Update 264 — GOP Double-Down Hair-Doo:

Liked the Tax Cut? How about a Perm?

While today marks the last day Americans will file their taxes under the old tax code, a number of Americans have already seen their paychecks influenced by lower tax withholdings. Republicans wasted little time celebrating the Tax Cuts and Jobs Act (TCJA) before turning to tax reform 2.0 — the next round of tax cuts.

On the theory that nothing succeeds like success, the GOP seems to be staging a sequel. What does entail substantively and will Americans want to see this movie again. And again…?

Best,

Dana

–––––––––––

Tax Cuts Round Two

Lead by Rep. Mark Meadows, Chair of the House Freedom Caucus, Republican leadership is grating up a “phase two” of tax slashing in anticipation of the upcoming midterm elections. This tax cut 2.0 is likely to be rolled out on two fronts: individual permanence and the indexing of capital gains.

Individual Permanence

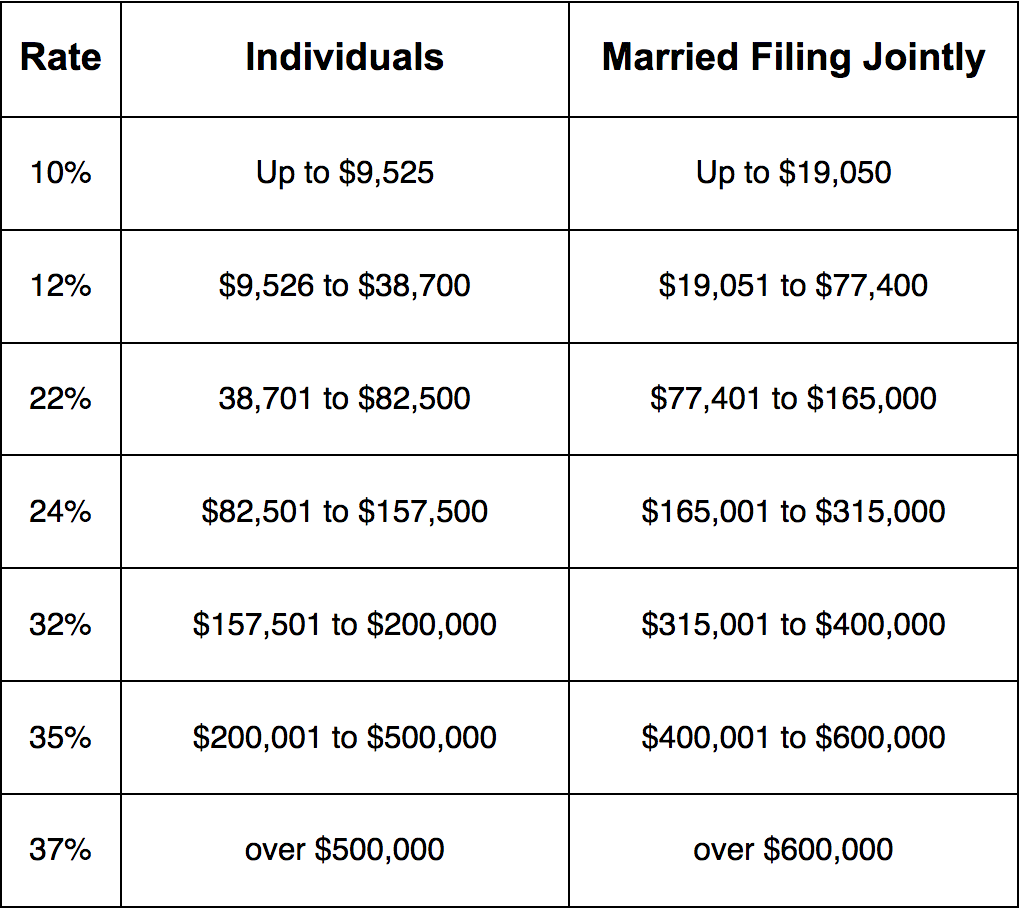

The TCJA was a massive restructuring of the American tax code that significantly cut corporate taxes and provided more modest relief for individual filers. Because no Democrats could be sold on it, the GOP had to pass the tax Act along party lines through the reconciliation process. Using reconciliation required tax drafters to adhere to the Byrd rule and ensure that their legislation did not add to the deficit beyond a ten-year window.

Making the individual tax cuts permanent would cost approximately $1.5 trillion in the decade after 2025. Republicans hope this maneuver will put Democrats in an awkward position come November, because allowing the cuts to expire in 2025 would see the bottom 80 percent of income earners paying higher taxes than if the law had never passed in the first place (see more below). This is a dangerous political game, however, as such a ploy would double the cost of the TCJA and further balloon the deficit.

