Update 686: Economic Policy Week in Review

Debt Limit; Gensler on the Hill; STOCK Bill

Congress returned this week from a two-week recess and with that came a jam-packed legislative agenda. The leading developments of the week included:

- Debt Limit – Speaker McCarthy opened the week with a speech at the New York Stock Exchange calling for drastic spending cuts. Then on Wednesday, he introduced a 320-page bill to institute draconian cuts while lifting the debt ceiling for less than a year. Schumer called it “dead on arrival” in the Senate, as the X-date creeps closer.

- SEC Agenda — SEC Chair Gary Gensler testified before the 118th Congress on Tuesday at a contentious hearing in House Financial Services on oversight of the SEC. The Securities Chair was pressed on a plethora of issues, including but not limited to digital assets, liquidity management, and the agency’s aggressive rulemaking agenda.

- Stock Trading — Sen. Merkley introduced the ETHICS Act with 20 Senate co-sponsors, adding to restrictions on trading in individual securities by members of Congress under the STOCK Act. The House is considering related legislation.

See more details on the Congressional hearings and related legislative developments below.

Good weekends all…

Dana

__________________

McCarthy Speaks at NYSE, Releases Debt Limit Bill

Speaker Kevin McCarthy gave a speech on the floor of the New York Stock Exchange Monday to lay out his proposal to raise the debt limit tied to a series of dramatic spending cuts. While that speech was light on details, the 320-page bill Republicans released Wednesday was not.

The sweeping bill is a grab bag of Republican priorities, rescinding unobligated COVID funds and $80 billion of funding for the IRS, ending the student loan pause and canceling forgiveness, repealing clean energy tax credits, expanding permitting of fossil fuels, limiting the executive branch’s rule-making powers, and making harmful cuts to SNAP, Medicaid, and TANF. The bill would also cut FY24 discretionary funding back to roughly FY22 levels and impose a one percent cap on growth each year for ten years. The bill would only suspend the debt limit through March 2024 or raise the debt limit to $32.9 trillion, whichever comes first.

The initial cut to FY24 appropriations would have a devastating impact in and of itself, both for the economy and for the government’s ability to provide critical services. Non-defense discretionary programs would most likely see cuts above 20 percent on average, and ongoing caps would ensure that discretionary funding fails to even keep pace with inflation every single year through 2033. This means real, ongoing cuts to programs that deal with education, healthcare, housing, transportation safety, food safety, and virtually every other aspect of American life lasting an entire decade in exchange for less than a year’s reprieve from the debt limit.

McCarthy is pushing to bring the bill to the floor next week. The speaker can only afford to lose four Republican votes to pass the bill along party lines, and some members have already expressed hesitancy about the package. Assuming McCarthy does find 218 votes, the bill will be dead on arrival in the Senate, but Republicans are hoping that finally forming a consensus will give them leverage in negotiations just before the X-date of early June to early September, depending upon how large tax receipts of April 18th and June 15th are.

House Financial Services Hearing: SEC Oversight

The U.S. Securities and Exchange Commission Chair Gary Gensler appeared before the House Financial Services Committee for the first time in over 18 months on Tuesday, and to describe the interaction as “tense” would be quite the understatement. Gensler took the stand to defend his agency’s aggressive actions and to affirm his regulatory authority and capability on a multitude of levels. Though the issues list was plentiful, the following took the spotlight:

- Crypto Regulation

House Republicans blasted the Securities Chair over his recent digital asset agenda, arguing the agency’s various lawsuits against crypto firms were baseless and far too excessive. Chair McHenry accused Gensler of “driving innovation overseas” and “endangering American competitiveness,” citing the agency’s regulation-by-enforcement approach as insufficient. Despite blasts from Committee Republicans, House Democrats lifted up Gensler for holding crypto criminals accountable and being the much-needed “cop on the beat” in this uncertain industry.

- SEC Rulemaking Agenda and Processes

Another point of contention circulated around the SEC’s rulemaking agenda, to which both parties expressed widespread concern. In a span of just two years, the agency has proposed fifty-three rules. As lawmakers repeatedly pointed out, this is nearly twice as many as Gensler’s predecessors and in a shorter period of time. Never mind the shortened public comment periods.

- Section 956 of Dodd-Frank

Legislators also highlighted that executives of the failed Silicon Valley Bank and Signature Bank awarded themselves millions in bonuses ahead of the institutions’ collapses. Following the 2008 financial crisis, lawmakers saw the danger of tying executive compensation to risky bank management. Section 956 of Dodd-Frank instructed the SEC and regulatory agencies to ban incentive-based executive compensation that encourages “inappropriate” risk-taking. After 12 years, such a rule has yet to be put forth. Following pressure to finalize relevant rules from Representatives Velazquez (D-NY) and Tlaib (D-MI), Gensler stated that necessary discussions with the other five agencies were ongoing.

House Financial Services Hearing: Capital Formation

On Wednesday, the House Financial Services Committee’s Subcommittee on Capital Markets concluded their four-part series of hearings on capital formation by discussing a dozen proposed pieces of legislation, the majority of which were designed to relax capital market regulation. The bills included a proposal to force the SEC to examine the impact of underwriting on IPOs, but discussions were dominated by consideration of the accredited investor definition.

