Update 654 — Tax Talk of the Town:

Fate of CTC and R&E Rest on FY23

Good news from Georgia — Senator Raphael Warnock has won re-election, giving Democrats 51 seats and a governing majority in the Senate (which we cover Friday).

Members of Congress, staff and advocates are working feverishly to hash out a compromise tax-extenders bill before adjournment. The window of opportunity for a tax package in the FY23 omnibus narrows as year-end approaches. Strong bipartisan support exists for various tax provisions, including a bipartisan retirement package (covered previously here). But is it sufficient for passage of a package?

The central tension appears between restoring the Child Tax Credit and corporate R&E tax breaks. Progressives advocates are dismayed at the prospect that corporate tax priorities might again prevail. Balancing the two priorities will be difficult, but expanding the Child Tax Credit is critical to get done while Democrats still have the trifecta.

In today’s update we cover the tax-extenders package, the two competing priorities, and the need for a fully refundable Child Tax Credit.

Best,

Dana

__________

The primary tax policy goal for progressives before the end of the 117th Congress is securing an expansion of the Child Tax Credit and Earned Income Tax Credit. Meanwhile, large businesses seek to stop phase-downs of significant corporate tax breaks from the 2017 TCJA. The idea of a trade-off is unfortunate — but if one has to give, we urge giving to those without first.

The Child Tax Credit Expansion

The American Rescue Plan Act (ARP) increased the per-child credit from $2,000 to $3,600 for children under six or $3,000 for children between the ages of six and 17. It made the credit fully refundable for the first time, ensuring that previously ineligible low-income families would be able to access the full credit. It also made the credit redeemable monthly rather than annually.

These changes didn’t just prevent a massive increase in child poverty during the economic downturn associated with the pandemic. Child poverty fell by 46 percent in 2021 compared to 2020, the largest one-year drop on record, thanks in large part to the Child Tax Credit. The expansion itself kept an additional 2.1 million children out of poverty and helped cut the percentage of children living in near poverty by one-third.

Because the money from the credit was disbursed monthly rather than in a lump sum, families were able to use the payments on regular expenses, like groceries, child care, and school expenses. Food insufficiency in households with children dropped by one quarter with the arrival of the first monthly CTC payments. Financial hardship in families with children also fell by nearly one-tenth after the arrival of the first checks.

Then, at the end of 2021, the expansion expired. By January 2022, 3.7 million more children were living in poverty than the month before. Although the House passed a version of the CTC expansion in the Build Back Better Act, the requisite support in the Senate never materialized, mostly due to West Virginia Senator Joe Manchin and opposition from all Senate Republicans.

Now, nearly a full year after the expiration of the ARP expansion, Republicans are on the cusp of taking control of the House, and Democrats’ opportunity to unilaterally expand the CTC has passed. Instead, progressives are focused on tying a group of corporate tax breaks to the restoration of a fully refundable credit, which would reach an additional 19 million children who are currently ineligible.

Corporate Tax Breaks

Chief among the tax provisions corporations are eager to see pass by the end of the year is the restoration of full expensing of Research & Experimentation (R&E) expenditures. The 2017 Tax Cuts and Jobs Act required businesses to begin amortizing their R&E expenditures over five years beginning this year. Delaying or stopping this change from taking effect is a top priority for the business community– a group of roughly 400 businesses and organizations signed onto a U.S. Chamber of Commerce letter putting pressure on Congress to stop the amortization requirements.

- Depreciation and Interest Expense — Firms large and small are hoping that Congress will put off the phase-down of bonus depreciation and changes in the calculation of net interest deduction limits. Firms are currently able to expense 100 percent of the cost of certain equipment and machinery. But this number will drop to 80 percent beginning next year and phase down incrementally to zero percent in 2027. The TCJA also set the net interest deduction limit at 30 percent of earnings before interest, tax, depreciation and amortization (EBITDA). Now, businesses must calculate the 30 percent limit using the less generous earnings before interest and tax (EBIT), reducing the interest a business can deduct.

