Update 481 • Consequences of Failure:

The Prospect of Months without Relief

The CARES Act, passed in March, was a short-term antidote to head off the worst of the economic impact from COVID. Many of the programs were designed to sunset this calendar year, with the expectation that Congress would provide additional relief to follow as needed.

Seven months later, that additional relief is nowhere to be found. Negotiations have started, stalled, and stopped too many times to count. Consequently or coincidentally, so has the economic recovery and, going forward, the consequences of this inaction will be severe. We take an in-depth look at what a future without another package looks like, below.

Best,

Dana

————————————————

This week, Harvard economists Lawrence Summers and David Cutler projected a $16 trillion hit to the US economy from the current downturn — four times that from the Great Recession. With every passing week, more people slide into long-term unemployment, and more small businesses close for good.

Below, we analyze the effects of the recession on workers, small businesses, and Wall Street, and what the lack of another package might mean for them.

Unemployment’s Trajectory

In April, unemployment rates spiked, peaking at 14.7 percent. As of September, that number is 7.9 percent, about 12.6 million people. But this figure does not include those who are no longer looking for work (more than a million people left the labor force last month), those who left jobs to take care of children or loved ones, or the many who remain misclassified by the BLS. Last month, 29.2 million people claimed Unemployment Insurance (UI) benefits. More temporary layoffs will become permanent job losses.

The United States also has 11 million fewer jobs in September than in February. Long-term unemployment and worker discouragement is set to rise rapidly in the coming months. In April, just under one million Americans fit into the long-term unemployed category. Now, Moody’s Analytics estimates this number will surpass five million in early 2021, but that number could double in a worst case scenario.

So far, the economic impact has been felt disproportionately by low-income Americans. Pew Research finds that, since March, a quarter of adults have had trouble paying their bills, a third have dipped into savings or retirement accounts, and one sixth have borrowed money from friends or family or utilized a food bank.

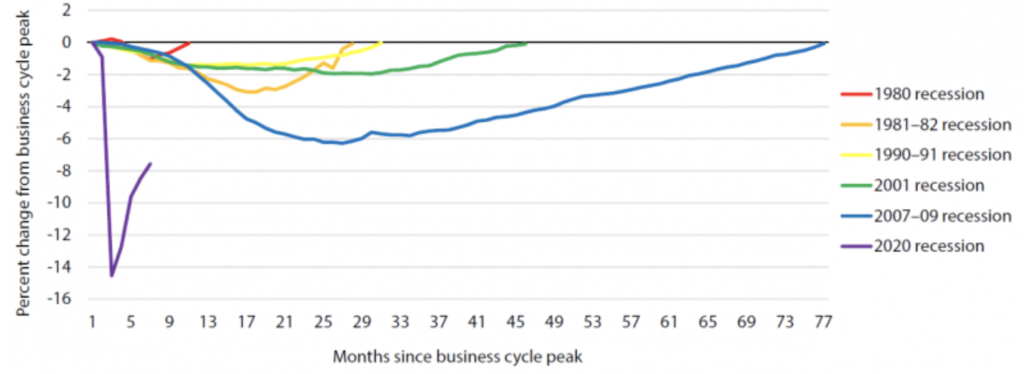

With CARES Act II negotiations pushed off until at least after November’s election, such economic dynamics may be locked in for the foreseeable future. Since the 1980 recession, the labor market has taken longer and longer to recover following economic downturns. Employment levels cratered following state lockdown orders in March and April and have since recovered to some extent. But the pace of recovery is slowing down, and fiscal assistance is running out.

Percent Change in Employment Relative to Business Cycle Peak By Business Cycle

Source: The Hamilton Project (Brookings Institute);Bureau of Labor Statistics

Small Businesses Living on the Edge

Just under half of all private sector workers are employed by small businesses with fewer than 50 employees. Small businesses tend to have small cash reserves, thin margins, and difficulty accessing capital. As a result, they are highly susceptible to prolonged market downturns.

The Paycheck Protection Program (PPP) was lauded as an example of Congress’ excellent COVID response but has amounted to little more than a bandage on a potentially mortal wound. Despite the $549 billion disbursed through the PPP, the National Bureau of Economic Research reports that the number of small business owners across the country has decreased by nearly a quarter since February.

At the same time, the number of businesses permanently closing is steadily increasing. Per Yelp’s most recent Economic Impact Report, 60 percent of business closures caused by the coronavirus are now permanent.

Number of Business Marked “Closed” on Yelp That Were Open on March 1

Source: Yelp – Local Economic Impact Report

With the PPP expiring in August and additional small business relief unlikely until early 2021, consequences for small businesses across the country could be dire. According to the National Federation of Independent Businesses, half of business owners who received PPP will require additional financial support to remain solvent. A Goldman Sachs survey found that 30 percent of small business owners expect to exhaust their cash reserves by January. PPP funds supported around five million small businesses and helped maintain 51 million jobs. Without intervention, an additional 2.5 million small businesses may close, leading to a potential loss of 25 million more jobs.

Wall Street: “What recession?”

As many workers face long-term unemployment and thousands of small businesses shutter, Wall Street has largely weathered the crisis. There has not been a wave of bank failures that some feared when markets seized in March. In fact, JP Morgan announced yesterday earning more than $9 billion in profit in Q3, more than they earned in Q3 2019. Even Citigroup, which had a relatively “bad” quarter, reported $3.2 billion in profit. The evidence of a “K-shaped” recovery could not be clearer.

Wall Street did not achieve this success on its own. Banks and corporations issuing debt were buoyed directly by the Fed’s aggressive liquidity measures and indirectly by the economic relief provided to individuals. And unlike some of the relief for individuals such as enhanced unemployment benefits that lapsed at the end of the summer, financial markets have continued to benefit from the Fed’s measures.The Fed plans to maintain its emergency facilities at least through the end of the year after deciding to extend them this summer.

Yet the health of the financial sector going forward could still be contingent on additional fiscal relief. JP Morgan’s earnings numbers show that while the firm saw increased profits, its consumer business was down 9 percent compared to Q3 2019. Q3 still included one month of unemployed workers receiving the $600 a week federal benefits, but Q4 is on track to have none.