Indexing Capital Gains

Beyond individual rate permanence, Republicans also seek to reduce the capital gains rate in a second round of tax cuts. One initiative spearheaded by Sen. Ted Cruz would deflate capital gains for inflation. GOP lawmakers have long sought to slash the capital gains rate in the name of increasing investment. But Trump railed against the preference on the campaign trail. National Economic Council Director Larry Kudlow has gone so far as to argue that the President could index capital gains via executive order.

Such an effort would only serve to make the Republican tax reform effort less equitable. According to the Tax Policy Center, nearly two-thirds of the gains from the Tax Cuts and Jobs Act will accrue to the top 20 percent of earners. Increasing the preference on capital gains will double down on this upward redistribution because nearly 70 percent of all capital gains income is claimed by households making at least $1 million.

Gratuitous, if Deficit-Financed, Stimulus

CBO estimated this month that the country will hit trillion-dollar annual deficits by 2020, mostly thanks to Republican tax efforts and the recently passed omnibus. Many economists view this level of stimulus as risky given where we are in the business cycle. The Fed is likely to continue to raise interest rates as the unemployment rate hits four percent, and rising debt combined with rising interest rates means rising interest costs.

The GOP has already started deflecting blame for its fiscal profligacy, with House Ways and Means Chair Kevin Brady claiming that “we don’t have a revenue problem in Washington, we have a spending problem.” Brady then pointed to entitlement spending as an example of out-of-control spending, an indication that Republicans plan on making the middle class pay for their tax cuts twice – straddling future generations with huge deficits, and contemporary ones with entitlement cuts.

Politics of Tax 2.0

• GOP Fecklessness — This new round of tax cuts is additional evidence of a fundamental truth: it is in the Republican DNA to cut taxes. The GOP has shown that its fiscal hawkishness during the Obama administration was nothing more than a political ruse. Since assuming power they championed tax legislation that will increase the debt by $1.5 trillion over a decade and next negotiated a spending Act that will bring the deficit to $1 trillion in the next fiscal year. All told CBO expects the debt to balloon to $33 trillion by fiscal 2028.

• Legislation in the Works — Legislation to make individual rate cuts permanent has been introduced in both houses. Senator Ted Cruz introduced a Senate bill to this effect, while Congressman Rodney Davis introduced a House version that makes pass-through rates permanent in addition to individual rates. Republicans will use this legislation to chide Democratic candidates who decried the fact that the TCJA’s made corporate cuts permanent while setting individual cuts expiration date at 2025. GOP leadership will suggest this is the Democrats’ opportunity to support making individual rates permanent. Don’t expect Democrats to bite.

• The Democrats’ Take — Democrats are currently not going to support anything that does not fix more fundamental problems with the TCJA. As Rep. Lloyd Doggett, member of the Ways and Means Committee, stated, the Republican proposals only “will make this debt situation even worse.” Senate Democrats have introduced legislation to roll back major parts of the TJCA.

Tax Plays Into Midterms

The push for a second round of tax cuts is nothing more than a political re-run in an election year. As in the first round, Republicans did not involve Democrats in these talks. While they did not need Democratic support to pass the original TCJA, they need 60 votes this time around – a threshold they surely will not clear. In short, Republicans always knew individual rate cuts would expire while corporate cuts would be permanent.

Nevertheless, polling trends indicate Democrats should prepare for the tax cuts’ growing popularity. In December, the TCJA polled poorly, with just 33 percent approving. By January, that figure had increased to 46 percent approving somewhat or strongly. February polls revealed a shrinking Democratic lead in generic Congressional control surveys alongside approval ratings for the TCJA reaching over 50 percent. Since February, approval for the Act has leveled off marginally, with just four in ten Americans saying they like it.

By reopening the tax debate, Republicans run the risk of suffering the consequences after a winter where they were viewed as doing the bidding of the wealthiest. It is hard to know which direction public opinion on taxes will go after tax day, but as always, but it is unlikely the Act will be resoundingly popular and a fair chance it may be associated with voters with entitlement reform and retirement insecurity.

Hi! I’ve been following your website for some time now and finally

got the courage to go ahead and give you a shout out

from Humble Tx! Just wanted to say keep up the great job!

asmr 0mniartist

Hi Dear, are you genuinely visiting this web page on a regular basis, if so after that

you will without doubt obtain nice know-how. asmr 0mniartist

WOW just what I was searching for. Came here by searching for 0mniartist 0mniartist

asmr

great issues altogether, you simply won a new reader.