- Defining Accredited Investors

Legislators on both sides of the aisle agreed that the existing definition of an “accredited investor” – someone eligible to invest in private securities – is arbitrary. As several legislators and witnesses pointed out, an accredited investor is currently defined by a household net worth of $1 million excluding home value, despite net worth not being necessarily tied to the sophistication of individual investors. Ranking Member Sherman (D-CA) suggested:

- Prohibiting private placement in which an individual accredited investor places over 5 to 10 percent of their net worth in any one offering or more than 50 percent of their net worth in all private offerings

- Ensuring that accredited investors have expertise or truly independent expert advisers

One bill under consideration would require the SEC to revise the definition to include persons who pass an exam established and administered by the Commission.

While the definition is arbitrary, it is designed to protect less sophisticated investors whose risk is steeper in the private market which requires fewer disclosures and provides less protections than the public market. The North American Securities Administrators Association (NASAA) endorsed another bill that would exclude Retirement Assets and Retirement Income Assets from the net worth calculation.

In Case You Missed It:

- HFSC Subcommittee on Digital Assets Hearing: The ‘Maxine McHenry’ Bill

House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion convened Wednesday to discuss the need for stablecoin legislation in the highly unregulated industry. At the outset, Republican Chair French Hill (R-AR) introduced a bill that he described as a bipartisan effort that came together at the end of last Congress – but ultimately fell through due to fall elections and other various time constraints.

Then-chairwoman Maxine Waters (D-CA) almost immediately debunked this narrative, claiming that yes – she had worked extensively with Rep. Patrick McHenry (R-NC) to explore and develop a regulatory framework for payment stablecoins. However, she insisted this bill in no way, shape or form, represented any final work or negotiations between the leaders, and that the House GOP had essentially gone on their own to draft this despite her request to revisit negotiations.

The hearing ultimately ended with no real legislative consensus or clear path forward, as many Democrats noted the bill in its current form is extremely outdated. Since then, Ranking Member of the subcommittee Stephen Lynch (D-MA) suggested we revisit the ultimate question – whether stablecoins are even needed.

- Introduction of the ETHICS Act

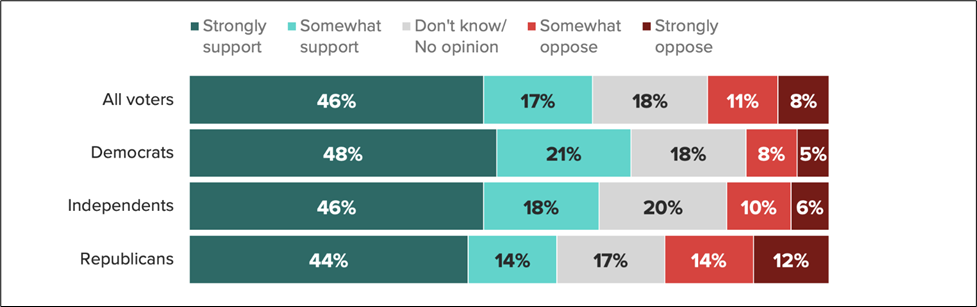

This week, Senator Jeff Merkley (D-OR) led 21 senators in the introduction of the Ending Trading and Holdings in Congressional Stocks (ETHICS) Act, while Representatives Raja Krishnamoorthi (D-IL) and Michael Cloud (R-TX) led the introduction of the companion House bill. The bipartisan, bicameral legislation is the result of over a year of collaboration with advocates and legislators. It seeks to prevent conflicts of interest by banning members of Congress from trading stocks, a ban supported by over 60 percent of voters, including a majority of Democrats and Republicans.

Source: Morning Consult/ Politico

Of the numerous pieces of legislation introduced this and last Congress, the ETHICS Act is notably comprehensive. The bill bans members of Congress, their spouses and their dependent minors from owning or trading securities, commodities, or futures. It also clearly outlines reasonable options for covered assets: divestment, diversification into mutual funds or exchange traded funds (ETFs), or placing assets in a qualified blind trust after divesting original assets. Finally, the bill includes a strong penalty for violations equal to a month’s salary or 10 percent of the value of the traded asset, whichever is greater.

- Senate Budget Takes On Tax Dodging by the Wealthy and Corporations

Senate Democrats spent tax day this year highlighting some of the many inequities in our Tax Code, focusing primarily on the carried interest loophole, profit sharing, and the ability of the ultrawealthy to avoid taxes by living off of unrealized gains. Budget Chair Sheldon Whitehouse (D-RI) highlighted that the wealthiest Americans pay an average tax rate of just 8.2 percent while large multinational corporations pay just 7.8 percent on average. Whitehouse also highlighted two of his proposals to make the Tax Code fairer, the Medicare and Social Security Fair Share Act and the No Tax Breaks for Outsourcing Act.

Also a topic of debate was the role tax cuts and revenue play in the federal deficit. Whitehouse and witnesses pointed to a recent report by the Center for American Progress that found that the Bush and Trump tax cuts are primarily responsible for increasing the deficit. This hearing comes at a time when Congressional Republicans are pushing for spending cuts to reduce the deficit and extension of the Trump tax cuts, while refusing to institute any new taxes on the wealthy and corporations.

Other Related Articles

- Update 741 — Fed Holds Rates; CPI 3.1%: (When) Can Fed Pivot from Long Pause?

- Update 740 — A Supplemental Surprise: Political Timelines vs. Actual Emergencies

- Update 739 — SCOTUS Seems Moore Unsure: Re Congress’ Authority to Tax Certain Income

- Update 738 — Immaculate Disinflation: Felt or Not, Prices Nearer Fed’s Target

- Update 737 — Undersupply and Costs: Problems Besetting the Housing Market