Update 574 — Debt Limit Agreement:

Resolution for Now; Reform for Later?

Late yesterday, House Democrats adopted legislation allowing the Senate to raise the debt ceiling without having to overcome a filibuster, this once. The Senate GOP is expected to cooperate to avoid a sovereign default that would otherwise have occurred within days or weeks. The fast-track process has been agreed to; the amount of the debt limit increase has not.

But even if this deal passes, the tumultuous events of the last few months demonstrate the precarity of the problem, as well as the systemic and partisan value of long-term reform so the economy is not held hostage to partisan dispute.Today, we make the case for permanent reform of the debt limit and review several options available to do so.

Best,

Dana

________

State of Play

With just a week left until the December 15 “X Date” that Treasury Secretary Yellen has warned would be the point at which the U.S. is at risk of default, Congress appears to have a path forward to increase the debt limit via a one-time workaround of the filibuster. While the final outcome is not assured, there remains some wiggle room for action, since a recent Bipartisan Policy Center estimate predicts the X Date will likely fall sometime between December 21 and the end of January. But rhetoric from both sides has been significantly cooler since the brinkmanship in October, and Majority Leader Schumer and Minority Leader McConnell have been negotiating for weeks, repeatedly asserting that a default will not occur.

The deal currently in place is a slightly convoluted, two-step process. First, Congress has included language in a bill preventing automatic sequestration cuts to Medicare and other federal programs creating special procedures for the Senate to increase the debt limit by a majority on a one-time basis. The House passed this first bill last night, and the Senate will vote on cloture this week, requiring McConnell to corral 10 Republican senators to take that procedural step. After that bill passes, Congress will then pass a second, standalone debt limit increase bill by majority vote that will likely last through the 2022 midterms. A backup option if this doesn’t work is to use reconciliation, but Democrats have been hesitant to pursue that option as politically risky and time-consuming.

Permanent Debt Limit Reform

Raising the debt limit does not authorize new federal spending; it merely allows the government to essentially pay the bills it already owes. But the debt limit is repeatedly weaponized in Congress by those willing to use the threat of a default as a means to extract a political win. Republicans’ rhetoric this past October showed they were willing to let the federal government default. The continued existence of the debt limit in its current form rewards and incentivizes this irresponsible behavior.

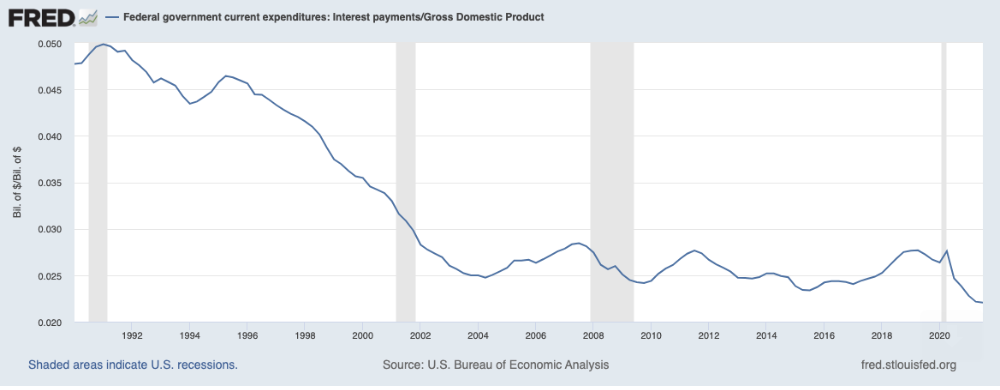

In recent years, the debt limit has been used most potently as a weapon by Congressional Republicans to score political points or policy concessions while Democratic Presidents are in office. In 2011, President Obama was forced to sign the Budget Control Act in exchange for a debt limit increase. The BCA established harmful cuts on federal spending for a decade and curtailed the post-2008 economic recovery. Republicans have misleadingly declared that raising the debt limit is fiscally irresponsible because it facilitates future deficit spending, even though interest payments as a percent of GDP are currently relatively low. This is particularly ironic given that voting against the full faith and credit of the United States is itself the height of fiscal irresponsibility.

