Update 629 — Biden’s Dollars for Scholars

Cancels $10K in Debt; Long-Term in Doubt

Within the hour, with the current student loan payment moratorium due to expire on August 31, President Biden announced another extension of the payment moratorium until December 31 and the cancellation of $10,000 of debt per borrower making less than $125,000 annually and $20,000 of debt per borrower who received Pell Grants, at an estimated cost of $300 billion. Cancellation is a welcome relief for many of the 43.4 million Americans who have outstanding student loan debt.

But policymakers must still address root causes of the $1.75 trillion in total student debt — the cost of education — as well as the left-outs, such as those who have paid their debts. In this update, we review these issues, asking Congress and the administration to look beyond this semester. It is past time to consider long-term policies that address structural questions and make it easier to pursue all types of education and work.

Best,

Dana

——————————

Causes and Costs

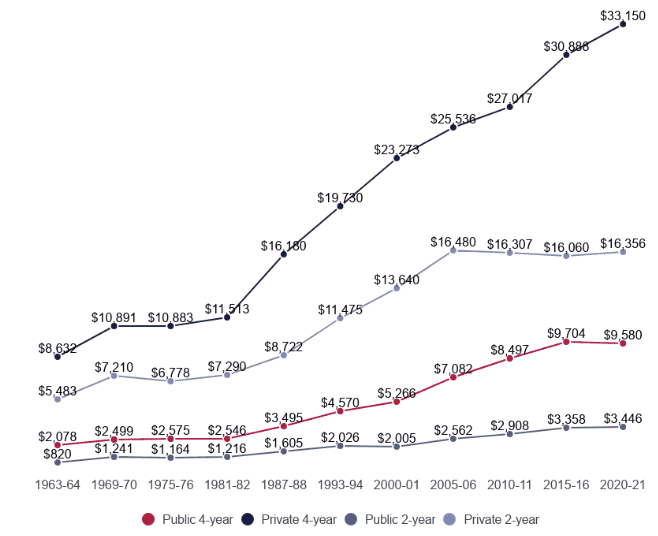

Back in 1963, the combined cost of tuition and fees for higher education in 2021 dollars ranged from $2,078 per year for public four-year programs to $8,632 per year for private four-year programs. Two-year programs cost relatively less with public two-year programs coming in at $820 per year and private two-year programs costing $5,483 per year. While many did not go to college, these costs were not nearly as burdensome as they are today. Sixty years later, the average cost of higher education has swelled to anywhere from three to five times as much per year.

Many factors have spurred the growing cost of education. State disinvestment has contributed to rising tuition costs at public colleges and universities. The cost to provide higher education itself has become more expensive due to issues such as changes in technology, increased demand in the private sector for potential faculty members, international competition for American degrees, and the increase in graduate education enrollment.

Historical Cost of College Tuition and Fees in 2021 Dollars

Source: Education Data Initiative

Congress should consider a variety of options that would reduce the cost of public education:

- Tuition-Free College: Tuition and fees are among the largest portions of the cost of higher education. Reducing these would increase accessibility to higher education, particularly for vocational and community college programs. Senator Sanders and Representative Jayapal’s College for All Act would do this by making public two-year programs tuition-and-fee-free for all students and public four-year programs tuition-and-fee-free for families making up to $125,000. Democrats have broadly supported making community college free through the America’s College Promise Act.

- Debt-Free College: Ensuring that students are able to attend and leave college without taking on debt should be a main objective in halting the growing student debt crisis and making education accessible to all. A bicameral coalition of Democrats introduced the Debt-Free College Act to cover the difference between the cost of attendance and what the student is able to pay. Proactively supporting students and protecting them from taking on debt would open countless doors for families across the country. A bipartisan coalition of members of Congress has proposed the PASS Act to expand financial aid, which would cut into the debt taken out for college.

- Expand Pell Grants and Federal Work Study: Alongside the College for All Act, there are multiple bills that would expand the size and longevity of Pell Grants. Expanding Pell Grants to cover more of the costs of higher education would increase access to higher education for many families and reduce their cost burdens considerably. Additional money can be provided by expanding the Federal Work-Study program so that students who work in exchange for financial aid can cover more tuition costs as well as books, housing, food, and other expenses.