JP Morgan CEO Jamie Dimon called for more fiscal stimulus to stave-off a double dip recession, which he said could strain the bank’s reserves. Dimon’s comments reflect the reality that even the bright spots of the economy could be imperiled in the coming months by Senate Republicans’ intransigence.

Elections Have Consequences

With CARES Act II negotiations stalling, it may be January 2021 before workers and small business owners can count on any help from Washington, assuming Democrats retake the Senate and the White House. Many communities barely managed to claw back losses from the Great Recession, and it could take even longer to recover from the job losses and business closures caused by COVID. The failure of the Trump Administration to deliver critical resources to those in need during these times should be at the forefront of voters’ minds this election season.

https://vsviagrav.com/ – viagra

I like this internet site because so much useful material on here : D.

Keep on working, great job! 0mniartist asmr

Simply wanna input that you have a very decent website , I like the pattern it actually stands out.

hello there and thank you for your information – I’ve certainly picked up something new from right here.

I did however expertise several technical points using this

website, since I experienced to reload the site

a lot of times previous to I could get it to load

properly. I had been wondering if your web host is OK?

Not that I am complaining, but slow loading instances times will

sometimes affect your placement in google and can damage

your high quality score if advertising and marketing

with Adwords. Anyway I am adding this RSS to my email and can look out for much more of your respective fascinating

content. Make sure you update this again very soon. asmr 0mniartist

It’s a shame you don’t have a donate button! I’d certainly donate to this superb

blog! I guess for now i’ll settle for book-marking and adding your RSS feed

to my Google account. I look forward to fresh updates and will talk about this blog with my Facebook group.

Chat soon! 0mniartist asmr

Just desire to say your article is as amazing.

The clearness in your post is simply cool and i

can assume you’re an expert on this subject. Fine with your permission let me to grab your feed

to keep updated with forthcoming post. Thanks a million and please carry on the enjoyable

work. 0mniartist asmr

Howdy very nice blog!! Man .. Beautiful .. Superb ..

I’ll bookmark your web site and take the feeds additionally?

I am glad to seek out numerous helpful info right here within the post, we want develop extra strategies in this

regard, thank you for sharing. . . . . . asmr 0mniartist

Howdy! I could have sworn I’ve been to this website before but after checking through some

of the post I realized it’s new to me. Anyhow, I’m definitely happy I found it and I’ll be bookmarking and checking back

often!

My coder is trying to persuade me to move

to .net from PHP. I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using Movable-type on a

number of websites for about a year and am anxious about switching to another platform.

I have heard great things about blogengine.net. Is there a way

I can transfer all my wordpress content into it? Any help would be really

appreciated!

constantly i used to read smaller content that as well clear their motive, and that is

also happening with this piece of writing which I am reading now.

Its like you read my mind! You seem to know a lot about this, like you wrote the

book in it or something. I think that you can do with a few

pics to drive the message home a little bit, but other than that, this is excellent blog.

A great read. I will definitely be back.

This site definitely has all the information and facts I needed about this subject and didn’t know who to ask.

Ahaa, its good discussion concerning this paragraph here at this webpage, I have read all that, so now me also

commenting here.

tindr , tindr

tindr

It’s an remarkable post designed for all the online viewers;

they will take advantage from it I am sure.

Amazing! Its actually amazing piece of writing, I

have got much clear idea about from this piece of writing.

You ought to take part in a contest for one of the finest sites on the internet.

I most certainly will highly recommend this web site!

priligy in sri lanka

scoliosis

Nice post. I learn something new and challenging on websites I stumbleupon everyday.

It will always be exciting to read articles from other writers and use

something from other sites. scoliosis

Great goods from you, man. I have understand your stuff previous to and you’re just extremely excellent. I actually like what you have acquired here, really like what you are saying and the way in which you say it. You make it enjoyable and you still take care of to keep it smart. I cant wait to read much more from you. This is actually a great web site.

scoliosis

Highly energetic post, I loved that a lot. Will there be a part 2?

scoliosis

scoliosis

What’s Going down i’m new to this, I stumbled upon this I have discovered It absolutely useful and

it has aided me out loads. I’m hoping to give a contribution & assist different users like its aided me.

Great job. scoliosis

dating sites

Hello! I’m at work surfing around your blog from my new iphone!

Just wanted to say I love reading through your blog and look

forward to all your posts! Carry on the fantastic work! https://785days.tumblr.com/ free

dating sites

dating sites

Thanks for your marvelous posting! I actually enjoyed reading it,

you can be a great author. I will ensure that I bookmark your blog and will come back later in life.

I want to encourage you continue your great job, have a nice day!

free dating sites

Generally I don’t learn post on blogs, but I wish to say that this write-up very forced me

to check out and do so! Your writing style has been surprised me.

Thanks, very nice post.

Thank you, I have recently been searching for information about this topic for a while and yours is the best I’ve found out so far. However, what in regards to the conclusion? Are you positive about the source?

you’re actually a good webmaster. The site loading speed is incredible.

It sort of feels that you are doing any distinctive trick.

Moreover, The contents are masterpiece. you have done

a excellent job in this subject!

Hi mates, pleasant post and nice arguments commented at this place, I am really enjoying by these.

Pingback: free interracial online dating

It’s very easy to find out any matter on web as compared to books, as I found this piece of writing at this web page.

Wow, amazing weblog layout! How lengthy have you been running a blog for?

you make running a blog glance easy. The overall look of your site is wonderful, let alone the content!

Oh my goodness! Amazing article dude! Thanks, However I am going through issues with your RSS.

I don’t know why I am unable to subscribe to it. Is there anybody else having identical RSS problems?

Anyone that knows the answer can you kindly respond?

Thanks!!

I loved as much as you’ll receive carried out right here.

The sketch is tasteful, your authored material stylish.

nonetheless, you command get got an impatience over that you

wish be delivering the following. unwell unquestionably come more formerly again as exactly the same nearly very often inside case you shield this

increase.

Great goods from you, man. I’ve understand your stuff previous to and

you are just extremely great. I really like

what you’ve acquired here, really like what you are stating and

the way in which you say it. You make it enjoyable and you still care for

to keep it smart. I can’t wait to read much more from you.

This is really a terrific website.

