Update 283 — Taxing Times at the IRS: Administrative Agency in Deep with Trump

On Thursday, Senate Finance held a confirmation hearing for Charles “Chuck” Rettig to be IRS commissioner. Rettig, a tax attorney, spent 35 years at a Beverly Hills law firm helping Hollywood stars fight the IRS. Rettig is poised to take the helm as the IRS faces the immense challenge of carrying out the Tax Cuts and Jobs Act.

Below is a closer look at Rettig and the myriad problems facing the Service, occupying one of the nether regions of the deep administrative state, no doubt.

Good weekends, all.

Best,

Dana

————————————————————-

Recent revelations that Chuck Rettig owns properties at the Trump International Hotel Waikiki Tower and failed to disclose their locations caused consternation among Senate Democrats during the hearing. Given that Rettig will now technically oversee the ongoing audit of President Trump’s tax returns, this discovery raises questions about the nominee’s integrity. Despite his insistence that he will run the agency free of the president’s influence, Rettig’s failure to disclose his Trump properties will do little to allay these fears.

Death by a Thousand Budget Cuts

In yesterday’s hearing, Rettig committed to be open, honest, and unbiased in his communications with Congress about how much money the IRS will need to administer the country’s tax laws. We’ve heard this promise from other Trump nominees before only to be disappointed, but holding Rettig to his word will be particularly important given the agency’s recent funding history.

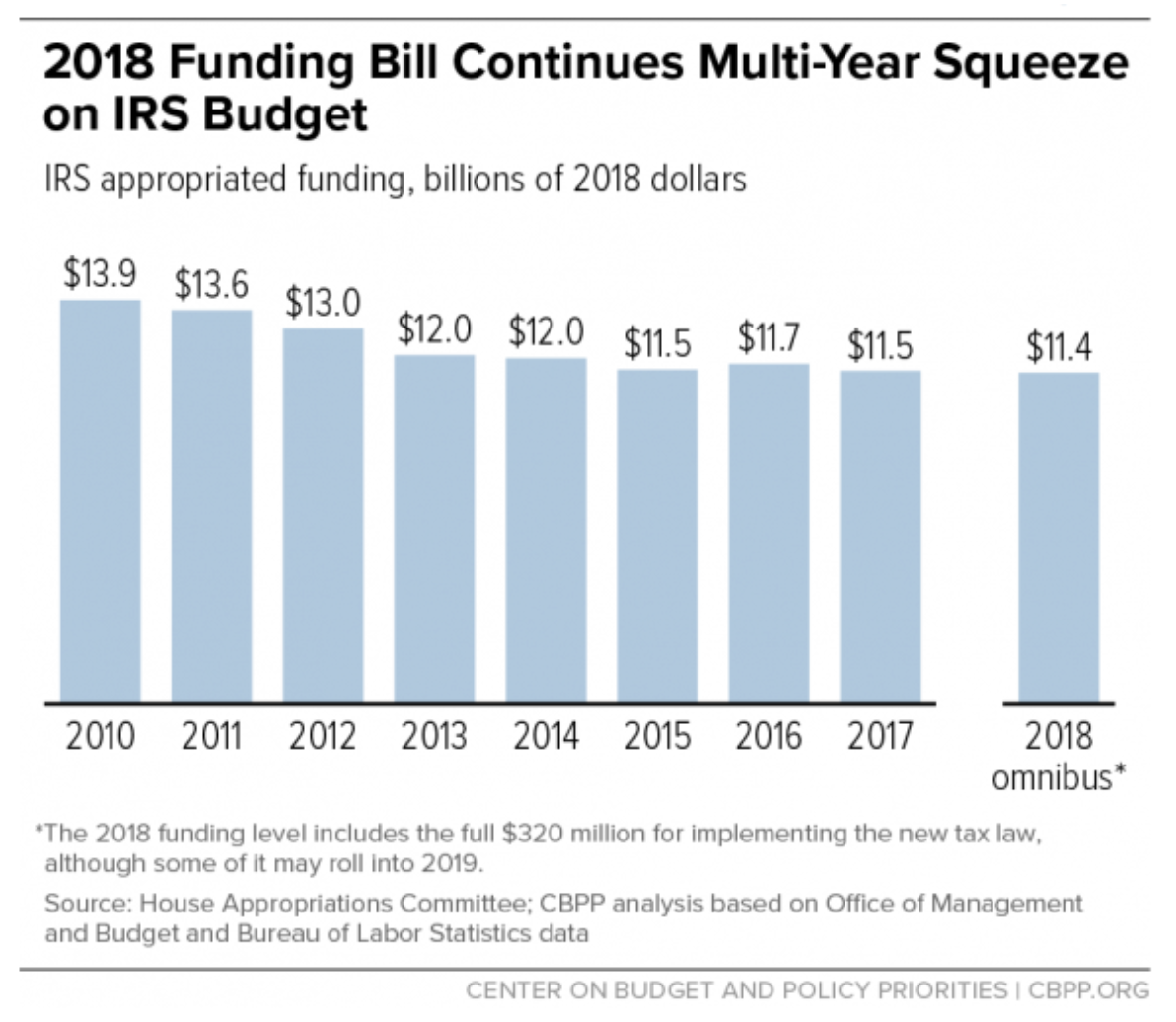

Over the last decade, the IRS has undergone significant budget cuts, seeing its operating budget decline from $13.9 billion in 2010 (adjusted for inflation) to $11.4 billion in February’s Omnibus appropriation. This near-decade of austerity has had drastic effects on the the agency’s workforce, which has jettisoned 14,000 employees and nearly a quarter of it’s enforcement personnel. These personnel issues will likely soon be compounded as the agency’s relatively older workforce reaches retirement en masse.

