Update 396 — The Contrast is Striking:

Workers Tell Tale of Two Labor Markets

For those on the lookout for harbingers of recession — today’s New York and Atlanta Fed projections for startlingly low 4Q19 growth being the latest — the labor market presents a unique challenge. Unemployment is neither a leading nor lagging indicator. It spikes without warning and does not relent until the damage is done and the recovery has begun.

So it pays to watch carefully for unemployment’s own set of indicators, trends in new temp vs. permanent jobs, hours worked, multiple jobs held, changes in pay, etc. We look behind the aggregate job figures that paint a picture-perfect portrait of a monolithic market and officially, full and record levels of employment.

Good weekends all…

Best,

Dana

————

From 30,000 feet, all seems well with the Trump economy. The unemployment rate is 3.6 percent and the stock market continued to break records this week.

But economic anxieties are bubbling to the surface. The Conference Board’s Consumer Confidence Index hit its lowest point in over two years, last month. U.S. manufacturing is in recession, business investments have been shrinking for the past two quarters, and productivity fell last quarter for the first time since 2015. Income inequality continues to grow and nearly 40 percent of all American families do not have $400 on hand in case of an emergency. Workers’ take home pay has barely moved in the past five years.

On October 25, the United Autoworkers (UAW) union ended their 40 day strike against General Motors. Last year, 485,000 employees were involved in major work stoppages — the highest number since 1986, per the Bureau of Labor Statistics, with stagnant wages and diluted benefits as a common thread. While the gig economy has grown, it adds stress for many American workers. Despite all of this, President Trump continues to call the economy “the greatest in our history.”

Contrary to what pundits and administration officials say, the labor market is not entirely healthy, and any decontextualized unemployment figure obscures what is actually happening. In the event of a recession, what happens to the American worker?

Diving into the Numbers that Divide

The nation’s topline unemployment figure of 3.6 percent is impressive and sustained. Yet a cursory look at the data reveals warning signs. The broad unemployment figure does not factor in discouraged workers and those working part-time involuntarily. For example, adding those two groups to the unemployed, the figure jumps to seven percent.

Year-over-year payroll jobs growth — the annual percent increase in jobs — is below 1.4 percent: an eight-year low. The Economic Cycle Research Institute’s Leading Employment Index, which includes components ranging from labor market conditions to real estate and finance, recently recorded its worst reading since the 2008 financial crisis. The Index is designed to predict trends in job growth. Drilling down further, more softenness in the markets emerge:

- Wages: With record-low unemployment, 102 straight months of job growth, 121 straight months of GDP growth, etc., we should expect the labor market to tighten, putting upward pressure on wages. That hasn’t happened. From 2018 to 2019, average hourly wages grew by 3.2 percent. During the late 1990s and early 2000s, wage growth regularly topped four percent but is now concentrated in a few occupations and industries.

- Multiple Job Holders: The share of the workforce holding multiple jobs has decreased since the early 90s, but could be on the rise. In the early 90s, about six percent of workers had multiple jobs. Last year it stood at five percent. In 2019, that has increased to between 5.2 and 5.3 percent. While this is a small part of the workforce, it is telling that this number is increasing month-over-month for the first time in over 20 years.

- Productivity: Productivity measures the output of goods in services in an economy as a ratio of inputs (labor and capital). In recent years, the U.S. has seen a decrease in labor-generated productivity. Labor productivity rose an average of just over two percent for decades. In 2004, that year-to-year rate shrank to around 1.2 percent, and since 2011, it has been 0.6 percent.

- Labor’s share of national income is declining: That is, the share of GDP growth accruing to workers in the form of salary or benefits is getting smaller. The share of national income, or GDP, enjoyed by workers fell from 64.5 percent in 3Q1974 to 56.8 percent in 2Q2017. Productivity may be steady, but gains are not being passed down to workers. This is not merely academic; a declining labor share in the U.S. means more economic inequality. More worrisome is the fact that the labor share topline does not account for between-worker inequality — how wage stratification is occurring among workers.

