Update 262 — Peering over the Fiscal Cliff:

Trillion-Dollar Deficits Far as the Eye Can See

Earlier this week, the Congressional Budget Office (CBO) projected that the federal government’s annual budget deficit will reach $1 trillion next fiscal year. Under current CBO expectations, the national debt will exceed $33 trillion by fiscal 2028, up from $20 trillion today.

Is this level of debt sustainable? What are the implications for interest expense, for inflation, for policy choices, including entitlements and retirement security, of current tax and spending going forward? We explore some of the implications of this fiscal future below.

Best,

Dana

––––––––––––––

The CBO report’s debt projections — which reflect last year’s Tax Cuts and Jobs Act and the spending increases in last month’s FY2018 Omnibus Appropriations Act — augur a fiscal future rife with uncertainty from retirees on fixed income to those making retirement plans, to millennial just entering or seeking to enter the workforce.

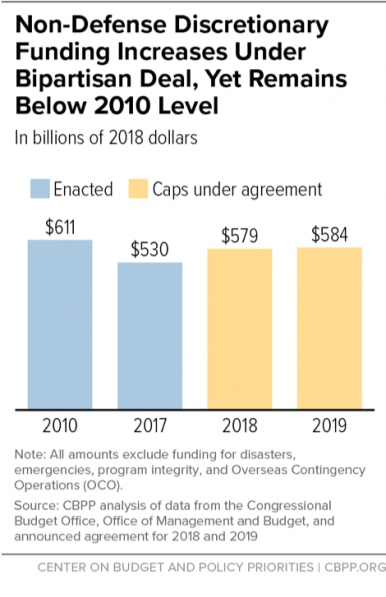

Some Republicans, perhaps intent on eviscerating the federal social safety net, have already begun arguing that the deficit they created will require spending cuts drastic enough to shred that net. This despite the fact that discretionary social programs were already significantly underfunded before the 2011 Budget Control Act imposed sequester caps on them. Even after the Omnibus, FY 2018 non-defense discretionary outlays will not even match the levels of FY 2010.

The GOP is now targeting the domestic discretionary spending they themselves agreed to in the March Omnibus package. Going forward, the threat that Republicans will try to take down vital social programs like Social Security, Medicare, and Medicaid will become increasingly real. Yesterday’s executive order requiring government departments to suggest deep rollbacks in low income assistance programs shows the Administration is preparing more paring.

New Budget Baselines

The $1.3 trillion FY2018 Omnibus Appropriations Act Congress passed in March raised Budget Control Act caps for two years. Topline appropriations for this year include:

• $629 billion in defense discretionary spending

• $579 billion in non-defense discretionary spending

The deal increased spending for appropriators by margins not seen since 2010:

• $80 billion above prior sequester-level restrictions for defense-related spending

• $63 billion more for non-defense related spending

Sequester-Era Austerity Over

The belief that domestic programs funding is wildly out of control is not universally shared. From 2012 to 2017, budget caps on non-defense discretionary spending brought grinding austerity home to millions of American families in reductions to critical programs focusing on childcare, job training, low-income housing — all of which were brought down to historically-low levels of funding.

During the sequestration period, non-defense discretionary spending amounted to just 3.4 percent of GDP, and in 2017 this figure was only 3.2 percent. The post-1962 average for non-defense discretionary spending was 3.8 percent of GDP. The new domestic figure in the omnibus will top out around 3.3 percent of GDP in 2019, well below the post-1962 average.

Here are a few areas that have suffered under the austere Budget Control Act:

• Job Training: Labor Department funding for state grants for career training and employment dropped by almost 20 percent since 2010 and 40 percent since 2001

• Low-Income Housing: Just a quarter of low-income households qualify for rental assistance due to funding shortages a decade after the foreclosure crisis

• Social Security Administration: The SSA’s administrative budget fell by 11 percent since 2010

• Water Infrastructure: Clean water infrastructure program funding is 35 percent below its 2001 level, including a nine percent cut (without adjusting for inflation) since 2008

Lack of Spending Parity in Omnibus

Many were relieved that Congress finally reversed some of the sequestration cuts imposed under the Budget Control Act of 2011. While sequester-era appropriations were insufficient to meet the country’s needs, the new caps in the omnibus are still broadly insufficient to meet the country’s domestic needs.

Democratic negotiators pushed for parity in the omnibus in domestic and defense increases. The Bipartisan Budget Act did increase the spending caps for both defense and nondefense spending equally over their Budget Control Act limits. But spending increases for defense exceed the increase in non-defense discretionary levels over sequester-level caps, and non-defense appropriations still fall well below levels reached in 2010. Inflation-adjusted, the new cap for this spending is 5.3 percent below what it was in 2010.

GOP Split on Rescission Decision

The nondefense spending increases in the Omnibus elicited immediate backlash from fiscal conservatives, especially in the House. In an attempt to appease these spending hawks, House Majority Leader Kevin McCarthy and President Trump are now considering a vote on a package that would rescind a number of domestic provisions from the new budget. Although specific details on which programs would be targeted have not been released, the White House’s 2019 budget proposal outlined dozens of programs that could be up for cuts. (The President has also floated a line-item veto, previously ruled unconstitutional by the Supreme Court in 1998, in order to cut spending programs preferred by Democrats.)

A rescission resolution could pass the Senate on a simple majority vote, per the 1974 Budget Act, but it is unclear that Republicans have the votes to overturn significant portions of a bill they just passed last month. Democrats are furious at the proposal, claiming that Republicans are pandering to their base after the deal received negative coverage in conservative media outlets.

Bipartisan agreement about the increased funding caps in the Bipartisan Budget Act was a reflection of the austerity consensus in recent Congresses in nondefense spending in the wake of the Budget Control Act left. While the Bipartisan Budget Act of 2018 would still see domestic funding caps below their 2010 levels, it brought much needed relief to programs Americans depend on. With the midterms looming, many Republicans are wary of overturning these measures.

Work Requirements, Entitlement Reform Next?

Although domestic spending figures are below historical averages, Republicans are now working up “starve the beast” solutions after Congress just deepened the deficit. Yesterday, President Trump joined the assault on entitlements, privately signing the “Reducing Poverty in America by Promoting Opportunity and Economic Mobility” executive order. The Order directs department heads to review their department’s welfare programs in order to expand work requirements, “find savings” (read: make cuts), and give more power to states to direct welfare resources. The order does not set any new policy, but it does reflect a hardline conservative approach to entitlement reform.

Republicans won two major fiscal priorities in recent months. With the Tax Cuts and Jobs Act, they deficit-financed a major reverse transfer payment to wealthy and large corporations. With last month’s Omnibus, they secured a substantial increase in defense spending. With these two priorities out of the way, Republicans now have their pretext for a familiar attack on entitlements and the nation’s poorest, most vulnerable citizens.

single women online

zoosk dating

2009 gay dating sites

gay sex pig dating

men’s gay dating websites

Pingback: keto creamer

gay farmers dating

gay dating europe

free gay dating sites in europe

gay male online dating

ugandan gay dating

gay man dating a transman

gay dating sites for women

gay muslim dating london

gay dating match