- Eliminate Student Loan Interest: Until the cost of education is significantly brought down, Congress should pass the Zero-Percent Student Loan Refinancing Act that would allow borrowers to refinance their private and federal loans to a 0 percent interest rate. The Department of Education could also move to eliminate existing student loan interest, which would alter the role the federal government plays in the student loan market, but it would bring significant relief to existing borrowers and protect future borrowers from their debt becoming unmanageable.

The rising cost of education is a critical issue that the federal government needs to address. Leaving this to the states, and ultimately the individual, has caused considerable harm to people and the economy as a whole. But investments in higher education must be paired with support for non-college options, for the sake of keeping cost pressures in line and to take a holistic view of the issue, not ask those without degrees to subsidize others’ education without getting corresponding benefits.

Mind the Education Gap

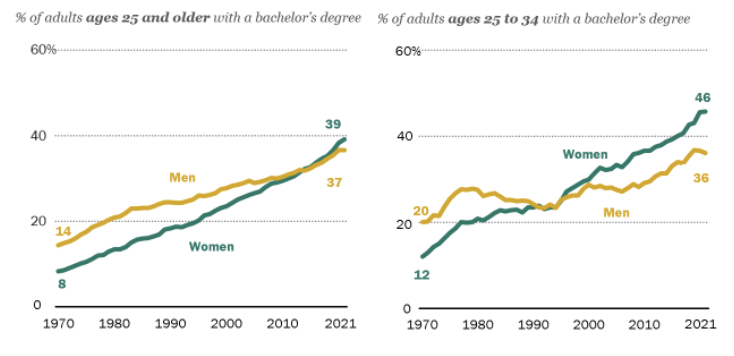

The college-educated populace has grown significantly over the past 60 years. Compared to the 7.7 percent of the population with a bachelor’s degree in 1960 to 37.9 percent of the population in 2021. The growing college-educated population has partially fueled the emergence of stark cultural divisions. The division has also emerged in partisanship as Democrats continue to make gains with college-educated voters while Republicans make inroads with non-college-educated voters. The result has been less mingling between these groups, further stoking tensions.

Percentage of Adults with a Bachelor’s Degree by Age and Gender

Source: Pew Research Center

The federal government can begin rectifying the class divide by ensuring there are adequate workforce development programs that would improve the quality of life for non-graduates. Increased access to community college and vocational school as mentioned above would also help allow these populations to mix again as there would be further avenues for additional education for the non-college-educated and decreased pressure to attend a four-year program.

There are also other proposals, perhaps a little bit more forceful, to address the education divide such as various national service programs. Multiple 2020 Democratic presidential candidates floated such an idea to promote social cohesion. The measures would work by exchanging a stint in service through the military, AmeriCorps, a proposed Civilian Climate Corps, or other service programs for educational or vocational scholarships.

Education as Industrial Policy

Beyond reducing the cost of education and promoting social cohesion, a comprehensive education investment and workforce development policy is also an investment in the future of our country and the productive capacity of our economy.

The recently signed CHIPS and Science Act highlights the need, importance, and feasibility of industrial policy even during politically divisive times. The legislation will incentivize semiconductor manufacturers to build in America and invest in advanced manufacturing and R&D across the country. But neither of these goals can be achieved without a populace ready for these tasks.

Investing in higher education to open pathways to fields of research builds the vocational workforce, particularly in manufacturing, can we harness the investments of industrial policy. In this sense, reforming higher education finance is just as much about easing the burden of growing costs and debt as it is about investing in the future of our economy and democracy itself.

Not All Bailouts Equal

President Biden’s decision to extend the student loan payment freeze through the end of the year, cancel $10,000 in student debt per borrower making less than $125,000 annually, and eliminate $20,000 of debt for Pell Grant recipients is necessary to remedy the failures of higher education finance policy in the past, but it cannot stop here.

Some may describe this policy as a handout for the highly educated but the vast majority of those with student debt are middle class. Bear in mind, the last major bailout in 2008 also had an acute macroeconomic rationale, and then it was the culprits, not the victims, who were bailed out. The announcement today is literal relief for those burdened by the failures of the current system. Canceling $10,000 in debt for everyone with federal student loans would settle the balances of roughly a third of borrowers and cut total debt by at least half for another 20 percent, according to the latest data from the Education Department. Policymakers, especially at the federal level, need to significantly change higher education finance so that future generations are not shackled by crippling debt and those students can power the economy of tomorrow.