential upon high school graduation.

Students who participate in high-quality career and technical education are more likely to graduate, earn industry credentials, enroll in college, and have higher rates of employment and higher earnings.

Not following through on his campaign promise could hurt groups that helped put the president in office. Biden received 92 percent of the Black vote in 2020, helping to deliver him the presidency with high turnout in swing states like Georgia. Per the Department of Education, Black college graduates owe $25,000 more in student loans on average than their white counterparts, and recent polls suggest a majority of Black voters support forgiving loans.

Come September and the next deadline for the moratorium, the Biden administration has an important decision to make. Biden should live up to his campaign promise and provide the much-needed relief to Americans who opted to pursue higher education. Canceling some loans would only address the symptom, not the disease. The administration ought to consider systemic reform to higher education costs and vocational schools as well. Taking further action to make higher education affordable, investing in technical training, and making the American education system more equitable will be critical not only for the midterm elections, but the future of our country and generations to come.