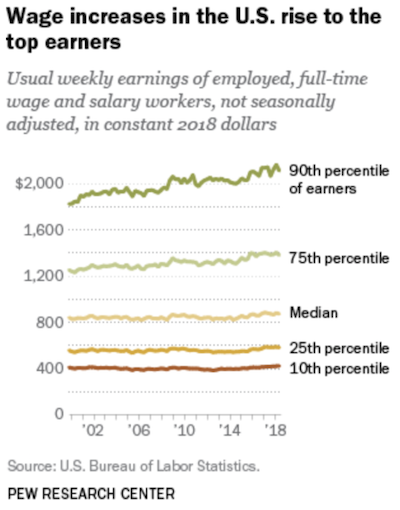

- Rising Inequality Among Workers: Low-wage workers are not seeing even the meager gains enjoyed by their higher-earning counterparts, fueling income inequality. Since 2000, real wages have risen by three percent for workers in the bottom 10th percentile in terms of earnings, and 4.3 percent for workers in the bottom 25th percentile. Contrast this with workers in the top 10th percentile, who have seen a 15.7 percent increase in wages.

As we have detailed in a previous update, workers are migrating across sectors, away from heavily-unionized and stable manufacturing jobs and towards more precarious service sector and gig economy work. In doing so, they lose collective bargaining power and the ability to secure strong benefits, workplace protections, and higher wages.

Cracks in the Facade; Tale of Two Markets

Job growth and economic vitality is not spread evenly across the country. A McKinsey study identified 25 cities, comprising 30 percent of the U.S. population, that will boast roughly 60 percent of the future job growth through 2030. Meanwhile, in 512 U.S. counties (mostly rural), home to 20.3 million Americans, up to a quarter of all workers could be displaced over the same time frame.

And from 2012 to 2017, three-quarters of metropolitan areas experienced statistically significant job growth. But in 2017, that shrunk to 13 percent, and last year just 12 percent. Steller economic performance in a handful of cities is concealing deep problems in the labor market.

Median wage growth, rather than average, better captures the stagnant wage problem for the majority of Americans. Leading indicators of recessions like manufacturing output and employment, consumer and business confidence, and durable goods purchases are paramount. Many of these indicators are showing signs of distress. Viewing the labor market solely through a national lens is misleading and won’t help fix the problem of wage stagnation and declining worker power. A fuller picture is necessary and both parties need a convincing story to tell.

[url=http://vslevitrav.com/]cialis and levitra[/url]

These are in fact fantastic ideas in regarding blogging.

You have touched some fastidious things here. Any way keep up

wrinting. asmr 0mniartist

Wonderful beat ! I wish to apprentice while you amend your web site, how

could i subscribe for a blog site? The account aided me a acceptable deal.

I had been tiny bit acquainted of this your broadcast offered bright clear idea asmr

0mniartist

WOW just what I was looking for. Came here by searching for 0mniartist 0mniartist asmr

I like the helpful information you provide in your articles.

I will bookmark your weblog and check again here regularly.

I’m quite certain I’ll learn many new stuff right

here! Good luck for the next! 0mniartist asmr

Attractive section of content. I just stumbled upon your site and in accession capital to assert that I get actually enjoyed account

your blog posts. Anyway I will be subscribing to your

augment and even I achievement you access consistently quickly.

asmr 0mniartist

free local dating sites

[url=”http://freedatingsitesus.com/?”]milfs dating.com [/url]

I am truly delighted to glance at this weblog posts which carries tons of helpful data, thanks for providing these statistics.

I think that is among the so much significant info for me.

And i am glad studying your article. But wanna statement on some

basic things, The web site taste is perfect, the articles is actually great :

D. Good task, cheers

Thanks for sharing such a fastidious idea, article is good,

thats why i have read it entirely

Just want to say your article is as surprising.

The clarity in your submit is just great and i can suppose you

are knowledgeable in this subject. Fine along with your permission let me to clutch your feed

to keep up to date with coming near near post.

Thanks one million and please continue the gratifying work.

browse tinder for free , tider

[url=”http://tinderentrar.com/?”]tider [/url]

If some one wants to be updated with latest technologies after that he must be go to see this site

and be up to date every day.

When I originally left a comment I seem to have clicked on the -Notify me when new

comments are added- checkbox and now each time a comment is added I get 4 emails with the

same comment. Is there a way you can remove me from that service?

Cheers!

A fascinating discussion is worth comment. I believe that you ought to publish more on this issue, it might not

be a taboo subject but typically people do not speak about such subjects.

To the next! Kind regards!!

Oh my goodness! Incredible article dude!

Thanks, However I am encountering difficulties with your RSS.

