Update 620 — CPI for June up 9.1%

But Trends Complicate Inflation Story

The CPI report for June, showing a 9.1 percent hike in prices from a year ago, up from 8.6 percent in May, may alarm some and immediately suggests another 75 basis point interest rate by the Fed at its next meeting, July 26-27. But it may not be an easy call.

This economy continues to confound — inflation sits alongside a 372,000 job gain in June, with unemployment at an historic low, robust spending by consumers, and silver linings in the CPI report itself. This as Democrats are tied with the GOP per a generic Congressional poll published in today’s NYT. But the silver linings — recent retreat in core prices, felt at the pump and grocery store —needn’t become harbingers of recession.

Today., we reflect on the conflicting macroeconomic indicators the Federal Reserve is looking at (see today’s Fed Beige Book release), urging a more cautious approach for the central bank given trends this month.

Best,

Dana

——————

Fed Dilemma: Baby vs. Bathwater

Risks of recession abound as demand for real estate has decreased dramatically, consumer confidence has fallen to a decade-low, and retail sales have begun to slow. All the while, inflation is climbing higher and higher. The Federal Reserve faces a unique dilemma.

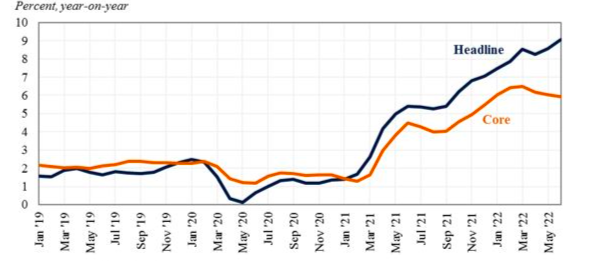

Recession fears have mounted for months, but began to calm with last Friday’s jobs report showing a robust gain of 372,000 new jobs. And fears of a contraction following the Fed’s 75 basis point hike went unrealized. But today’s CPI report will only reinforce the Fed’s commitment to fighting inflation: Headline inflation increased from 8.6 percent to 9.1 percent, and core inflation barely inched down from 6 percent to 5.9 percent.

With inflation accelerating again in June, the month-over-month reading highlights both how broad the inflation we are seeing is and how much of it is still driven by gas prices. There were multiple significant contributors to the 1.3 percent month-over-month inflation reading:

- Gas: 11.2 percent

- Health Insurance: 2.1 percent

- Rent and Owner’s Equivalent Rent: 0.8 percent and 0.7 percent

- New and Used Vehicles: 0.7 percent and 1.6 percent

Federal Reserve Chair Jerome Powell – and now the full Board with Michael Barr’s confirmation – has a much more difficult road ahead than anticipated with inflation numbers continuing to rise. He must find the Goldilocks Zone between countering inflation and protecting the strong job market from a total economic slowdown, especially as the recent CPI report continues to show inflation hitting record highs, partially as the fallout from Russia’s invasion of Ukraine continues to strain energy and food prices.

Headline and Core CPI Inflation

Source: Bureau of Labor Statistics, Council of Economic Advisors

Fed Receiving Mixed Signals

Confusing signals from the macroeconomy continue to muddle the future for policymakers, particularly the Federal Reserve. This is evident in wage growth. Despite slowing down since its March high, wage growth still remains relatively strong. While wage growth is not strong enough to fuel a wage-price spiral, it has become the target for the Fed to reduce inflation.

The slowdown over the last couple of months could likely be attributed to the Fed’s policy path of hawkish interest rate hikes, but the reduction to 0.3 percent month-over-month wage growth should be a sign the Fed has hit its goal on this front. Additionally, jobless claims have marginally ticked up, a sign the labor market is cooling off as a result of the Fed’s actions. The strong jobs report last week and a stubbornly high CPI reading today will confound policymakers. The Federal Reserve’s Beige Book report released today confirms the mixed signals from the economy: modest growth, strong labor market, and high inflation.

Recent data alongside parts of the CPI report did show countervailing trends for inflation:

- Energy Prices: Gas has fallen from it’s June 14 high of $5.02 per gallon to $4.63 per gallon

- Retailer Discounts: Retail companies and e-commerce alike are offering discounts and cutting prices, reflecting easing in supply chains and competition with Amazon’s Prime Day

- Airfare Prices: Airline ticket prices fell in June, a much needed reprieve during the high-travel summer months

Though today’s CPI announcement points to another 75 basis point interest rate hike, this move could run risks of overshooting, becoming the straw that breaks the camel’s back into a recession. With commodity prices starting to fall, including a large drop in the price of oil following the surge in prices brought on by Russia’s invasion of Ukraine, next month’s CPI report could show a significant reduction in inflation. If commodity prices continue to fall or fall more broadly and sharply, the Fed may want to rethink the course outlined clearly right now in its in forward guidance.

The Fed may not be omnipotent, and in a supply-driven inflationary environment it is particularly and lamentably impotent today, but if the central bank misses its soft landing target, millions will feel the pain. And it will be for nothing if inflation vanishes in the rear view mirror in the coming months.

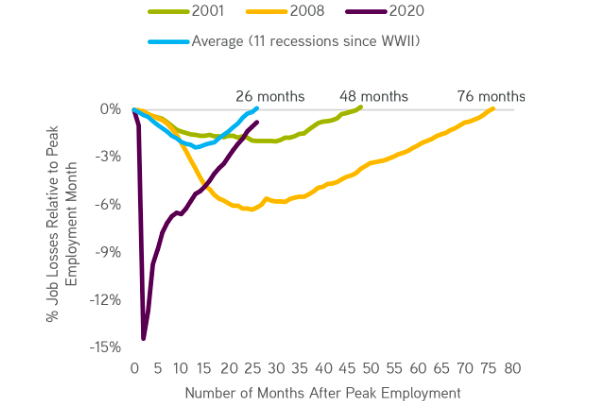

Historic U.S. Job Losses & Recovery Trajectories

Sources: Bureau of Labor Statistics Haver Analysis, KKR Global Macro & Asset Allocation

Balancing Policy Priorities with Voters Watching

With inflationary pressures persisting, though probably peaking, the coronavirus pandemic and its byproducts, such as supply chain disruptions, continue to exert uncustomary pressures on the economy. The jobs report indicated that 155,000 more people had difficulties obtaining work due to the pandemic than in May, which is likely to worsen as the CDC predicts another wave of Omicron in the coming months.

The silver linings in the form of price drops threaten to become tomorrow’s concerns — the leisure and hospitality sector has begun to recover and return to pre-pandemic levels of activity. The sector added 67,000 new jobs in June, forcing Powell to be careful not to disrupt this job growth in the economy. The industry is still down by 1.3 million jobs since the start of the pandemic two and a half years ago. Powell must try to curb inflation while maintaining the positive gains in industries most affected by the pandemic. Growth within the industry could bode well for consumer confidence, but COVID will continue to hinder the sector’s full recovery.

The Federal Reserve and Jerome Powell have a tough set of choices to make at the next FOMC meeting as high inflation and robust job growth mix with the ongoing coronavirus pandemic. The Fed will raise rates again in order to tame inflation, but the health of the job market and the chance of a recession hang in the balance.

The White House made the point today that there is still much that Congress can and should do to provide support. Even with the midterms on the horizon, Congress is unlikely to back up the Fed with legislation, so Powell faces the burden of steering a $21 trillion ship through the steep cliffs of inflation and recession.