Update 394 • Warren’s $20.5 Tr. M4A Pay-For:

Revenue Neutral; No New Middle Class Taxes

Last week, Sen. Elizabeth Warren released a plan to pay for her Medicare for All (M4A) proposal. Sen. Warren’s plan is to raise $20.5 trillion in revenue over ten years, raising no taxes on the middle class. The scope and size of the revenue-raising exercise is enormous. But is a fiscally responsible investment that does not include new taxes on middle class filers.

We will leave aside for now consideration of the progressive priorities that such a massive federal investment might crowd out, or how this mighty revenue stream could include them. Below, though, we take a closer look at the scale, progressivity, and viability of her ambitious proposal, accepting the $20.5 trillion cost estimate and examining the revenue sources.

Best,

Dana

————

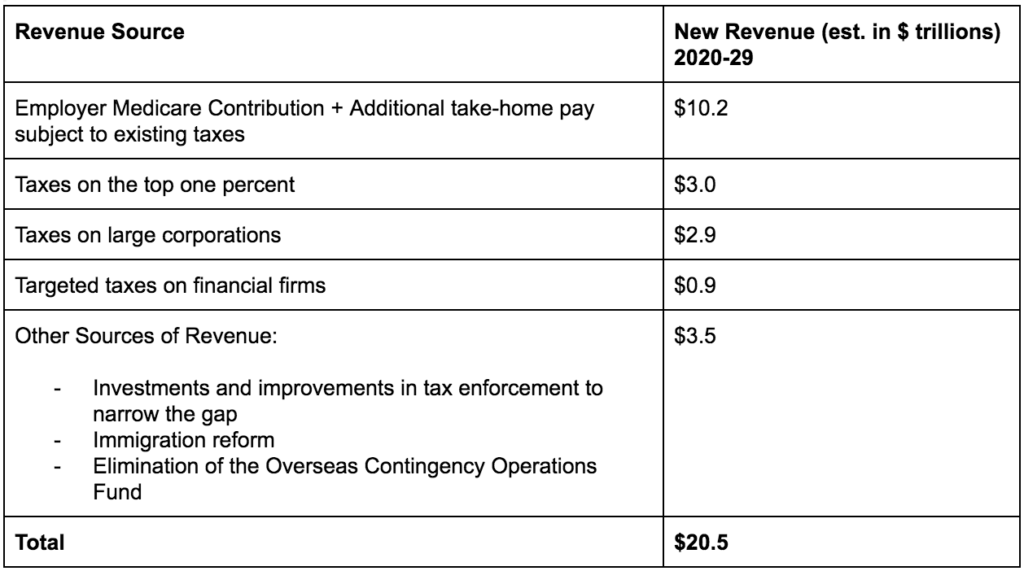

The Path to $20.5 Trillion

Medicare for All proposals from candidates and others have been variously estimated to cost the federal government between $13.5 trillion (UMass Amherst) and $34 trillion (Urban Institute) over ten years, depending on the overall cost of healthcare. Sen. Warren’s plan announced last week provides for $20.5 trillion in increased revenues over ten years.

Federal Revenue Estimates

Employer Contribution + Additional Take Home

Under Warren’s M4A, instead of purchasing private insurance, businesses would instead pay the government a levy equal to 98 percent of their (pre-M4A) per-capita/employee healthcare costs. Right away, businesses pay 2 percent less than they otherwise would for private insurance. Over time, employers’ contributions will converge towards a national average, resulting in a ‘head tax,’ whereby every employer pays the same amount per employee.

Many Medicare expansion proposals, such as Sen. Sanders’, envision something akin to progressive income or payroll tax rate hikes, whereby marginal earnings over a certain threshold are subject to greater taxation. Instead, Warren’s head tax treats all employees as equal, whether they are low, medium, or high earners — a flatter, more universalist-approach.

Warren’s M4A would do away with most other healthcare costs, like contributions to premiums, co-pays, deductibles — which undoubtedly help those who are uninsured, under-insured, or suffering from high monthly costs. On the other hand, compared against other M4A proposals, a flat head tax fee is regressive. There could also be increased avoidance, through worker reclassification and corporate restructuring.

In total, Warren projects that the Employer Medicare Contributions would raise about $8.8 trillion, or 40 percent of the total program cost.

The Warren plan takes into account that workers, no longer forced to pay into employer-based plans and associated premiums, will have increased take-home pay. This income would be subject to existing taxation structures, like income tax, and would generate an additional $1.4 trillion in revenue.

Taxes on the Top

- Wealth tax: Sen. Warren originally proposed her wealth tax to finance a universal child-care program, tuition-free public college, and student debt forgiveness via a two percent annual tax on households with a net worth between $50 million and $1 billion and a 3 percent annual tax on households with a net worth over $1 billion. Warren’s M4A plan calls for an additional 3 percent tax on households with a net worth over $1 billion. For the small number of asset-rich, but cash-poor individuals, the wealth tax assessment may be deferred for up to five years.