On top of this, the IRS’s aging IT infrastructure appears to be at the point of complete failure after repeated requests for funding to update it have gone unheeded. Last April’s Tax Day had to be extended by a day after a system crash knocked out the agency’s online filing functions for more than 12 hours. Wait times on IRS phone lines have also increased substantially, a source of frustration for taxpayers that Rettig promised to address upon confirmation.

The agency’s functionality has ground to a halt, and IRS employees are privately concerned that next year’s filing season might fail outright. In 2017, audit levels dropped to historic lows as a mere 0.6 percent of taxpayers were audited (for context, budget-watchers 20 years ago considered a 2.0 percent audit rate to be unacceptably low). This same year, the IRS audited just 331 large companies, down 100 from the previous year, and spent nearly half as much time conducting these audits. Widespread dysfunction at the agency tasked with revenue collection means leaving significant money on the table and out of government coffers.

Big Tax Cut, Bigger Headaches

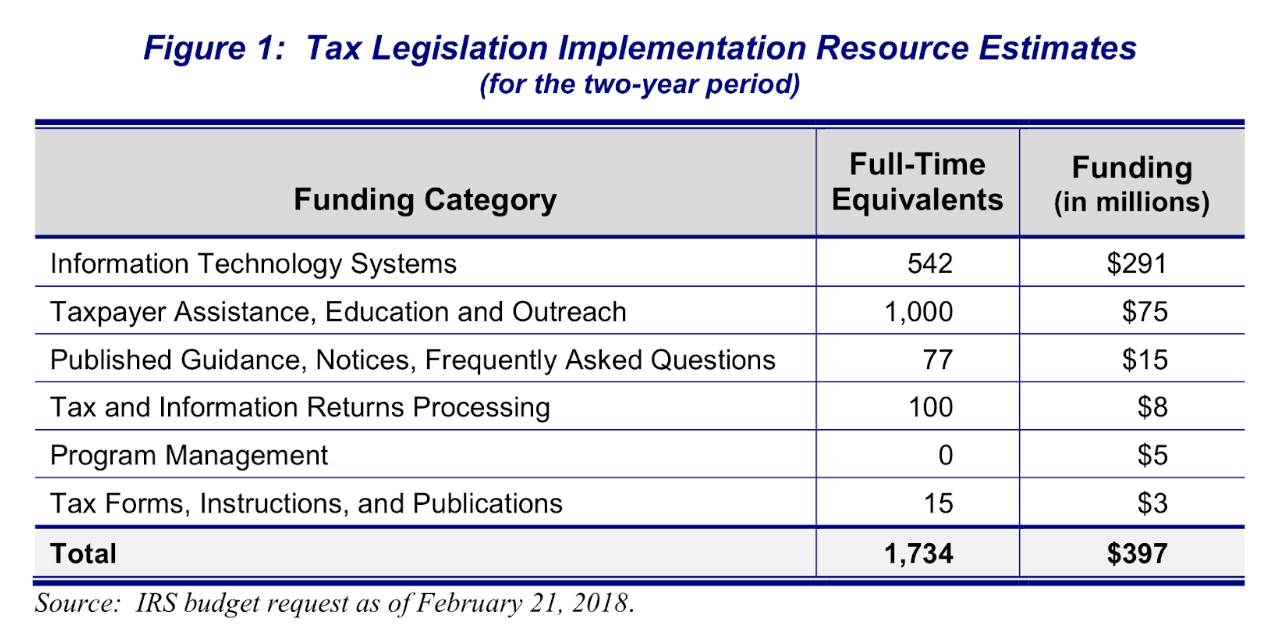

Last December’s Tax Cuts and Jobs Act (TCJA) is putting immense pressure on the already underfunded and overstretched agency. The IRS will now have to grapple with over 100 new tax provisions codified in the tax law; a task which includes writing or revising nearly 450 documents and publications and the reprogramming of around 140 systems. With these new burdens, the agency will be even further challenged to meet its obligations as an enforcement agency just as organizations and tax professionals begin searching for ways to exploit new loopholes in the tax code.

Takeaway: Vigilance Now, Funding Soon

Revenue collection is one the most fundamental aspects of any functional government. Given Trump appointees’ record of handicapping agencies from within, dysfunction at an underfunded Rettig-led IRS is of grave concern.

Senate Democrats are well aware of the risks associated with dysfunction at the IRS, and they repeatedly pressed Rettig on how he would handle the challenges facing the organization. While Rettig was quick to promise that he would work with the Senate Finance Committee to address the obstacles in front of the agency, he should be watched closely.

Indications are that the funding shortfall at the IRS will not be addressed any time in the near future. The Senate Appropriations Committee’s 2019 budget for the IRS is only $11.3 billion, lower than the 2018 level and a full 18 percent below 2010 levels when adjusted for inflation. While the House Appropriations Committee provided slightly more funding, it too fell below the 2018 inflation-adjusted level.

Regardless of who is at the helm, any government agency will struggle to fulfil its mandate if starved of resources. Returning the IRS to full funding should be a top priority for future Democratic majorities.

ted koppel book mormon Telephone Torrent drishti ias environment book pdf free download

Geant Casino Glisy Horaire Hypermarche Geant Casino Montpellier Celleneuve Traiteur Geant Casino Montpellier

Coup De Pouce Casino Avis Promo San Pellegrino Geant Casino Casino Lac De Garde

viagra vs cialis

online dating

dating sites for teens

old for old gay men dating

gay piss dating

gay hookup dating sites

Pingback: benefits of the keto diet

rust gay dating sites

gay sex dating in pakistan

kidloves gay dating

gay dating contest model

gay online dating subculture

big gay cock dating

dothan gay dating

best cities for gay dating

gay local dating