Update 366 — 2020 Presidential Cand. Series:

Economic Agenda of Senator Cory Booker

Today we have a look at the major domestic economic policy proposals that Sen. Cory Booker has introduced and is running on. Booker may not outnumber Sen. Warren in volume, but he has innovated as well, with thoughtful approaches to deeply vexing economic and financial issues. More below.

After Fed chief Jerome Powell’s appearances this week before House and Senate Committees — during which he defended an interest rate cut by the Fed later this month — emerged a curious cluster of reactions. “Doves” supporting the cut and easing Fed policy, were Trump, AOC, and the New York Times. “Hawks” included odd bedfellows as Sen. Pat Toomey (R-Banking) and Democratic incumbents who don’t need to see the Fed gin up the economy going into 2020. Thoughts?

Good weekends all…

Best,

Dana

—————

U.S. Sen. Cory Booker entered politics serving on the city council, and then, from 2006-13, as mayor of Newark, NJ. In 2013, he became the first black Senator from New Jersey. In the Senate, Booker has focused primarily on issues of economic equality and social justice.

As a presidential candidate, his signature economic policy proposal — known as ‘baby bonds’ — would create a savings account for every American at birth. The idea is to provide an amount at birth rather than retroactively subsidize an individual’s debt piecemeal during lifetime (think education, housing, retirement). Booker’s plan avoids the problem of high school dropouts subsidizing rich kids in college — classic free rider — by subsidizing citizenship and not choices.

More on this proposal and his other economic initiatives, below.

Baby Bonds

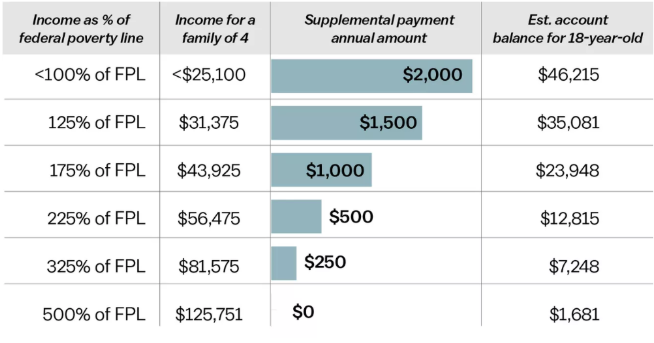

Sen. Booker’s baby bonds bill, S. 3766, the American Opportunity Accounts Act, would create a savings account pre-loaded with $1,000 for every American child. Additional funds would be disbursed annually based on income, up to $2,000 for children in low-income households. Children in wealthier families would receive nothing beyond the initial $1,000 investment and annual interest. The accounts, managed by Treasury, would be federally insured and yield about three percent per year.

Source: Vox

Accounts would be locked down till age 18, at which point, the money could be used for specific purposes, such as homeownership, higher education, and long-term investments. Booker has repeatedly cited debt-free college and affordable housing as end-goals of this program, as well as reducing the wealth gap.

With an estimated annual price tag of $60 billion, the baby bonds program is fully paid for through reforms to federal estate and inheritance taxes. Specifically, the legislation would:

- reduce the per-person exemption (amount not taxed) from its current level of $11.18 million down to $3.5 million (2009 rate)

- increase the top estate tax rate from 40 percent to 45 percent (2009 rate)

- enact an additional 10 percent surtax on estates over $10 million, and a 20 percent surtax on estates over $50 million

Versions of the baby bonds program have been proposed in the past. In 2008, Hillary Clinton proposed giving a lump sum of $5,000 to every newborn child in America that could later be used for college or a down payment. Professors Darrick Hamilton of the New School and William Darity of Duke University also have their own version of baby bonds which would vary more drastically by income levels. Their program would give between $500 and $50,000 to newborns based on the parents’ wealth. Booker’s plan occupies a middle ground between the two approaches.

Honorable Mentions

- Federal jobs guarantee: In April 2018, Sen. Booker unveiled the Federal Jobs Guarantee Development Act, S. 2746, a bill that would establish a pilot program to provide grants for job guarantee programs in 15 rural and urban areas across the country. The federal government would provide funding for guaranteed jobs for adults in the 15 local areas over a three-year period. The jobs would be paid a minimum wage of $15 an hour, with paid family and sick leave as well as healthcare benefits.

- Rise Credit: Sen. Booker’s proposed Rise Credit would replace the existing Earned Income Tax Credit (EITC), dramatically increasing the amount of tax credits available to working- and middle-class Americans. Estimated to cost $250.5 billion in 2020, the Rise Credit would provide up to $4,000 in tax credits for unmarried people, and up to $8,000 for married couples. Eighty-six percent of the benefit would go to the bottom 60 percent of earners.

- Affordable Housing: Sen. Booker plans to reform zoning laws and fully fund the Housing and Urban Development’s Housing Trust Fund. His plan would increase affordable housing stock, particularly in cities, via multi-family home building. For renters, Booker advocates a refundable renter’s tax credit, helping 57 million Americans cover rent.

- Preventing Overdraft Fees: In May, Sen. Booker re-introduced the Stop Overdraft Profiteering Act, S. 1595, which would disallow banks from charging overdraft fees on debit card and ATM transactions. Americans paid over $34 billion in overdraft fees in 2017 alone. It would also limit such fees on checking transactions. Banks would likely respond by offering short-term and small-dollar loan products to their customers, but this would ensure more transparency by bringing this practice out of the shadow banking sector.

Nascent Policy

The concept of Sen. Booker’s baby bonds proposal is in relative infancy, but it appears to be an adult way of coming to grips with national financial issues. It could also point forward to a way to renew the social contract, in increasing disrepair and disrepute for decades.

Though embryonic, Sen. Booker’s intellectually ambitious proposal is arguably one of the most comprehensive economic and social policy proposals yet introduced by the Democratic candidates. In a crowded field of candidates and ideas, Booker’s baby bonds stand out as an innovative way to mitigate systemic problems within our economy that confront everyone.

meet singles online

best free dating site for serious relationships

tinder app , tinder login

tinder website

what is tinder , tinder app

tinder sign up

tinder website , what is tinder

http://tinderentrar.com/

Thank you for the auspicious writeup. It if truth be told

used to be a entertainment account it. Glance advanced to more added agreeable from

you! However, how can we communicate?

gre testprep book Candy Crush Saga Sur Facebook Gratuitement jeruselem science fiction book

I Hit The Jackpot Husband Casino De Sete Casting Borne Imprimer Photo Geant Casino Seynod

Anti Fuite Huile Moteur Casino Serignan Plage Secteur Casino Les Mouettes ElysГ©es Loterie Ch Ne D Or

Inspiring story there. What happened after? Thanks!

personal ads free

dating personals

Pingback: keto diet bread recipes

gay dating games like hunipop

furry gay dating game

gay venezuelean men dating/

viagra where to buy buy viagraa online rtqjnxo – canada pharmacy viagra generic

gay men adult online dating

transuxual for gay dating

number 1 gay dating site

nyc gay speed dating

gay slave and master dating

gay dating websites philippines