Fantastic post however , I was wanting to know

if you could write a litte more on this topic?

I’d be very grateful if you could elaborate a

little bit further. Thank you!

What a stuff of un-ambiguity and preserveness of valuable familiarity regarding unpredicted

feelings.

payday loans nc

auto loans

credit loan company

Why viewers still use to read news papers when in this

technological world the whole thing is accessible on web?

mexican pharmacy

It’s very easy to find out any matter on web as compared

to books, as I found this paragraph at this website.

online pharmacy nz cialis

best loans

Just desire to say your article is as astonishing. The clearness in your post is simply

cool and i can assume you’re an expert on this subject.

Fine with your permission let me to grab your RSS feed

to keep up to date with forthcoming post. Thanks a million and

please continue the enjoyable work.

easy payday

cialis and viagra sales

interest on loan

It is the best time to make some plans for the future and it is time to be happy.

I have read this post and if I could I wish to suggest you some interesting

things or advice. Perhaps you can write next articles referring to this article.

I want to read more things about it!

can you purchase viagra online

Hello there! This is my first visit to your blog!

We are a collection of volunteers and starting a new project in a community in the same niche.

Your blog provided us valuable information to work on. You

have done a marvellous job!

When some one searches for his essential thing, thus he/she desires to be available

that in detail, so that thing is maintained over here.

tadalafil india generic

personal loans for debt consolidation

Hello to every one, as I am really keen of reading this website’s

post to be updated daily. It includes fastidious material.

Hi there just wanted to give you a quick heads up and let

you know a few of the pictures aren’t loading properly.

I’m not sure why but I think its a linking issue.

I’ve tried it in two different browsers and both show the same outcome.

generic tadalafil from india

tadalafil for sale canadian pharmacy

personal loans bad credit

online fast cash loans

viagra tablets online india

I will immediately grab your rss feed as I can’t

find your email subscription hyperlink or e-newsletter service.

Do you’ve any? Please allow me realize in order that

I may subscribe. Thanks.

Hi, I do believe this is an excellent site. I stumbledupon it ;

) I may revisit once again since i have bookmarked

it. Money and freedom is the best way to change, may you be rich and

continue to help other people.

Thanks , I’ve just been searching for info about

this subject for ages and yours is the greatest I have came upon till now.

But, what in regards to the conclusion? Are you sure concerning

the supply?

no doc loans

loans website

buy ivermectin nz

each time i used to read smaller articles that as well clear their motive, and that is also happening with this post which I am reading here.

Hey There. I discovered your blog the use of msn. This is a really well written article.

I will be sure to bookmark it and come back to read more of your

useful info. Thank you for the post. I’ll definitely

return.

how to get viagra us

tadalafil cialis

fast payday loans near me

Someone necessarily help to make critically articles I would state.

This is the first time I frequented your website page and thus far?

I surprised with the research you made to create this particular post amazing.

Excellent activity!

Paragraph writing is also a fun, if you

know then you can write or else it is complex to

write.

loans with poor credit

I was very pleased to uncover this great site. I wanted to thank

you for ones time for this particularly fantastic read!!

I definitely loved every bit of it and i also have you book

marked to look at new information in your site.

payday loans direct deposit

green loans

weekend payday loans

instant payday loans

Yeah bookmaking this wasn’t a risky decision outstanding post! .

where to buy sildenafil without prescription

people with bad credit

loans with no income

I really like your blog.. very nice colors & theme.

Did you create this website yourself or did

you hire someone to do it for you? Plz respond as I’m looking to construct my own blog and would

like to know where u got this from. thank you

Having read this I believed it was really informative.

I appreciate you spending some time and effort to put

this information together. I once again find myself spending a significant amount of time

both reading and leaving comments. But so what, it was still worth it!

non prescription prednisone

www loan

payday loans for bad credit

No matter if some one searches for his necessary thing,

therefore he/she wishes to be available that

in detail, thus that thing is maintained over here.

tadalafil uk paypal

I’d like to thank you for the efforts you have put in penning this

blog. I’m hoping to view the same high-grade content by you

in the future as well. In fact, your creative writing abilities has motivated me to get my very own site now 😉

Its such as you learn my mind! You appear to know so much approximately this, such as you wrote the e book in it or

something. I think that you simply can do with some p.c. to pressure

the message home a little bit, however instead of that, that is wonderful blog.

A fantastic read. I’ll certainly be back.

viagra medicine

all the time i used to read smaller content that as well

clear their motive, and that is also happening with this article which I

am reading at this time.

Hi, I do believe this is a great blog. I stumbledupon it 😉 I am

going to come back yet again since I book marked it.

Money and freedom is the greatest way to change, may you be rich

and continue to guide other people.

online loan

loan programs

This site was… how do you say it? Relevant!! Finally I

have found something which helped me. Many thanks!

Because the admin of this web page is working, no uncertainty very shortly it will be famous, due to its feature contents.

loans online approval

Hello Dear, are you in fact visiting this web site

regularly, if so afterward you will absolutely obtain nice experience.

zoloft tablets australia

This is a topic that’s close to my heart… Thank you! Exactly where are your contact details though?

Hiya! I know this is kinda off topic however , I’d figured I’d ask.

Would you be interested in trading links or maybe guest writing a blog post or vice-versa?

My blog covers a lot of the same topics as yours

and I feel we could greatly benefit from each other.

If you are interested feel free to shoot me an email. I look forward to hearing from you!

Fantastic blog by the way!

Thank you for sharing your info. I truly appreciate your efforts and I will be waiting for your further write ups

thanks once again.

First off I want to say superb blog! I had a quick question which I’d like to

ask if you do not mind. I was interested to find out how you center

yourself and clear your thoughts before writing. I’ve had a hard time clearing my mind in getting my thoughts out.

I truly do take pleasure in writing but it just seems

like the first 10 to 15 minutes are usually wasted just trying to figure

out how to begin. Any recommendations or tips? Cheers!

Hurrah! After all I got a web site from where I be able to really take useful facts regarding my study

and knowledge.

viagra from canadian pharmacy

Hmm is anyone else having problems with the pictures on this blog loading?

I’m trying to figure out if its a problem on my end or if it’s the blog.

Any responses would be greatly appreciated.

