Update 554 — The Road to Reconciliation:

Path, Process Ahead for Budget Resolution

Last week, the House passed an FY2022 budget resolution, allowing the $3.5 trillion package to move forward via reconciliation, which requires only a simple majority to pass. In order to achieve the Democratic unity needed for passage, Speaker Pelosi promised a group of moderate Democrats a vote on the $550 billion bipartisan Infrastructure and Jobs Act on September 27.

This deadline puts pressure on House committees to race through the mark-up process to keep the legislative packages moving simultaneously through the chamber. Negotiations notwithstanding, House leaders seek to complete the FY22 budget by September 30. The top-line targets and reconciliation instructions are in place but not final, with committee spending sub-allocations to be decided. This updatelays out the reconciliation process, possible pitfalls, and what is at stake for Democrats.

Good Labor Day weekends, all.

Best,

Dana

———————————

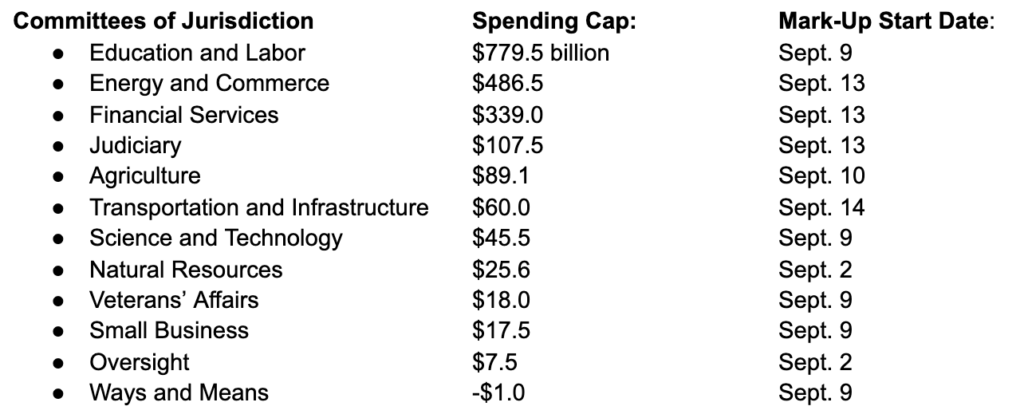

Reconciliation Home Stretch

The budget resolution provides spending caps for both House and Senate committees. However, it appears that the House is going through the full mark-up process with the Senate opting for informal committee recommendations likely to take the form of a manager’s amendment. The Senate is willingly sidelining its committees to expedite the reconciliation process and prevent the package from moving to a conference committee. With all eyes on the House, committees of jurisdiction have been instructed to report their policy prescriptions and fiscal allocations to the Budget Committee by September 15. The Budget Committee will then have a week to organize these mark-ups into an omnibus package ready for a floor vote.

While the reconciliation package is being reported as $3.5 trillion cumulatively, the budget resolution allows only for a net deficit of around $1.8 trillion over the next ten years, after which all permanent programs will need to be fully offset. The reason for this gap is that almost half of the new spending is under Ways and Means jurisdiction, such as child tax credit enhancement, ACA expansion, paid family leave, and closing the Medicare coverage gap. However, Ways and Means has been instructed to fully finance their spending with new revenue, thus their cap is negative.

After You, Alphonse

Almost all House Democrats are on board with the spending side of the reconciliation package, but major rifts are opening up over revenues, primarily caused by uncertainty over Senate action. Sen. Sinema has stated the $3.5 trillion topline figure is unacceptable, while Sen. Manchin has said deficit neutrality is a must for his vote. While Sinema and Manchin’s public opposition poses challenges for Congressional leadership, both have proven that their deficit hawkery is flexible when push comes to shove.

House moderates have voiced concerns over voting for a tax increase that the Senate will scale back, leaving them with all political risk and none of the reward. At the same time, progressives fear that lowballing the pay-fors could lead to Senators cutting critical investments from the package in the name of “fiscal responsibility.” This has led to a race to the bottom between the two wings of the caucus that could unnecessarily deteriorate House Democrats’ negotiating position when the package makes its way to the Senate. The fight over revenue will play out in the open during the Ways and Means mark-up process. The obvious way to cut through this gordian knot would be all sides agreeing to work within the budget resolution framework and allow a small portion of the bill to be deficit-financed.

Big ticket pay-fors that are causing the most contention include:

- Corporate Taxation: Biden has proposed an increase of the corporate tax rate to 28 percent, generating up to $850 billion in new revenue. Moderates want the rate to be no higher than 25 percent, reducing the pay-for value by around $350 billion.

- Treatment of Capital Gains: Biden has called for investment income to be taxed at the same as labor income and change the step-up basis rule to curb excessive intergenerational wealth transfers, generating up to $430 billion. Moderates are firmly against Biden’s step-up change and only want the top capital gains rate to be increased by a few points, reducing the pay-for value by at least half.

- Prescription Drug Reform: Biden is backing the House’s Lower Drug Costs Now Act, which would allow Medicare to negotiate prices, saving the federal government up to $500 billion. It passed the House last December but has yet to move forward this Congress. Moderates are pushing for a scaled-down version that benefits drug manufacturers, reducing the pay-for value by up to two-thirds.

Democratic Majority’s Best Defense

The Democrats’ objective in the House is to pass up to $3.5 trillion in spending. While it is unlikely that each of the tax reforms President Biden has proposed will make it to the final bill, House Democrats should avoid negotiating against themselves and shrink the bill before it even gets to the Senate. Given the current dynamics in the upper chamber, the Senate is unlikely to add in any revenue raisers left out by the House. If the House bill contains a smaller package of offsets, the Senate will likely trim down the spending provisions — an undesirable outcome. The stakes are high: the future of Democrats’ congressional majorities depends on passage of this package.

Even though the Senate will likely modify the House bill, the House must make a strong “opening offer” to the Senate. If House Democrats negotiate against themselves too much, the likely outcome will be a final bill much smaller than Biden’s original proposal. This reconciliation bill has the potential to include once-in-a-lifetime boosts in social spending that would provide both short- and long-term benefits to the macroeconomy. But the fewer offsets the House includes, the less spending will likely be included in the final bill, unless members see the benefits of deficit financing, with the macroeconomy in mind.

Big business is engaging in a massive lobbying campaign to pare back the bill’s tax provisions. Democrats do not have to fear this effort for policy or political reasons. The proposed taxes poll extremely well: 64 percent of Americans support raising the corporate rate, 67 percent support raising the individual rate for high-income earners, and 67 percent support raising the capital gains rate. Additionally, there is an intense lobbying effort by corporate interest groups seeking to scale back major revenue raisers such as prescription drug reform and enhanced IRS enforcement. If these provisions are scaled back, that will inevitably lead to either sunsets or slashing of popular provisions. The present moment offers Democrats a rare opportunity to make equitable reforms to the tax system while also making significant investments in the economy.

In 2020, Democrats campaigned on a platform of standing up for working families and ending forty years of regressive fiscal policy. The reconciliation resolution is the moment to deliver. The price of failure could be disappointment and disillusionment among base Democratic voters. But success can restore faith in Democrats’ ability to govern and improve material conditions for most voters and represents the best chance to defend if not extend their majorities.