Update 595 — Power of Sanctions:

All United on the Western Front

President Biden heads to Brussels today, the most critical overseas trip of his presidency yet. Biden will bring with him US support for Ukraine, the NATO alliance, and other European allies in the form of a new round of sanctions. These will aid enforcement of current sanctions, “ensuring that there is joint effort to crack down on evasion, sanctions-busting, on any attempt by any country to help Russia basically undermine, weaken, or get around the sanctions.”

Biden’s leadership reminds us why the 2020 elections were so important. The administration has demonstrated global skill in facing Putin’s invasion of Ukraine — unleashing a devastating asymmetric line of attack: a battery of US-led sanctions that have already pummeled Russia’s economy. Biden has pursued and achieved results through economic might, not just military force. More below.

Best,

Dana

—————

A United Front

Vladimir Putin managed to accomplish something that seemed impossible only a matter of weeks ago: unite the West. The Russian leader’s invasion has received widespread condemnation from the international community, with even traditionally neutral Switzerland taking a clear stance in favor of Ukraine. In spite of claims that relations between “Western” countries are seriously fractured, the Biden administration has pulled together its NATO allies as well as additional key nations including Japan and Australia, to wage economic war against Russia through a multitude of sanctions. Many global businesses have seen the writing on the wall and have ceased their business activities in and with Russia.

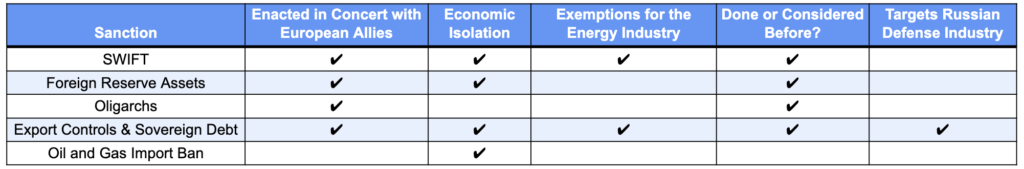

Current Sanctions Against Russia

The Impact of Sanctions

Despite the far-reaching nature of these sanctions, financial markets have managed to weather the storm. Since Russia’s invasion began on February 24, the S&P 500 has increased by about 6.3 percent while the Dow is up roughly 4.25 percent. Meanwhile, the STOXX Europe 600 index has remained unchanged since Russia’s invasion began and the Russian capital markets are shuttered. The Central Bank of Russia doubled interest rates to about 20 percent, and inflation has set in, far worse than in the West.

Russia overcame fears of a debt default by making a $117 million interest payment to bondholders on March 16. JPMorgan Chase expects that Russia will experience a 7 percent contraction in GDP this year, while Goldman Sachs estimated a decline of 9 percent. This would represent an economic collapse exceeding the size of Russia’s 5.3 percent slump in 1998.

Moves by private companies to sever relations with Russia are wreaking havoc on the country’s labor market. “The Russian economy will rapidly lose human capital, and the rate of its outflow may be higher than in the 1990s,” wroteVladimir Gimpelson, head of the Moscow Higher School of Economics’ center for labor market studies. A Yale study lists over 400 companies that have already severed ties, with thousands of immediate job losses already incurred across sectors like retail, advertising, and financial services.

Putin’s inner circle is not safe from the economic fallout. The UK, US, and EU governments announced sanctions against multiple Russian oligarchs. These sanctions target oligarchs’ personal properties like real estate, superyachts, and soccer teams. While oligarchs with minimal overseas investments will not be greatly affected, individuals with foreign property holdings are scrambling to move assets. Spain temporarily seized Rostec Chemezov’s $140 million superyacht in Barcelona while Roman Abramovich announced the sale of Chelsea FC for $3 billion.

Despite the effectiveness of these sanctions, there is growing concern that individuals may resort to cryptocurrency as a loophole. Ruble-denominated trades with Tether reached $29.4 million in late February. Though a small amount of money, the sum is a threefold increase in trading volumes before the invasion. Crypto exchanges like Coinbase have stopped short of an outright ban on Russian customers and claim they are screening those targeted by sanctions. Some crypto experts argue that funds could be moved through privacy coins – a form of crypto that hides customer identities more than Bitcoin. Cryptocurrencies also allow for the sale of Russian-owned assets without having to go through formal international payments systems.

While the economic consequences of these sanctions are more severe for Russians, Americans will see increased gas prices. The AAA national average gas price jumped from $3.54 in February to $4.24 as of March 23. In a recent survey, 59 percent of Americans said they were going to “make changes to their driving habits or lifestyle” as a result of gas exceeding $4 per gallon.

