Update 289: Trump Floats Tax Cuts By Decree Called “Illegal, Flat-Out Bonkers;” Is it News?

The GOP impulse to overreach when it comes to tax cuts is gaining almost frantic momentum right before the the August recess, as the GOP’s hopes of keeping its majorities in Congress looks ever more remote.

Last week it was Tax Reform 2.0. This week, it is an aggressive approach to capital gains: index them for inflation. The Trump administration is eyeing yet another tax cut for the wealthy, this time bypassing Congress and using executive power to push another plutocratic windfall under the family and friends plan.

Details of the plan, if you can stand them, revealed below…

Best,

Dana

——————————————————

Treasury Secretary Steven Mnuchin has confirmed in recent data that his Department is in fact looking at the “tools” necessary to change tax law, without seeking Congressional authority, to index capital gains for inflation for income tax purposes.

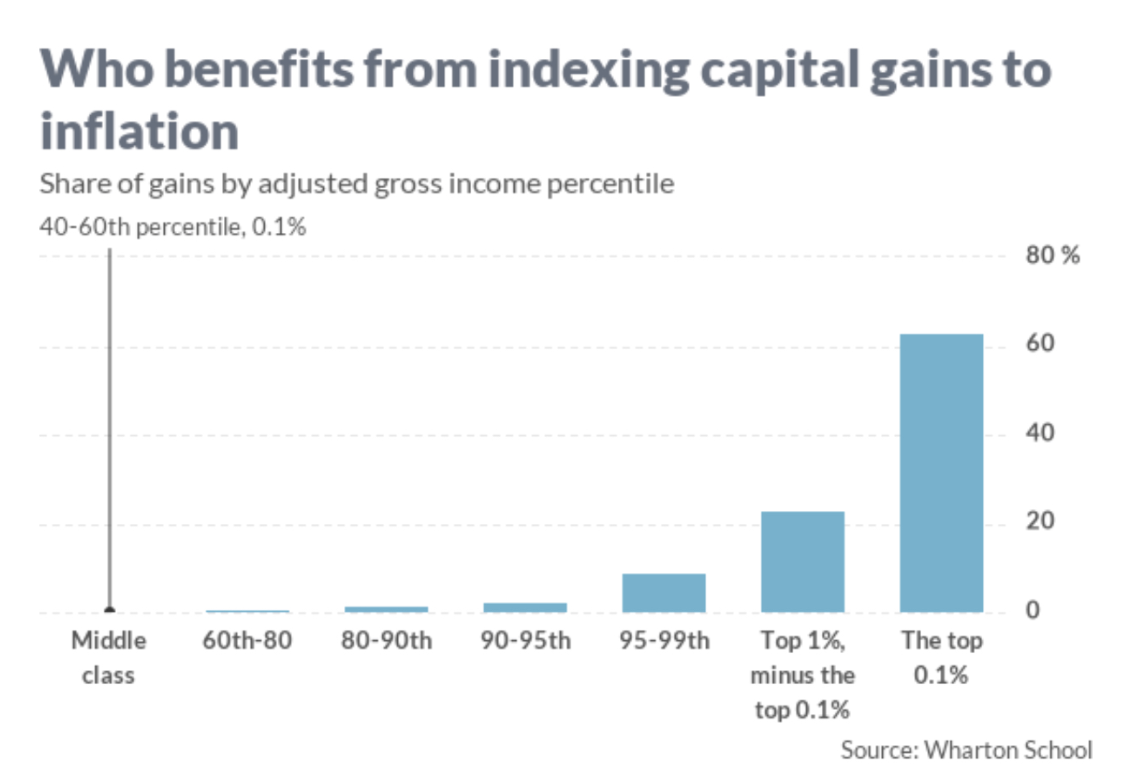

The Tax Policy Center estimates that the change would cost the country’s coffers $100 billion over ten years — with more than 97 percent of the tax savings going to the top 10 percent of earners, and nearly two-thirds going to the top 0.1 percent.

Source: Tax Policy Center

Indexing Cap Gains — What Does it Mean?

Capital gains taxes are assessed on the difference between the sale price of an asset and its original cost basis. The proposed change would adjust the original cost of the asset for inflation, reducing the tax burden on taxable gains and potentially saving wealthy individuals millions of dollars in tax liabilities.

For example:

- Under current law, if you bought $10,000 worth of stock in 1980 and it grew to be worth $40,000 by the time you sold it in 2018, then you’d pay capital gains taxes on the difference between what you sold the stock for and what you bought it for ($30,000).