I don’t understand why I cannot subscribe to it.

Is there anybody else getting identical RSS problems?

Anyone that knows the answer will you kindly respond?

Thanx!!

Good web site you’ve got here.. It’s difficult to find quality writing like yours these

days. I honestly appreciate individuals like you!

Take care!!

I visited many websites but the audio feature for audio songs current at this web page

is in fact wonderful.

what is tinder , tider

[url=”http://tinderentrar.com/?”]tinder app [/url]

tinder dating app , browse tinder for free

[url=http://tinderentrar.com/]http://tinderentrar.com/[/url]

scoliosis

It’s actually a nice and useful piece of information. I’m happy that you simply shared this helpful information with us.

Please keep us informed like this. Thanks for

sharing. scoliosis

scoliosis

When I initially left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and from now on every time a comment is added I receive 4 emails with the same comment.

Is there an easy method you are able to remove me from that service?

Appreciate it! scoliosis

scoliosis

I’d like to find out more? I’d care to find out more details.

scoliosis

dating sites

Great blog you have got here.. It’s difficult to find high

quality writing like yours nowadays. I seriously appreciate individuals

like you! Take care!! https://785days.tumblr.com/ dating sites

dating sites

You should take part in a contest for one of the most useful blogs on the net.

I’m going to recommend this web site! free dating sites

I’m not sure exactly why but this website is loading very slow for me.

Is anyone else having this issue or is it a issue on my end?

I’ll check back later and see if the problem still

exists.

Hi there! This post could not be written any better!

Reading this post reminds me of my old room mate!

He always kept talking about this. I will forward this page to

him. Fairly certain he will have a good read. Thanks for sharing!

Thanks very nice blog!

Hi there i am kavin, its my first occasion to commenting anywhere, when i read this post i thought i could also

create comment due to this good paragraph.

An outstanding share! I have just forwarded this onto

a friend who had been doing a little homework on this.

And he in fact ordered me lunch because I found it for him…

lol. So let me reword this…. Thanks for the meal!!

But yeah, thanks for spending time to talk about

this topic here on your web site.

hey there and thank you for your information – I have definitely picked up

anything new from right here. I did however expertise some technical points using this site,

as I experienced to reload the website many times previous

to I could get it to load correctly. I had

been wondering if your hosting is OK? Not that I am complaining,

but sluggish loading instances times will sometimes affect your placement in google

and can damage your quality score if advertising and marketing with Adwords.

Well I am adding this RSS to my email and can look out for a lot more of your

respective interesting content. Make sure you update this again soon.

Hmm it appears like your website ate my first comment (it was super long) so I

guess I’ll just sum it up what I wrote and say,

I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to

everything. Do you have any tips and hints for newbie

blog writers? I’d genuinely appreciate it.

Hi! This is my first visit to your blog! We are a

collection of volunteers and starting a new project in a community

in the same niche. Your blog provided us valuable information to work on. You have done a outstanding job!

It’s going to be ending of mine day, except before

ending I am reading this great post to improve my know-how.

Heya are using WordPress for your site platform? I’m

new to the blog world but I’m trying to get started and create

my own. Do you need any coding knowledge to make your own blog?

Any help would be greatly appreciated!

Wow, this article is nice, my younger sister is

analyzing these things, so I am going to convey her.

Here is my page web page

free phone chat lines

[url=”http://datingonlinecome.com/?”]dating someone with depression[/url]

Pingback: keto diet for seniors

buy viagra without a script can you buy viagra mexico – viagra prix

gay blog dating

gay sex dating games

[url=”http://gaychatgay.com?”]gay dating and grindr[/url]

Howdy just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Ie.

I’m not sure if this is a format issue or something to do with browser compatibility but I figured I’d post

to let you know. The style and design look

great though! Hope you get the issue fixed soon. Thanks

It’s amazing in favor of me to have a web

site, which is useful in support of my know-how. thanks admin

gay muscle dating sites

gay speed dating orlando

[url=”http://freegaychatnew.com?”]nytimes gay dating sites[/url]

This is really interesting, You are a very skilled blogger.

I’ve joined your rss feed and look forward to seeking

more of your wonderful post. Also, I’ve shared your website in my social networks!

guy steals gay dating sign

gay speed dating manchester uk

[url=”http://gaychatus.com?”]boston gay dating free sites[/url]