What’s up to every , since I am in fact eager of reading this blog’s post to be updated regularly.

It contains fastidious stuff.

affordable pharmacy

I truly love your blog.. Very nice colors & theme.

Did you create this website yourself? Please reply back as I’m attempting to create my very own blog and would like to know

where you got this from or what the theme is named.

Thanks!

small payday loan lenders

cost of prescription cialis

generic lasix

payday loans bad credit

quick cash loans

advance payday loans

Wow, awesome blog layout! How long have you been blogging for?

you made blogging look easy. The overall look

of your site is magnificent, as well as the content!

direct lender payday loans

This is really interesting, You’re a very skilled blogger.

I’ve joined your feed and look forward to seeking more of your wonderful post.

Also, I have shared your website in my social networks!

Great blog here! Also your web site loads up fast! What host are you using?

Can I get your affiliate link to your host? I wish

my web site loaded up as fast as yours lol

loans with low interest

loan process

cialis 50mg

loans in athens ga

I simply could not go away your website prior

to suggesting that I extremely loved the standard info a person provide for your guests?

Is gonna be again continuously in order

to investigate cross-check new posts

order sildenafil from india

quick loans no credit check

money fast online

sildenafil generic cost

This text is priceless. Where can I find out more?

purchase viagra over the counter

stromectol price usa

I like the valuable information you provide to your articles.

I’ll bookmark your weblog and take a look at again here frequently.

I’m quite sure I will be told a lot of new stuff proper here!

Good luck for the following!

There’s certainly a lot to know about this subject.

I like all the points you’ve made.

Wonderful web site. A lot of helpful info here. I am sending it to some pals ans also sharing in delicious.

And naturally, thanks in your effort!

vardenafil 20mg uk

Thank you for some other informative website. The place

else may just I am getting that kind of info written in such an ideal

manner? I have a project that I am just now working on, and I have

been at the look out for such information.

cheap viagra in united states

order cheap generic viagra online

Hi, I read your blog regularly. Your humoristic style is awesome,

keep it up!

sildenafil buy online india

i need cash

Appreciating the time and effort you put into your website and in depth information you provide.

It’s good to come across a blog every once in a while

that isn’t the same outdated rehashed material.

Great read! I’ve saved your site and I’m adding your RSS feeds

to my Google account.

Hey I know this is off topic but I was wondering

if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was

hoping maybe you would have some experience with something like this.

Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

price of modafinil 200 mg in india

online instant loans

generic cialis daily canada

Does your blog have a contact page? I’m having a tough time locating it but,

I’d like to shoot you an email. I’ve got some creative ideas for your blog you might be interested in hearing.

Either way, great site and I look forward to seeing it

improve over time.

loan money

loan no credit

generic cialis over the counter

soft cialis online

parent loan

Article writing is also a excitement, if you know then you can write otherwise it is difficult

to write.

Greetings! Very helpful advice within this article!

It is the little changes that will make the greatest changes.

Thanks for sharing!

payday loans instant

cash advance

safe online payday loans

I have learn several just right stuff here.

Certainly value bookmarking for revisiting. I wonder how so

much attempt you set to create such a fantastic informative web site.

reliable online pharmacy

personal loans low interest rates

Pretty! This was a really wonderful post. Thank you for providing this information.

hello there and thank you for your info – I’ve definitely picked up anything new from right here.

I did however expertise several technical points using this site, as

I experienced to reload the website a lot of times previous to I could get it to load correctly.

I had been wondering if your hosting is OK? Not that I am complaining, but

slow loading instances times will very frequently affect your

placement in google and can damage your high-quality score if advertising and marketing with Adwords.

Anyway I am adding this RSS to my email

and could look out for a lot more of your respective exciting content.

Make sure you update this again soon.

For most recent information you have to pay a quick visit world-wide-web and on world-wide-web I

found this site as a best site for most recent updates.

dollar loan

Hi there, I found your web site by the use of Google whilst searching for a similar topic,

your website came up, it appears great. I have bookmarked it in my google bookmarks.

Hello there, just changed into alert to your weblog through Google, and located that it’s

truly informative. I am going to be careful for brussels.

I’ll appreciate if you happen to continue this in future. Lots of

other people can be benefited out of your writing. Cheers!

I am truly grateful to the owner of this web site who has shared this great paragraph

at at this place.

advair diskus online

cheapest price for sildenafil 20 mg

Wow! At last I got a weblog from where I be able to in fact get useful

data regarding my study and knowledge.

Really when someone doesn’t understand then its up to other viewers that they

will assist, so here it happens.

loan broker

You really make it seem so easy with your presentation but I find this

topic to be really something which I think I would never understand.

It seems too complicated and very broad for me.

I’m looking forward for your next post, I will try

to get the hang of it!

We’re a group of volunteers and starting a new scheme in our community.

Your site offered us with valuable info to work on. You’ve done an impressive job and our whole community

will be grateful to you.

An outstanding share! I have just forwarded this onto a co-worker who had been conducting

a little homework on this. And he in fact ordered me lunch because I stumbled upon it for him…

lol. So let me reword this…. Thank YOU for the meal!!

But yeah, thanx for spending time to talk about this topic here on your site.

order viagra pills online

best online loans

Hi it’s me, I am also visiting this site daily, this site

is really pleasant and the users are truly sharing good thoughts.

legitimate online pharmacy

buy generic cialis daily

Wonderful beat ! I would like to apprentice while you amend your site, how could i subscribe

for a blog website? The account aided me

a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear

concept

Heya i am for the first time here. I found this board and I find It truly useful &

it helped me out a lot. I hope to give something back and help others like you helped me.

Pretty nice post. I simply stumbled upon your weblog and wished to mention that I have

truly loved surfing around your weblog posts. After all I’ll be subscribing

to your feed and I hope you write again soon!

best debt consolidation loans

WOW just what I was looking for. Came here by searching

for car removal auckland

order tadalafil online

cash loans

canadian pharmacies online

spotloan

loans usa

We’re a bunch of volunteers and starting a new scheme in our community.

Your web site provided us with valuable info to work on. You have done an impressive activity and our whole community shall

be grateful to you.

paycheck loan

canada pharmacy coupon

online cialis in canada

can i buy generic viagra

Heya i am for the first time here. I found this board and I find It truly useful & it helped me out a lot.