- Mark-to-market: M4A changes how we tax long-term capital gains. Long-term capital gains currently enjoy preferential tax treatment and lower rates: 0 percent for households making less than $40,000, 15 percent for households making less than $435,000, and 20 percent for everyone else. These taxes aren’t due until the assets are sold. Investors often hold onto assets for a long period of time, so as to defer and minimize tax liabilities. Warren’s changes would only affect households making more than $200,000 annually, and would 1) tax their capital gains at regular income rates, and 2) tax capital gains at an annual basis instead of when the asset is sold.

Together, these two changes will bring in around $3 trillion.

Taxes on Large Corporations

- Accelerated Depreciation: Under current law, businesses benefit from accelerated depreciation when they make investments in certain fixed assets. Full expensing allows companies to deduct the full purchase price of assets in year one, rather than depreciation over time. Warren’s plan still allows businesses to write-off asset depreciation, but in a way that better reflects the actual loss in value every year. Closing this loophole would raise $1.25 trillion over ten years.

- Crossborder Minimum Corporate Tax: Warren seeks to crack down on corporate tax avoidance by imposing a 35 percent minimum tax on foreign earnings by American multinationals. Companies would have to pay the difference between their effective tax rate paid in foreign countries and 35 percent. Her proposal would also subject foreign firms who would have outstanding liabilities if they were subject to the same country-by-country minimum tax to a 35 percent minimum tax rate on revenue generated in the United States.

These two provisions would generate $1.65 trillion over ten years.

Targeted Taxes on Wall Street

- FTT: Sen. Warren advocates for a financial transactions tax, or FTT, which would amount to a 0.1 percent tax on all stock, bond, and derivatives transactions. The proposal is identical to S. 647, the Wall Street Tax Act of 2019, which was introduced by Sen. Schatz in March. The Tax Policy Center estimates that 75 percent of the burden of an FTT falls on taxpayers in the highest income quintile, and 40 percent falls on the top one percent. Still, some middle to high income earners may see their retirement accounts affected. The tax would raise $777 billion over ten years, according to a 2018 Congressional Budget Office report.

- Systemic Risk Tax: In addition to the FTT, Warren is proposing to levy a “systemic risk fee,” equivalent to 0.15 percent, on the covered liabilities of the roughly forty banks in the country with over $50 billion in assets. The systemic risk tax is projected to raise $100 billion over ten years.

Other Sources of Revenue

Warren wants the IRS fully funded and equipped to go after tax cheats. Since 2011, Republicans in Congress have systematically defanged the IRS. Experts say that Warren’s IRS proposals alone could bring in $2.3 trillion over ten years. Per a 2013 CBO estimate, immigration reform could contribute an additional $400 billion in revenue over ten years. Another $798 billion could be saved by eliminating the Pentagon’s Overseas Contingency Operation budget, which she has called a “slush fund.”

The Trillion Dollar Question

Now that Senator Warren has answered the “how are you going to pay for it?” question, we ask her, “how are you going to get it passed into law?” With a price tag of over $20 trillion, there is an opportunity cost: some of the pay-fors identified could fund other social programs instead, such as tuition-free college, universal pre-K, and more.

The decision will largely be up to middle class voters whether the math works. If they are convinced the plan is better than the status quo and less expensive, they won’t oppose it on tax or other cost grounds. In addition, if the plan can pass intact, it would put behind us six decades of debate on health care and resolve the single most vexing domestic economic policy of our time… for the time being.

http://vsdoxycyclinev.com/ – buy vibramycin doxycycline new zealand

Muchas gracias. ?Como puedo iniciar sesion?

free dating site

free chat online singles

free online dating

free adult dating sites

what is tinder , tinder sign up

tinder date

tindr , tinder sign up

tider

reputable online levitra

tinder app , tinder website

tinder login

tinder login, tinder login

tinder online

levitra on line sale

tider , browse tinder for free

http://tinderentrar.com/

tinder sign up , tider

http://tinderentrar.com/

cheap generic cialis

cheapest propecia

best price cialis

accutane without a perscription

cheap price

matteo pena children book 1080p Torrent 2013 lincoln mkx awd v6 blue book

Magasin Casino Saint Maur Des Fosses Circuit De L Gende Slot Racing 1 32 Casino Noum A Recrutement

Casino Mondorf Les Bains Concert New Online Casinos Accepting Us Players Cambriolage Casino Las Vegas 1987

cialis 20 mg

date sites

best adult dating sites

free online dating

free online dating

Pingback: keto naan

free gay dating colombia

gay teens dating sites

phil corbett gay dating

free gay latino dating

gay mobile dating sites

gay dating sites for ohio

viagra using paypal where to buy viagra in denver – 5 viagra pills

free gay men dating sites

gay dating site 0

persona 5 gay dating

dating sites for gay trans men

gay st louis dating

gay old bears dating young

gay dating mobile

gay dating sites for android

american gay dating site

professional gay dating service

gay dating seattle

noah antwiler gay dating site

gay online dating site

gay asian dating san francisco

teenage dating sites gay