Update 546 — You Can’t Bank on That:

63 Mil. Short of Credit, Account Services

All eyes today were on the Senate’s bipartisan negotiations and an initial vote to move to debate on the infrastructure bill. Moments ago, Republicans defeated the motion, 51-49, with 60 votes needed. With GOP negotiators signaling they will not have bill text until next week, today’s vote was a mere exercise. Next week, we will return to cover tangible developments.

Today in the House Financial Services Subcommittee on Consumer Protection and Financial Institutions, Democrats outlined their agenda for expanding access to banking and financial services. The under and unbanked make up about a quarter of all Americans, so lack of access to basic financial services is on a scale with macroeconomic implications.

Below we cover today’s hearing, examine this problem, and expand on possible legislative solutions.

Best,

Dana

—————————————

During today’s Subcommittee hearing, Democrats focused on expanding access to traditional financial services through a slew of policy proposals, promoting public banking, postal banking, and no-fee accounts. Republicans lauded the role of the private sector and FinTech in expanding financial access while objecting to the Democratic proposals on ideological grounds and Dodd-Frank harmed consumers more than it helped.

Demographics of the Underserved

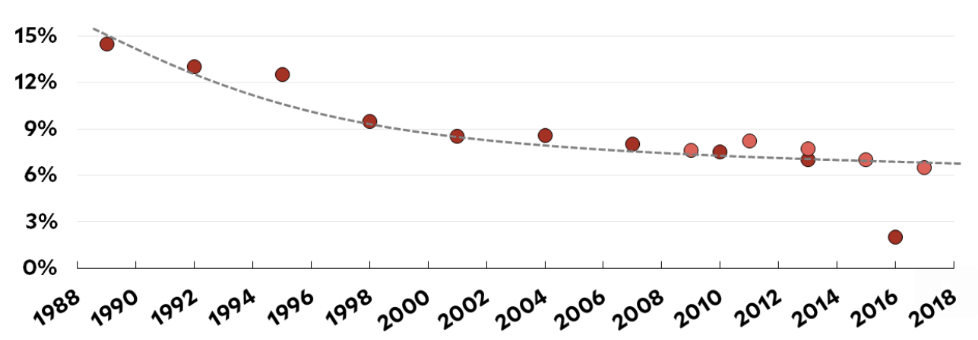

Despite the United States’ economic prosperity, a significant cohort of its population has limited or no access to a checking, savings, or money market account. Estimates place the unbanked population around 7.9 million American households, or 13.8 million individuals. The underbanked population — those who have a bank account but still rely on alternative financial services such as payday loans and check cashing facilities — is estimated to be over 21 million households or approximately 49 million individuals. Since the 2008 financial crisis, 3.7 million unbanked households have moved into the banking system, but the overall pace of this movement has slowed since the 1990s.

Households With No Bank Account

Both populations are disproportionately composed of households with low income, less education, or nonwhite members. 7.3 million unbanked households and 10.7 million underbanked households have a family income of less than $40,000 a year. 6.3 million unbanked households and 9.4 million underbanked households have a high school degree or less. And 7 million unbanked households and 17.4 millionunderbanked households are nonwhite.

The unbanked and underbanked rely on alternative financial services to participate in the economy and are at risk of numerous dangers:

- Limited Financial Access: These households lack the ability to establish credit and access basic financial services like online bill pay, automatic transfers, direct deposit, and mobile check deposits.

- Relative Costs: Unbanked and underbanked households spent $189 billion on fees and interest on alternative financial services in 2018.

- Financial Abuse: Cyclical and predatory payday lending generates huge interest payments. Households are borrowing $375 on average in payday loans.

- Threats: Loan sharks present dangers outside mainstream financial services.

Unbanked in America

Nearly 50 percent of unbanked households cited not having enough money to meet minimum balance requirements as a reason they do not have a bank account, while roughly one-third of unbanked households cited high and unpredictable fees. When unbanked households turn to alternative financial services, they risk higher costs and lackluster reliability. Unbanked individuals spend an average of $1,200 per year on “fringe financial services,” sometimes up to 10 percent of their income. In addition, the unbanked face barriers to building savings, establishing credit, and receiving government benefits.

Connecting these households to a reliable banking system could increase entrepreneurship, employment, and income. Unfortunately, the costs of maintaining an account disincentive private banks from creating free or low-cost accounts for customers. Lawmakers need to find ways to close the banking gap.

