Update 689 — Fed Again Lifts Rates 25 BPs;

Rate Hikes Amid Simmering Bank Crisis

The Fed’s tenth consecutive interest rate hike comes today despite favorable data: jobs added to the economy have fallen each month since January and inflation has also declined — for nine straight months now – down from 9.1 percent in June to 5 percent in March. And despite some political pushback from ten congressional Democrats urging the central bank to pause.

Meanwhile, tightening in certain credit markets following the recent failures of three regional banks is effectively supplementing the Fed’s current policy. Austan Goolsbee, president of the Federal Reserve Bank of Chicago, estimates that the hit to growth from the banking turmoil could be equivalent to between one to three quarter-point rate increases, an estimate that came well before First Republic’s fall.

Taking these factors into account, where is the Fed headed from here? See below.

Best,

Dana

Today the Federal Reserve announced yet another interest rate hike, continuing its most aggressive series of hikes since the early 1980s. The 25 basis point hike brings the interest rate to a 16-year-high of 5.0 to 5.25 percent. The move comes amidst tightening credit conditions following the failures of Silicon Valley Bank and Signature Bank in March. These conditions may only be exacerbated by the collapse of First Republic Bank, which the Federal Deposit Insurance Corporation (FDIC) seized and immediately sold to JPMorgan Chase on Monday.

The Fed’s latest rate hike is sure to draw ire from a group of 10 members of Congress– led by Senator Elizabeth Warren (D-MA), Representative Pramila Jayapal (D-WA) and Representative Brendan Boyle (D-PA) – who called for the Fed to pause its campaign in a letter to Fed Chair Jerome Powell on Monday. The letter cited the very real risk of a recession the Fed foresees and throwing millions of Americans out of work, which it acknowledges.

The question now: whether this week marks the last in a series of rate hikes, or if the Fed will continue its streak when the Federal Open Market Committee (FOMC) meets again in June. Powell made clear today that “we are closer to the end than the beginning [but] we still have a long way to go” to reach the Fed’s two percent inflation target.

The Fed’s statement today announcing the latest hike suggests that the committee is open to a pause in June. While previous statements anticipated that additional policy firming would be appropriate, the latest statement instead says that the committee will “take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments” in determining the extent to which additional policy firming may be appropriate.

Let’s Go to the Data

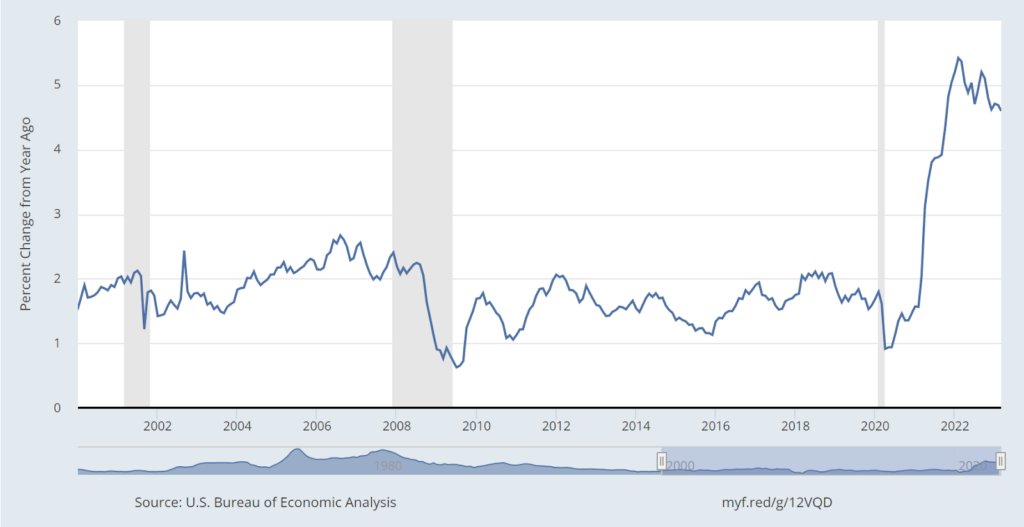

The latest inflation data, released Friday, showed that inflation seems to be cooling but possibly not as fast as the Fed would like. In March the personal consumption expenditures price index (PCE) – the inflation measure primarily used by the Federal Reserve in determining its policy choices – increased just 0.1 percent from the previous month and 4.2 percent year on year. This is down from a 0.3 percent increase in February when the year-on-year increase in PCE was at 5.1 percent.