I hope to give something back and help others like you aided me.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point.

You obviously know what youre talking about, why waste your intelligence on just posting videos to your site when you could be giving us something informative to read?

difference between ventolin and proventil can you buy ventolin inhalers over the counter ventolin 100 bijsluiter

faiseurs de miracles book cover fadil al azzawi Autre Torrent eleeza art book

Quality articles or reviews is the main to interest

the visitors to pay a visit the website, that’s what this website is providing.

generic viagra uk

Great post! We will be linking to this particularly great post

on our website. Keep up the good writing.

generic cialis india

Good information. Lucky me I discovered your blog by accident (stumbleupon).

I have saved as a favorite for later!

canadian pharcharmy online

viagra originalverpackung buy cheap viagra in the uk paroxetina viagra juntos

The other day, while I was at work, my sister stole my apple ipad

and tested to see if it can survive a twenty five foot drop, just so she can be a youtube sensation. My iPad is now

broken and she has 83 views. I know this is entirely

off topic but I had to share it with someone!

I love what you guys tend to be up too. This sort of clever work and coverage!

Keep up the fantastic works guys I’ve you guys to my blogroll.

top 10 online pharmacy in india

Hello, i think that i saw you visited my web site thus i came to “return the

favor”.I’m attempting to find things to enhance my website!I suppose its ok to use a few of your ideas!!

viagra soft tabs uk

viagra and omega 3 how soon viagra take effect viagra placebo effect

Hi there! I know this is kind of off topic but I was wondering if you knew where I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having difficulty finding

one? Thanks a lot!

modafinil online without prescription

I enjoy what you guys tend to be up too. This kind of

clever work and reporting! Keep up the awesome works guys I’ve added you guys to

my blogroll.

viagra via huisarts viagra bei grippe viagra time to act

cialis 2

I always emailed this blog post page to all my friends, since if like to read it next my contacts will too.

viagra without doctor prescription

ooOO cialis online in europa cialis no prescription generic cialis online uk

cialis zel opinie how much is tadalafil betrouwbare generic cialis

Hey I know this is off topic but I was wondering if you knew of any

widgets I could add to my blog that automatically tweet my newest

twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would

have some experience with something like this. Please let me know

if you run into anything. I truly enjoy reading your

blog and I look forward to your new updates.

Ck2 Event New Holding Slot Geant Casino Prix Du Porc Coup De Pouce Cdiscount Banque Casino Anarque

how to buy tadalafil online

cialis 5 mg online pharmacy

does cialis cause itching tadalafil citrate cialis 5mg n3

I am sure this paragraph has touched all the internet

visitors, its really really good paragraph on building up new

website.

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I

get three e-mails with the same comment. Is there

any way you can remove people from that service? Thanks a

lot!

does cialis increase fertility 5 mg cialis online cheap cialis

Hello, I enjoy reading through your article. I wanted to write a little

comment to support you.

Woah! I’m really enjoying the template/theme of this site. It’s simple, yet effective. A lot of times it’s very difficult to get that “perfect balance” between usability and visual appearance. I must say that you’ve done a very good job with this. Also, the blog loads extremely fast for me on Safari. Outstanding Blog!

sildenafil 100mg price australia

Every weekend i used to pay a visit this

web page, as i want enjoyment, as this this site conations truly nice funny material too.

Today, I went to the beach front with my children. I found a sea shell and gave it

to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is completely off topic but I had to tell someone!

Cr Er Une Roulette Casino Sur Excel Resultat Euro Jackpot Italie 10 11 17 Diablo 3 Equipment Slots

medicamente pentru potenta cialis tadalafil uk prescription does cialis cause facial flushing

hi!,I love your writing so much! percentage we keep in touch extra about

your post on AOL? I need an expert on this space

to unravel my problem. Maybe that is you! Having a look ahead

to look you.

Hello colleagues, how is everything, and what you would

like to say regarding this piece of writing, in my view its

truly remarkable in support of me.

how to get real viagra

dividir pastilla cialis tadalafil wiki best cialis online review

brand levitra for sale

buy ivermectin pills

finasteride over the counter

sildenafil 100mg

As the admin of this web site is working, no question very quickly it will be famous, due to its quality contents.

viagra 100mg

buy viagra over the counter australia

buy fluoxetine from india

stromectol 6 mg tablet

canadian online pharmacy viagra

furosemide 40 for sale

lisinopril 10 mg

Thanks for a marvelous posting! I really enjoyed reading it, you could be a great author.I will be sure to bookmark your blog and will eventually come back down the road. I want to encourage yourself to continue your great posts, have a nice day!

This piece of writing is truly a nice one it

helps new net people, who are wishing in favor of blogging.

generic viagra 100mg price

Nice post. I was checking continuously this blog and I am impressed!

Extremely helpful information specially the last part 🙂 I care for such info

a lot. I was seeking this certain information for a long time.

Thank you and good luck.

order cialis canada

buy viagra best price

levitra 20mg online

cialis diario bula buy cialis 5mg daily doctissimo cialis viagra

generic viagra cost

cialis generic 20mg

As the admin of this web page is working, no uncertainty very soon it will be well-known, due to its quality contents.

tadalafil 10 mg cost

generic viagra sale

cialis preise italien buy cialis 60 mg online cialis use for what

can you buy viagra over the counter in australia

viagra tablets online

generic antabuse cost

generic viagra 25

cialis 50mg

cialis rosacea buy cialis 5 mg cialis em goiania

real viagra for sale

generic viagra capsules

real viagra pills for sale

provigil online order

order sildenafil from canada

tamoxifen generic

fincar

This article is actually a fastidious one it helps new web visitors,

who are wishing for blogging.

how much is accutane in canada

tadalafil uk paypal

buy cialis online cheap

order viagra online cheap

cialis 5 mg dose buy cialis in malaysia cialis helps prostatitis

lexapro 5mg australia

cialis 5 mg daily use cost

stromectol otc

ivermectin 0.5% lotion

ivermectin 4000 mcg

ivermectin cost australia

ivermectin 5 mg

stromectol tab price

stromectol tablets for humans for sale

stromectol sales

stromectol 3mg tablets

ivermectin 18mg

Hi there, the whole thing is going perfectly here and ofcourse

every one is sharing data, that’s actually excellent, keep

up writing.

stromectol ivermectin

stromectol 3mg tablets

stromectol tablets

This article is really a good one it helps new internet people, who are wishing

in favor of blogging.

cost of ivermectin lotion

stromectol medicine

ivermectin where to buy for humans

I visited multiple web pages but the audio quality for audio songs current at this web site is genuinely

marvelous.

viagra cialis online buy cialis in chiang mai costo cialis italia

ivermectin price usa

ivermectin tablets

stromectol medicine

buy oral ivermectin

stromectol online canada

ivermectin 3 mg

stromectol covid

ivermectin 50 mg

cost of ivermectin medicine

I love your blog.. very nice colors & theme.