Federal Government Interest Payments as a Percentage of GDP, 1990-Present

Brinkmanship in Congress over the debt limit — even if a default does not occur — can have negative economic consequences. The 2011 crisis led to a downgrading of the United States’ credit rating, which increased U.S. government borrowing costs by $1.3 billion in FY2011 alone. The October standoff this year rattled financial markets until a short-term deal was struck. Debt limit reform should ensure that these unnecessary and harmful economic effects will never happen again.

Leading Options for Reform

The following is a menu of legislative options that Congress could enact to permanently reform the debt limit, listed from least likely to most likely to be enacted by Congress:

- Full Repeal: The End the Threat of Default Act (H.R. 3305/S. 1785), sponsored by Rep. Foster and Sen. Schatz, would permanently repeal the federal debt limit. This is a simple and obvious solution to the problem. Eliminating the statutory requirement would give the Treasury the ability to continuously pay out its obligations with no risk of default.

- Transfer Power to President: The Protect Our CREDIT Act (S. 2819), sponsored by Sens. Merkley and Kaine, would authorize the President to raise the debt limit subject to a joint resolution of disapproval by Congress within 15 days. This option greatly reduces the odds of default because it would require Congress to act affirmatively to overrule the President’s action. This concept has precedent: the Budget Control Act gave President Obama a temporary authorization to raise the debt limit subject to Congressional disapproval. President Biden has indicated openness to this reform.

- Transfer Power to Treasury Secretary: The Debt Ceiling Reform Act (H.R. 5414), sponsored by Rep. Boyle, would authorize the Treasury Secretary to raise the debt limit. While a variation of the aforementioned Presidential option, it would have a similar effect. Any Treasury Secretary would likely act according to the wishes of the President and would never let a default occur.

- Peg to Actual U.S. Debt: Congress could specify that the debt limit is automatically raised as the U.S. incurs additional debt. This could be done if Congress automatically increases the debt limit by the spending levels set in the yearly budget resolution. While it lessens the risk of default by essentially tying the debt limit to the regular appropriations process, it doesn’t eliminate it. Another proposed bipartisan bill would set up a mechanism like this but includes an unhelpful provision requiring the President to send a plan for deficit reduction to Congress.

- Increase by an Extremely Large Number: One relatively simple method to avoid future debt limit fights is to simply raise the debt limit to an absurdly high number such as one googleplex. Taking this action would both expose the ridiculous nature of the debt limit itself and prevent any future defaults. Congressional Democrats have been reluctant to use the reconciliation process to raise the debt limit since the GOP could use a specified increase in the debt limit as a line of attack against vulnerable incumbents in 2022. But the number could be too incomprehensible to be used in attack ads.

The deal struck by Congress this week, which amounts to a one-time carveout from the filibuster, could be the basis for permanent reform. If future Congresses use this deal as a precedent to exempt debt limit legislation from the filibuster, then the future risk of default will be reduced.

Is the Time Right for Reform?

Any of these reforms would be preferable to the status quo of repeated brinkmanship and political hostage-taking. A full repeal would be the simplest fix, but transferring power to the executive branch might be more satisfactory to lawmakers concerned about discarding a long-standing law. The fifth option is most viable because it could be done by reconciliation, requiring only a majority vote in the Senate. The first three options are statutory changes subject to the filibuster but would be most effective in actually guaranteeing a default will never occur.

Ironically, Schumer and McConnell’s deal may lower the immediate possibility for reform, since few members want to deal with the debt limit unless they have to. But reports indicate that McConnell ended up providing votes for the short-term increase in October out of concern that Senate Democrats would create a permanent filibuster carveout for the debt limit as a measure of last resort. McConnell’s willingness to pass a temporary law to create a workaround for the filibuster shows that raising the prospect of reform, even if unlikely, can put pressure on lawmakers to let cooler heads prevail.