Update 296 — Education Finance Update:

Effect of Student Loan Dollars on Scholars

The aggregate burden of US student loan debt surpassed $1.5 trillion this month. A generation of students and graduates is struggling to keep up with payment plans and debt relief programs. To put this figure in perspective, the total student loan burden in 2006 was under 500 billion; since the 2010-11 academic year, the total US student debt outstanding has surged 50 percent.

A coincidence offers a telling comparable: the tax cuts passed by Congress last year will cost the US Treasury an estimated $1.5 trillion over 10 years. While corporations and the wealthy receive this whopping tax break, millennials are saddled with a growing debt burden that is holding back their broader participation in the economy.

More on this back-to-school special below. Good long weekend and happy Labor Day, all.

Best,

Dana

————————————————————-

Drowning in Debt

According to the US Department of Education, students who attain a bachelor’s degree owe an average of $30,500 upon graduation. Student debt is one of the worst performing areas of consumer credit in the United States. A January Brookings report warns that nearly 40 percent of borrowers are at risk of defaulting on their student loans by 2023.

The details are grim. Women hold almost two-thirds of all student loan debt but as a result of the continuing gender pay gap, they take longer to pay off their loans and incur more interest payments as a result. There are racial disparities, as well: black BA graduates default at five times the rate of their white counterparts and even default at a higher rate than white college dropouts.

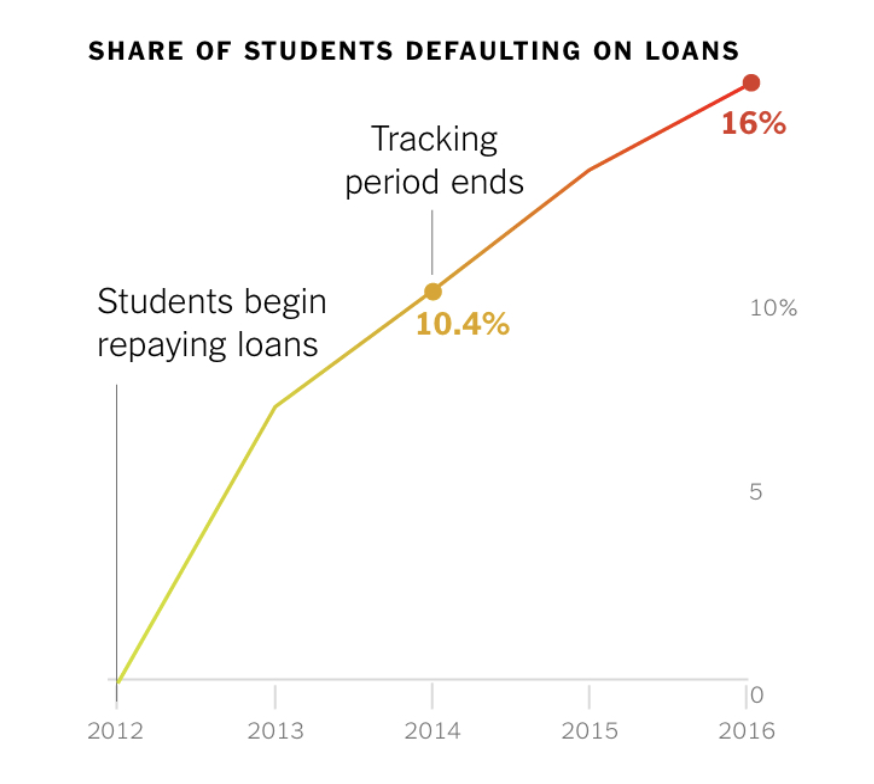

About one in 10 borrowers who started repaying in 2012 defaulted on their loans after three years. According to a report by the Center for American Progress, after five years, the default rate surges to 16 percent — amounting to over 840,000 borrowers in default. Almost as many borrowers were severely in arrears or not repaying their loans, resulting in around 30 percent of borrowers struggling to pay off their debt after just five years.

Source: NYT

Dereliction of Duty

The current administration is hindering rather than helping the situation. This week, Seth Frotman, student loan ombudsman at the CFPB, stepped down from his position. In a pointed resignation letter directed at CFPB director Mick Mulvaney, Frotman explained that his position was no longer tenable because, “the Bureau has abandoned the very consumers it is tasked with protecting.”