This trio of tax breaks is a high priority for both corporations and a significant portion of Congress. But a growing chorus of Democrats are insisting that corporations should not receive support before low-income families do and they have the power to ensure that.

Poverty Pitted against Profits

The historic drop in child poverty that the United States experienced in 2021 is proof that a monthly fully refundable Child Tax Credit can make a meaningful difference in the lives of American families. Congress has both an economic and moral obligation to expand the CTC at the end of this year and build upon the success of the ARP expansion by restoring monthly fully refundable payments. A recent survey found that voters favor the CTC by a 75-19 percent margin. Voters also agree nearly six-to-one that Congress should not pass any more tax breaks for big corporations unless there is also support for families.

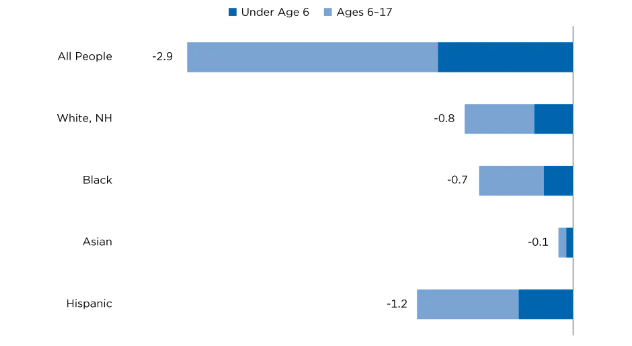

Change in the Number of Children in Child Poverty

Due to the Child Tax Credit, 2021 (in millions)

Source: Census Bureau

Furthermore, the arguments regularly lobbied against the Child Tax Credit expansion are somewhat disingenuous. The first argument conservatives generally reach for is that we cannot afford full refundability without offsets. However, conservatives have not as of yet offered a way to pay for their corporate tax breaks, which carry a significant price tag.

- R&E Expensing Cost — CRFB estimates put the cost of retroactively restoring full R&E expensing for just one year at $60 billion. If made permanent, the policy would cost $155 billion over ten years. The three corporate tax provisions above would carry a combined first-year cost of roughly $95 billion with no related offsets.

- CTC Cost — CTC refundability would carry a price tag of roughly $12 billion a year with the added benefit of lifting children out of poverty.

If we can afford to extend corporate tax breaks and even consistently pass defense spending bills above the levels the White House requests, then we can more than afford to expand the CTC.

Opponents of full refundability will also often cite work disincentives as a reason not to extend benefits to those low-income families most in need. However, a growing number of studies and Census data have found no effect of payments on employment among CTC recipients. In fact, parents eligible for the CTC were much less likely to report being unemployed due to child care responsibilities after monthly CTC payments began. People who were eligible for CTC were 1.3 times more likely to start new professional training.

If a critical mass of Democrats in Congress are unsuccessful in tying corporate tax breaks to a fully refundable CTC this year, the fight for expansion won’t be over, but it will be different. With a Republican-controlled House and without the leverage of corporate tax breaks, the odds that Democrats will need to make even further concessions on issues like work requirements or offsets in order to secure any kind of expansion shoot up. As a result, it’s important that the current Congress do everything it can to secure critical support for children and families in the few weeks it has left.

Americans know that our tax code is tilted in favor of large corporations and the richest citizens. Extending corporate tax breaks without at least restoring full refundability would be a betrayal of the low-income families whose quality of life could be meaningfully improved. As we approach the holiday season, Congress has the power to ensure that more families can put food on the table, make rent or utility payments, and pay for clothes or school expenses. All that they need is the political will to do so.

__________

Send a message to your member of Congress and Senators to put children ahead of corporate tax cuts and extend the Child Tax Credit by the end of the year or Text CTCNow to 747464 or call 1-888-496-4842 to connect to your U.S. Senator’s office and demand the expanded Child Tax Credit is included in an end-of-the-year tax package.