Did you create this website yourself or did you hire someone to do it for you?

Plz answer back as I’m looking to design my own blog and would like to know where

u got this from. thank you

Ahaa, its good discussion about this article here at this

web site, I have read all that, so at this time me also commenting here.

ivermectin goodrx

stromectol covid 19

ivermectin for sale

ivermectin iv

ivermectin pill cost

order stromectol online

generic stromectol

buy ivermectin cream for humans

ivermectin ireland

stromectol online canada

buy stromectol uk

ivermectin lotion for lice

stromectol 3 mg price

stromectol online canada

ivermectin usa

ivermectin where to buy for humans

Wonderful article! This is the type of info that should be shared across the web.

Shame on Google for not positioning this publish upper! Come on over

and consult with my web site . Thanks =)

When someone writes an post he/she retains the thought of a user in his/her brain that how a user can understand it.

Therefore that’s why this piece of writing is perfect.

Thanks!

Your way of telling everything in this paragraph is in fact fastidious,

all be capable of without difficulty be aware of it, Thanks a lot.

getting prescribed cialis tadalafil 10mg prendre 4 cialis 5mg

ivermectin cream canada cost

stromectol lotion

ivermectin buy uk

price of stromectol

ivermectin 1%

ivermectin cream uk

generic tadalafil

ivermectin pills

ivermectin cost uk

buy stromectol online uk

cost of stromectol medication

stromectol order online

ivermectin cream cost

ivermectin ebay

where to buy stromectol online

ivermectin 3 mg

ivermectin 3

vardenafil dosage

ivermectin brand

stromectol online pharmacy

ivermectin 3mg tab

ivermectin india

ivermectin 3mg dosage

how to buy stromectol

ivermectin buy online

buy ivermectin pills

ivermectin uk buy

stromectol pills

stromectol 12mg

ivermectin 6mg tablet for lice

cialis icerigi tadalafil tablets ip 20 mg cialis gives you confidence

stromectol medicine

stromectol tablets buy online

cost of stromectol

ivermectin 3 mg tabs

ivermectin 9 mg

ivermectin virus

stromectol 12mg online

ivermectin lice

ivermectin 1 topical cream

stromectol online canada

ivermectin syrup

stromectol cvs

ivermectin cream cost

stromectol 12mg online

It’s very trouble-free to find out any matter on net as compared to textbooks, as I found this paragraph at this

web site.

where to buy stromectol online

ivermectin where to buy for humans

stromectol ivermectin

purchase stromectol

ivermectin ebay

ivermectin canada

buy stromectol pills

price of ivermectin tablets

ivermectin drug

ivermectin 90 mg

ivermectin buy online

ivermectin 4 mg

existe cialis manipulado side effects for tadalafil humana cialis

stromectol uk

I really love your site.. Great colors & theme.

Did you build this web site yourself? Please reply back as I’m wanting to create my own personal website and want to find out where you got this from or what the theme is called.

Many thanks!

ivermectin brand

stromectol online

price of stromectol

how much does ivermectin cost

stromectol nz

ivermectin eye drops

ivermectin 2ml

ivermectin human

ivermectin generic name

ivermectin 9mg

how much is ivermectin

ivermectin

stromectol liquid

cheap stromectol

ivermectin drug

ivermectin rx

stromectol pill

ivermectin pill cost

ivermectin canada

stromectol buy

generic ivermectin for humans

stromectol online canada

ivermectin buy nz

ivermectin 3 mg

stromectol pills

ivermectin 10 mg

how much does ivermectin cost

ivermectin 2

ivermectin uk

cialis for overactive bladder tadalis sx tadalafil cialis diario barato

stromectol coronavirus

Hi to all, how is all, I think every one is getting more from this web page, and your

views are fastidious in support of new viewers.

stromectol ivermectin buy

My brother recommended I might like this website. He was totally right.

This post actually made my day. You cann’t imagine just how much time I had

spent for this information! Thanks!

stromectol oral

ivermectin cost canada

order stromectol online

ivermectin 80 mg

buy stromectol uk

ivermectin buy

stromectol tablets buy online

where can i buy stromectol

where can i buy oral ivermectin

generic ivermectin cream

stromectol ivermectin

generic ivermectin

ivermectin 1 cream generic

stromectol pills

stromectol medicine

ivermectin tablet 1mg

stromectol for sale

stromectol how much it cost

ivermectin 3mg tablet

buy ivermectin pills

hello there and thank you for your information – I’ve

definitely picked up anything new from right here.

I did however expertise a few technical issues using this site,

since I experienced to reload the web site lots of

times previous to I could get it to load properly.

I had been wondering if your web hosting is OK? Not that I’m complaining,

but sluggish loading instances times will sometimes affect your placement in google and can damage your high-quality score if ads and marketing with

Adwords. Well I am adding this RSS to my email and can look out for much

more of your respective intriguing content.