Frotman highlighted three recent examples of the Bureau’s recent dereliction of duty, gravely compromising its ability to oversee the student loan market:

- abandoning enforcement — Since its inception, the Bureau has returned over $750 million to harmed student borrowers and stopping predatory practices that targeted millions of Americans. Recently, the Department of Education stopped helping CFPB conduct oversight of the largest student loan companies, which has undermined CFPB’s ability to oversee malign practices and hold companies accountable to the student loan market.

- sabotaging the Bureau’s independence — Recent decisions by the leadership of the Bureau have made it clear that its independence is compromised. The agency is capitulating to political demands by the Trump Administration, rather than serving the needs of American students. This is exemplified by recent moves to block actions that would have shed light on predatory for-profit schools and blocking attempts to alert ED about its recent “unprecedented and illegal” actions to protect student loan companies from accountability for abuses.

- protecting bad actors — When it emerged that the nation’s biggest banks were ripping off student borrowers by charging legally questionable account fees, the Bureau’s leadership suppressed publication of a report and shirked its responsibility, leaving students vulnerable to predatory lending practices.

In addition to the actions by the CFPB, Education Secretary Betsy DeVos recently proposed damaging cuts that would make it more difficult for students swindled by for-profit colleges to receive loan forgiveness. Under the new policy, the burden of proof would fall on students to prove they were intentionally misled or in financial distress. In addition, schools will be allowed to require students to sign arbitration clauses, barring them from taking legal action against the school.

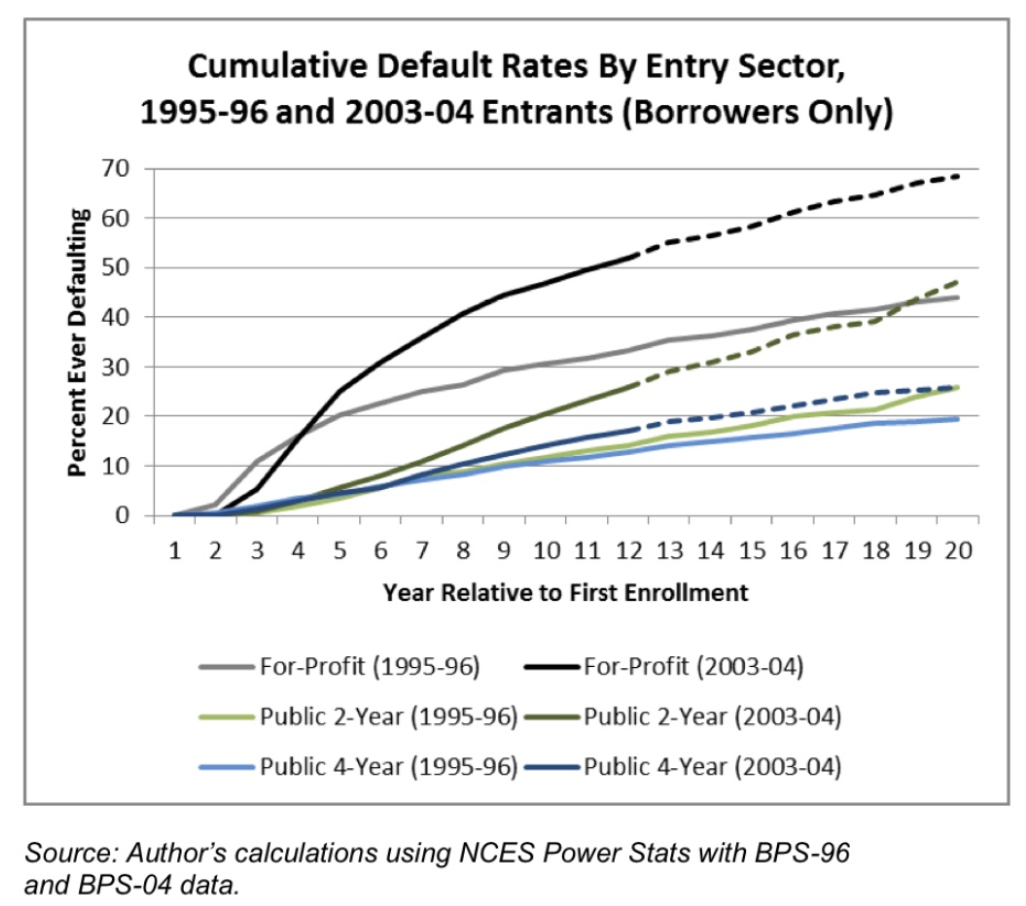

The proposed changes were unsurprisingly lauded by for-profit schools, but lambasted by advocates for student borrowers—for good reason. Borrowers who attended for-profit schools (disproportionally students of color) default at twice the rate of their two-year public counterparts. To add insult to injury, for-profit students are more likely to borrow and as a result, the rate of default among all for-profit entrants, excluding non-borrowers, is nearly four times that of public two-year entrants:

Source: Brookings

Congress Shoots and Does Not Score

There have been a few legislative proposals introduced in the last year to address the student debt crisis. There are two notable bills in the House and one in the Senate.