Looking Ahead

While sanctions against Russia have been implemented quickly, there is still more to be done to punish Putin for the war he has started. Some options the US and its allies could pursue include:

- More sanctions on Russian oligarchs

- Expanding sanctions to more banks and companies

- Sanction state-owned companies

- Sanction Russian lawmakers

- Ban trade with Russia

Last Thursday, the House passed a bill that would revoke normal trade relations with both Russia and Belarus until 2024. It passed by an overwhelming majority with only eight House Republicans voting against it. This bill would give the President the authority to raise tariffs on Russia and Belarus through 2023. In another move to unite the West, this legislation would direct the US Trade Representative to encourage other nations to block trade relations with Russia. The bill now heads to the Senate but may get held up by Senate Republicans pushing for an energy import ban. The House also passed a bill to ban Russian gas and oil but has not sent it over to the Senate yet.

Initial estimates suggest that the war and ensuing sanctions will have an impact on economic growth. The Federal Reserve uses a rule of thumb estimate that each $10 per barrel increase in oil would raise headline inflation by 0.2 percentage points and exact a 0.1 percentage point decrease in the US GDP. More precise measurements from analysts at Goldman Sachs and Bank of America estimate that the impact on consumers from surging commodity prices will push GDP growth down by 0.3 percent in 2022.

Across Europe and the US, there are increasing calls for energy independence. While the US is already the world’s largest oil producer, it will be more challenging for the EU to transition away from Russian fossil fuels. The EU has announced a pledge to cut gas imports by two-thirds before the end of 2022 and cease fossil fuel purchases entirely before 2030. If shipments through Ukraine are curtailed, then Euro-area GDP could be cut by around 1 percent. Even in a baseline scenario where the fuel keeps flowing, the European economy could take a 0.6 percent hit.

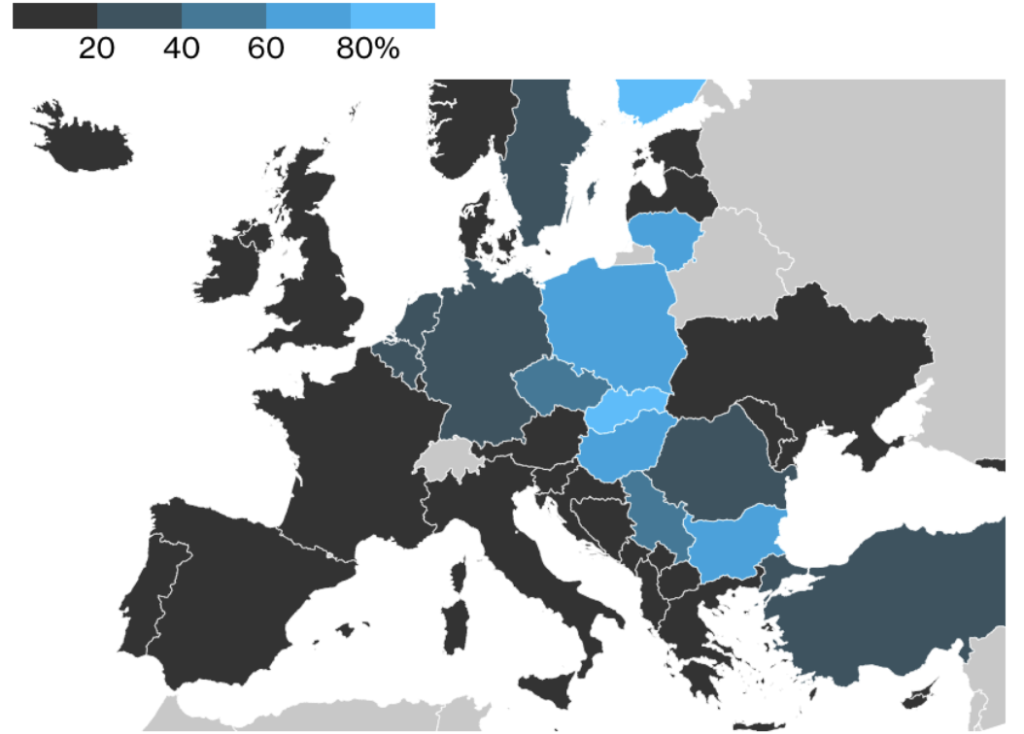

Most of Europe’s countries depend on Russia for more than half of their crude imports

The EU is also facing the biggest European refugee crisis since World War II. Russia’s attacks against civilian targets have driven at least 3.5 million people into other countries. Another 6.5 million Ukrainians are internally displaced, which means that about 25 percent of Ukraine’s 43 million citizens are now homeless. The EU will face the challenge of meeting the immediate needs of refugees like food and shelter in addition to providing long-term relief such as employment and education.

It is difficult to predict the ultimate outcome of this war and the devastating toll it will continue to have on the Ukrainian people. What we do know is that if we continue to punish Putin for his imperialist war, our economic efforts to deter Russia will make the West more likely to see success, maybe not today, but ultimately.