Make sure you update this again soon.

cost of ivermectin 3mg tablets

cost for ivermectin 3mg

stromectol without prescription

You’ve made some decent points there. I looked on the net to learn more about the issue and found most people will go along with your views on this website.

ivermectin gel

stromectol 6 mg tablet

cialis coupon goodrx cialis super active vs professional cialis digestione

ivermectin price canada

ivermectin lotion for lice

stromectol over the counter

ivermectin for sale

stromectol tablets for humans

stromectol tablets buy online

stromectol generic

ivermectin 50mg/ml

stromectol south africa

ivermectin cream

buy ivermectin canada

stromectol ivermectin tablets

stromectol price

generic ivermectin for humans

ivermectin syrup

stromectol buy

ivermectin pills

stromectol ivermectin tablets

stromectol lotion

stromectol 3mg tablets

stromectol drug

buy stromectol

If you are going for most excellent contents like I

do, simply go to see this site all the time because it gives quality contents, thanks

stromectol price usa

stromectol pills

stromectol usa

stromectol cream

buy stromectol pills

stromectol cost

ivermectin 2mg

tadalafil cialis

805551 sildenafil

order celexa

online pharmacy europe

75 mg sildenafil

trust pharmacy

nolvadex 10 mg tablet price

sildenafil 20mg tablet price

chewable cialis buy cialis from canada cialis flomax bph

cheap viagra pills online

sildenafil generic 50 mg

legal online pharmacy coupon code

can i buy sildenafil over the counter in canada

cialis for daily use coupon

buy finasteride

sildenafil online nz

cialis how to get a prescription

where can you buy cialis online

where to buy over the counter cialis

hydroxychloroquine covid-19

can you buy sildenafil over the counter

trazodone 125 mg

where can i buy generic cialis online

ivermectin cost

wellbutrin prices

cheap cialis for daily use

viagra soft gel capsules

sildenafil 100mg tablets canada

cymbalta cap 30mg

best online pharmacy tadalafil

how to get modafinil prescription

best place to purchase cialis

buy viagra generic

tadalafil india 20mg

generic viagra in us

prednisone online australia

celexa 10 mg cost

viagra paypal canada

ivermectin 0.2mg

tadalafil online uk

how to viagra prescription

generic cymbalta no prescription

tadalafil price uk

80 mg celexa

trazodone cost canada

tadalafil india 10 mg

tadalafil 10 mg tablet

cheap pharmacy no prescription

sildenafil 10mg tablets

buy tadalafil 20mg price in india

modafinil 200 mg india

sildenafil tablets for sale

tadalafil pills

cost tadalafil generic

online viagra no prescription

Why people still use to read news papers when in this technological

world all is existing on net?

kamagra 100mg tablet price in india

Ahaa, its good discussion concerning this paragraph at this place at this weblog, I have read all that,

so now me also commenting at this place.

stromectol ivermectin buy

average cost of zoloft

discount viagra 100mg

tadalafil tablet online in india

sildenafil uk best price

viagra online costs

stromectol cream

finasteride 1mg coupon

price of ivermectin

cialis 800mg

best online pharmacy

viagra buy in australia

canadian pharmacy 365

sildenafil tablets australia

buy sildenafil online usa

viagra online cost

tadalafil

tadalafil drug

cost for celebrex

how to buy provigil online

stromectol ivermectin 3 mg

sildenafil buy usa

sildenafil 100mg tablets in india

pct nolvadex

nolvadex 10 mg online

cialis pills from canada

canadian cialis 60mg

ivermectin canada

best online pharmacy india

order antabuse over the counter

cialis 36

tadalafil generic coupon

buy online generic cialis

25 mg generic viagra

average cost of viagra

generic tadalafil in usa

cialis generic price

stromectol tab

I’m not sure exactly why but this weblog is loading extremely slow for me.

Is anyone else having this issue or is it a problem on my end?

I’ll check back later on and see if the problem still exists.

buy viagra online australia

buy tadalafil online canada

generic tadalafil price

I visited various blogs except the audio quality for audio songs present at this web site is really fabulous.

cialis comparison

where can you buy viagra in south africa

sildenafil medication

cheap cialis online india

cost of sildenafil in mexico

price viagra 100mg

WOW just what I was looking for. Came here by searching for Dave ramsey mortgage calculator

how much is cialis daily

cost tadalafil generic

order celebrex

can i buy tadalafil in mexico

cialis pharmacy discount

how much is viagra online

no prescription cheap cialis

no prescription generic sildenafil online

buy tadalafil online india

prescription prices for trazodone

sildenafil 100mg price canada

sildenafil 100mg buy online us

tadalafil buy online india

viagra pills online south africa

cheap tadalafil 5 mg

cialis canada pharmacy

provigil online usa

Link exchange is nothing else but it is only placing the other person’s weblog link

on your page at proper place and other person will also do similar

in favor of you.

sildenafil 25 mg cost

sildenafil 50mg canada

canada order cialis

sildenafil for sale india

sildenafil 20

where to buy tadalafil in usa

best sildenafil

finasteride for hair loss

sildenafil best price uk

tamoxifen brand name canada

kamagra oral jelly cheapest

viagra 50mg price in india

online pharmacy indonesia

viagra 100mg tablet online

how to get viagra tablets in india

tadalafil 50mg generic

can you buy viagra over the counter canada

where to buy sildenafil online

sildenafil 100

sildenafil over the counter usa

100mg sildenafil 30 tablets price

viagra soft gel capsules

zithromax 250 g

tadalafil 10 mg tablet

buy clomid online no prescription

ventolin tablet medication

best viagra pills in india

zithromax coupon

cheap viagra generic

cialis 100 mg

over the counter viagra pills

cialis 5mg for daily use

buy atarax without prescription

tadalafil soft gel

motilium tablets over the counter

buy cialis in australia online

sildenafil medicine in india

Excellent blog here! Also your website loads up very fast!