- Under the proposed changes, the original purchase price of the stock would be adjusted for inflation. From 1980 to 2018, the dollar experienced an average inflation rate of around 3 percent a year. In other words, $100 in 1980 is equivalent to $300 in 2018.

- In the example above, the original purchase price would be inflation adjusted from $10,000 to $30,000 to reflect the fact that prices had tripled over the period, and the indexed capital gain would go from $30,000 to just $10,000.

- Consequently, in the scenario above, you would only pay taxes on $10,000 — reducing the capital gains tax liability by a whopping two-thirds. The change would provide a huge windfall for wealthy individuals on their long-term investments at the expense of the federal budget deficit.

History of Treasury Unilateralism

Constitutional Issues

In 1992, the National Chamber Foundation (NCF) requested legal consult to discern if the Treasury, by regulation, could index capital gains to inflation. They decided Treasury did have the power to do so. The NCF memo relied on the Supreme Court legal doctrine of Chevron Deference to administrative agencies and what they thought of as the ambiguous definition of “cost basis” in the IRS Tax Code.

The Treasury independently concluded that they did not have the legal authority, but President George H. W. Bush asked the general counsel of the White House to assess the NCF memo, as well. The conclusion from the counsel affirmed that Treasury did not have the sought-after regulatory power for a few reasons:

- If the intent of Congress is clear then there is no blanket authority for regulatory rewriting of statutes, according to Chevron Deference.

- Congress had repeatedly considered proposals to index capital gains for inflation but had not sent any to the President to be enacted.

- Legislative history evidences a clear congressional intent that “cost” be given its common and ordinary meaning, that is, price paid in normal dollars not adjusted for inflation.

The Congressional stance on indexing capital gains has not changed since 1992. For these reasons, the same conclusions reached by the general counsel in 1992 would still apply. There would almost certainly be a swift court challenge if Secretary Mnuchin goes through with the plan.

Legislative Efforts

Various other indexing measures have been introduced in the past two decades, but none have progressed past committee and almost none were the subject of a floor speech or debate or a committee report. Most recently, in early 2018, Sen. Ted Cruz introduced a bill to index capital gains to inflation. It was referred to committee but no action has been taken since. No one has co-sponsored this bill.

(Capital) Gains for Some, Not for Most

In addition to the incredible regressivity of the tax cut and the $100 billion hole in the federal budget it would create, there are other issues that would make indexing capital gains a bad move.

- Indexing capital gains will create tax shelters: “If you index the asset side of ledger but don’t index liabilities, you have a clear arbitrage for debt-financed investments,” according to Steven Rosenthal from the Urban-Brookings Tax Policy Center. In other words, if you index capital gains, without indexing capital expenses, this creates tax arbitrage opportunities for savvy taxpayers who might look to take advantage of these inefficiencies. Yet another sign that the Administration seems hellbent on creating opportunities for those who can afford it (themselves) to game the system.

- Indexing unknowns: There are still lots of questions to be answered on the logistics and substance of such a change. What price index would be used? What assets would be included/excluded? Would the change be an addition or substitute for existing tax benefits? Would indexing cover both past and future inflation? Could indexing create or exacerbate capital losses?

At the end of the day, the proposed change to index capital gains to inflation is a blatant and brazen attempt to appeal to the wealthiest Americans in an attempt to pry open their checkbooks before the midterms, as well perhaps to those who imagine being wealthy enough to benefit someday.

If at First You Don’t Succeed, Bypass Congress

The overreach of the Administration in pushing such an unpopular and untimely move, even with the certainty that any such change would be challenged in court, shows how much it prioritizes fulfilling the desires of GOP donors while controlling the Congressional majority.

Despite a vocal minority of Republican legislators led by Sen. Ted Cruz, there doesn’t seem to be widespread Republican support for indexing capital gains to inflation. Legislatively, both now and in the past, nothing concrete has been done on this issue. In fact, even in the most recent tax bill passed by Congress, the Tax Cuts and Jobs Act, they left capital gains alone. Logically, if there were widespread support and it could be easily passed by Congress, the measure would not need to be unilaterally carried out by the executive branch.

senior women for sex

the dating game

Pingback: keto mexican food

best gay dating sites 2021

gay midget dating

http://gaychatrooms.org?

recan gay dating bdsm

gay dating no hookups

decreet gay dating

gay smoker dating

gay age gap dating sites

gay dating sites for young guys

squirt gay dating

gay speed dating new york city

gay dating as a minority

gay triangle of dating meme

gay interracial dating?forum

gay dating nashville