- H.R. 4001 — Student Loan Refinancing and Recalculation Act: This is a bipartisan bill that was introduced by Rep. John Garamendi (D-CA) and Rep. Brian Fitzpatrick (R-PA). The bill would allow students to refinance their student loan interest rates, lower future interest rates, eliminate origination fees, and delay interest accrual while pursuing education. The bill has 28 cosponsors but has been held up in the House Committee on Education and the Workforce since last year.

- H.R.6543 — Aim Higher Act: This bill was introduced by Rep. Robert Scott (D-VA) in July of this year. It is a comprehensive reauthorization of the Higher Education Act. It includes free community college and student loan refinancing.The bill has 57 Democratic cosponsors and was referred to the House Committee on Education and the Workforce in July.

- S.2598 — Debt-Free College Act of 2018: This bill was introduced by Sen. Brian Schatz (D-HI) in March of this year. The bill would provide incentives to states to increase investments in public higher education through a dollar-for-dollar federal match to state higher education appropriation. It has 9 Democratic co-sponsors, including Sens. Booker, Warren, Gillibrand, and Harris — all rumored to be aiming for 2020 presidential runs. The bill was referred to the Committee on Health, Education, Labor, and Pensions, but no action has been taken since.

Bipartisan or not, lawmakers are struggling to pass bills that address the growing student debt crisis. If ignored, this crisis will only get worse and will undoubtedly have negative effects on the economy.

Implications for the Economy

Student loan debt has pervasive effects across different sectors of the economy. These effects are sometimes subtle but have substantial consequences. One area that has been getting a lot of attention lately is the housing market. CNBC reported yesterday that pending home sales fell for the seventh straight month in July. Home prices have been rising and with that affordability has been falling.

Millennials, who are classified as people born between the early 1980s and the mid-1990s, are on track to be the largest living adult generation by 2019. They also hold the most student debt, which prevents them from doing things like buying a house. CNBC reports, “Eighty-three percent of people ages 22 to 35 with student debt who haven’t bought a house yet blame their educational loans.” This problem will only get worse as housing prices rice and millennials become a larger share of the adult population. As we know, the housing market has large impacts on the economy as a whole.

Student loan debt doesn’t just threaten the housing market, it threatens the whole health of our economy. Earlier this year, Fed Chairman Jerome Powell testified to Congress that he believed student loan debt could hold back economic growth and should be discharged in bankruptcy. He said, “You do stand to see longer-term negative effects on people who can’t pay off their student loans…It hurts their credit rating, it impacts the entire half of their economic life.” He went on to say that you can’t see the full negative effects in the economy right now and that they would get worse over time as student loan debt continues to grow.

Implications for Midterms

In the 2016 election, many believed that Hillary Clinton’s platform appealed less to young voters than Bernie Sanders did. Sanders ran on a debt-free college platform, which Clinton later emulated. Sanders’ platform truly galvanized young voters in the primary, in which he won 71 percent of Democratic millennial primary voters compared to the 21 percent that Clinton won. A national poll done in 2016 found that millennials ranked college affordability and student debt as their second most important voting issue, right after the economy.

As of 2016, millennials made up 31 percent of the electorate, the same proportion as baby boomers. Millennials will soon surpass them. Appealing to these voters and getting them to the polls is crucial for Democrats. Millennials once preferred Democratic candidates overwhelmingly, but that has become less certain in the last coulomb of years. According to a Reuters-Ipsos poll from April of this year, 46 percent of millennial respondents said they would vote for the Democratic candidate over the Republican in their congressional district, a nine point drop from 2016 when 55 percent said they would vote Democrat. If Democrats wish to take back the House and the Presidency, they must appeal to millennial voters.

Other Related Articles

- Update 735: Shutdown Threat In Temporary Remission

- Update 729 — House Elects Speaker: Can Bipartisan Fiscal Policy Follow?

- Update 728 — Suspended Animation:House Left Behind as the World Turns

- Update 722 — From Strikes to Shutdown: Challenges to the Post-Covid Recovery

- Update 720 — Weekly Economic Roundup