What may you suggest in regards to your put up that you just made a

few days ago? Any certain? asmr 0mniartist

We’re a gaggle of volunteers and starting a

new scheme in our community. Your site offered us with helpful info to work on.

You’ve done an impressive process and our whole community shall be grateful to you.

0mniartist asmr

Hello! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up losing many months of hard

work due to no data backup. Do you have any methods to stop hackers?

Hello! I know this is kind of off topic but I was wondering which blog platform are you using for this site?

I’m getting tired of WordPress because I’ve had issues with hackers and I’m looking at options for another platform.

I would be awesome if you could point me in the direction of a good

platform.

It’s difficult to find educated people about this topic, but you sound like you know what you’re talking

about! Thanks

Very nice article, totally what I needed.

tinder website , tinder app

how to use tinder

Keep on writing, great job!

Hello Dear, are you truly visiting this web site on a

regular basis, if so then you will absolutely get pleasant experience.

It’s nearly impossible to find educated people in this

particular topic, but you sound like you know

what you’re talking about! Thanks

We’re a group of volunteers and starting a brand new scheme in our community.

Your web site provided us with helpful info to work on. You’ve

done an impressive activity and our entire community will likely be grateful to you.

You actually make it seem so easy with your presentation but I find this matter to

be actually something that I think I would never understand.

It seems too complex and very broad for me. I am looking forward for your next post,

I’ll try to get the hang of it!

priligy

scoliosis

A fascinating discussion is definitely worth comment.

I do believe that you ought to publish more on this issue, it may

not be a taboo matter but generally people do not speak about such issues.

To the next! Kind regards!! scoliosis

scoliosis

If you are going for finest contents like me, just pay a visit this web site

daily since it offers feature contents, thanks scoliosis

scoliosis

Hello there! Do you know if they make any plugins to help

with SEO? I’m trying to get my blog to rank for some targeted

keywords but I’m not seeing very good results.

If you know of any please share. Cheers!

scoliosis

free dating sites

Greetings! Very useful advice within this article! It is the little changes that produce the most important changes.

Thanks for sharing! dating sites https://785days.tumblr.com/

free dating sites

Today, I went to the beach with my children. I found a

sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the

shell to her ear and screamed. There was a hermit crab inside and it pinched

her ear. She never wants to go back! LoL I know

this is entirely off topic but I had to tell someone!

dating sites

My brother recommended I might like this website. He was entirely right.

This post actually made my day. You cann’t imagine simply how much

time I had spent for this info! Thanks!

I’m gone to convey my little brother, that he should

also pay a quick visit this weblog on regular

basis to get updated from hottest gossip.

I think this is one of the most important information for me.

And i’m glad reading your article. But want to remark on few general things, The website style is great,

the articles is really nice : D. Good job, cheers

Pingback: free zodiac dating sites

I don’t even know how I ended up here, but I thought this

post was good. I do not know who you are but

definitely you’re going to a famous blogger if you are not already 😉 Cheers!

Hi just wanted to give you a quick heads up

and let you know a few of the pictures aren’t loading properly.

I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show

the same results.

Every weekend i used to pay a visit this web site, as

i wish for enjoyment, for the reason that this this site conations in fact

nice funny stuff too.

Hey! Someone in my Facebook group shared this website with us so I came to give it a look.

I’m definitely enjoying the information. I’m book-marking

and will be tweeting this to my followers!

Great blog and amazing design.

Hello, I log on to your blog daily. Your story-telling style is witty, keep doing what you’re doing!

I believe that is among the most important info

for me. And i’m happy reading your article. But wanna commentary

on some normal things, The website style is great, the articles is in reality

nice : D. Excellent job, cheers

mature adult phone chat

jennifer aniston dating

gay prison dating

gay black dallas dating

speed dating in the dark gay

alternative for viagra viagra online store forum ViagraCND100Mg – i want to order some viagra

gay triangle of dating meme

best gay dating most variety

gay bodybuilders dating

Your style is unique in comparison to other folks I have

read stuff from. Thank you for posting when you have the opportunity, Guess

I’ll just book mark this web site.

gay online dating sites canada

gay mens dating

tighty whities gay dating site

Thanks to my father who informed me on the topic of this weblog, this website is truly remarkable.

atraf gay dating site

dating a gay aries man

gay dating websites canada

“gay military dating sites”

walmart’s video gay dating

gay dating side