Meanwhile, core PCE – which excludes food and energy prices – increased 0.3 percent from the prior month and 4.6 percent from a year earlier. This is on par with the 0.3 percent rise in core PCE in February when the year-on-year PCE increase was 4.7 percent.

Personal Consumption Expenditures (Excluding Food & Energy)

(2000-present)

Source: Bureau of Economic Analysis, FRED

In March, monthly energy prices fell 9.8 percent, while food prices increased 8.0 percent. Prices for goods increased 1.6 percent, and prices for services increased 5.5 percent. The numbers were unlikely to have significantly shifted the FOMC’s attitude ahead of its meeting, particularly since it followed last month’s Consumer Price Index data which also indicated cooling inflation.

Another Bank Failure

The Fed’s rate hike comes two days after yet another bank collapse. On Monday – before markets opened – First Republic Bank was taken into receivership by the FDIC, and its deposits and most of its assets were immediately sold to JPMorgan Chase.

At the end of last year, First Republic was the 14th largest bank in the U.S.. Two thirds of its deposits were uninsured. Following the failures of Silicon Valley Bank and Signature Bank, uninsured deposits largely fled and First Republic hired advisers to explore options to save the bank. First Republic took $70 billion in emergency loans from the Fed, Federal Home Loan Banks (FHLB) and JPMorgan Chase. Fears remained in March that contagion would reach the broader banking sector, when 11 of America’s largest banks injected a combined $30 billion into the bank in a government-brokered deal to reflect “their confidence in First Republic and in banks of all sizes.” The bank’s borrowing peaked in mid-March, when total borrowings reached $138 billion.

It wasn’t enough. First Republic’s valuation fell 97 percent over the last two months. Last Monday, First Republic could no longer downplay what even its CEO described as “unprecedented deposit outflows” and released its earnings report for the first quarter of 2023. The report showed that deposits had fallen to $104 billion from about $176 billion at the end of 2022.

First Republic was like SVB in many ways. It was a regional bank with a large proportion of uninsured deposits that experienced significant deposit flight within recent months. First Republic held some of the same kind of unrealized losses on its balance sheet that helped bring down SVB and Signature – hold-to-maturity assets which fell in value as the Fed raised interest rates.

The failures of SVB and Signature led to a slowdown in lending that may be exacerbated by the fall of First Republic. Tightening credit conditions may only get worse as regional banks seek to build up their liquidity.

Soft Landing After Turbulence?

The possibility of a soft landing still exists but is gradually becoming less clear. The crisis in the banking sector may not be over. On Tuesday, share prices of small banks continued to fall. The S&P 500 index of larger regional bank shares fell by almost 7 percent while the S&P 500 index of smaller regional banks fell more than 6 percent. PacWest’s stock price fell by almost 30 percent, Western Alliance’s stock price fell by about 15 percent, and stock prices of Comerica and Zions also declined.

Interest rate hikes have been slow to spark the chilling effect desired by the Fed, but they seem to be setting in. The job market has been resilient amidst interest rate hikes, but the labor market seems to be tightening. Friday’s jobs report is expected to show that job gains slowed once again to 179,000 in April, according to an estimate by Refinitiv. This would be down from 236,000 jobs gained in March, 311,000 in February and 504,000 in January. It is also expected that unemployment will climb to 3.6 percent from the 3.5 percent level seen in March.

Market participants are all but convinced today’s rate hike will be the Fed’s last this cycle, with rate cuts to follow later this year. Moving forward, we add our voice to those calling on the Fed to consider the intended and unintended ripple effects of its monetary policy decisions.