The Underbanked

Despite having bank accounts, 16 percent of households still use, and often rely on, alternative financial services. While these households do not face the same barriers unbanked households do, they still face the financial burdens imposed by alternative financial services. In aggregate, households spend about $8 billion per year in fees and expenses to borrow just $50 billion from payday loan services.

For the underbanked, addressing the high-interest rates and costs prevalent in alternative financial services would remedy many of the difficulties they face. For example, capping payday lending rates, as has been proposed, would free up significant amounts of cash in these households to move toward traditional banking accounts and a more secure financial position.

Legislative Proposals

The 22 percent of American households either unbanked or underbanked rely on costly financial servicesthat lack proper oversight. With tens of thousands more bank locations shuttering since the pandemic, this problem will only grow larger. Congress is considering the following legislation:

- The Postal Banking Act (Sen. Gillibrand) would re-establish the postal banking system as an accessible alternative to private banking or payday lending. Under this proposal, individuals could deposit up to $20,000 at their post office, which would offer the same essential retail services as any bank.

- The Public Banking Act (Rep. Tlaib) would create a federal incubator program to encourage the development of state and local public banks, like that of North Dakota. The bill provides new public financial institutions grants as start-up capital, technical assistance, and access to Federal Reserve’s payment systems for low-cost lines of credit.

- The Banking for All Act (Sen. Brown) combines many of these legislative proposals into one. The Act would create a no-fee digital dollar wallet as a bank account with no minimum balance requirements called “FedAccounts.” The accounts would be accessible at local banks and Post Offices and would offer the same essential retail services as any bank.

- The Expanding Financial Access for Underserved Communities Act would allow all federal credit unions to apply to the National Credit Union Administration in order to expand their membership services to communities that lack local depository institutions. The bill would also exempt loans made by credit unions to businesses in underserved areas from the credit union member business lending cap.

- The Access to No-Fee Accounts Act would require Federal Reserve member banks to establish no-fee digital transaction accounts for individuals and small businesses, with no minimum balance requirements. Participating community banks and credit unions would be reimbursed for their operational costs.

Each of these proposals would reduce the banking gap by offering the unbanked the ability to put money in traditional banking accounts or credit unions. The underbanked would also benefit since there would be low-cost competitors that could help these households save money instead of being preyed upon by alternative financial services.

Looking Forward

Despite Congressional interest in providing public solutions to inadequate banking access, legislative action will be difficult without a bipartisan agreement or procedural reform in the Senate. The White House’s interest in promoting financial inclusion and the Federal Reserve’s research in a Central Bank Digital Currency bode well, though, for moving the agenda forward.

White House advisors acknowledged the banking gap earlier in the spring as Economic Impact Payments were distributed. The newly implemented Child Tax Credit has also raised the stakes for low-income, unbanked households with children as the slow distribution of prepaid debit cards from the government will reduce the effectiveness of the program for these households. The President has leeway to influence bank behavior through the Office of the Comptroller of the Currency. Nominating an advocate for the unbanked to the position, such as Mehrsa Baradaran, who testified during the hearing, could pave the way for executive actions on expanding financial access.

The Federal Reserve has been conducting research into a Central Bank Digital Currency (CBDC). While no decision has been made, Fed Chair Powell stipulated he would prefer to see Congressional authorization for a CBDC if such a decision was made. The research agenda of the Fed aligning with the interests of members of Congress on a CBDC suggests there could be progress made here in the next few years on the matter. We all have a stake in reducing the numbers of financially underserved, so large that the macroeconomy suffers from problems ranging from exclusion to driving market participants into the grey economy.

I love the efforts you have put in this, thank you for all the great posts.

single women online

best free dating sites

free personal ads online

asian dating scams

Pingback: keto shake

gay truckers dating sites

remeo gay dating

indian gay dating site

viagra vs. generic viagra viagra online without a prescription ehsyraa – viagra new zealand buy online

offline gay dating

asian gay dating site dragon

gay dating websites canada

natural food substitute to viagra what\’s better viagra cialis levitra – viagra online pay with paypal

free sex gay dating

gay dating game show

gay senior dating sites

gay christian dating service

gay chat dating

gay black and white dating

gay guy dating a ftm

top 50 gay dating sites

gay sock feet dating sites

gay dating italy

austin tx gay dating sties

gay military dating uk

interracial gay dating sits

gay dating winfield ks

gay dating sim romance koi