What host are you using? Can I get your affiliate link to your

host? I wish my web site loaded up as quickly as yours lol

best online pharmacy tadalafil

clomid mexico pharmacy

cialis 20mg price in usa

sildenafil discount coupon

sildenafil online india

best us price tadalafil

price of sildenafil in india

ivermectin cream uk

generic hydroxychloroquine

sildenafil 100mg mexico

lexapro generic 40 mg

motilium price

cialis best price uk

generic tadalafil 5mg cost

buy ventolin online nz

lexapro prices

best generic zoloft brand

disulfiram price in india

sildenafil brand name

Great article, totally what I was looking for.

stromectol ireland

5mg cialis from canada

price of cialis for daily use

buy viagra without prescription? mixing cocaine and viagra – where i buy viagra in delhi

canadian viagra paypal

buy ivermectin stromectol

stromectol 15 mg

canadian pharmacy viagra paypal

sildenafil india pharmacy

sildenafil brand name in india

cheap zoloft online

ivermectin 3mg price

viagra price comparison canada

cost of viagra

viagra generic drug

cost of ivermectin pill

average cost cialis 20mg

zoloft tabs

buy generic cialis 5mg

viagra 150 mg online

canadian pharmacy prices

hydroxychloroquine sulfate 200mg

ivermectin coronavirus

cheap viagra.com

tadalafil 20mg price

provigil pill

At this time it looks like Expression Engine is the

top blogging platform out there right now. (from what I’ve read) Is that what

you’re using on your blog?

ivermectin 15 mg

40 mg sildenafil

mexican pharmacies online drugs

ivermectin pills

can you buy viagra online without a prescription

generic antabuse cost

cialis 2019

buy cialis without prescription

clomiphene citrate clomid

sildenafil buy online usa

viagra coupon canada

viagra uk pharmacy

price for cialis

non prescription cialis

clomid cost australia

over the counter atarax

prednisone 20mg by mail without prescription

buying viagra with mastercard

mail order pharmacy no prescription

real viagra for sale online

ivermectin oral solution

soft tabs cialis

cialis price uk

ivermectin australia

ivermectin lotion for scabies

reputable online pharmacy no prescription

tadalafil 5mg in india

can you buy genuine viagra online

stromectol covid 19

stromectol where to buy

generic cialis no prescription canada

cialis super active cheap

5mg tadalafil price

sildenafil daily use

sildenafil generic

how to buy cialis online usa

where to buy tadalafil online

canada drug pharmacy viagra

daily cialis cost

tadalafil soft tablets 20mg

sildenafil citrate tablets 100mg

buy cheap sildenafil online

ivermectin otc

cialis online europe

viagra substitute over the counter

ivermectin 3 mg

where to buy viagra

cialis free shipping

tadalafil tablets 20mg

how to get viagra online

ivermectin canada

cheap daily cialis online

cheap sildenafil online no prescription

Hey! Someone in my Myspace group shared this website with us

so I came to take a look. I’m definitely enjoying the information. I’m book-marking and will be tweeting

this to my followers! Great blog and wonderful design and style.

sildenafil 100mg price uk

cost of 1 viagra pill

tadalafil in india online

online pharmacy 365 pills

price of tadalafil 10mg

azithromycin buy over the counter uk

tadalafil 30mg

viagra pills 100 mg

generic viagra online india

albuterol over the counter usa

canadian pharmacy for viagra

Pretty nice post. I just stumbled upon your

weblog and wanted to say that I have truly enjoyed browsing your blog posts.

After all I will be subscribing to your rss feed and I hope

you write again soon!

stromectol buy

I do agree with all the concepts you have offered to your post. They’re very convincing and can definitely work. Nonetheless, the posts are too brief for novices. May you please lengthen them a bit from subsequent time? Thank you for the post.

cheap albuterol inhalers

sildenafil viagra

ivermectin cost australia

viagra best brand

cialis tadalafil

sildenafil buy online india

ivermectin 10 mg

sildenafil 50mg prices

generic sildenafil in canada

cheap stromectol

viagra price comparison canada

how to purchase cialis online

60 mg tadalafil

cheap viagra pills

can i order azithromycin online

ivermectin cost canada

ivermectin virus

can i buy lexapro medicine online

stromectol cream

buy cialis 2.5 mg online

ivermectin 6mg tablet for lice

ivermectin coronavirus

price of ivermectin

buy cialis without prescription

can you buy cialis online

buy cialis wholesale

where can i get cialis cheap

tadalafil – generic

cost of tadalafil 10mg

cheapest sildenafil 100 mg uk

stromectol tablets 3 mg

viagra buy uk

cialis over the counter in canada

where to buy cialis over the counter uk

how can you get viagra

prednisone online paypal

ivermectin 3mg tablets

viagra without prescription uk

viagra price in india online

You could definitely see your enthusiasm within the work you write. The sector hopes for more passionate writers like you who are not afraid to mention how they believe. Always follow your heart.

sildenafil pills

tadalafil tablets 10 mg price

stromectol medicine

buy online cialis generic

viagra tablets for sale

generic cialis discount

buy sildenafil citrate online

plaquenil 0.2

best female viagra

plaquenil 100 mg tablets

cheap viagra online india pharmacy

legal generic viagra

generic viagra 100mg india

order tadalafil canada

cialis cheap online

purchase cymbalta online

kamagra 100mg oral jelly

tadalafil medicine

otc cipralex

buy viagra using paypal

cialis 2.5 mg

tadalafil tablet buy online

baclofen 20 mg price

tadalafil 5mg daily price

baclofen 20 mg

script pharmacy

safe reliable canadian pharmacy

canada pharmacy online

motilium canada otc

tadalafil prescription us

online pharmacy viagra no prescription

I simply couldn’t go away your web site prior to suggesting that I extremely loved the standard information a person provide in your guests? Is going to be again regularly to check out new posts.

generic ivermectin

tadalafil best price 20mg uk

order viagra europe

cialis soft tabs uk

how to get viagra in australia

stromectol tablets

cialis 20mg order

generic viagra online 100mg

hydroxychloroquine 700

viagra 100mg online in india

generic cialis 20 mg cheap

online pharmacy delivery

order tetracycline canada

buy viagra 100mg online uk

cialis 5mg cost canada

legal online pharmacy coupon code

20 mg lisinopril tablets

viagra online no prescription

tadalafil price in india

tadalafil female

buy propecia online india

best over the counter cialis

stromectol prices

baclofen 25 mg australia

cost of cialis in mexico

genuine viagra tablets

where to buy viagra over the counter usa

lexapro medication cost

ivermectin uk

where to buy cialis otc

propecia discount online

order stromectol

sildenafil

cymbalta prices

sildenafil 25 mg buy

cialis india generic

kamagra 100mg tablets

cialis 10mg online

stromectol xr

prednisone without precription

sildenafil discount coupon

cost of sildenafil in india

viagra prescription buy

ildenafil citrate

wellbutrin brand coupon

cialis tablets 5mg price

where to buy provigil online usa

lisinopril 1.25

trazodone 80 mg